Today ING says it is increasing variable rates for investor mortgage customer by 15 basis points. The changes come into effect from Tuesday 25 September and is for both new and existing investor loan customers.

This is the second rise in rates – ING had already increased its rates in June by 10 basis points for owner occupier loans.

This will put more pressure on the investor segment, already wilting under the strain.

Recently of course all the big banks but NAB repriced their entire book, attributing the rise to pressure from international funding. The rate hikes already signalled will now start to bite.

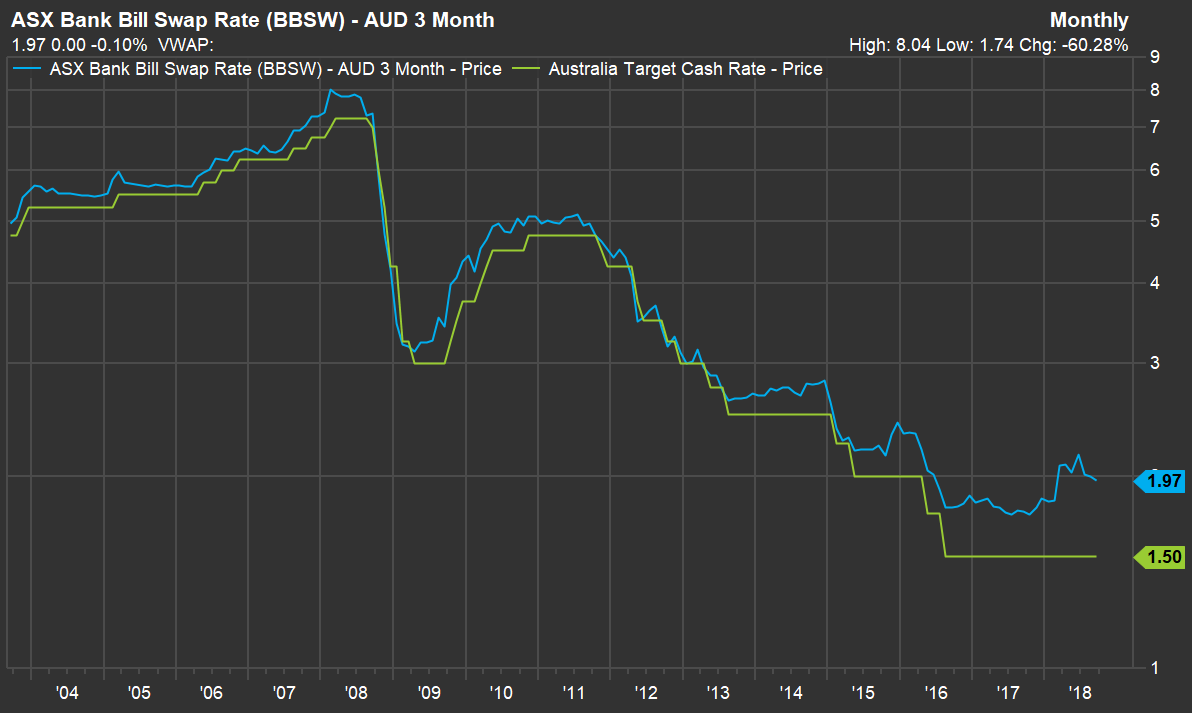

Actually the BBSW has come back somewhat, but remains elevated. This chart shows the divergence to the cash rate. The point is as the majors fund some of their book from short term sources the funding gap is real and sustained.

Westpac also put the cat among the pigeons by cutting mortgage rates by up to 110 basis points for new business, as they seek to dominate the meager pickings in the changed market. This is being funded by the back book repricing, so lower risk mortgage holders who shop around may be able to grab a low low rate, for now.

Westpac also put the cat among the pigeons by cutting mortgage rates by up to 110 basis points for new business, as they seek to dominate the meager pickings in the changed market. This is being funded by the back book repricing, so lower risk mortgage holders who shop around may be able to grab a low low rate, for now.

In a change from honeymoon offers, the banks new loan packages includes discounts of up to 80 basis points for the life of the loan.

Expect more specials from the other major players. This may also put more pressure on NAB, who held their rates last week.

The new Westpac Group rates will also apply for new lenders for Bank of Melbourne, BankSA and St George Bank.

The offer excludes owner occupied loans with interest only repayments or to switches within the Westpac Group.

There is also an offer to first time buyers, with an 85 basis point discount for 5 years and a lower discount beyond.

Westpac has tightened their lending policies again for existing borrowers with a focus on commitments such as Afterpay and leases.

Bottom line is there is merry dance of cross subsidization in play as existing borrowers are forced to pay more, (the back book) while certain classes of refinacing and first time buyers are being enticed. However, bearing in mind that home prices are likely to fall further, buyers should beware. Always read the small print!

We also wonder how sustainable these discounts are given current margin pressures. But I guess volume and margin are being traded off at least to an extent!