In a falling property market, who still has to sell? Property expert Joe Wilkes and I discuss. We also note how the banks are targetting some of these cohorts.

Category: Banking Culture

ASIC welcomes approval of new laws to protect financial service consumers

ASIC has welcomed the passage of key financial services reforms contained in the Treasury Laws Amendment (Design and Distribution Obligations and Product Intervention Powers) legislation introducing:

- a design and distribution obligations regime for financial services firms; and

- a product intervention power for ASIC

The design and distribution obligations will bring accountability for issuers and distributors to design, market and distribute financial and credit products that meet consumer needs. Phased in over two years, this will require issuers to identify in advance the consumers for whom their products are appropriate, and direct distribution to that target market.

The product intervention power will strengthen ASIC’s consumer protection toolkit by equipping it with the power to intervene where there is a risk of significant consumer detriment. To take effect immediately, this will better enable ASIC to prevent or mitigate significant harms to consumers.

These reforms were recommended by the Financial System Inquiry in 2014 and represent a fundamental shift away from relying predominantly on disclosure to drive good consumer outcomes.

ASIC Chair James Shipton said the reforms were a critical factor in the development of a financial services industry in which consumers could feel confident placing their trust.

‘These new powers will enable ASIC to take broader, more proactive action to improve standards and achieve fairer consumer outcomes in the financial services sector. This will be a significant boost for ASIC in achieving its vision of a fair, strong and efficient financial system for all Australians,’ he said.

‘This will also provide invaluable assistance to ASIC as we all seek to rebuild the community’s trust in our banking and broader wealth management industries. And we note the overwhelming level of support this attracted from across the Parliament.’

Mr Shipton also welcomed the amendments to the original legislation, which extended the reach of these reforms, providing a comprehensive framework of protection for most consumer financial products. It will also empower ASIC to intervene in relation to a wider range of products where ASIC identifies a risk of significant detriment to consumers.

How Complex Is Banking Change Really?

In the final part of my discussion with Ex-ANZ Director John Dahlsen, ahead of the closing date for submissions into the Senate Inquiry into Banking Structural Separation, we discussed the core questions, and what barriers really need to be overcome.

To make a submission, check out this link:

http://cecaust.com.au/Pass-Glass-Steagall/

There you will find a guide to make a submission, and some pointers to help develop your input.

See our earlier discussions

“Structure is a dirty word“, “Beyond The Royal Commission” and

“More on Bank Separation“.

Credit squeeze is supply-driven, says Elliott

ANZ CEO Shayne Elliott has told a parliamentary inquiry that banks triggered the credit downturn impacting the supply of housing finance, via InvestorDaily.

Softening conditions in the credit and housing space has sparked debate among market analysts regarding the cause of the downturn, with some stakeholders, including governor of the Reserve Bank of Australia (RBA) Phillip Lowe claiming that the “main story” of the downturn is one of “reduced demand for credit, rather than reduced supply”.

Mr Lowe claimed that falling property prices have deterred borrowers, particularly investors, from seeking credit.

According to the Australian Prudential Regulation Authority’s latest residential property exposure statistics for authorised deposit-taking institutions, new home lending volumes fell by $25.1 billion (6.5 per cent) over the year to 31 December 2018. The decline was driven by a sharp reduction in new investment lending, which dropped by $17.7 billion (14 per cent), from $126.9 billion to $109.2 billion over the same period.

However, the ANZ CEO has told the House of Representatives’ standing committee on economics that he believes the downturn in the credit space has been primarily driven by the tightening of lending standards by lenders off the back of scrutiny from regulators and from the banking royal commission.

Liberal MP and chair of the committee Tim Wilson asked: “Is the reported credit squeeze more demand-driven by borrowers pulling back or supply-driven by banks being more conservative?”

To which Mr Elliott responded: “This is a significant question that’s alive today, and there are multiple views on it. I can’t portion between those two.

“I’m probably more in the camp that says conservatism and interpretation of our responsible lending obligations and others has caused a fundamental change in our processes, and that has led to a tightening of credit availability.

“It’s a little bit ‘chicken and egg’,” Mr Elliott added. “If people find it a little bit harder to get credit, they might step back from wanting to invest in their business or buy a home, so I think they’re highly correlated, but I do think banks’ risk appetite has had a significant impact.”

Mr Elliott said that “vagueness and greyness” regarding what’s “reasonable” and “not unsuitable” as part of the responsible lending test have left the law to the interpretation of lenders.

“Unfortunately, we haven’t always had the benefit of a significant amount of precedence or court rulings on some of those definitions, so we’ve done our best,” he said.

