The ABS released their September data on Private Capex spending. The trend volume estimate for total new capital expenditure fell by 4.9% in the September quarter 2016 while the seasonally adjusted estimate fell by 4.0%.

Within that, the trend volume estimate for buildings and structures fell by 8.5% in the September quarter 2016 while the seasonally adjusted estimate fell by 5.7%. On the other hand, the trend volume estimate for equipment, plant and machinery rose by 1.0% in the September quarter 2016 while the seasonally adjusted estimate fell by 1.9%.

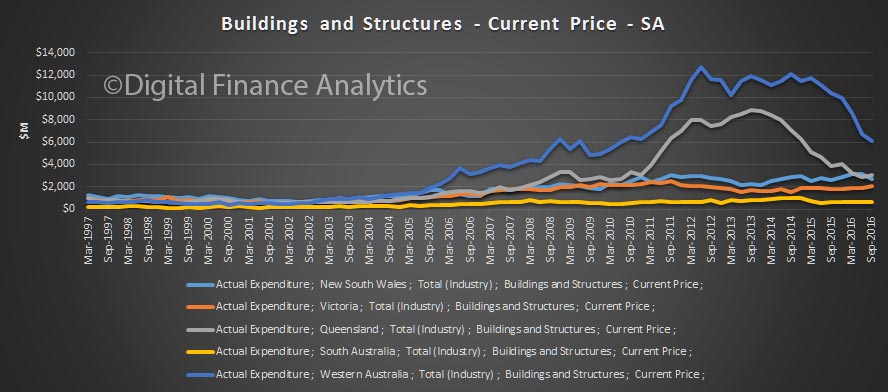

But taking a longer view, and across states we can see the real problem the economy has. We see significant falls in capex (current prices) in WA and QLD. Despite attempts to sure up momentum, using housing construction, the gap is just too big. This is a plot of buildings and structure investment flows.

It also appears WA has further to fall, to revert to more normal levels. We conclude that the fall in mining investment is just too large to be replaced by dwellings, and in any case, we saw yesterday, approvals are also falling.

It also appears WA has further to fall, to revert to more normal levels. We conclude that the fall in mining investment is just too large to be replaced by dwellings, and in any case, we saw yesterday, approvals are also falling.

So, where will future growth come from? This does not bode well for future household income.

The ABS also notes:

Each September quarter, the reference and base year for chain volume estimates for the Survey of Private New Capital Expenditure are updated. A new base year, 2014-15, has been introduced into the chain volume estimates which has resulted in minor revisions to growth rates in subsequent periods. In addition, the chain volume estimates have been re-referenced to 2014-15. Additivity is preserved in the quarters of the reference year and subsequent quarters. Re-referencing affects the level of, but not the movements in, chain volume estimates.As happens each year, a seasonal review has been undertaken based on estimates up to and including the June quarter 2016. This review has not resulted in noteworthy revisions to estimates up to and including June quarter 2016. There are no noteworthy revisions to previous estimates.