The ABS released the Capital Expenditure estimates to June 2019 today.

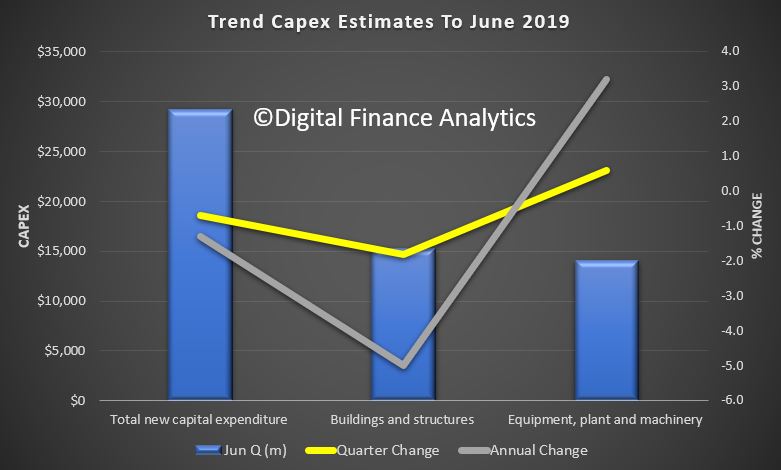

They said that the trend estimate for total new capital expenditure fell by 0.7% in the June quarter 2019 while the seasonally adjusted estimate fell by 0.5%.

The trend estimate for buildings and structures fell by 1.8% in the June quarter 2019 while the seasonally adjusted estimate fell by 3.3%.

The trend estimate for equipment, plant and machinery rose by 0.6% in the June quarter 2019 while the seasonally adjusted estimate rose by 2.5%

The annual trend changes were down 1.3% overall, with buildings and structures down 5% and equipment plant and machinery up 3.2%.

Overall this will likely reduce the already weak-looking GDP out turn.

Looking ahead the estimates do not look too bad, but given the external and local risk factors, the final results may be lower.

Total capital expenditure

- Estimate 7 for total capital expenditure for 2018-19 is $122,119m. This is 2.3% higher than Estimate 7 for 2017-18.

- Estimate 7 is 0.1% lower than Estimate 6 for 2018-19.

- Estimate 3 for total capital expenditure for 2019-20 is $113,404m. This is 10.7% higher than Estimate 3 for 2018-19.

- Estimate 3 is 14.9% higher than Estimate 2 for 2019-20.

Buildings and structures

- Estimate 7 for buildings and structures for 2018-19 is $65,330m. This is 2.8% lower than Estimate 7 for 2017-18.

- Estimate 7 is 3.7% lower than Estimate 6 for 2018-19.

- Estimate 3 for buildings and structures for 2019-20 is $66,922m. This is 12.3% higher than Estimate 3 for 2018-19.

- Estimate 3 is 12.9% higher than Estimate 2 for 2019-20.