The ACCC proposes to impose conditions on the Australian Banking Association’s (ABA) Banking Code of Practice to ensure the revised Code will benefit low-income consumers and drought-affected farmers.

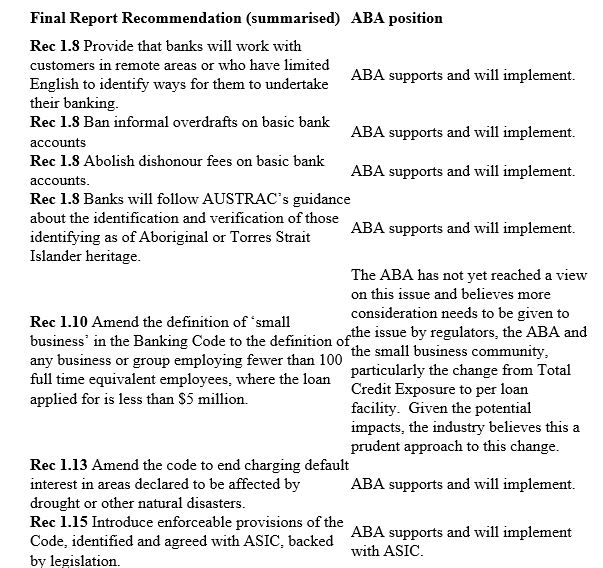

The ABA, on behalf of its 23 members including the major banks, has sought authorisation to amend its Banking Code in line with recommendations of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry (Hayne Royal Commission).

The proposed amendments aim to improve basic bank accounts and low or no-fee accounts by prohibiting informal overdrafts unless requested by the customer, and dishonour fees. The ABA is also proposing that certain types of basic bank accounts have no minimum deposits, free direct debit facilities, access to a debit card at no extra cost and free unlimited domestic transactions.

In addition, the ABA’s changes would prevent default interest being charged on agricultural loans in drought-affected areas.

After considering the ABA’s proposal, the ACCC believes that additional conditions are required to strengthen these changes.

“The proposed changes to the Code should result in public benefits, by giving customers on low incomes better access to affordable banking, and to address a source of significant harm to farmers experiencing drought,” ACCC Deputy Chair Delia Rickard said.

“While the ACCC strongly supports these objectives, we are proposing to place extra conditions on ABA members to ensure the changes effectively address the Royal Commission’s recommendations, and in turn actually deliver these public benefits.”

For example, under the ABA’s proposal, basic bank accounts could still be overdrawn without the customer’s agreement in some circumstances, and banks could continue to charge interest, in some cases at rates approaching 20 per cent, on overdrawn amounts.

“This could lead to low income customers getting into debt from overdrafts they did not agree to, which is exactly the kind of problem the Hayne Royal Commission sought to address,” Ms Rickard said.

The proposed conditions of authorisation would not allow interest to be charged in these cases, or would require any such interest charges to be repaid to the customer.

The ACCC also shares consumer groups’ concerns that the ABA’s proposed changes would not require banks to proactively identify existing customers who would be eligible for the accounts, or even to continue to offer a basic bank account at all.

To address this, the ACCC’s proposed conditions would require banks to proactively identify eligible customers, including through data analysis; inform these customers of their eligibility, and for the ABA to report to the ACCC on measures taken to offer them fee-free bank accounts, and report how many customers have taken them up.

The ACCC will also require members of the ABA who currently offer a basic banking product to continue to do so for the period of authorisation.

Feedback is invited on these issues and the proposed conditions by 14 October 2019. The ACCC’s final determination is due in November 2019.

The draft determination and more information about the application for authorisation is available at The Australian Banking Association.