Welcome to the Property Imperative weekly to 22nd September 2018, our digest of the latest finance and property news with a distinctively Australian flavour.

Watch the video, listen to the podcast, or read the transcript.

Watch the video, listen to the podcast, or read the transcript.

The 60 Minutes segment which aired last Sunday put the cat among the pigeons. I made a significant contribution to the programme, both in helping to shape the story and through my interviews. You can watch the segments on YouTube, and also an additional “extra minutes” segment which was a longer form selection from my comments.

And by the way you value the content we produce please do consider joining our Patreon programme, where you can support our ability to continue to make great content.

Of course, the property spruikers accused the programme of misrepresentation, and some other contributors complained after it had aired. As I discussed in my live stream event last Tuesday, (where by the way we had more than 400 participate live, a record) they represented my views accurately, but noted that we were talking a worst case scenario case of home prices falling 40-45% over 3 years, and that the headline in the introduction that it would be “within 12 months” did not come from me. Speaking to the editor, it appears this was from the Liquidator which was also featured in the segment. As a result, we suspect the ABC’s Media Watch may be looking at the segment.

So to be clear, there is a 20% chance, on my estimation, that due to a disruption in the international capital markets, the property edifice here could collapse, as a result of less liquidity, inflated prices well above true value, dodgy lending practices as highlighted by the Royal Commission, and strained household budgets thanks to flat incomes and rising costs. But, and this is important, there is still time for policy makers and regulators to wake up and take steps to alleviate the risks. But time is getting short in my view.

Oh, and you can also read about the wager I refused to accept from The Kouk, and the article I wrote for 60 Minutes “The Debt Bomb Which No One Wants to Talk About” which outlines my perspective. Overall, I believe this was an important event in raising public understanding of the issues we face. I reject the acquisition I was scaremongering, because if you have been following my channel, you will have heard it all before. Perhaps it will help some households from making poor decisions.

Remember my analysis is data driven, and the signs are still showing further falls. For example, CoreLogic says a total of 1,983 homes were taken to auction across the combined capital cities last week; a slight increase on the week before. But the weighted average clearance rate dropped to 51.8 per cent, which was not only lower week-on-week (55.3 per cent), but the lowest seen since Dec-12.

The two largest auction markets of Melbourne and Sydney both recorded a lower clearance rate week-on-week. Melbourne returned a final clearance rate of 54.1 per cent, down on the 60 per cent over the previous week. While over half of the Sydney homes taken to auction last week failed to sell, returning a final clearance rate of 48.6 per cent, decreasing on the 50.6 per cent over the week prior. Both markets did see a slightly higher volume of auctions over the week, with volumes across Melbourne up by 10.9 per cent, while Sydney saw a 2 per cent rise in volumes.

As usual the performance across the smaller auction markets was mixed, with Canberra recording the strongest final clearance rate of 65.2 per cent, while only 33.3 per cent of Tasmanian homes sold. However, Brisbane and Perth were the only auction markets to see a week-on-week improvement in clearance rates. Across the regional auction markets, Geelong returned the strongest clearance rate of 60.6 per cent. In terms of volumes, the Gold Coast saw the highest number of auctions (58), however only 31.9 per cent sold. CoreLogic says a higher number of auctions are scheduled this week, with a total of 2,277 homes scheduled for auction, up 15 per cent on last week’s final figures, although lower than one year ago when 2,782 capital city homes went to auction. It looks like a weak spring sales season so far.

Domain also released research explaining the strong correlation between auction clearance rates and dwelling prices and confirms the buyers’ market at the moment. They showed the rolling annual clearance rate (Australia wide) alongside annual growth in the Domain median dwelling price and observed that annual movements in the two indicators are highly aligned over the past 20 years, and are strongly correlated. Steady demand in the property market is generally regarded as a clearance between 60 per cent and 70 per cent. Any lower than 60 per cent and it is thought the market is slowing down. Prices are going down in a buyers’ market. Indeed, In the week ended 20 September 2018, the CoreLogic 5-city daily dwelling price index, which covers the five major capital city markets, declined another 0.17%, with Melbourne falling by 0.28% and Sydney by 0.14%, again showing that Melbourne is seeing the strongest declines, after a later run up.

