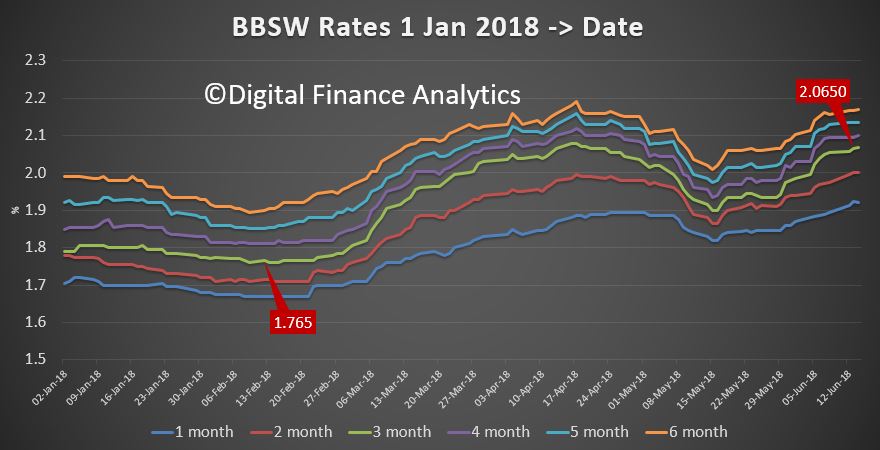

The latest BBSW rates have moved higher again in response to the higher US rates, and local uncertainty in the banking sector. The key 3-month rate is around 30 basis points above its February lows.

This puts more pressure on the banks in terms of margin erosion. As we said recently:

This puts more pressure on the banks in terms of margin erosion. As we said recently:

… we think something else is going on, because the spreads in Australia are a lot bigger now than other markets, and we suspect it’s a lack of confidence in our local banks, thanks to the revelations from the Royal Commission. A quick look at the recent share prices of for example Westpac, the largest investment loan lender…

… and CBA the largest owner occupied loan lender tells the story.

The markets are nervous. The pincer movements of higher funding, less confidence and a slowing and more risky housing market are all adding to the banks’ woes. They are stuck because any lift in mortgage rates will drive prices lower and lift defaults from overleveraged households.

Actually this is the reason why we think the RBA may be forced to cut the cash rate ahead.

A nasty cocktail.