Bendigo and Adelaide Bank released their full year results today. And given everything, it was not a bad result. But margin pressures and questions about future home lending volumes haunt the sector, and Bendigo is no exception.

Australia’s fifth largest bank announced an after tax profit of $434.5 million for the 12 months to 30th June 2018, up 1.1% from the prior year. Underlying cash earnings were $445.1m up 6.4% on the prior year. They were lower in the second half.

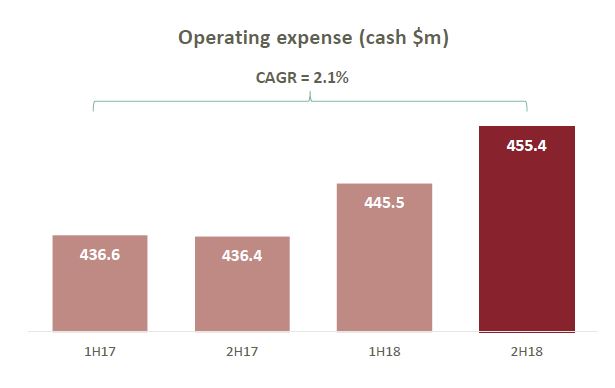

Their cost to income ration fell 50 basis points to 55.6% and their return on equity was 8.23%, up 13 basis points. They called out increase compliance costs, a 3.5% rise in staff salaries, higher software amortisation and “2H18 negative jaws”.

Their cost to income ration fell 50 basis points to 55.6% and their return on equity was 8.23%, up 13 basis points. They called out increase compliance costs, a 3.5% rise in staff salaries, higher software amortisation and “2H18 negative jaws”.

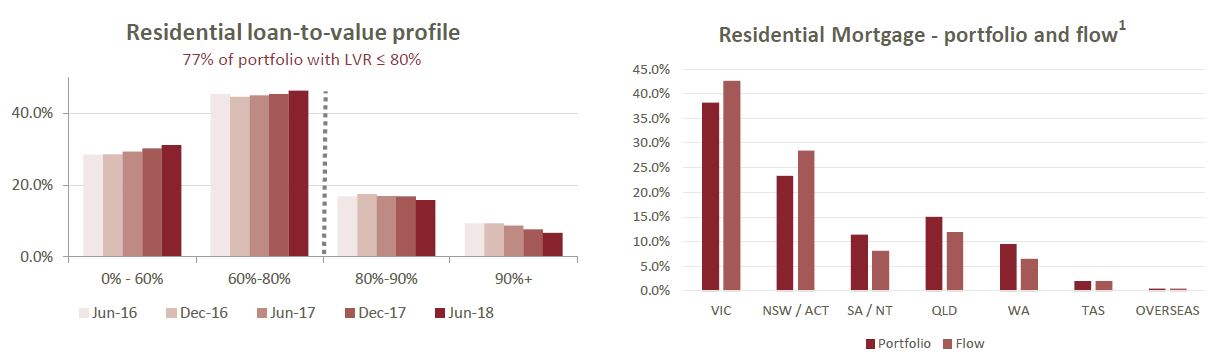

Total gross loans rose 1.4% to $61.8 billion, home lending grew below system at 4.7%, and retail deposits stayed steady at 80.2%, growing at 0.9% in the year.

Total gross loans rose 1.4% to $61.8 billion, home lending grew below system at 4.7%, and retail deposits stayed steady at 80.2%, growing at 0.9% in the year.