The ABS Home Price Series data came out on Tuesday, just in time for our live event. The total value of residential dwellings in Australia was $6,9 trillion at the end of the June quarter 2018, falling $13.2 billion over the quarter. A first, for years, and hardly reported. But this is significant! We need to get use to more falls ahead. Of course it varies by locations and property types. The mean price of residential dwellings fell $4,100 to $686,200 despite the number of residential dwellings rising by 40,800 to over 10 million in the June quarter 201

The price index for residential properties of the eight capital cities fell 0.7% in the June quarter 2018. The index fell 0.6% through the year to the June quarter 2018. So the falls are accelerating and the more recent CoreLogic series shows further falls ahead. The capital city residential property price indexes fell in Sydney (-1.2%), Melbourne (-0.8%), Perth (-0.1%) and Darwin (-0.9%), and rose in Brisbane (+0.7%), Hobart (+3.0%), Adelaide (+0.3%) and Canberra (+0.6%). Annually, residential property prices fell in Darwin (-6.1%), Sydney (-3.9%) and Perth (-0.9%), and rose in Hobart (+15.5%), Canberra (+3.0%), Melbourne (+2.3%), Adelaide (+2.1%) and Brisbane (+1.7%). Finally, the total number of property transfers were also significantly down.

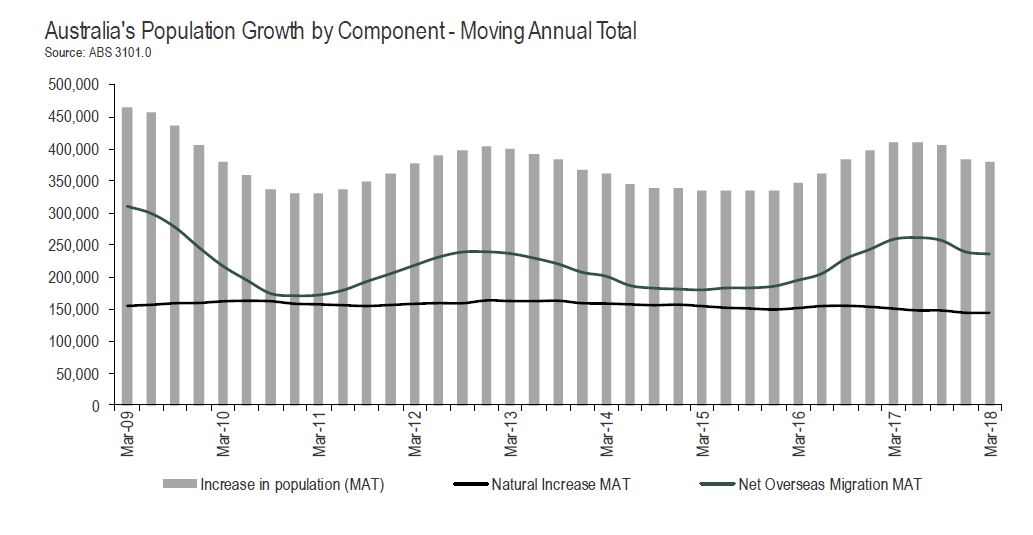

Also this week the latest migration figures from the ABS showed that a 9% fall since visa changes made in April 2017. No surprise then the HIA bemoaned the fall, pointing to slowing demand for new property. In fact, Australia’s annualised population growth rate slowed for the fourth consecutive quarter. Over the year to March 2018, Victoria saw the strongest growth in population (+2.2 per cent), followed by the ACT (+2.1 per cent) and Queensland (+1.7 per cent). New South Wales was fourth fastest (+1.6 per cent) with Tasmania fifth (+1.0 per cent), Western Australia sixth (+0.8 per cent) and South Australia seventh (+0.7 per cent). The population of the Northern Territory has actually declined over the last two quarters and the annual rate of growth has slowed to 0.1 per cent.

