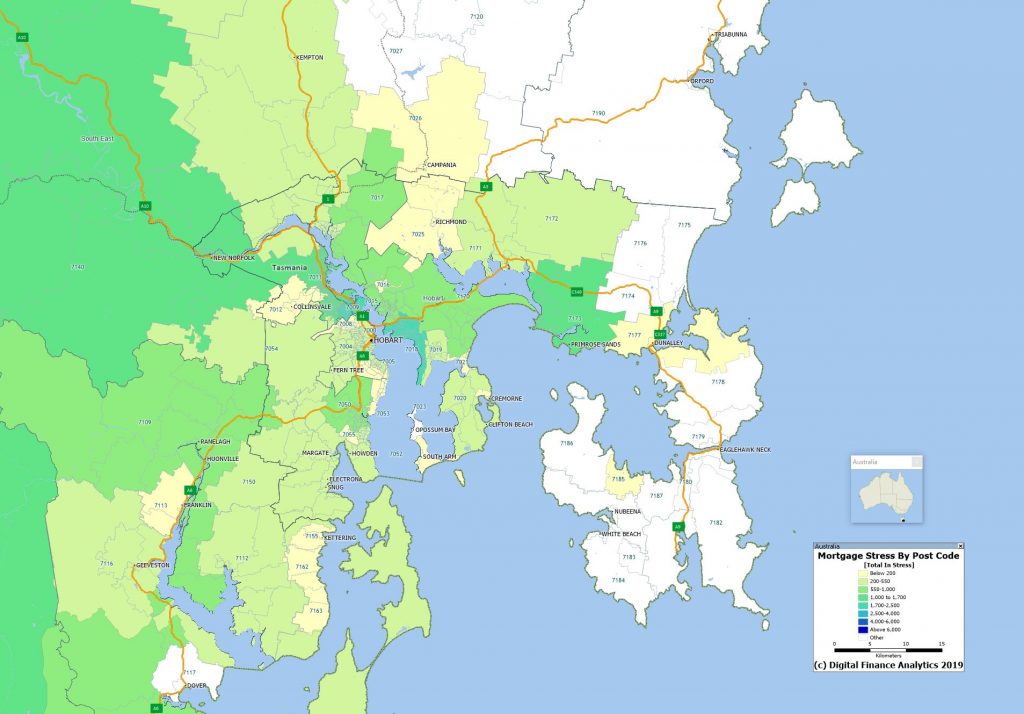

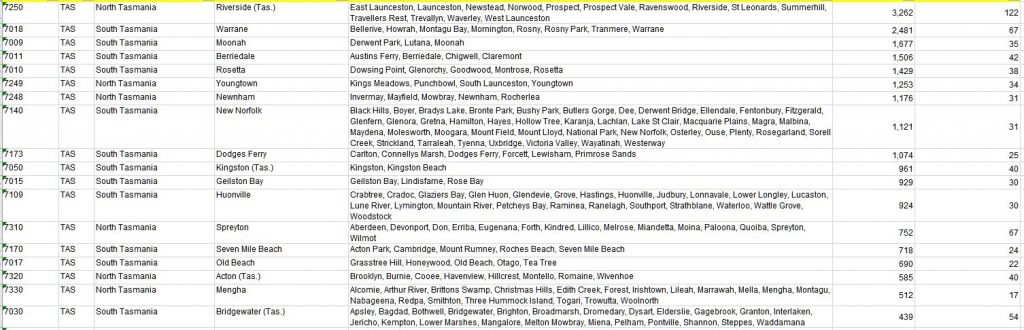

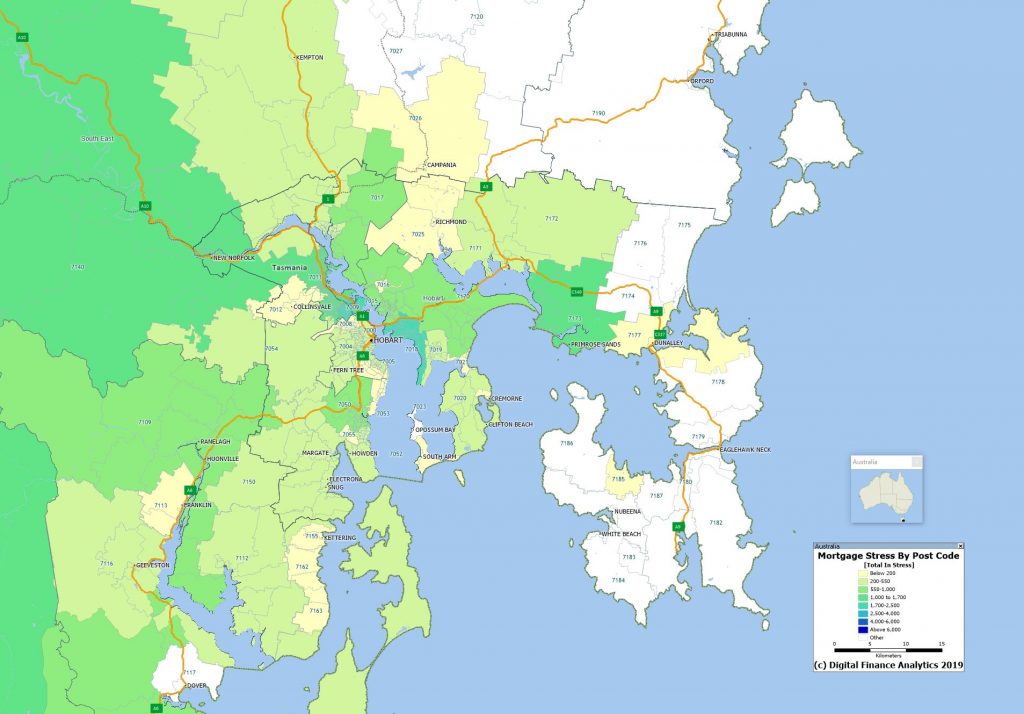

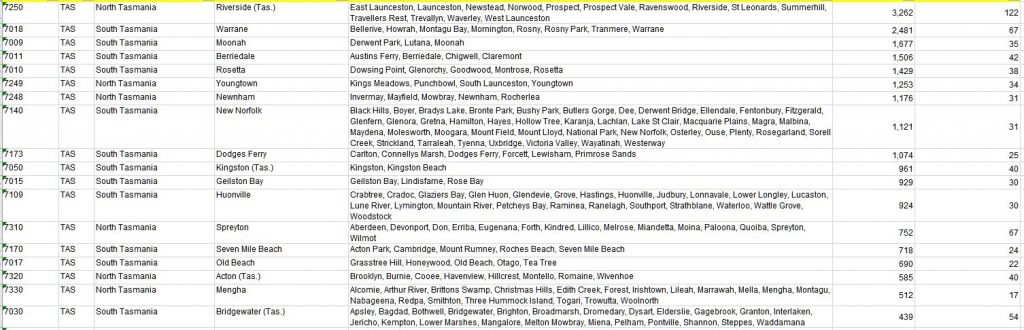

Here are the most stressed post codes in Tasmania.

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

Here are the most stressed post codes in Tasmania.