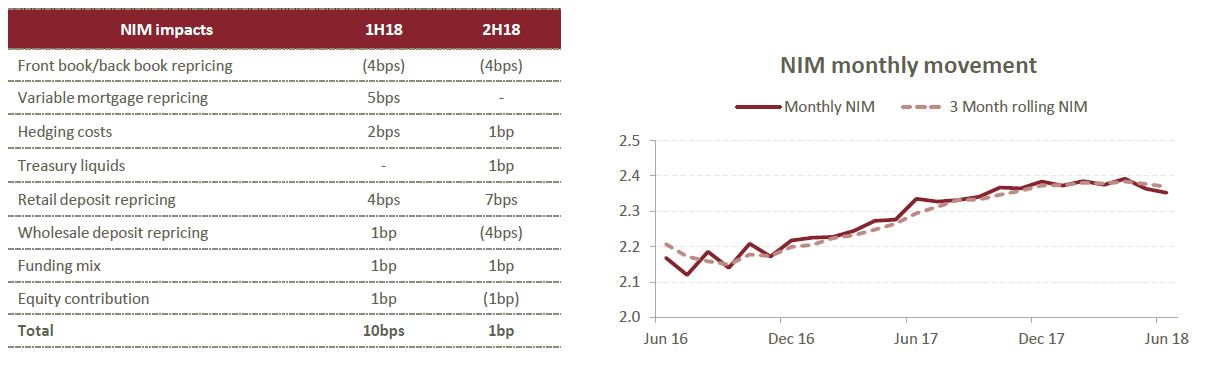

They reported a margin of 2.36%, up 14 basis points, but the exit margin is falling, reflecting pressure in the market. Deposits were repriced by 11 basis points over the year, especially in the second half.

They reported a margin of 2.36%, up 14 basis points, but the exit margin is falling, reflecting pressure in the market. Deposits were repriced by 11 basis points over the year, especially in the second half.

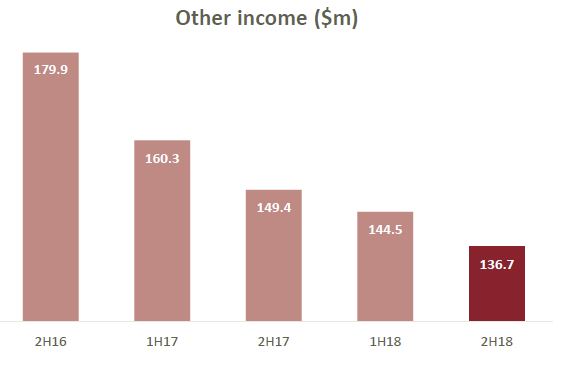

There was a significant fall in “other income” with lower ATM fees, lower trading book income and a range of other factors. It fell 9.2% on the prior year from $309.7 million to $281.2 million this year. This is reflective of industry-wide pressures.

There was a significant fall in “other income” with lower ATM fees, lower trading book income and a range of other factors. It fell 9.2% on the prior year from $309.7 million to $281.2 million this year. This is reflective of industry-wide pressures.

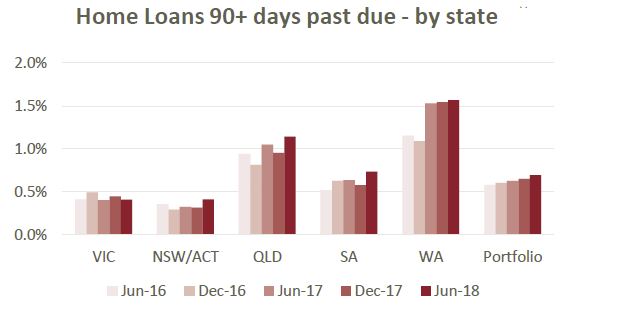

While business arrears fell slightly, there were rises in 90+ past due in WA, QLD and NSW/ACT rising, so the portfolio risks rose. Keystart loans were included from June 2017.

While business arrears fell slightly, there were rises in 90+ past due in WA, QLD and NSW/ACT rising, so the portfolio risks rose. Keystart loans were included from June 2017.

