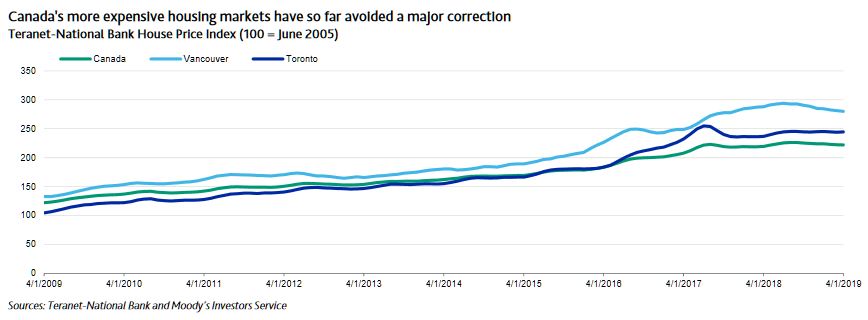

On 14 June, the Canadian Real Estate Association (CREA) reported that May home sales rose 1.9% nationally from April, says Moody’s. The report confirms other recent data suggesting that macro-prudential measures the Canadian government has taken to cool extreme houseprice appreciation over the past five years have been successful in engineering a “soft landing,” easing market concerns that some of the country’s more expensive markets such as Toronto and Vancouver were poised for a major correction. CREA now predicts home sales nationally will rise a sustainable 1.2% in 2019, a reversal from a previous forecast for a drop of 1.6%.

Reducing elevated house-price growth without triggering a severe correction in housing markets supports financial stability in Canada’s

banking system and reduces the prospect of rapid consumer deleveraging, which would pressure Canadian bank asset quality. Although Canadian banks’ mortgage portfolios are relatively resilient, unsecured consumer exposures would generate substantial incremental loan losses under the stress of a major housing price correction. This would pressure profitability at the Canadian domestic systemically

important banks (D-SIBs) and be detrimental to their strong credit profiles. The D-SIBs are Bank of Montreal, Bank of Nova Scotia, Canadian Imperial Bank of Commerce, Royal Bank of Canada, The Toronto-Dominion Bank and National Bank of Canada. Rising house prices in the major urban areas of Toronto and Vancouver have been the main driver of the growth in Canadian residential mortgage debt to almost CAD1.9 trillion (about 95% of GDP) as of 31 March 2019. Roughly 50% of domestic banking assets are

residential mortgages. Positively, about 85% of Canadian mortgage debt is in disciplined amortizing structures, which are lower risk than interest-only home equity lines of credit (HELOCs).

Policy decisions by the national and several provincial governments, including the tightening of mortgage eligibility requirements, have stabilized prices somewhat in recent quarters. We expect a more sustainable growth rate in housing prices over the next year, as supported by the CREA announcement.

A significant number of Canadian mortgages are explicitly backstopped by the Canadian government through Canada Mortgage and Housing Corporation (CMHC, Aaa stable) insurance, and the loans’ historical credit quality is high. However, federal initiatives to reduce the government’s exposure to housing risk have reduced the proportion of insured mortgages to about 33% at 31 March 2019 from 47% at 31 March 2014.

Structural features of the Canadian mortgage market also buffer banks against the effects of a housing shock: mortgage loans are full recourse, securitization and broker origination levels are low, payments are not tax-deductible and the level of subprime loans is low.

Banks are not invulnerable to losses on mortgages in a stress scenario, but losses would be moderate relative to strong capitalization and earnings. The non-mortgage consumer loans of Canadian banks are relatively more prone to rapid deterioration in the event of an economic shock, especially given high household indebtedness. These exposures also have higher expected loss given defaults than real estate secured debt. We expect increased provisions for credit losses on consumer portfolios over the next year, starting from a low base, with the potential for more significant asset quality deterioration in the event of an economic shock. Evidence of a moderation in housing price growth rates reduces the prospect of this risk.

– A canadian financial advisor called Hilliard MacBeth wrote a book called “”When The Bubble Bursts: Surviving the Canadian Real Estate Crash.” (2015 ???). Mr. MacBeth was interviewed about his views and his book back already in 2015. Watch the following video (about 9 minutes):

https://www.youtube.com/watch?v=TgUXWfbKWZ8

– Sounds familiar ?