The Australian Banking Association (ABA), says farmers, small business owners, customers living in remote areas or with limited English and Australians with basic bank accounts will receive new protections under a revamped Banking Code of Practice in response to the Final Report of the Royal Commission.

The new Code, approved by ASIC last year, introduces a range of new measures to make banking products easier to understand and more customer focussed. The Code itself is currently enforceable through the courts and the Australian Financial Complaints Authority as it forms part of a customer’s contract with their bank.

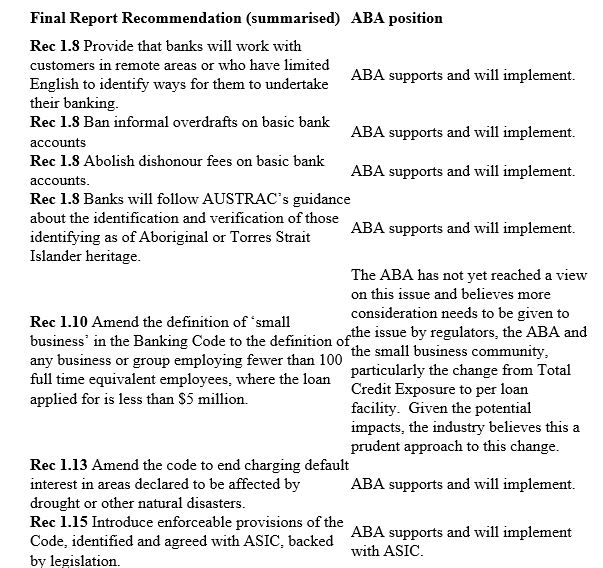

Of the 76 recommendations, 29 apply to banks, 7 to be taken forward by the Australian Banking Association with the remaining to be implemented by regulators and government.

The Code represents a stronger commitment to ethical behaviour, responsible lending, greater financial protection and increased transparency. The new changes announced today further increase protections for Australian customers.

The Code will be updated with key amendments in response to the recommendations of the Royal Commission Final Report, which outlined the need for changes in protection for small businesses and farmers and a greater focus on customers in remote areas and those with limited English.

In addition to changes to the Code, banks also support the Final Report’s

recommendation (1.14) for clearer and improved practices for banks assisting

farmers in financial distress.

Regarding recommendation 1.10, the current Code definition of $3m total credit

exposure was reached after considerable evidence-based consideration about the

likely impact on availability of credit and competition in the market. ASIC

approval of this clause of the Code is subject to an ASIC review of its

operation 18 months after it commences.

The Royal Commission recommendation to expand the definition from total

borrowings of a business to an assessment on a per loan basis regardless of the

existing borrowings is a very significant expansion on the current definition

which the industry believes should be considered carefully before any change is

made.

The industry has serious concerns that this recommendation may have a material

impact on access to credit for small business borrowers.

In finalising the industry position on this recommendation, ABA members will

model the impact on their own customers and consult with Treasury, regulators

and small business groups.

Some of the changes outlined in the table will be subject to regulatory

approval and banks will work with ASIC, the ACCC and Treasury to ensure these

changes are made as soon as possible.

CEO of the Australian Banking Association Anna Bligh said that the updated Code

would create a stronger code for customers.

“The Royal Commission Final Report is the industry’s roadmap for earning back

the trust of the Australian people,” Ms Bligh said.

“The industry has taken the report and is acting with urgency to ensure lasting

reform occurs without delay.

“The Royal Commission highlighted the need for the Banking Code of Practice to

be strengthened to increase protections for small business and increase the

accessibility of services for customers in remote areas or with limited

English.

“In addition to the changes to the Code, banks will also deliver greater

assistance to farmers through clearer and improved practices when assisting

farmers with distressed loans.

“The industry will be implementing these changes to our Code as soon as

possible.

“This work will build upon the new Code, approved by ASIC in July last year,

which delivers a better banking experience for Australian customers,” she

said.

So the CBA using its tech to steal customers extra payments on home loans is OK?

I mentioned this to one of our team and she discovered all of her extra payments on her CBA home loan have been stolen this way for the last 5 years.

The Commissioner also recommended the banks continue to sell worthless credit card insurance.

Your a “predatory lender” if you suggest an overdraft that subjectively is “too large”, one way around this was temporary overdrafts so now you go to the real predatory lenders with their high tech algo’s that charge 15% or more.

Just curious if its so “high tech” and their claimed hundred’s of thousands of data points ensure little if any risk how come their interest rates are so high?

The FinTech seem to me to be using the spoiled fruit model where you factor in say 30% of your loans going bad and then calculate your interest rate.

Based on my personal experience people will find a way to borrow and at the moment all of legislation will, as usual, lead to unintended consequences.

Add in the final days of the coal Royalty boom, last I heard 40% of Fed revenue was from coal royalties and as per the old Chinese curse “we will live in interesting times”.