We discuss the question of inflation targeting and the role of Central Bankers.

Category: Banking Culture

Macquarie Securities pays $300,000 infringement notice

Macquarie Securities (Australia) Limited (‘Macquarie’) has paid a penalty totalling $300,000 to comply with an infringement notice given by the Markets Disciplinary Panel (‘the MDP’).

The MDP had reasonable grounds to believe that Macquarie contravened the market integrity rules that deal with the provision of regulatory data to ASX and Chi-X.

Over a four-year period from July 2014 to July 2018, Macquarie transmitted approximately 42 million orders to ASX and Chi-X that included incorrect regulatory data or omitted required regulatory data. Over the same period, Macquarie also submitted approximately 377,000 trade reports to ASX and Chi-X with the same deficiencies.

The kinds of regulatory data that was incorrect or missing was information about:

- ‘capacity’: a notation to identify whether Macquarie was acting as principal or agent;

- ‘origin’: a notation to identify the person on whose instructions Macquarie was acting; and

- ‘intermediary’: the AFSL number of an intermediary using Macquarie’s automated order processing system.

The MDP emphasised that the provision of accurate regulatory data enhances market transparency and ensures an orderly market. The provision of incorrect or missing regulatory data to market operators impedes informed regulatory decision-making by market operators and by ASIC.

The MDP found that while Macquarie intended to comply with the market integrity rules, there were weaknesses in the configuration and integration of Macquarie’s systems, its processes for on-boarding new clients and its control framework.

The MDP considers Macquarie’s conduct to be negligent, having regard to Macquarie’s poor design and implementation of updates to key systems, the high number of orders and trade reports containing incorrect or missing data, the multiple categories of incorrect or missing data and the length of time the problems persisted without detection by Macquarie.

Given Macquarie’s scale, market share and high market flows, the MDP considers that market participants such as Macquarie have greater potential and capacity to undermine market integrity. A market participant such as this should carry a greater responsibility to properly manage the risks that flow from their conduct. If that risk is poorly managed, the financial consequences to the market participant should be commensurately greater.

The MDP noted that, once Macquarie became aware of the scale of the issues, which it reported to ASIC, it undertook a comprehensive review to identify the causes, and promptly implemented remedial measures.

AMP class action filed

Maurice Blackburn Lawyers has filed the first class action against AMP, alleging that the bank eroded more than an estimated two million superannuation accounts with ‘unreasonable fees’, via InvestorDaily.

The action is seeking compensation for the bank’s super fund members. Maurice Blackburn has opened an online portal where members can sign up to claim fees dating back to 30 May 2013.

Material tendered during the royal commission conveyed that AMP’s super funds were charging uncompetitive administration fees, with high costs exceeding returns and causing investment losses in some cases.

Maurice Blackburn’s action has claimed that AMP trustees failed to monitor, compare, negotiate or seek reductions of hefty fees being pocketed by the group’s companies, despite their duty to act in the best interest of members.

“It’s important that inquiries and regulators uncover mass wrongdoing of this nature, but that doesn’t give people back their hard-earned superannuation funds, which they need for their retirement,” Brooke Dellavedova, principal lawyer, Maurice Blackburn said.

“We estimate that over two million accounts have been impacted by AMP’s alleged misconduct.

“This class action asserts that AMP trustees breached statutory and general law obligations, essentially paying itself handsome fees from members’ funds. The case we are running will hold AMP to account for that.”

AMP said the proceeding will be “vigorously defended” in a statement, noting that it had cut product fees in the last year.

“In 2018, we cut fees on our flagship MySuper products, benefiting approximately 600,000 existing customers as well as new customers, improving member outcomes. In 2019, we also cut fees to MyNorth,” AMP said.

“AMP and the trustees of its superannuation funds are firmly committed to acting in the best interests of their superannuation members and acting in accordance with legal and regulatory obligations. We encourage any customers who have concerns to contact AMP directly or their financial adviser.”

Litigation funder Harbour is funding the class action, which has been filed in the Federal Court in Melbourne.

“Importantly, the matter will proceed in a way that means no one has to dip into their own pockets to fund the litigation,” Ms Dellavedova said.

“AMP account holders can band together to recover compensation, in circumstances where most people would not bring a case on their own.

“If you have had a superannuation account with AMP at any time since 30 May 2013, then you can sign up for this action to recover some of your lost funds, including compound growth amounts you missed out on.”

