Over the next few days we will be discussing alternative banking structures. Is it time for a different approach?

In part 1 I discuss the concept of a “national bank” with Robbie Barwick from the CEC.

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

Over the next few days we will be discussing alternative banking structures. Is it time for a different approach?

In part 1 I discuss the concept of a “national bank” with Robbie Barwick from the CEC.

The Australian Prudential Regulation Authority’s (APRA) macro-prudential easing on interest-only residential mortgages is unlikely to meaningfully affect loan growth, as tighter underwriting standards have become the most effective constraint on riskier types of lending, says Fitch Ratings.

The restriction that interest-only loans cannot exceed 30% of new mortgages, which APRA will remove from 1 January 2019 for most banks, was put in place in March 2017 as part of the regulator’s efforts to contain banking-sector risk amid rising house prices and high and increasing household debt. The cap initially had a strong impact, but banks have collectively been operating well below the limit over the previous year due to stronger underwriting standards. This partly reflects the regulatory focus on risk control and mortgage underwriting – with APRA strengthening serviceability testing, for example – while banks have also become more cautious as market conditions have toughened.

The benchmark will be removed for banks that have provided assurances on maintaining the strength of their underwriting standards, which was also a requirement for the removal of a cap on investor loan growth in April 2018. Most banks have provided these assurances.

Some banks could take advantage of the cap removal to gain market share in a slow credit-growth environment, but we expect no more than a small uptick in overall interest-only lending. Lending standards should continue to curb the pace at which interest-only loans are made available by banks. The weak housing market, especially in Sydney and Melbourne, is also a headwind to interest-only lending, as it will dampen investor demand and speculative buying. We forecast nationwide house prices to drop by 5% yoy in 2019.

Fitch expects Australian banks to continue tightening control frameworks and underwriting standards, especially around expense testing and income verification, which should support the quality of new mortgages. APRA plans to review banks’ risk controls and interest-only lending as part of a broader assessment of lending standards next year.

The interest-only lending cap is the last macro-prudential measure outstanding. Fitch maintains a negative outlook on Australia’s banking sector, as bank returns are likely to fall further in the near term on slowing mortgage credit growth – especially in the residential mortgage segment – further remediation and compliance costs associated with inquiries into the financial sector, higher wholesale funding costs and rising loan-impairment charges.

NAB executives were slammed for destroying shareholder value and for losing its lead as Australia’s biggest bank by market capitalisation at its annual general meeting in Melbourne this morning.

One shareholder during the question and answer session didn’t hold back his disappointment with the bank’s failure to prevent issues that resulted in billions of dollars wiped out in market capitalisation.

In the lead up to the financial services Royal Commission, the shareholder said there was something “amiss” in the way the board ran the bank, as reflected in failed ventures in the UK and the share trading scandal among other examples.

The shareholder, who has been a NAB customer for about 50 years, went on to describe the leaders as the “unacceptable face of capitalism.”

One reason why he stayed with NAB for so long is because of the frontline staff or bank tellers who have taken care of him as a customer for decades. Ironically, these are the employees senior management are “laying off” as a result of the mess the business is in, he said.

Another shareholder suggested senior managers should do more to reach out and connect with aggrieved customers rather than rely on net promoter scores figures.

NAB chair Ken Henry was then criticised for saying it will take 10 years for NAB to change the bank’s culture at the Royal Commission.

This should only take 10 months, the shareholder said, adding if it takes 10 years then there is “something is wrong with the board and senior management.”

In response to counsel assisting Rowena Orr’s question about what NAB is doing to embed new culture, Henry listed initiatives that include closely monitoring non-compliance and net promoter score across 700 branches.

“It could be 10 years. It could be. I hope not. But I wouldn’t be at all surprised. That would not be unusual for organisations that seek to embed challenge in cultures,” he said at the time.

In his opening address, Henry flagged that the board estimates more than 80% of the votes cast will be ‘against’ the remuneration report.

Chief executive Andrew Thorburn said in his opening statement that NAB has completed its refunds of plan service fees, and the issue affecting more than 304,000 customers has been closed.

“We have also agreed on a remediation methodology with ASIC that will see NAB Financial Planning refund adviser service fees to those customers who didn’t get the services they paid for. That is starting this week, and is to be completed in 2019,” Thorburn said.

Thorburn will take annual leave from December 21, and will return to respond to the Royal Commission’s final report to be released on 1 February 2019. He will then take a month-long break as part of his long-service leave entitlement.