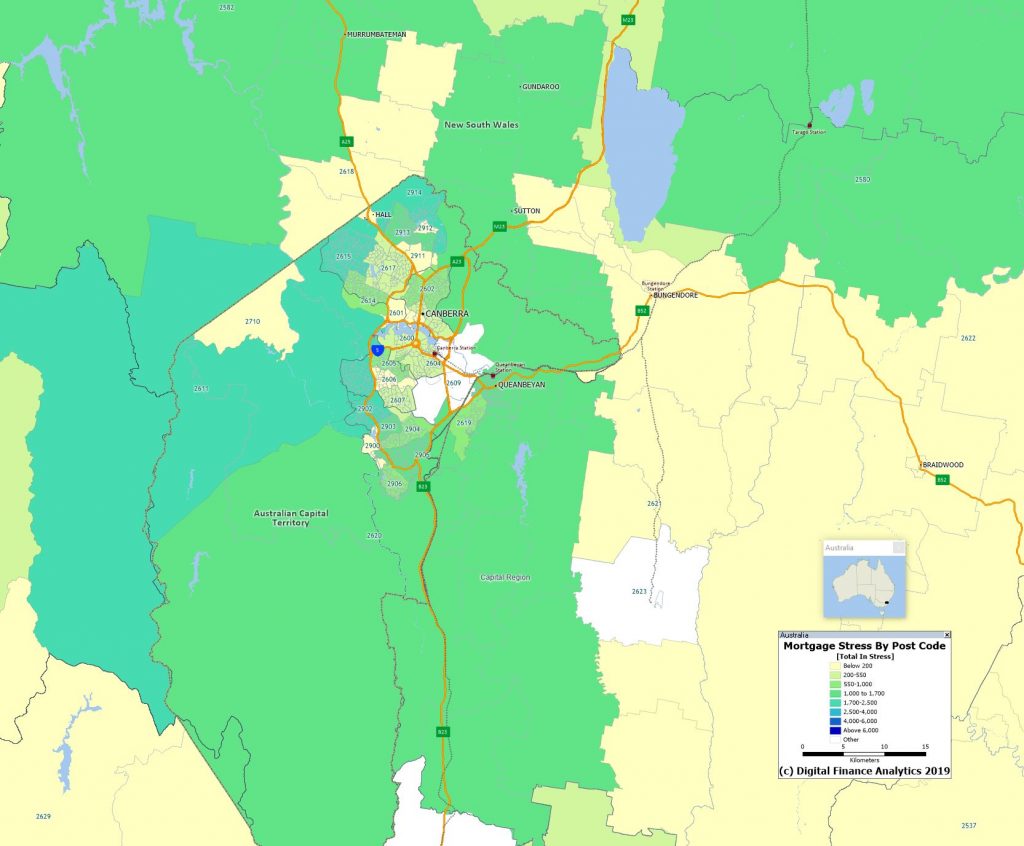

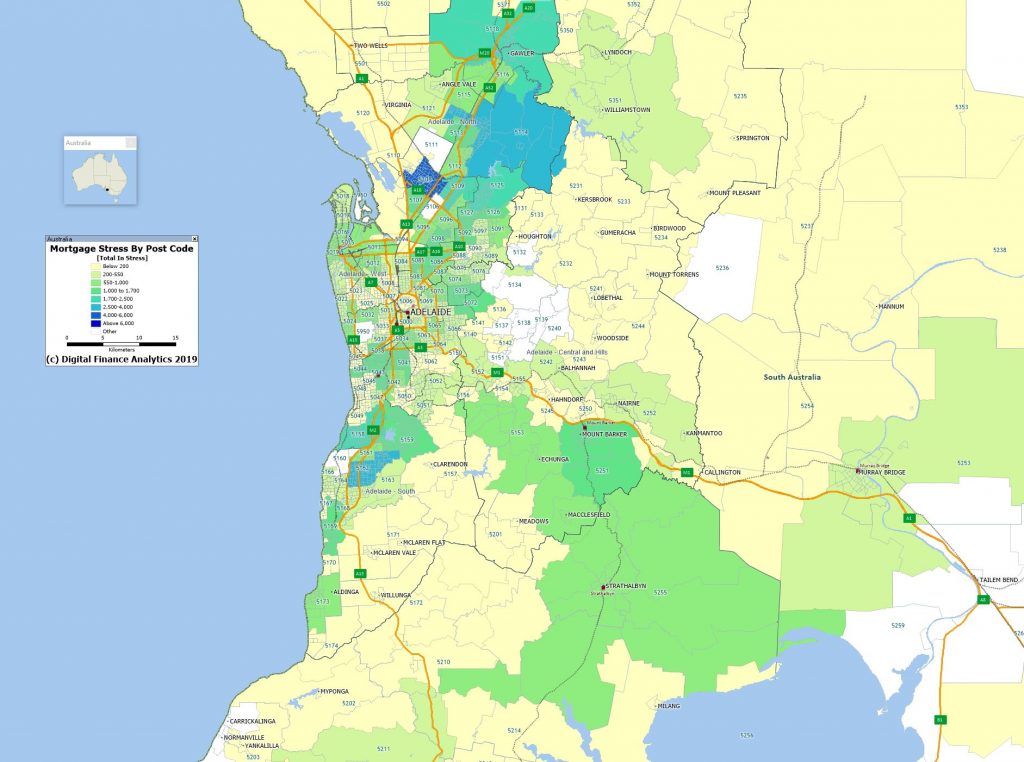

Here is the top stressed post codes in the ACT