Investment banks face cartel class action lawsuit

Five global investment banks are facing a cartel class action lawsuit after a suit was filed at the Federal Court yesterday, via InvestorDaily.

Maurice Blackburn Lawyers, who is also taking on AMP in a class action, have launched the suit against UBS, Barclays, Citibank, Royal Bank of Scotland and JP Morgan, claiming the banks colluded to rig foreign exchange rates.

The suit alleges that between January 2008 and 15 October 2013, traders in chat rooms bearing names such as ‘The Cartel’ and ‘The Mafia’ communicated directly with each other to coordinate the manipulation of FX benchmark rates.

“The chat rooms included those named ‘The Cartel’, ‘The Mafia’, ‘One Team’, ‘One Dream’, ‘The Players’, ‘The Three Musketeers’, ‘A Co-Operative’, ‘The A-Team’, ‘The Sterling Lads’, ‘The Essex Express’ and ‘The Three Way Banana Split’,” according to Maurice Blackburn’s statement of claim.

It is alleged that the actions resulted in the pricing of ‘spreads’ and the triggering of client stop loss orders and limit orders.

“Sharing with each, alternatively one or more, of the other respondents, and/or one or more of the other cartel participants, information in relation to trade in FX Instruments with respect to one or more of the affected currencies, including in relation to trade volumes and/or trade strategy,” said the statement of claim.

The alleged conduct has been the subject of extensive regulatory and private enforcement action worldwide including settlements in the US and Canada resulting in the payment of US$2.3 billion and CA$107 million respectively.

Some of the allegedly affected currencies include the Australia, Canadian, New Zealand and US dollar as well as the Russian ruble, Indian rupee, the Euro and the British pound.

Maurice Blackburns principal lawyer Kimi Nishimura said that the cartel behaviour could have affected a number of Australian business and investors.

“Australian businesses and investors – particularly medium to large importers, exporters, institutional investors and businesses with operations overseas – have been affected by the distortion of the FX market by these banks.

“Such cartel behaviour cheats Australian businesses in circumstances where they may already have been vulnerable to currency fluctuations,” she said.

The class action will be represented by lead plaintiff J.Wisbey and Associates, a medical equipment importer, but is open to any customers that brought or sold currency during the period where total value of transactions exceeded over $500,000.

Spokespeople for the banks involved did not issue a statement at time of writing.

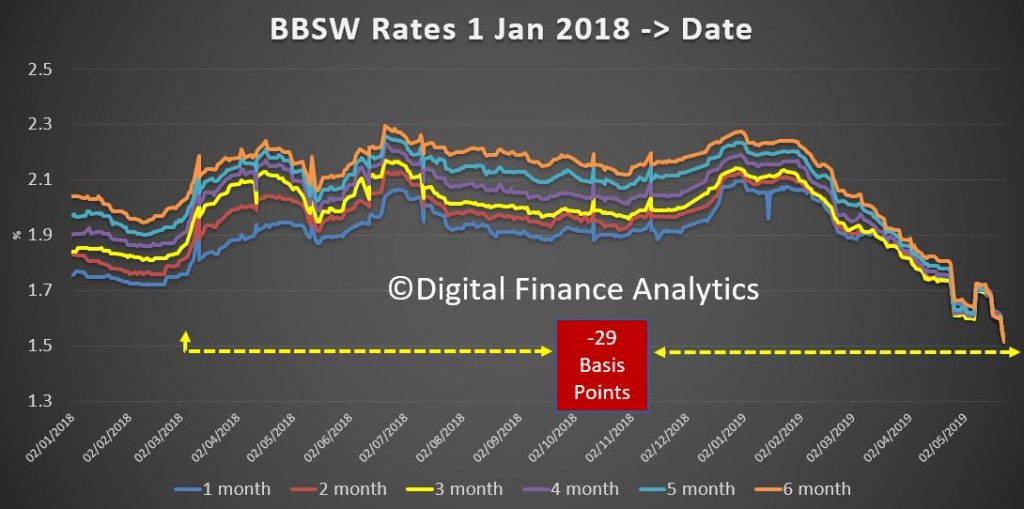

BBSW Lower = Banks Sitting On Margin Advantage

The Bank Bill Swap Rate continues to track down, which means that Banks are sitting on considerable funding advantage, which is being used to discount attractor mortgage rates.

However, there is a strong case now for banks to reverse their out of cycle rate hikes imposed on borrowers over recent months, irrespective of whether the RBA moves the cash rate down next month.