NAB shares traded at $23.32 per share at publication time. This time last year, it traded at about $30.

The Housing Industry Association (HIA) welcomed APRA’s removal of the 30% IO limit, but argues that banks are tightening beyond the APRA limits and still more credit is needed.

Actually, this is not really the case, rather it is reversion to more normal lending standards as defined by suitable lending.

The HIA are therefore advocating a loosening of standards back to the pre-royal commission and APRA conditions, where people got loans they could not afford and the industry was rife with poor practice and fraud. We should not aspire to return to such conditions again.

This is what they said:

“The removal of the restriction on interest-only lending is essential to addressing the concerning decline in credit growth for new housing,” said Tim Reardon, HIA Principal Economist.

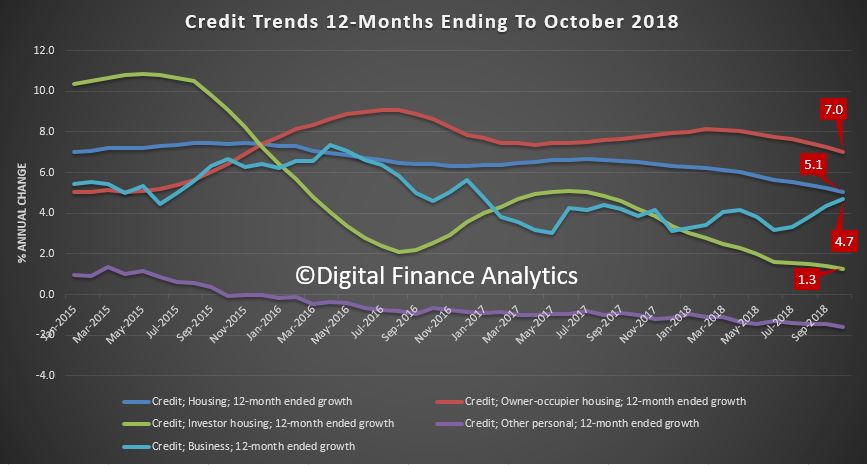

“Credit growth across the market is the lowest it has been since the 1983 recession.

“Credit growth to investors is the lowest on record.

“Today APRA announced it is lifting its 30 per cent cap on banks’ interest-only lending. This is a welcome development in Australia’s mortgage market, but much more needs to be done to ease the current credit squeeze.

“APRA’s restrictions were designed to curb high-risk lending practices. Over the past 12 months ordinary home buyers have experienced significant constraints in accessing the appropriate level of finance to buy a home.

“The credit squeeze is happening at the behest of the banks’ own lending practices which have been tightened above and beyond APRA’s requirements.

“HIA research has found that the time taken to gain approval for a loan to build a new home has blown out from around two weeks to more than two months.

“HIA members are also reporting that almost half of loan applications are being rejected.

“APRA’s announcement sends an important message about the overall health and stability of the mortgage market which should be heeded by policy makers and lenders alike.

“With the Royal Commission scheduled to release recommendations early next year there is a risk that the credit squeeze may drag on into 2019. The residential construction sector is already cooling. Policy makers will need to proceed cautiously when responding to the Commission’s recommendations,” concluded Mr Reardon.

The Australian Bankers Association (ABA) says the APRA decision “will increase choice for home loan customers”.

They say:

Today’s announcement of the removal of the 30% benchmark for new interest-only residential mortgages will allow all banks to offer more choice for customers, leading to an increase in competition across the industry, particularly for smaller and regional banks.

The benchmark was introduced by APRA in 2017 to respond to concerns of an oversupply of interest-only loans. The benchmark had a greater effect on banks with smaller home loan lending operations.

CEO of the Australian Banking Association Anna Bligh said that the decision by APRA would not only benefit customers, it also showed that banks were lending prudently with the proportion of interest-only loans more than halving in two years.

“APRA’s announcement today shows that banks have adjusted lending to respond to concerns around an oversupply of interest-only loans, illustrating a prudential system where both banks and regulators can quickly and effectively respond to a changing environment,” Ms Bligh said.

“While banks will continue to lend prudently, today’s decision will mean all banks can offer more choice for customers who are looking to buy a house or apartment.

“Increased competition across the industry will mean customers have more ability to shop around for the best deal for them when looking at an interest-only home loan,” she said.

In terms of banks home loan commitments, the proportion of interest-only loans are now 16.2% much lower than the proportion seen two years ago (37%).

