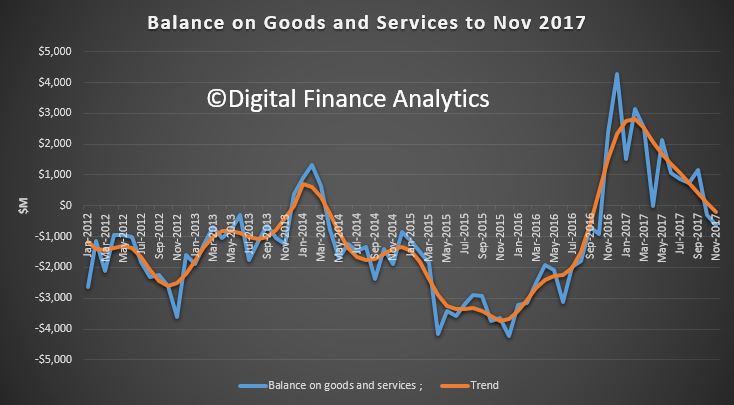

The latest data from the ABS highlights that in November, Australia’s widened trade deficit widened, against expectations of $550m surplus; which is close to a $1bn miss. It was largely driven by a large fall in non-monetary gold exports. This raises the possibility of weaker than expect fourth quarter growth outcomes.

The ABS says that in trend terms, the balance on goods and services was a deficit of $194m in November 2017, a turnaround of $296m on the surplus in October 2017. In seasonally adjusted terms, the balance on goods and services was a deficit of $628m in November 2017, an increase of $326m on the deficit in October 2017.

In seasonally adjusted terms, goods and services credits rose $141m to $31,853m. Non-rural goods rose $394m (2%) and rural goods rose $25m (1%). Non-monetary gold fell $425m (23%). Net exports of goods under merchanting remained steady at $53m. Services credits rose $147m (2%).

In seasonally adjusted terms, goods and services debits rose $467m (1%) to $32,481m. Consumption goods rose $213m (3%), capital goods rose $190m (3%) and intermediate and other merchandise goods rose $81m (1%). Non-monetary gold fell $100m (25%). Services debits rose $83m (1%).