This would help household with their budgets, and help support the weakening economy. They could also stop the rot in terms of falling bank deposit rates.

The question is, will they?

Maurice Blackburn wins right to class action against AMP

The NSW Supreme Court has selected law firm Maurice Blackburn to be the one to take a shareholder class action against AMP following last year’s royal commission; via InvestorDaily.

Five law firms, Maurice Blackburn, Slater & Gordon, Phi Finney McDonald and Shine Lawyers, all filed class action lawsuits against the financial services company seeking compensation on behalf of shareholders.

The actions followed a drop in AMP’s share price after testimony at the royal commission last year, which was followed by the resignation of AMP’s then chief executive and chairwoman and the dismissal of its general counsel after criticism of his handling of a report by Clayton Utz.

NSW Supreme Court Judge Julie Ward chose Maurice Blackburn, whose funding model under their “no win, no pay” promise she considered the best.

“In the present case the combination of: absence of a separate funding commission; the incentive created by an uplift in fees only once a specified resolution sum is achieved; the comparable return based on standardised assumptions and the fact that no common fund order is being sought, seems to me to point in favour of the [Maurice Blackburn] funding model,” Judge Ward said.

The case against AMP alleges AMP engaged in misleading and deceptive conduct and breached its Corporations Act obligations when it failed to disclose its practice of charging fees for no service and in its interactions with ASIC.

An AMP spokesperson welcomed the decision to permit only one class action to proceed and said they would defend against the proceedings.

“AMP will continue to vigorously defend the class action proceeding. AMP denies the allegation that it had information that was required to be disclosed to the market regarding ‘fees for no service’ and AMP’s interactions with ASIC (including in respect of the Clayton Utz report).”

AMP also noted that Maurice Blackburn had been ordered to pay millions in security for AMP’s legal costs.

“The selected class action has been ordered to pay $5 million in security for AMP’s costs,” said AMP

A class action by Slater & Gordon will be consolidated into the Maurice Blackburn case but with the latter running the litigation alone.

Maurice Blackburn’s national head of class actions Andrew Watson was pleased with the result and said he looked forward to getting on with the job.

“We are pleased that the Court accepted that Maurice Blackburn’s funding model could help deliver the best returns to group members. We look forward to getting on with the important job of obtaining a recovery for affected AMP shareholders.”

Class actions typically take a long time to reach a conclusion with the next date set for next week for a directions hearing, which is a largely procedural issue.

APRA changes “unlikely” to invigorate housing market

While APRA’s proposed changes to serviceability assessments for ADIs have been broadly celebrated, others have expressed doubt that the regulatory revisions will stimulate the housing market in as meaningful a way as is hoped. Via Australian Broker.

“While these changes are welcome and will help some borrowers that can’t quite access a mortgage currently to get one, it is unlikely to result in a rebound in the housing market,” said CoreLogic research analyst Cameron Kusher.

Kusher referred to ANZ’s recent investor update to the market to elaborate on his stance.

The update from ANZ attributed reduced borrowing capacity to three factors: changes to HEM accounting for 60%, the servicing rate floor responsible for 30%, and income haircuts causing the remaining 10%.

Kusher pointed out that, according to this data, 70% of the reduction in borrowing capacity is unrelated to the current serviceability assessment model. Even if APRA were to change its current guidelines, it will likely continue to be much more challenging to get a mortgage than in the past.

Roger Ward, director of Champion Mortgage Brokers, agrees that the current 7.25% assessment rate is just one of six lending standards that have contributed to the credit squeeze.

Drawing from his 25 years in the banking and finance industry, Ward outlined the remaining five challenges to lending as:

- Banks considering borrowers’ capacity to repay for the full 25 to 30 years of a mortgage term, despite most loans now only lasting seven to eight years

- A one-dimensional and inaccurate approach to identifying spending habits and current costs of living

- Changes in credit reporting providing data on the last 24 months’ payment history on credit cards, with one late payment sometimes enough to be declined by a bank

- LVR changes and limitations, especially those impacting investors

- Tiered interest rates dependant on the size of the original deposit

While allowing lenders to review and set their own minimum interest rate floor will undoubtedly help some borrowers access previously unreachable mortgages, the housing market will require stimulation from elsewhere in order for dwelling values to begin their rise.

According to Kusher, “[APRA’s] proposed changes, in conjunction with the uncertainty of the election now behind, will potentially provide additional positives for the housing market. [They] would potentially slow the declines further and may result in an earlier bottoming of the housing market.