The Australian Prudential Regulation Authority (APRA) has announced that it will remove its supervisory benchmark on interest-only residential mortgage lending by authorised deposit-taking institutions (ADIs).

The benchmark was put in place as a temporary measure in March 2017, as part ofa range of actions over recent years to reinforce sound lending practices. The introduction of the benchmark has led to a marked reduction in the proportion of new interest-only lending, which is now significantly below the 30 per cent threshold.

Earlier this year, APRA announced its intention to remove the supervisory benchmark on investor loan growth subject to ADIs providing certain assurances as to the strength of their lending standards. Most ADIs have now provided those assurances. ADIs that are no longer subject to the investor loan growth benchmark will also no longer be subject to the benchmark on interest-only lending from 1 January 2019. For other ADIs, it will be removed concurrently with the removal of the investor loan growth benchmark.

APRA Chairman Wayne Byres said: “APRA’s lending benchmarks on investor and interest-only lending were always intended to be temporary. Both have now served their purpose of moderating higher risk lending and supporting a gradual strengthening of lending standards across the industry over a number of years.”

Notwithstanding the removal of the interest-only benchmark, ADIs still need to ensure they maintain adequate oversight of the level and type of interest-only lending, consistent with APRA’s Prudential Practice Guide APG223 Residential Mortgage Lending and ASIC’s responsible lending obligations on borrower requirements and objectives.

A copy of the letter to industry outlining the decision is available on APRA’s website at: https://www.apra.gov.au/letters-notes-advice-adis.

Following the recent minutes from the Council of Financial Regulators, which is chaired by the RBA, now according to the Australian, the RBA has been lobbying the banks to lend more.

“Reserve Bank governor Philip Lowe is understood to have met with the big bank chiefs in recent weeks to caution them against an overzealous tightening of credit supply in response to lending rules and the Hayne royal commission”.

The RBA is of the view that lenders are turning good business away, and need to take risk on.

Some SME’s are getting caught in the cross fire, and its clear that business is finding it harder to get funding. This was covered in the RBA’s minutes, released yesterday.

Of course the responsible lending obligations have not changed, but now the meaning and obligations are front of mind. Thus banks need to examine income and expenses etc and cannot necessarily rely on HEM or mortgage brokers. So all this is in direct opposition to the RBA’s wishes, and we suspect the risk of legal action, or worse will continue to limit bank lending.

The ASIC Westpac case will be back before the courts in the new year, though as yet is not clear whether HEM will be tested in court, or whether its more about reaching a settlement. And the royal commission recommendations will be out in February

Is the RBA really condoning the bad behaviour and law breaking exposed in the past year?

And remember that currently mortgage lending is still running at more than 5% on an annualised basis, according to RBA data.

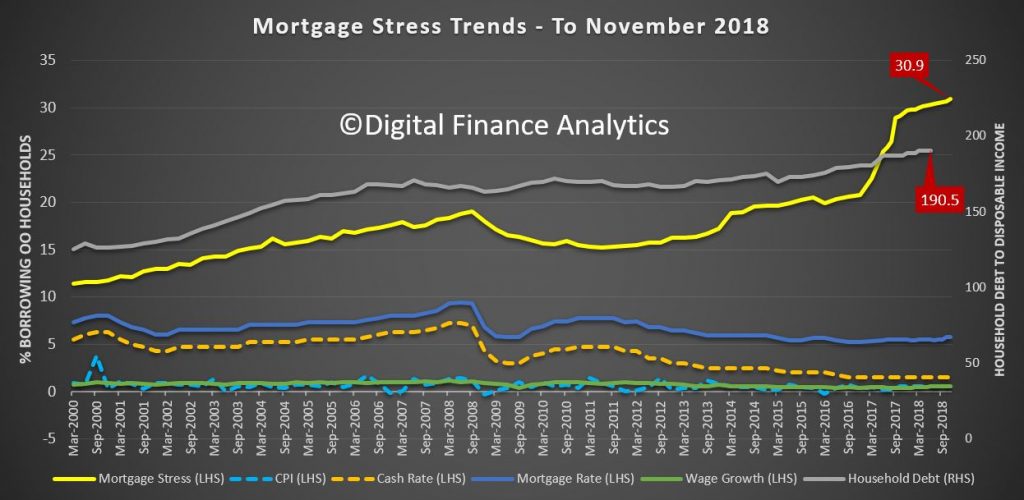

The fundamental problem is the RBA has been responsible for the growth of credit to the point where households in Australia are some of the most leveraged in the world, home prices have exploded and bank balance sheets have inflated. But all this “growth” is illusory. Mortgage stress continues to build and the wealth effect is reversing as home prices slide.

