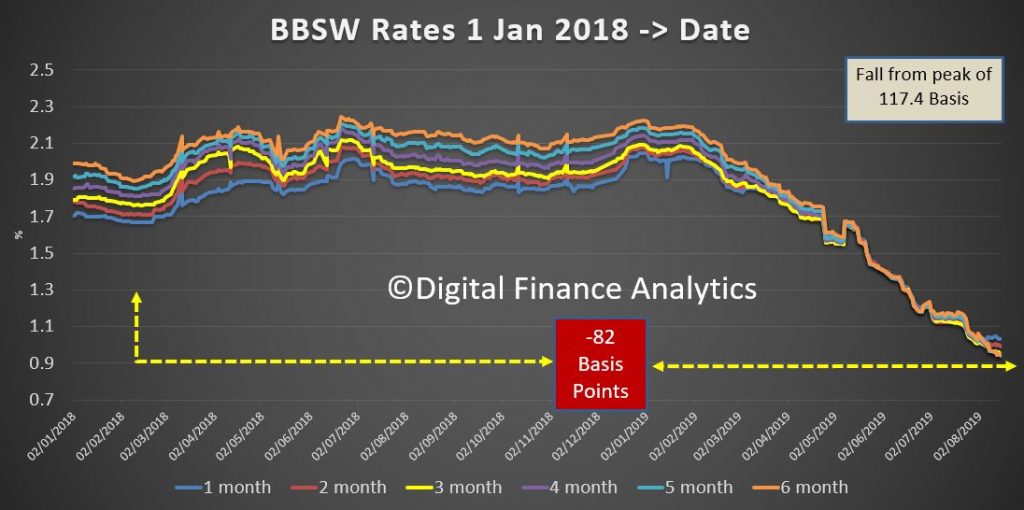

The fall from peak just a few months back has now risen to 117.4 basis points, compared with 114.9 last week and now 82 basis lower than the previous low last year. So bank funding continues to ease.

This week we will get the RBA and Fed minutes, otherwise it is a lighter week for data, though Central Bankers will be at the Jackson Hole Symposium, Wyoming, USA discussing “Challenges for Monetary Policy” – timely or what… and our own Philip Lowe will be in attendance and participating in a panel discussion.

Personally I think the title should have been the failure (or limits) of monetary policy! Central Bankers still think they pull the strings on the global economy, it’s a pity they fail to see the levers are not connected to the real world any more.

– When those (long/longer term) rates on those bank bonds start to rise (see my other posts in this thread) then the banks will have to roll over their maturing bonds/debt into new bonds with a higher interest rate. And that will drain the cash reserves & cash flow (even more).

– Here is where the yield curve is so usefull. It depicts the ratio (I use the ratio and NOT the difference) between short term rates and long term rates. When the yield curve starts to steepen then those long term rates (think: e.g. bank bonds) will go (much) higher. Then banks also will see their funding costs go up.

– The (australian) banks have been very blessed by a flattening yield curve and falling bond yields in the last few years because long term rates came down substancially, making funding costs much lower.

– Funding costs for banks will also go down when negative rates are introduced. Because deposits are found on the credit side of the bank’s ledger. Deposits are (unsecured) loans from the depositors to the banks. With negative interest rates the banks no longer have to PAY interest but they then can CHARGE interest to the depositor.

– But negative interest rates on deposits will be dwarfed by the impact of rising long term interest rates.

– Central banks wil NEVER admit that they follow short term rates (like the US 3 month T-bill rat or the australian BBSW). It would blow away their cover and the magic of central banking.

– I stiil expect the BBSW to go (much) higher in the next (australian) financial crisis.