“Despite that prospect, it will remain more difficult to obtain a mortgage than it has done in the past and we would expect that if or when the market bottoms, a rapid re-inflation of dwelling values is unlikely,” he concluded.

New credit card rules will impact brokers, says lawyer

Brokers should be applying new credit card assessment rules to their loan applications, the solicitor director of The Fold Legal has suggested. Via The Adviser.

The Australian Securities and Investments Commission (ASIC) last year announced new assessment criteria that is to be used by banks and credit providers when assessing new credit card contracts or credit limit increase for consumers.

Under the changes, credit licensees are required to assess whether a credit card contract or credit limit increase is “unsuitable” for a consumer based on whether the consumer could repay the full amount of the credit limit within the period prescribed by ASIC.

ASIC outlined last year that, as part of the new measures, credit licensees undertaking responsible lending assessments for “other credit products”, including mortgages, should ensure that the consumer “continues to have the capacity to repay their full financial obligations” under an existing credit card contract, within a “reasonable period”.

Speaking of the new rules, Jaime Lumsden Kelly, solicitor director of The Fold Legal, has suggested that, while it is not mandatory for brokers, both lenders and brokers should apply the same rules to their loan applications.

Writing in a blog post for The Fold Legal, Ms Lumsden Kelly elaborated: “In the past, credit card contracts were assessed as unsuitable if the applicant couldn’t repay the minimum monthly repayment for that limit. Under the new rules, credit card providers must make their assessment based on whether the applicant can repay the entire credit card limit within three years.

“If a credit card applicant cannot repay the full credit limit in three years, it’s assumed that they will be in substantial hardship. This is because a consumer who cannot afford to repay the limit within three years will probably pay a staggering amount of interest that will take an extraordinarily long time to repay.

“If the applicant is in substantial hardship, the credit card provider must decline the application as being unsuitable,” she said.

While the rule doesn’t “technically” apply to other lenders or brokers, the lawyer added that “all lenders and brokers have an obligation to reject a credit contract if it would place the consumer into substantial hardship”.

“If the inability to repay a credit card within three years is considered to be a substantial hardship when assessing a credit card application, how can it also not be substantial hardship, if a consumer will no longer be able to repay their credit card within three years because they’re meeting new repayment obligations on a car or home loan?” she said.

Ms Lumsden Kelly gave the following scenarios as an example to illustrate the point.

In the first scenario, an applicant with a $500,000 mortgage applies for a $15,000 credit card. When assessing the credit card, the provider determines that the applicant is “unsuitable” because they won’t have enough income to repay their credit card limit in full within three years. So the credit card provider declines the application.

However, if the same applicant already has a $15,000 credit card and then applies for a $500,000 mortgage (on identical terms as in the first scenario). The licensee is only required to consider whether the applicant can make the minimum monthly repayment on their credit card when determining if they will suffer substantial hardship. On this basis, the licensee approves the mortgage.

“The end result for the applicant is the same in both scenarios,” she said. “They have a $500,000 mortgage and a $15,000 credit card limit. So how can we say that they are in substantial hardship in one scenario but not in the other?

“It’s an absurd outcome that the same person could be approved or declined for a credit product just because they applied for them in a particular order.”

The Fold Legal solicitor concluded: “Over time, the courts and AFCA may seek to align the obligations of all credit providers and brokers. In the meantime, ASIC has said it expects all credit licensees to apply the rule to existing credit cards by 1 July 2019.

“This means credit providers and brokers should consider the implications of this situation when determining how they will assess a credit card holder’s capacity to pay and substantial hardship for other loan applications.”

She urged any brokers unsure of how the rules affect their business or credit obligations to contact a lawyer.

