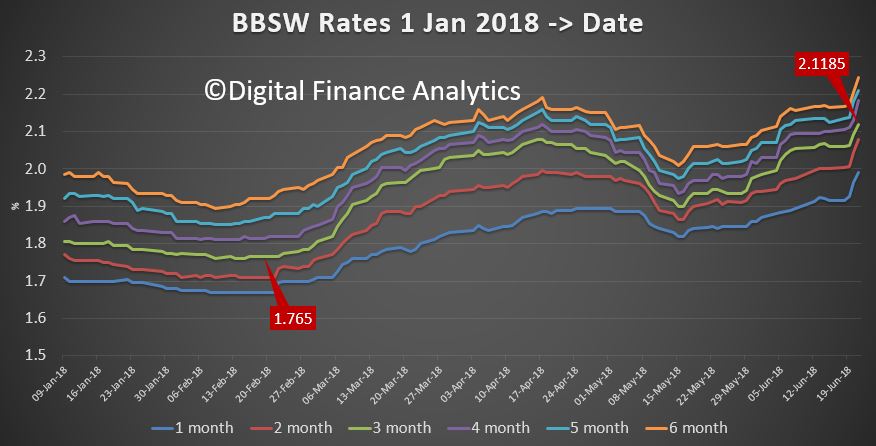

The benchmark BBSW rate has moved higher again, with the 3 month series now at a high of 2.1185; up ~36 basis points from February.

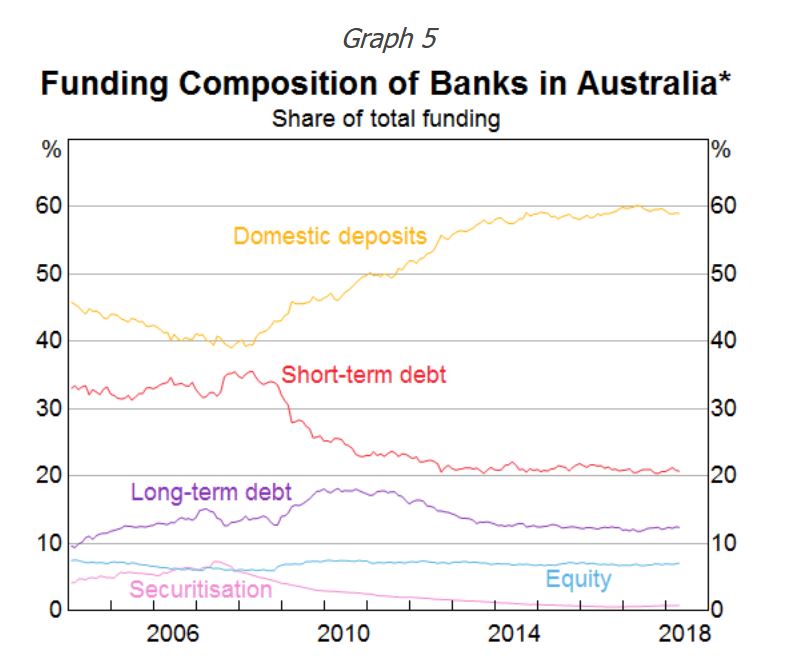

We know that around 20% of bank funding is from short term sources, according to the RBA.

We know that around 20% of bank funding is from short term sources, according to the RBA.