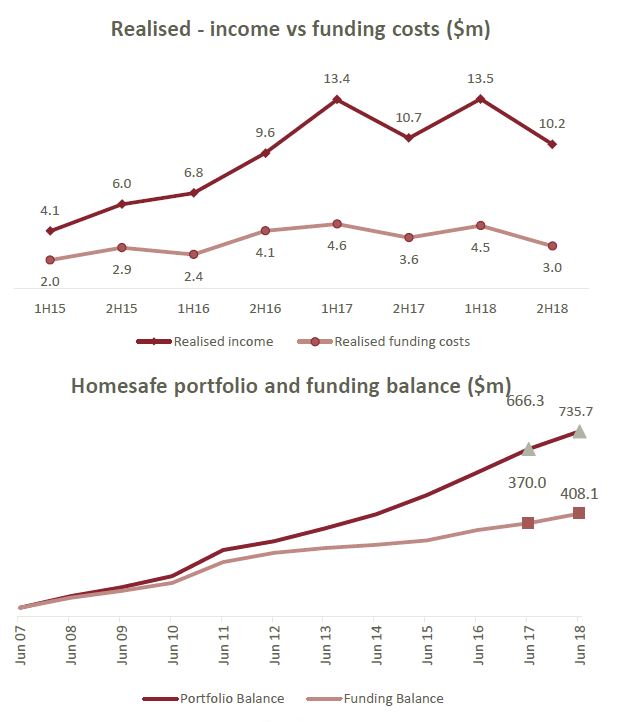

Homesafe’s overlay reflects an assumed 3% increase in property prices in the next 18 months, before returning to a long term growth rate of 6%.

Homesafe’s overlay reflects an assumed 3% increase in property prices in the next 18 months, before returning to a long term growth rate of 6%.

Great Southern past due 90 days was $50.5 m, down 36% from June 2017.

Great Southern past due 90 days was $50.5 m, down 36% from June 2017.

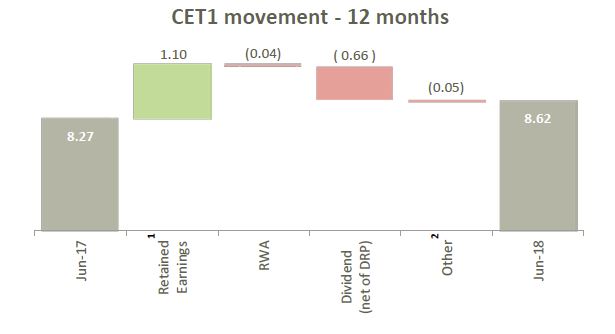

Their CET1 ratio rose 35 basis points since June 2017 to 8.62%. Their total capital rose 39 basis points to 12.85%.

AASB9 lead to an increase of $112.8 expected loss and the increase was taken through retained earnings as at 1 July 2018. CET1 ratio will decreased by 8 basis points on 1 July 2018.

AASB9 lead to an increase of $112.8 expected loss and the increase was taken through retained earnings as at 1 July 2018. CET1 ratio will decreased by 8 basis points on 1 July 2018.

They said their last RMBS transaction was in August 2017 for $750m, they are evaluation the new APRA credit risk proposals, and work toward advanced accreditation is continuing (though we think the benefit is being eroded). Their liquidity coverage ratio is 125.6% and the Net Stable Funding ratio at 109% at 30 June 2018.

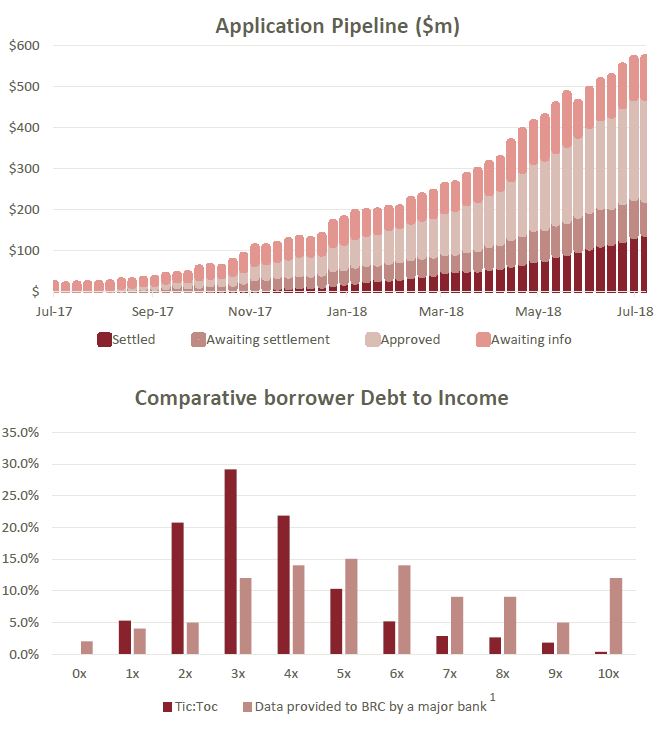

They also disclosed data from Tic:Toc, the quick approval lender, with $1.36bn of submitted applications and $170m loan portfolio.