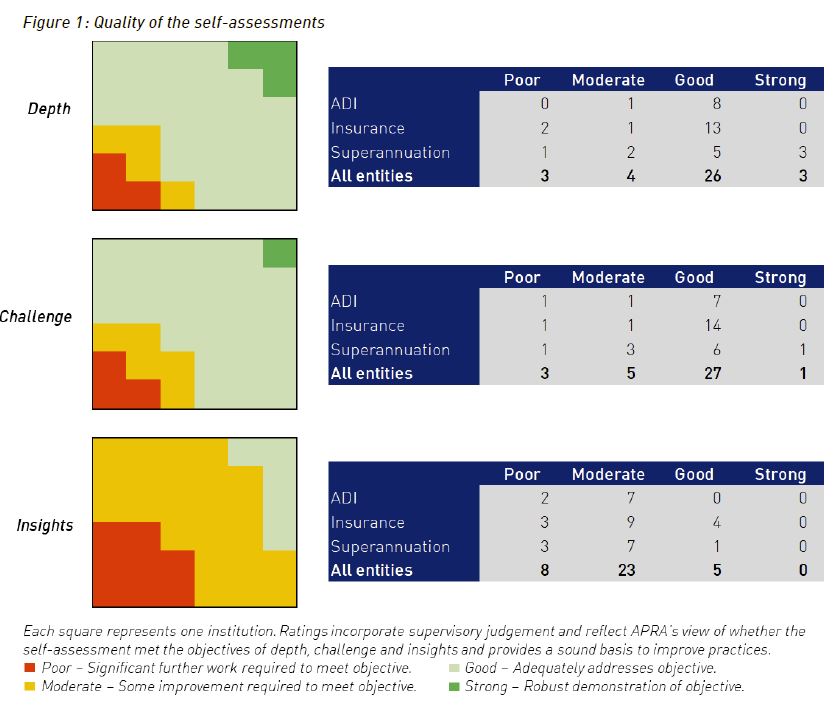

APRA On Financial Firm Conduct – Could Do Better

APRA’s report released today highlights the gaps which still exist across our financial firms, following the CBA analysis. Worryingly, despite firms’ boards and management teams being aware of the risk and accountability deficits which exist, some are not addressing them appropriately. Indeed, in some organsiations, there is still limited visibility of potential non-financial risks.

The Final Report of the Prudential Inquiry into the CBA found that continued financial success dulled the institution’s senses to signals that might have otherwise alerted the Board and senior executives to a deterioration in the bank’s risk profile. This was particularly evident in relation to the management of non-financial risks.

The Prudential Inquiry also found a number of prominent cultural themes; there was a widespread sense of complacency, a reactive stance in dealing with risks, insularity and not learning from experiences and mistakes, and an overly collegial and collaborative working environment that lessened constructive criticism, timely decision-making and a focus on outcomes.

The Final Report listed 35 recommendations focussing on five key levers of change:

- more rigorous board and executive committee governance of non-financial risks;

- exacting accountability standards reinforced by remuneration practices;

- a substantial upgrading of the authority and capability of the operational risk management and compliance functions;

- injection of the “should we” question in relation to all dealings with and decisions on customers; and

- cultural change that moves the dial from reactive and complacent to empowered, challenging and striving for best practice in risk identification and remediation.

In releasing the Final Report, APRA noted that all regulated financial institutions would benefit from conducting a self-assessment to gauge whether similar issues might exist in their institutions. APRA subsequently wrote to the chairs of 36 institutions requesting a board endorsed written self-assessment of the effectiveness of their own governance, accountability and culture practices. APRA received all of these assessments by mid-December 2018.

APRA’s request for institutions to conduct the self-assessments was intentionally not prescriptive. Boards were asked to determine an approach to the assessment which would provide them with a comprehensive understanding of the effectiveness of governance, accountability and culture, and enable them to form a view as to the extent the ‘tone from the top’ is permeating through and across the institution. As a result, the structure, methodology and format each institution took to completing the self-assessment was considered an important indicator of how seriously boards approached the task.

APRA set three principles that it expected the self-assessments to reflect:

- Depth – to enable the board to gain assurance that appropriate governance, accountability and culture are embedded in practices and behaviours, and enforced within the various levels and across the group-wide operations;

- Challenge – either independent or self-challenge, to provide the board with fresh perspectives on the strength of governance, accountability and culture (e.g. the assessment should not only reflect the view of the risk function); and

- Insights – to inform the board of areas requiring attention and improvement, and how better practice can be achieved.

Emerging themes

While the self-assessments exhibited considerable variation in the number and severity of findings, four themes emerged across all industries:

- non-financial risk management requires improvement. This was evidenced through a range of issues identified by institutions, including resource gaps (particularly in the compliance function), blurred roles and responsibilities for risk, and insufficient monitoring and oversight. Institutions acknowledged that historical underinvestment in risk management systems and tools has also contributed to ineffective controls and processes.

- accountabilities are not always clear, cascaded, and effectively enforced. Institutions noted that, while senior executive accountabilities are fairly well defined within frameworks, there is less clarity or common understanding of responsibilities at lower levels, and points of handover where risks, controls and processes cut across divisions. This is further undermined by weaknesses in remuneration frameworks and inconsistent application of consequence management.