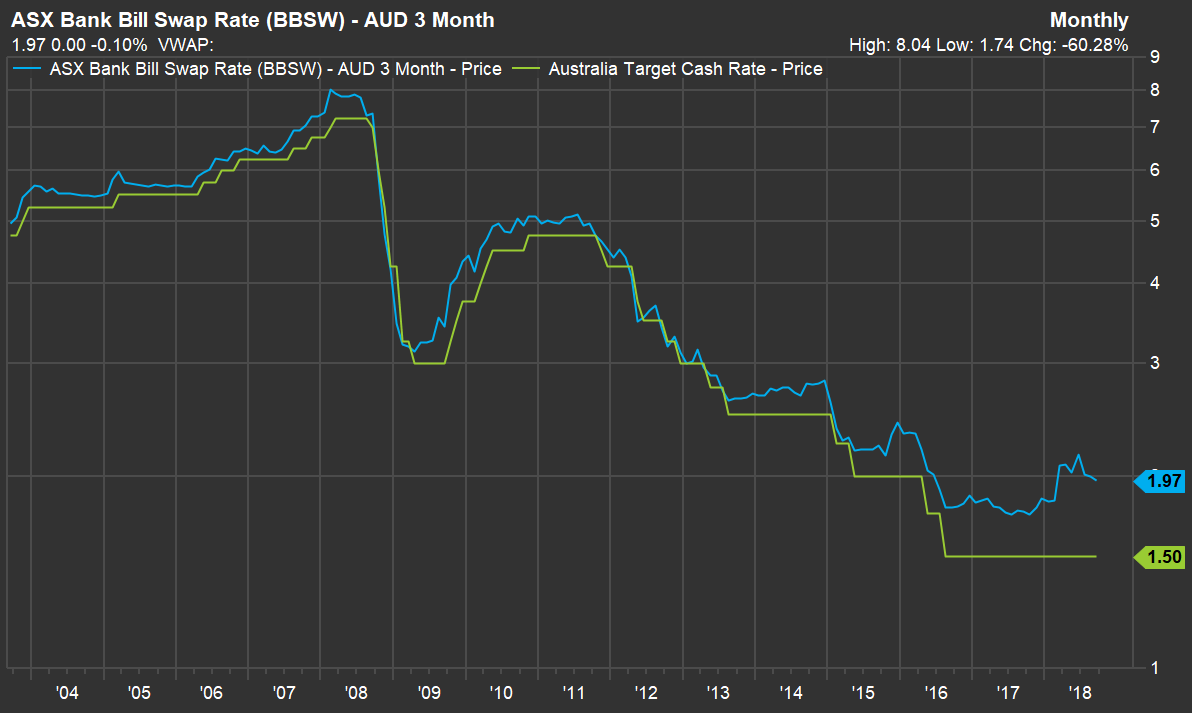

This week we saw more tweaks in mortgage rates, as the recent hikes to existing loans start hitting households. ING says it is increasing variable rates for investor mortgage customer by 15 basis points. The changes come into effect from Tuesday 25 September and is for both new and existing investor loan customers. The banks have blamed the higher funding costs. Actually the BBSW has come back somewhat, but remains elevated. The point is as the majors fund some of their book from short term sources the funding gap is real and sustained. That said, Westpac made some aggressive moves by discounting mortgage rates for selected new customers, essentially funding the attempt to grow share from the higher returns from existing borrowers. Bottom line is there is merry dance of cross subsidization in play as existing borrowers are forced to pay more, (the back book) while certain classes of refinancing and first time buyers are being enticed. However, bearing in mind that home prices are likely to fall further, buyers should beware. Always read the small print! We also wonder how sustainable these discounts are given current margin pressures. But I guess volume and margin are being traded off at least to an extent!

UBS has once again highlighted the issues relating to Interest Only Loans, According to UBS’ Australian Banking Sector Update on 19 September, which involved an anonymous survey of 1,008 consumers who took out a mortgage in the last 12 months, 18 per cent stated that they “don’t know” when their interest-only (IO) loan expires, while 8 per cent believed their IO term is 15 years, which doesn’t exist in the Australian market. The research found that less than half of respondents, or 48 per cent, believed their IO term expires within five years. They said “We believe the royal commission creates an inflection point and credit conditions are tightening materially. Whether Australia can orchestrate an orderly housing slowdown remains to be seen, and we think the risks of a credit crunch are rising given the significant leverage in the Australian household sector.”

And the Royal Commission concluded its hearing relating to the Insurance sector in Australia. More damming evidence highlighting poor behaviour in terms of mis-selling insurance products, charging premiums to dead people, failing to handle claims fairly, illegal behaviour, and further failures of the regulators to fulfil their role. The law is also missing in action in a number of critical areas, including claims processing. Indeed, the small fines imposed on these large and profitable businesses were just seen as a small cost of doing business. More to come when the interim report is due at the end of the month. But the behaviour of corporate Australia is once again in the dock. Shameful.