“I think the processes recently, the questions that this committee has asked, the questions in the royal commission, have started a debate, not just with the regulators but with the community about what is the real definition of [responsible] lending.”

He added: “As a result of that, we’ve become more conservative in our interpretation, and so we’ve tightened up, [and some] Australians will find it a little bit harder to either get credit or get the amount of credit that they would have otherwise had in the past or would like.

“I’m not suggesting for a minute that it’s wrong, it’s just the reality.”

RC issues ‘not unique to Australia’, says former Coutts boss

A Hong Kong-based banker has applauded Australia for shedding light on issues within its financial sector and warned that the issues revealed by the royal commission are widespread across the globe, via InvestorDaily.

CFA Institute managing director, Asia Pacific, Nick Pollard has held a number of senior banking roles, including the MD of exclusive British bank Coutts and CEO of Coutts Asia.

Speaking to Investor Daily, Mr Pollard said that while the major banks in Australia have shown a clear interest to be rid of their troubled wealth businesses, the fact remains that people need wealth management and financial advice.

“The challenge for Australia, which is the challenge the rest of the world has, is how do you ensure the demands of the customers are able to be met by organisations that can provide that advice in a fair and transparent way?

“The industry as a whole hasn’t been very good at that over the last few years. That’s why regulators have become involved and it has become tougher to operate in this climate.”

While the Hayne royal commission has cast a shadow over the Australian financial services sector over the past 12 months, Mr Pollard believes the conversations that are now being had off the back of the inquiry reflect a positive approach that other markets are yet to benefit from.

“What Australia is doing, which many countries aren’t, is bringing this out into the public domain and having those critical conversations and hopefully can look forward with some optimism that the industry is owning up to the fact that it need to improve and needs to do something about it,” he said.

“In many ways, the issues that are coming out of the royal commission don’t just apply to Australia. Don’t think that the rest of the world has got these things right. If there is any kind of introspection by those in the financial services communities of Hong Kong and Singapore it is ‘Where do we stand on these issues?’

“At least Australia has been bold enough to being this out into the public domain.”

According to global research consultants Cerulli Associates, Australia remains an attractive market for investment managers and asset consultants, both local and global.

While the royal commission has caused significant reputational damage, Cerulli Associated managing director for Asia, Ken Yap, said super funds in particular will still need to make exactly the same decisions about asset allocation, currency hedging, and liquidity as they always did, and nothing in the royal commission is likely to make them choose any different underlying managers than they have done in the past.

Consumers Confusing Different Types of Financial Advice – ASIC

ASIC has released new research revealing many consumers confuse ‘general’ and ‘personal’ advice exposing them to greater risk of poor financial decisions.

The ASIC report, Financial advice: Mind the gap (REP 614), presents new independent research on consumer awareness and understanding of general and personal financial advice, identifying substantial gaps in consumer comprehension.

“This disturbing gap in understanding whether the advice they are getting is personal or not means many consumers are under the false premise their interests are being prioritised, when no such protection exists,” said ASIC Deputy Chair, Karen Chester.

Millions of Australians will likely seek financial advice at some stage in their lives. When they do, it is critical they understand whether that advice is personal, whether it is tailored to their circumstances and does the adviser have a legal obligation to act in their interest.