- acknowledged weaknesses are well known and some have been long-standing. The majority of self-assessment findings were reported to be already known to boards and senior leadership. Nevertheless, some issues have been allowed to persist over time, with competing priorities, resource and funding constraints typically cited as the basis for acceptance of slower progress. It was observed that these issues are often only prioritised when there is regulatory scrutiny or after adverse events.

- risk culture is not well understood, and therefore may not be reinforcing the desired behaviours. Institutions are putting considerable effort into assessing risk culture, but many continue to face difficulties in measuring, analysing, and understanding culture (and sub-cultures across the institution). It is therefore unclear if these institutions can accurately determine whether their culture is effectively reinforcing desired behaviours (or identify how it would need to be changed to do so).

While the self-assessments contained some in-depth self-reflection and acknowledgement by institutions of issues within their organisations, the assessments relating to the effectiveness of boards and senior leadership were notably less critical. Many self-assessments noted that the institution is generally well governed, with a respected and suitably challenging board, strong executive leadership teams and a good tone from the top, although at the same time acknowledging weaknesses spanning most or all chapters of the Final Report. This raises the question of whether boards and senior management have a potential blind spot when it comes to assessing their own effectiveness.

Labor missed a trick with mortgages

Aussie Home Loans boss James Symond has described the mortgage industry’s mammoth lobbying efforts as a “case book study” in uniting a competitive industry – via InvestorDaily.

Few sectors of the financial services universe had more riding on the 2019 federal election than mortgage broking. A Labor victory would have been a devasting blow to the third-party channel, which is responsible for helping most Aussies secure finance to buy a home.

“The industry banded together. You couldn’t be prouder of them all. This is a case book study of an industry that felt vulnerable and came together and stepped up to defend itself,” Mr Symond told Investor Daily. “You had individual mortgage brokers working in small businesses around the country having one-on-one meetings with MPs,” he said.

Regardless of what their individual political views might have been, this election was deeply personal for mortgages brokers, who earn an average of around $86,000 – far from what some might consider the “big end of town” that Labor was hell bent on destroying. Shorten effectively galvanised a formidable opposition in the third-party channel by failing to back down on remuneration changes.

After the Hayne royal commission recommended scrapping broker commissions, the industry quickly united to lobby both sides of the government. The result saw an enlightened coalition confirm no changes would be made to broker remuneration. Labor, on the other hand, would act on Hayne’s view and ban trail commissions while introducing a higher cap of 1.1 per cent on upfront commissions.

With the opinion polls prior to the election pointing to a Labor victory, the mortgage industry was making one hell of a gamble.

“It was very much a bet, because we couldn’t infiltrate Labor,” Mr Symond said. “With the Liberals, we got onto the right people who listened, who were open to being educated about how the mortgage broking industry operates and its value to consumers. But Labor was simply not interested.

“We got lucky that the coalition got back in. We don’t have to worry about the fact that Labor wouldn’t listen.”

It was a major misstep for Labor not to interact with the mortgage broking fraternity, given the opposition’s strong stance on economic matters. Negative gearing reforms were a major policy for Labor, which could have easily won over an army of mortgage brokers and the first-home buyers they represent by coming to the table on remuneration. Linking affordability and home ownership with the value proposition of a mortgage broker is easy enough to spin.

On the flipside, those with negatively geared properties who use the services of a broker would be highly unlikely to vote for a Shorten government. Including many brokers themselves.

“Labor had their own agenda,” Mr Symond said. “They didn’t give a hoot about mortgage brokers.”

“Thankfully the coalition got in, because it would’ve been a different story if they didn’t. We have some stability now.”

The broking industry has the government on its side and will continue to drive competition in the mortgage market – something that was in serious jeopardy if Labor had succeeded and scrapped trail commissions.

In addition to Aussie Home Loans, listed broking businesses like Mortgage Choice, AFG and Yellow Brick Road – which recently confirmed that it is doubling down on mortgages – will be the obvious beneficiaries of the Coalition’s win.

What will be interesting to watch is how the major banks react. While they have historically moved as a group, the question hanging over the broking industry has led them in different directions in recent years.

The royal commission and the 2019 federal election were arguably the final battles in a multiyear campaign that has ultimately sealed a victory for the third-party channel and the millions of home buyers it serves.