Citi made the point that the Royal Commission exposes “systemic over lending” saying In our view the most material conclusion of the commission is likely to be that the lending process presently isn’t sufficiently responsible. Responses to this issue are likely to involve increased due diligence which will impact the growth and availability of credit further to existing measures. [Bank systems] have allowed them to lend too much…This is visible across the system, with issues in mortgage broking all the way through to expense verification. [Leading to] adverse customer outcomes as evidenced by more leverage and higher loan balances for broker loans. [This will lead to] a spate of legal consequences and ongoing litigation. [HEM could be banned because it led to] adverse customer outcomes as evidenced by more leverage and higher loan balances for broker loans”. We agree, our data is pointing the same way. This is why the current credit tightening is not temporary, but marks a shift back simply to more normal sensible practices. The debt bomb though is baked in.

That said, S&P said that based on the expectation that the general government fiscal position will return to surplus by the early 2020s, as the central government’s continued focus on fiscal prudence turns higher revenue collection into better budget performance. They view the government as having significant revenue flexibility to achieve this based on its track record of raising general government revenue faster than the growth of nominal GDP. So they revised their outlook on Australia to stable from negative and affirming our ‘AAA’ long-term and ‘A-1+’ short-term ratings. They said that “the stable outlook reflects our expectations that the general government fiscal balance will return to surplus by the early 2020s. We expect steady government revenue growth supported by the strong labour market and relatively robust commodity prices, to be accompanied by expenditure restraint. We also expect property prices to continue their orderly unwind, and that this slowdown won’t weigh heavily on consumer spending and the financial system’s asset quality. So that’s alright then.

This despite further delinquency rate rises in their SPIN monthly report for July. Although Australian prime home loan arrears rose year on year in July they remained unchanged month on month at 1.38% since May, but up from 1.17% a year earlier. This despite arrears normally falling at this time of year. They say that high household indebtedness and low wage growth have increased borrowers’ sensitivity to interest-rate rises. Some borrowers, including those with higher LTV ratios, are more exposed to rising interest rates, particularly at a time when lending standards are tightening and refinancing opportunities are diminished. However, Australian RMBS portfolios’ exposure to such borrowers is not significant (exposure to loans with an LTV ratio in excess of 80% is 13%). In other words, the RMBS portfolio is not necessarily representative of the wider market.

Arrears movements were mixed nationwide, with New South Wales reporting a month-on-month increase in mortgage arrears in both percentage and dollar terms, while in Victoria there was a decline in loans more than 30 days in arrears. Arrears remained at a record high in Western Australia, but the Northern Territory took the nation’s top spot again in July, with arrears at 2.67%. Australian RMBS portfolios’ exposure to the Northern Territory is minimal, at just under 1%. The trends in NSW are concerning, and mirror the growth in mortgage stress we are seeing.

Turning briefly to the local markets, the banks were mixed, with NAB down 0.32% on Friday to 27.66 and ANZ higher, up 0.14% to 28.46. The ASX 200 Financials Index move a little higher, up 0.14% on Friday to 6,159, but remains below the peak last November before the Royal Commission kicked off. Frankly, we think the financial sector is in for a rough patch as the output from the inquiry hits, and more class actions, like the one announced by Maurice Blackburn Lawyers who are preparing court proceedings against the major banks and brokers in regards to alleged breaches of the NCCP.

Turning to the Aussie, the main bear trend is getting tested as the AUD/USD is nearing the 50-day simple moving average and the multi-month bear trendline from late January 2018. It ended on Friday at 72.91 a couple of percent high, and it could break above the 72.94-73.07 zone (August 13 high) to target 73.83 August 21 high and 74.85 July 10 high. This is in reaction to a weaker USD, as we will see shortly.

So to the US, where the Dow soared to record highs for a second-straight day Friday as defensive stocks turned to offense on falling U.S. Treasury yields. Trade-sensitive stocks such as Boeing and Caterpillar pushed the Dow into record-setting territory this week, as both posted strong weekly gains. The VIX fear index was lower, again, down 1.02% to 11.68, signalling relatively steady sailing in the near term.

The Dow Jones Industrial Average rose about 0.32% to 26,743. On the other hand, the S&P 500 fell 0.04% to 2,929., while the tech-heavy Nasdaq Composite fell 0.51% to 7,987. But beware, trading was volatile today due to quadruple witching, where stock options, stock index options, stock index futures and single stock futures expire. I’ll be very surprised if the Fed doesn’t raise rates at the upcoming meeting but it’s also the end of the quarter and “THEY” want to keep the market at record highs – so they can print up pretty charts and graphs to show you how you need to put your money in the markets.