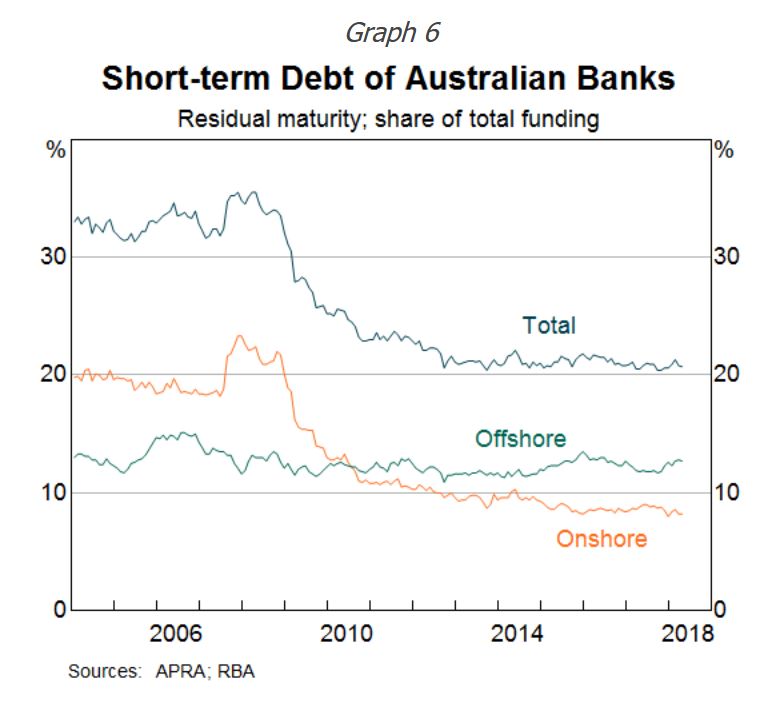

Of that, more is sourced offshore than onshore.

Of that, more is sourced offshore than onshore.  Both overseas rates – as typified by the US LIBOR …

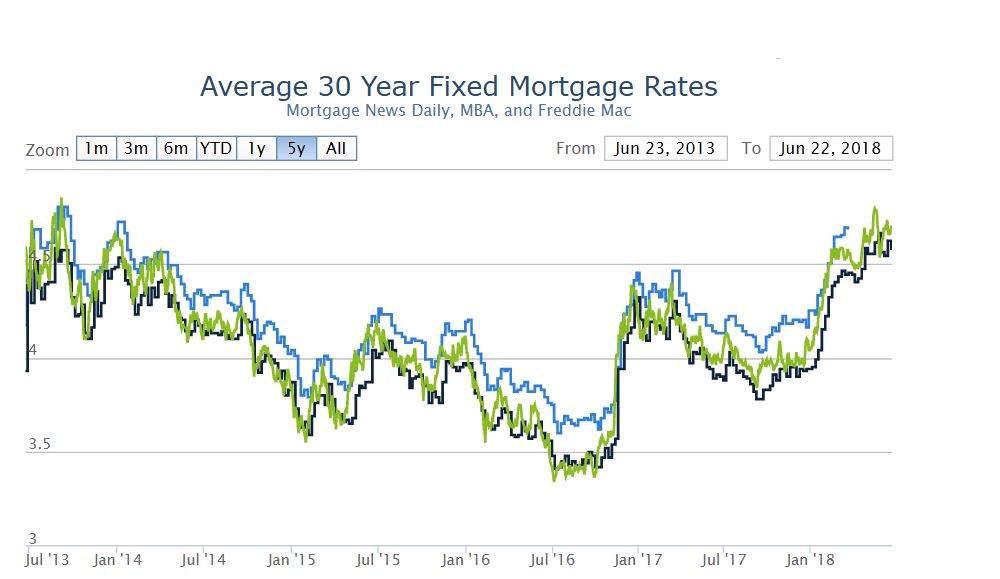

Both overseas rates – as typified by the US LIBOR …

… and the local BBSW rates as we looked at before, suggest a hike in mortgage rates is coming. In fact more smaller lenders quietly lifted their rates last week, following Suncorp, ME Bank and others.

… and the local BBSW rates as we looked at before, suggest a hike in mortgage rates is coming. In fact more smaller lenders quietly lifted their rates last week, following Suncorp, ME Bank and others.

IMB Bank said from 22 June, its standard variable interest rate will increase by 0.08 per cent for new and existing home loan customers and Auswide has also lifted with increases of five basis points (0.05%) for owner occupied home loans and thirteen basis points (0.13%) for investment home loans and residential lines of credit, effective 27th June.

Unless the majors follow suite, expect their profits to drop, and returns of bank deposit to fall further.

US Mortgage Rates continue higher too…

So Martin I’ve got a $2 scratchy that the CBA and other big 4 will be caught doing this – https://www.zerohedge.com/news/2018-06-24/bis-confirms-banks-use-lehman-stryle-trick-disguise-debt-engage-window-dressing

For banks, however, it may also reflect responses to regulatory requirements, especially if combined with end-period reporting. One example is the Basel III leverage ratio. This ratio is reported based on quarter-end figures in some jurisdictions, but is calculated based on daily averages during the quarter in others. The former case can provide strong incentives to compress exposures around regulatory reporting dates – particularly at year-ends, when incentives are reinforced by other factors (eg taxation).”

The biggest losers of the RC will be borrowers who have to pay the cost of higher interest rates caused by a lack of trust from overseas banks and others lending to all Australian home lenders, “rate for risk”.