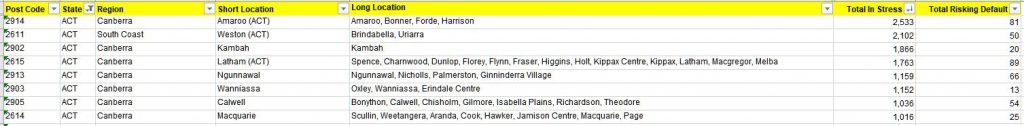

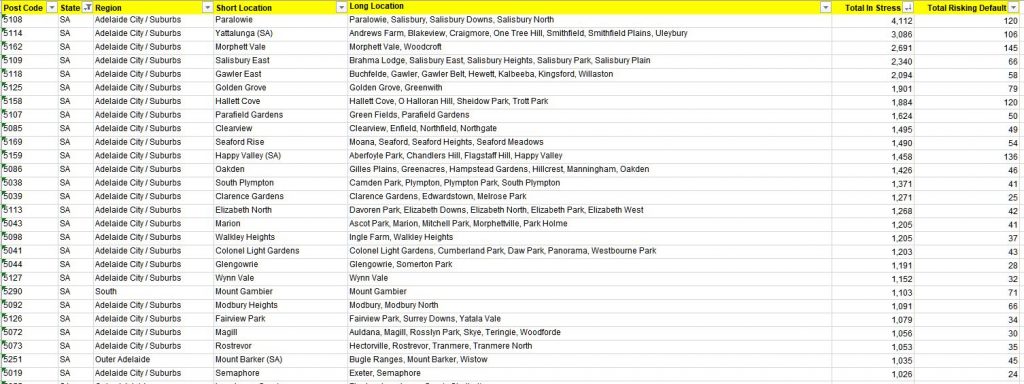

Top post codes by stressed households in SA.