The 10-year Treasury yield slipped on Friday, following strong early-week gains as the benchmark Treasury breached the key psychological 3% level earlier this week ahead of a widely-expected U.S. interest rate hike next week. The gap to the short term – here the LIBOR rate is still compressed warning of potential stress ahead.

The Fed will make a policy adjustment on Wednesday (2pm) and also will extend their economic projections out to 2021 for the first time – so that will be interesting. Ray Dalio, who founded Bridgewater Associates, the world’s biggest hedge fund, this month predicted the U.S. economy is about two years from a downturn. Former Fed Chairman Ben Bernanke shared that view of a possible decline in 2020, when fiscal stimulus wanes like “Wile E. Coyote is going to go off the cliff.”

China and the United States earlier this week imposed less-harsh-than-expected tariffs on each other, helping lift sentiment on trade. In sharp contrast, U.S.-Canada talks were set to end the week with little sign of progress as a key White House official suggested the United States could move ahead with a revamp of the North American Free Trade Agreement (NAFTA) without Canada, ahead of the U.S.-imposed Oct. 1 deadline. “We’re still talking to Canada, and we’re getting very, very close to the deadline where we’re going to have to move ahead with Mexico all by themselves,” White House economic adviser Kevin Hassett said on Friday.

Pollsters are saying there is a 75% likelihood Democrats will take the House. That will cripple any chance of further US tax cuts but, more importantly, it will curb Trump’s ambitions on trade and leave the US deadlocked once again.

Energy, meanwhile, also racked up gains, supported the broader markets, as oil prices rebounded from lows, which followed a report suggesting major oil producers were set to discuss plans to boost output. On the New York Mercantile Exchange, crude futures for October delivery rose 40 cents to settle at $70.72 a barrel.

At the moment, the crypto-currency prices are near the lows, but unleashed by Trump trade war, sanctions, tightening of the monetary policy and uncertainty create a favourable environment for the long-term cryptocurrencies growth, especially in the emerging economies. Bitcoin rose 3.96% to 6,782. Bitcoin got support on approaching the “bottom” about $6,000. However, in the nearest future the benchmark cryptocurrency will have to face the test of the important resistance level. An important resistance level descended into the region of $7,000, in case of taking it, the cautious bulls should also await the confirmation with crossing the previous peaks at $7,500. Without taking these levels, it will be difficult to talk about a change in the trend.

The US dollar rose against its rivals on Friday, as investors reined in appetite for emerging-market currencies, while the pound racked up losses as the UK and EU reached an “impasse,” on a post-Brexit deal. The U.S. dollar index, which measures the greenback against a trade-weighted basket of six major currencies, rose by 0.40% to 93.84.

UK Prime Minister Theresa May criticized the EU for rejecting her post-Brexit plans, citing it “unacceptable,” particularly as the bloc failed to put forward alternative proposals. May further claimed that the UK and EU were at an “impasse,” denting optimism for a post-Brexit deal agreement following recent reports that the EU were set to adopt a warmer approach to Brexit talks.

GBP/USD fell 1.41% to $1.3075, eroding most of the week’s gain as the pair looks set to end the week roughly flat.

The dollar was also supported by profit-taking on emerging-market currencies like the South African rand and Turkish lira, both of which have enjoyed sharp gains on the back of improving sentiment in developing economies. Turkey unveiled a new economic program earlier this week to reduce its current account deficit, while South Africa’s central bank stood pat on interest rates Thursday.

Elsewhere, EUR/USD fell 0.29% to $1.1743 on weaker-than-expected eurozone manufacturing data. The single currency was set, however, to post a second-straight weekly gain ahead of an important week, as the Italian government is slated to release its budget on Thursday.

So in the short term the financial markets look confident, though below the surface there are shadows lurking, as higher FED rates put more pressure on corporate bonds.

Locally though, the next three months will be testing given the outfall from the Royal Commission, tighter credit and falling home prices. And to reinforce that, the RBA has confirmed what we all knew, namely than Banks do and can create money – deposits follow. See Our Post “How Banks Create Money” . This underscores the need to actively manage credit, rather than arguing as many do that because for every credit there is a debt, for every asset and liability, credit growth is unimportant – yes many still hold this view – when in fact it is availability of credit which drives home prices. And because credit is now much tighter, the downward forces mean home prices are set to continue to fall. And just as in a rising market high prices begets more loans, so less lending can only drive prices one way. Yes, we are indeed in for a fall, the question is how far and how fast? Time will tell.

And by the way, if you value the content we produce please do consider joining our Patreon programme, where you can support our ability to continue to make great content.