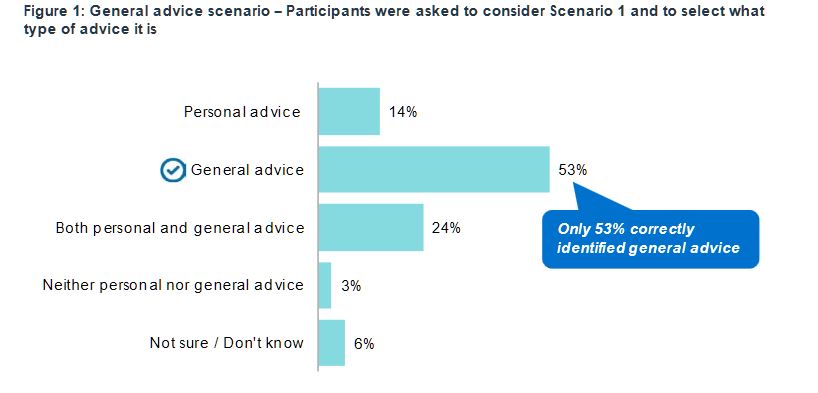

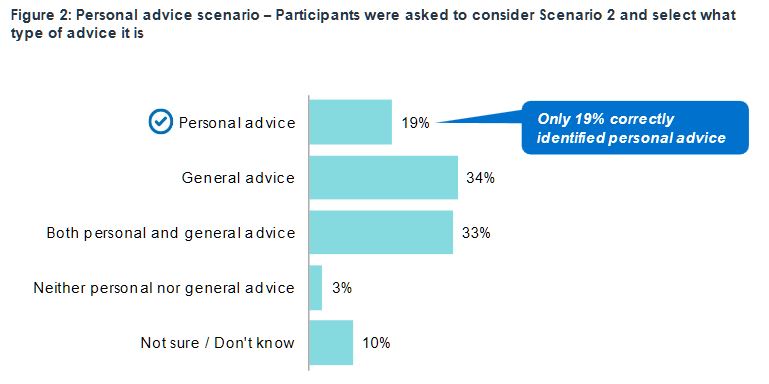

“The survey not only revealed consumers are not familiar with the concepts of general and personal advice, but only 53 per cent of those surveyed correctly identified ‘general’ advice. And even when provided the general advice warning, nearly 40 per cent of those surveyed wrongly believed the adviser had an obligation to take their personal circumstances into account,” Ms Chester said.

The report highlights the importance of consumer awareness and understanding of the distinction between personal and general advice with the Future of Financial Advice (FOFA) protections only applying when personal advice is provided. These include obligations for advisers to act in their client’s best interests, to provide advice that is appropriate to their client’s personal circumstances and to prioritise their client’s interests. These obligations do not apply when general advice is provided.

“The survey also revealed that the responsibilities of financial advisers, when providing general advice, is not well understood. Nearly 40 per cent of those surveyed were unaware that advisers were not required by law to act in their clients’ best interests,” Ms Chester said.

ASIC anticipates the need for financial advice to grow, reflecting an ageing population and many financial products, especially retirement products, becoming more complex. ASIC reports that much of the advice is likely to be general advice, and while appropriate in some circumstances, it is inevitably of limited use.

“ASIC is seeing increased sales of complex financial products under general advice models – so not tailored to personal circumstances – leaving many consumers, especially retirees, exposed to the potential risk of financial loss. And whilst the Financial Services Royal Commission, and the Government’s response, dealt with the most egregious risks of hawking of complex financial products, consumer confusion about what is personal and general advice needs to be addressed,” Ms Chester said.

The report’s findings reinforce those of the Murray Financial System Inquiry and the Productivity Commission reports on the financial and superannuation systems. Those reports made recommendations about the use of the term ‘general advice’, which is likely to lead to false consumer expectations as to the value of and protections afforded advice received.

Ms Chester said, “This consumer research is timely. It comes as the Government is considering policy recommendations on financial advice from the Productivity Commission’s twin reports on Australia’s financial and superannuation systems. And at a time when the financial system itself undergoes much change, following the intense scrutiny of the Financial Services Royal Commission, including considering new financial advice and distribution business models”.

The report includes quantitative and qualitative research commissioned by ASIC and undertaken by independent market research agency, Whereto Research. The research used hypothetical advice scenarios to test consumer recognition of when general and personal advice was being provided, and awareness of adviser responsibilities when being given each type of advice.

Report 614 Financial advice: Mind the gap is the first stage in ASIC’s broader research project into consumer experiences with and perceptions of the financial advice sector. Additional research by ASIC will get underway in 2019 to identify a more appropriate label for general advice and consumer-test the effectiveness of different versions of the general advice warning.

A Further Update On Mortgage Loan Approvals

We discuss the findings from today’s House Economics Committee questioning of NAB’s new CEO, and look specifically at the issue of mortgage loan approvals.

Shadow treasurer says government has ‘got it wrong’ on trail

In a clear stance on Labor’s trail position, Chris Bowen MP has said that the government’s response to the banking royal commission has “got it wrong”, particularly in regard to its “backflip” on removing trail from next year; via The Adviser.

Speaking at the AFR Banking & Wealth Summit on 26 March, Chris Bowen, shadow treasurer and federal member for McMahon, reaffirmed the Australian Labor Party’s stance on trail commission payments to mortgage brokers.

In the final report for the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, commissioner Kenneth Hayne recommended that “changes in brokers’ remuneration should be made over a period of two or three years, by first prohibiting lenders from paying trail commission to mortgage brokers in respect of new loans, then prohibiting lenders from paying other commissions to mortgage brokers”.

Following the release of the report, the Coalition government’s official response initially suggested that it would seek to ban trail for new loans from 1 July 2020, but Treasurer Josh Frydenberg announced earlier this month that government would instead postpone any decision on removing trail until after a review of mortgage broker remuneration has been undertaken in three years’ time.

