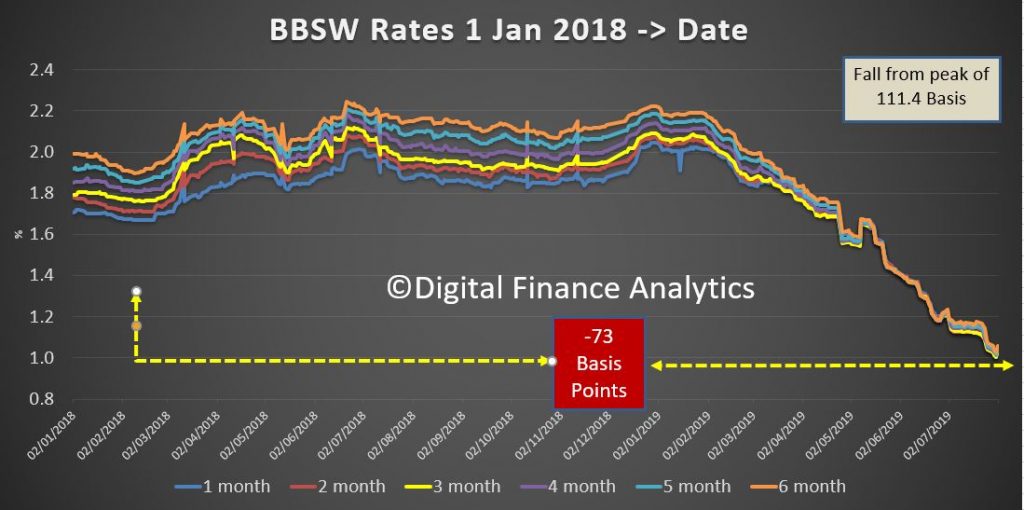

Following the rates cuts, the Bank Bill Swap Rate has continued to fall.

It is now more than 1.10% lower than its recent peak. This should help to support bank margins, so it will be interesting to see what is reported in the next few days as the bank reporting season fires up.

On Wednesday we will get CBA and Suncorp, and on Thursday AMP, among others.

On Friday we will get the latest Statement on Monetary Policy – watch out for their latest estimates of GDP and inflation, and Philip Lowe will also be testifying before Parliament, after the latest RBA meeting on Tuesday, where most expect no further rate change.

Finally, watch for the job ads data on Tuesday – to see if the rate cuts have lifted job opportunities as the RBA is hoping!

And by the way, it is a “bank holiday” in NSW today!

– Looking at the US 3 month T-bill rate I make a prediction: The FED WILL cut rates – at least – one more time.

– A second prediction: The FED will cut rates down to zero. although they will say someting alon g the lines of “Our target is between zero and 0.25%”.

– Can you provide a good source for historical date of the BBSW rate over the last say 20 years (weblink ?) ? I tried to search the internet but didn’t find any that was useful for me. Do you have such a long term chart available and are you willing to post it here on the blog in a next blog post ? Is there a website where I can track the BBSW ?

– Do you know what happened to the (australian) BBSW in 2008 & 2009 ? I would expect that the BBSW (being a swaprate) “went through the roof” in late 2008 & early 2009. Did it go “through the roof” in those 2 years ? Like the socalled “TED spread” went through the roof as well in the same timeframe ? The “TED spread” is a gauge of how much trust there is in the (US) financial system.

The BBSW is reported by the ASX. http://www.asx.com.au/prices/asx-benchmark-rates.htm. I do not know of a free source of BBSW history. I maintain my own, based on the ASX data which is the past 10 trading days, delayed by at least a day.