Thus, as we anticipated, we will see a number of “unnatural acts” by the RBA and the Government to try and stop the debt bomb from exploding, by trying to get credit to expand. But this is irresponsible behaviour, in the light of rising global interest rates, high market volatility and building systemic risks.

ASIC has released Report 604 Credit card lending in Australia – An update (REP 604), which sets out the changes being made by lenders to help consumers with credit card debt.

In July 2018, ASIC released Report 580 Credit card lending in Australia (REP 580), which found more than one in six consumers is struggling with credit card debt.

The report made it clear that ASIC expects credit providers to:

ASIC engaged with the ten largest credit providers that were part of our review (American Express, ANZ, Bendigo and Adelaide Bank, Citigroup, CBA, HSBC, Latitude, Macquarie, NAB and Westpac) and sought their commitment to change. Their commitments are described in their report released today.

Although these commitments are not required by the law, they are important in ensuring that the credit card market works for consumers, including vulnerable consumers.

Across the board, lenders have committed to changes to address the concerns by ASIC:

Many credit providers are trialling measures — such as tailored communications and/or structured payment arrangements — to help consumers with potentially problematic credit card debt or who are failing to repay balance transfers.

Others are taking a fairer approach to balance transfers, such as by allowing interest free periods on new purchases and enhancing disclosure about cancelling old credit cards.

Macquarie, CBA and HSBC are the most progressed with implementing changes around credit card lending. Although American Express has committed to some changes, other lenders have proposed more comprehensive measures.

‘ASIC expects that all credit card lenders will address the issues raised in our review,’ ASIC Commissioner Sean Hughes said. ‘We will be monitoring lenders over the next two years to make sure they have taken action to address our concerns, and to ensure that consumer outcomes are improving in the credit card market.’

In REP 580, ASIC committed to conduct a follow-up review to see if there is an improvement in outcomes for consumers. ASIC will also not hesitate to use its future enforcement powers if necessary to bring about needed changes.

In July 2018, ASIC published its report on credit card lending in Australia.

ASIC’s review of credit card lending found:

Since REP 580 was released ASIC has prescribed a three-year period for credit card responsible lending assessments. This means that credit providers must not provide a credit card with a credit limit that the consumer could not repay within three years. This reform commences on 1 January 2019. More information about the reform is available in Report 590 Response to submissions on CP 303 Credit cards: Responsible lending assessments (REP 590).

The Government has implemented other reforms to help prevent problematic credit card debt. This includes banning unsolicited credit limit increase invitations and making it easier for consumers to cancel credit cards.

ASIC’s MoneySmart website has information for consumers about choosing and using credit cards, including information about balance transfers, how to pay off multiple cards and how to cancel a credit card.

Consumers can also use MoneySmart’s credit card calculator to work out the fastest way to pay off their card and how much they can save by paying it off sooner.

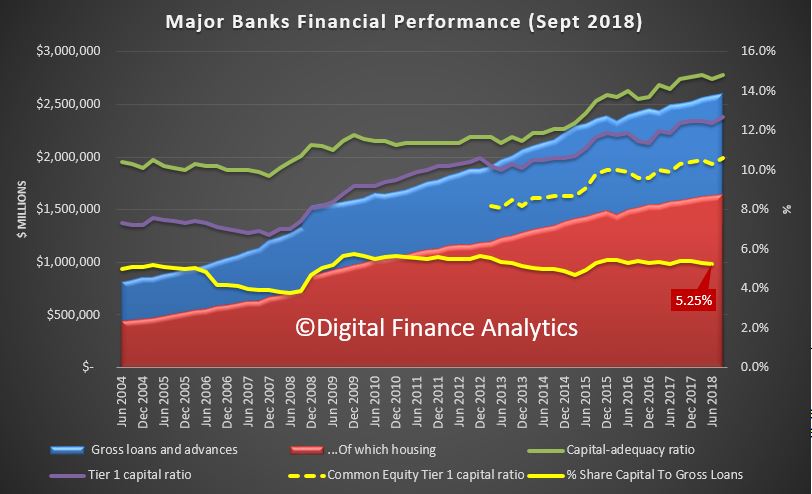

We discuss the question we get asked the most: which banks are most risky?

Given the lack of consistent data we examine the aggregated series from APRA. Not all banks are created equal!