Meanwhile, the Labor Party’s response called for the removal of trail for new mortgages from 1 July 2020 and for a standardised upfront commission as a proportion of the loan amount. It suggested that commissions should be capped at 1.1 per cent “so that banks can’t offer brokers incentives to choose their products”.

‘A big tick to a big flick’

Speaking at the AFR Banking & Wealth Summit today, Mr Bowen slammed the government for its “backflip” on trail commissions, stating that they continued to “get it wrong” on the royal commission recommendations.

He said: “I’m normally not too partisan at these events, I normally steer away from political commentary – at least through much of my speech, but given we are at the business end of the term, with the federal election less than 50 days away, I’m sure you’ll appreciate some plain speaking.

“The choice is between an opposition prepared to make big calls, and get those calls right, versus a government that has got the big calls wrong.”

Mr Bowen outlined that commissioner Hayne was “very clear” in his observations, which he said included the observations that “the interest of customers was relegated to second place far too often; too often, consumers were being left in the dark about how products or services are acquired and delivered; and too often, financial services entities were breaking the law and not held to account for their actions”.

“Those actions that were revealed through the royal commission had given the entire sector a bad name,” Mr Bowen said.

“They needed, and need, to be dealt with. These are systemic failures in our financial services industry when it comes to providing community standards and expectations.”

Emphasising that the government had previously called the royal commission a “populist whinge”, “regrettable”, a “reckless distraction” and a “QC’s complaints desk”, Mr Bowen added: “They got the big call wrong. And they also continue to get it wrong now, in terms of the recommendations.

“That’s probably most clear in relation to mortgage brokers.”

Mr Bowen elaborated: “A few days after the royal commission was handed down, the government told us that they were implementing the royal commission recommendation on trail commissions and said the royal commission recommendation was getting a ‘big tick’. No nuance, no discussion, just simply that this would be implemented.

“Now the reasons given by the commissioner on this issue were clear: The chief value of trail commissions to the recipient, to put it bluntly, is that they are money for nothing, [he said].

“And these are not new issues. The Productivity Commission found trail commissions have the effect of aligning the broker’s interests with those of the lender, rather than those of the borrower. The case was clear.”

Mr Bowen therefore called the government’s change in stance on trail as “a backflip with triple pike”.

“Just weeks after giving a recommendation a big tick, it was given the big flick,” he said, noting that it took “just 35 days to backflip on a major reform of phasing out trailing commissions for mortgage brokers”.

However, the shadow treasurer said that “there was, and is, a strong case for thinking carefully about the royal commission recommendation and ensuring we protect competition in banking. That’s exactly what we did,” he said.

“We consulted with mortgage brokers, we consulted with banks and financial institutions – particularly the smaller ones.

“We came up with a different way of removing conflicted remuneration for mortgage brokers. We announced that we would have legislated a flat upfront commission rate to avoid mortgage brokers’ advice being conflicted by the rate of the commission offered,” he said.

Mr Bowen concluded: “It’s one thing to achieve the objectives of the royal commission recommendation in another way, as Labor has done; it’s another thing to completely abrogate any policy action, as the Treasurer has done.

“When we make big calls – and we’ve made quite a few of them – we stick to them, fight for them, and seek to mandate for them, which is what we’ll be doing, presumably, on the 11th of May [for the federal election].

“We will implement 75 recommendations of the royal commission in full. The government cannot say that and already we are seeing consumer groups being very concerned that the government is already walking away from other recommendations,” he said.

Broking industry continues engagement with ALP

While the shadow treasurer has reaffirmed the party’s stance on trail commissions, the broking industry continues its work in engaging and educating ALP members on the benefits of trail.

Indeed, just last week, a group of nearly 100 representatives from the mortgage industry met shadow assistant treasurer and federal member for Fenner, ACT, Dr Andrew Leigh, at the QT Hotel in Canberra for the Future of Mortgage Lending forum, organised by AFG in partnership with Connective and Mortgage Choice, in which the need for trail was hotly discussed.

Speaking to The Adviser about the event last week, AFG’s Mark Hewitt said that the purpose of the meeting was to have a town hall type discussion with economist-turned-politician Dr Leigh, and to outline how Labor’s plans to remove trail for new loans from next year could impact borrower outcomes.

“We wanted to get the point across to Dr Leigh about the unintended consequences of abolishing trail and the impacts that could have on the brokers’ ability to provide an ongoing service to their clients,” Mr Hewitt said.

“Labor’s focus was very centred on talking about them being the first to move on commissions, but the sentiment in the room was definitely around the abolition of trail and why it was not a good idea.

“What was particularly impressive to me was the care and concern that the brokers in the room had for their customers and also their concern about the unintended consequences of having their remuneration front-loaded in the way that Labor is proposing.”

