In the RBA Bulletin, released today, there is a section which shows major bank margins have improved. Essentially, the story is one of falling deposit rates, plus change in mix, and rises in home lending rates independent of the cash rate in recent months. Consumers are bearing the burden whilst big business lending rates and margins are being compressed thanks to competition from overseas banks. The big banks are benefiting the most from the margin improvement, which shows again their market power.

Consistent with the large fall in interest rates on term deposits, the level of term deposits in the system declined in 2015, mostly due to some maturing deposits not being rolled over. In contrast, transaction and at-call savings deposits grew strongly in the year .

Throughout 2015, banks also adopted pricing strategies aimed at reducing deposits from institutional depositors (such as superannuation funds), which are more costly to banks under the LCR framework. The change in the mix of deposit funding lowered the cost of those funds by 3 basis points owing to particularly strong growth in transaction deposits, which carry lower interest payments. In part, this reflects the rapid growth of mortgage offset account balances through 2015, where funds are typically deposited in zero-interest rate accounts but are used to reduce the calculated interest on the associated mortgage. One implication of the increased use of such accounts is the high ‘implied’ cost of funds for banks – equivalent to interest forgone on mortgages. Interest rates on mortgages are much higher than those on deposit products, so banks implicitly pay their customers the mortgage rate on funds held in offset accounts. However, money held in offset only accounts for about 6½ per cent of at-call deposits.

They make the point that housing rates generally declined in line with the cash rate in the first half of 2015, with the average outstanding interest rate on mortgages falling by around 50 basis points over that period. In the second half of the year, however, banks adjusted their lending rates such that the average outstanding housing interest rate for investor loans was only modestly lower over 2015, while rates for owner-occupiers declined by roughly 30 basis points over the year. Interest rates on investor loans were increased midyear, following concerns raised by APRA about the pace of growth in lending to investors. Increases in investor lending rates ranged from around 20–40 basis points, and were applied to both new and existing investor loans.

In November, the major banks raised mortgage rates across both investor and owner-occupier loans by 15–20 basis points, citing the cost of raising additional equity to meet incoming regulatory requirements. Of particular relevance, the Financial System Inquiry’s Final Report recommended higher capital requirements for banks using ‘advanced’ risk modelling (the major banks and Macquarie Bank) in order to reduce a competitive disadvantage relative to other mortgage lenders (FSI 2014). The other Australian banks similarly increased mortgage lending rates, despite not facing the same regulatory costs as the major banks.

Business rates generally fell by more than the cash rate in 2015, with large business rates falling by around 70 basis points and small business rates by around 60 basis points. These lending rates remain at historic lows. Banks reported that declines in business rates beyond the changes in the cash rate were driven by intense competition for lending, including from the Australian operations of foreign lenders.

The major banks’ implied spread, being the difference between average lending rates and debt funding costs, increased by around 20 basis points over 2015. This change was driven in roughly equal parts by the decline in average funding costs relative to the cash rate, and an increase in the average lending rate. However, lending rates and debt funding costs tend to move in line with each other in the longer run. The contribution to the aggregate implied spread from higher lending rates was entirely due to increases in housing lending rates, with the implied spread on housing lending now higher than the previous peak in 2009. However, the measure of funding costs used to calculate implied spreads does not account for the increased share of relatively expensive equity funding. As such, the increase in the implied spread for housing lending is likely to overstate the true change in major banks’ margins for this activity. Implied spreads on business lending declined over 2015. Consistent with strong competition, implied spreads on large business lending have returned to pre-global financial crisis levels, when there was strong competition, business conditions were highly favourable and risk premia were compressed. Much of the competition is coming from foreign banks, with the average rate on business loans written by foreign banks significantly lower than the rate being charged by Australian banks.

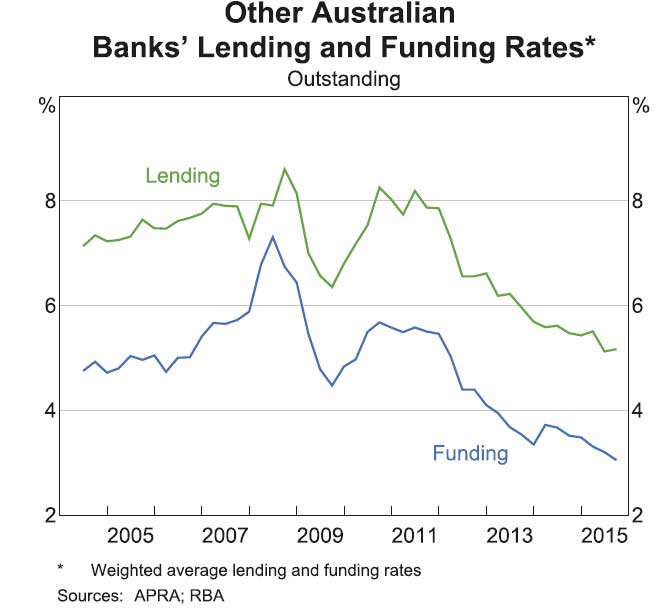

The average implied spread on other Australian banks’ lending has been around 25 basis points lower than for the major banks since 2005. However, there is considerable variation in implied spreads of the other Australian banks, driven more by the high variation in lending interest rates across banks than variations in funding costs. In contrast to the major banks, the spread on other Australian banks’ lending for housing declined over 2015 with their lending rates falling by more than their funding costs. The other Australian banks’ spread on business lending also decreased in 2015. The spread on business lending remains higher for the other Australian banks, which reflects the fact that these banks generally lend more to smaller business than the major banks, and do not compete as heavily with the major and foreign banks on large business lending.