According to the Bank of England, climate change creates risks to both the safety and soundness of individual firms and to the stability of the financial system. These risks are already starting to crystallise, and have the potential to increase substantially in the future. There is a pressing need for central banks, regulators and financial firms to accelerate their capacity to assess and manage these risks.

So, the Bank of England has published a discussion paper which sets out its proposed framework for the 2021 Biennial Exploratory Scenario (‘BES’) exercise.

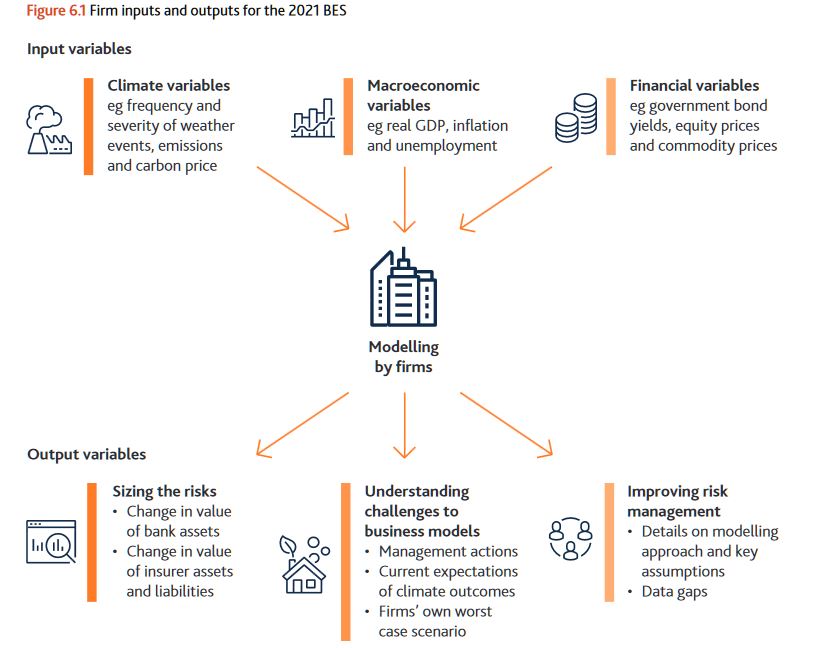

The objective of the BES is to test the resilience of the largest banks and insurers (‘firms’) to the physical and transition risks associated with different possible climate scenarios, and the financial system’s exposure more broadly to climate-related risk.

They say, conducting a climate stress test poses distinct challenges compared to conventional macrofinancial or insurance stress tests. To ensure it is effective in light of these challenges, the Bank is using this discussion paper to consult relevant stakeholders on the design of the exercise. This includes financial firms, climate scientists, economists, other industry experts, and informed stakeholder groups.

Whilst climate-related risks will materialise over decades, actions today will affect the size of those future risks. It is therefore important that firms, and other stakeholders such as the Bank, continue to develop innovative approaches to measure climate-related risks before it is too late to ensure resilience to them. The BES will use exploratory scenarios to size these future risks and to explore how firms might respond to them materialising, rather than testing firms’ capital adequacy.

The key features of the BES are:

- Multiple Scenarios that cover climate as well as macro-variables: to test the resilience of the UK’s financial system against the physical and transition risks in three distinct climate scenarios. These range from taking early, late and no additional policy action to meet global climate goals.

- Broader participation: both banks and insurers are exposed to climate-related risks, and the action of one will spill over to affect the other. For insurers, this exercise builds on the scenarios developed for this year’s insurance stress test.

- Longer time horizon: is needed as climate-related risks crystallise over a much longer timeframe than conventional risks. The BES proposes a modelling horizon of 30 years. This is because climate change, and the policies to mitigate it, will occur over a much longer timeframe than the normal horizon for stress testing. To make these scenarios credible and tractable, the Bank proposes that the BES examine firms’ resilience using fixed balance sheets, focusing on sizing the risks and the scale of business model adjustment required to respond to these risks, rather than testing the adequacy of firms’ capital to absorb those risks.

- Counterparty-level modelling: a bottom up, granular analysis of counterparties’ business models split by geographies and sectors is proposed to accurately capture the exposure to climate-related risks.

- Output: the Bank will disclose aggregate results of the financial sector’s resilience to climate-related risk rather than individual firms.

The Governor Mark Carney said: “The BES is a pioneering exercise, which builds on the considerable progress in addressing climate related risks that has already been made by firms, central banks and regulators. Climate change will affect the value of virtually every financial asset; the BES will help ensure the core of our financial system is resilient to those changes.”

Sarah Breeden the Executive Director sponsor for climate change said “None of us can know exactly how climate change will unfold, but we do know that it will create risks to the financial system. I am excited that this ground-breaking exercise will for the first time allow us to quantify this risk and so determine the actions we need to take today if we are to minimise these future risks.”

The Bank is consulting on the design of the exercise and welcomes feedback on the feasibility and the robustness of these proposals from firms, their counterparties, climate scientists, economists and other industry experts by 18 March 2020. The final BES framework will be published in the second half of 2020 and the results of the exercise will be published in 2021.

The Banks concludes, there are many challenges involved in designing such an exercise and this proposal seeks to balance various trade-offs. These include providing a comprehensive description of the potential risks while also creating a tractable exercise for firms, and providing sufficient detail in the scenarios to allow results to be aggregated consistently while also providing scope for firms to assess the risks in a granular way.