He continued: “We were talking about the impacts that the removal of trail might have on brokers’

to provide ongoing service to clients and also the fact that the model without trail doesn’t provide any incentive for an ongoing customer relationship.”

Mr Hewitt told The Adviser that Dr Leigh “was very receptive to the messages in the room and was very impressive and engaging”.

“It takes a fair bit of courage as well, as he was the only person in the room who thought that abolishing trail was a good idea, but he stood by the party line while still engaging and being respectful to the counter arguments,” Mr Hewitt said.

“We were very pleased with how it went because it’s a continuing conversation – and it was a two-way conversation, hearing both sides, which is what we wanted to achieve,” AFG’s general manager for broker and residential added.

NAB ends ‘Introducer’ payments program

The National Australia Bank has announced an end to its ‘Introducer’ payments program to take effect in October 2019, via InvestorDaily.

The Introducer program was launched by NAB to reward businesses with a commission for new successful lending referrals to NAB.

The program was promoted by NAB as a way to fundraise for communities and as a relationship strengthen program.

The program has been the source of many problems for the bank with KPMG being commissioned to investigate the program in 2015 and found large issues including bankers falsifying documents to issue bogus loans and serviceability issues.

KPMG went as far as investigating introducers for links to organised crime and terrorist financing and NAB continued to investigate the problem and in 2016 notified the police and ASIC resulting in the sacking of 20 staff and more disciplined.

By October 2019 NAB will no longer make referral payments to Introducers with chief executive Philip Chronican saying it was important that the bank acted and changed its actions.

“Through the royal commission, we heard clearly that our actions need to meet the expectations of our customers and the community. We need to be simpler and more transparent to earn trust. We have to put customers first, to be a better bank,” Mr Chronican said.

Commissioner Kenneth Hayne in his final report did not recommend the banning of such schemes but after hearing about fraud issues around such programs did raise the question about who the introducers were actually working for.

The program was reportedly responsible for approximately $24 billion in loans and in 2018 the bank said it was responsible for one in every twenty home loans it wrote.

Mr Chronican said he wanted Australians to come to NAB because of what the bank offered, not because someone was paid to do so.

“We want customers to have the confidence to come to NAB because of the products and services we provide – not because a third-party received a payment to recommend us.”

The change is significant for NAB and the industry, but Mr Chronican said it was the right thing to do for the banks customers.

“Like other businesses, we will still welcome referrals and will continue to build strong relationships with business and community partners. However, there will be no ‘Introducer’ payments made,” he said.

NAB is the first of the big banks to remove their introducer program with a report from ASIC revealing that in 2015 $14.6 billion in home loans by the big four were sold via introducer channels.

The announcement is the latest by the bank who recently announced that it would keep all regional and rural branches open until at least 2021.

The bank has also extended the protections of the code of banking practice to small businesses and has supported 72 of the royal commission recommendations with 26 either completed or in the process of being implemented.

“NAB has a significant role to play in leading the change our customers and the community want to see.”

Westpac Takes A Profit Hit On Remediation

Westpac says its cash earnings in first half 2019 have been reduced by an estimated $260m due to its customer remediation programs.

Cash earnings of customer remediation provisions for the full year of 2017 and the full year of 2018 were $118m and $281m respectively, so the newly released figure shows a sharp increase.

The key remediation items include:

• Customer refunds associated with certain ongoing advice service fees charged by the group’s salaried financial planners

• Refunds for certain consumer and business customers that had interest only loans that did not automatically switch to principal and interest loans when required

Westpac CEO Brian Hartzer said, “As part of our ‘get it right put it right’ initiative we are determined to fix these issues and stop these errors occurring again. We will continue to review our products and services to ensure they deliver the right outcomes for customers, and if necessary, make further provisions.”

Westpac will commence remediation in the group’s second half 2019 for customers of authorised representatives still operating under BT Financial Group’s licences.

Work is also underway to determine the extent of the services provided by authorised representatives who are no longer operating under BTFG’s licences, including those who have left the industry.

According to a statement from the bank, this remediation program is more challenging, because many of the authorised representatives’ files have been difficult to access.

Westpac said:

• Total fees received by authorised representatives in 2008 to 2018 were approximately $966m

• Within this total, fees received from customers by authorised representatives still operating under BTFG’s licences in the period 2008 to 2018 were approximately $437m

• For customers of authorised representatives, Westpac has not yet been able to finalise a reliable estimate of the proportion of fees that may need to be refunded

• Interest on refunded fees and additional costs to implement this program will also need to be considered when determining any remediation provisions