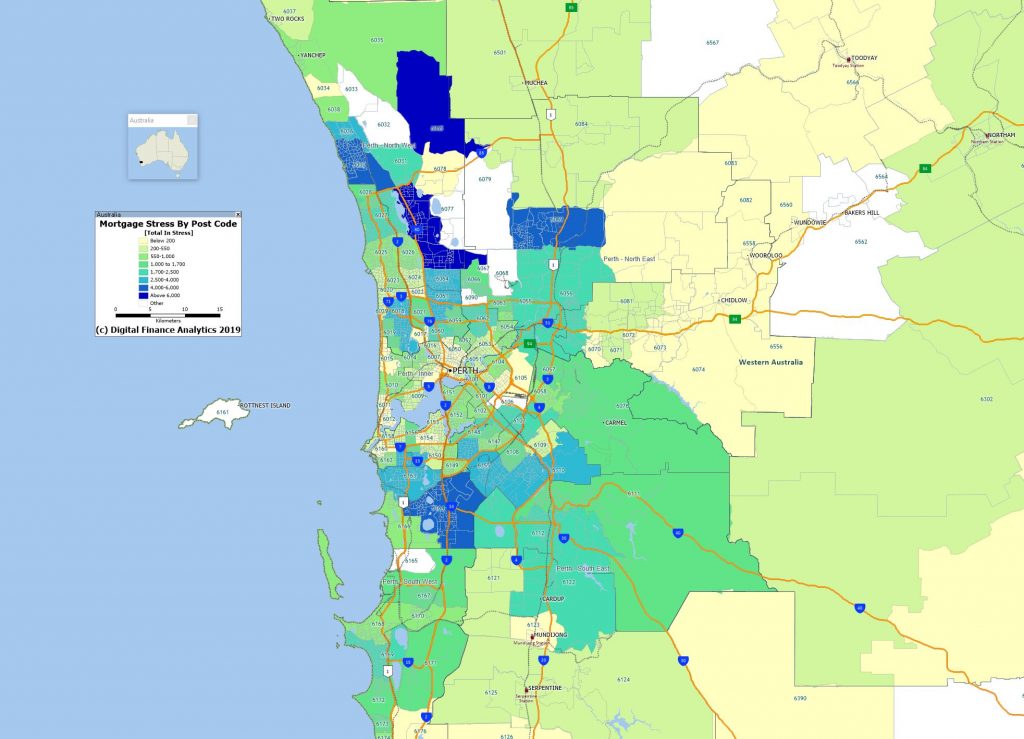

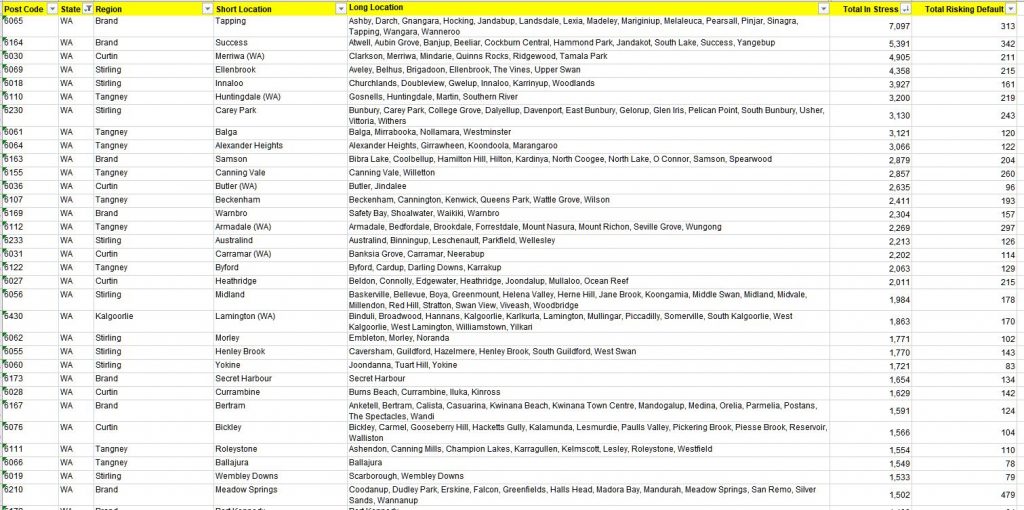

List of top postcodes across WA

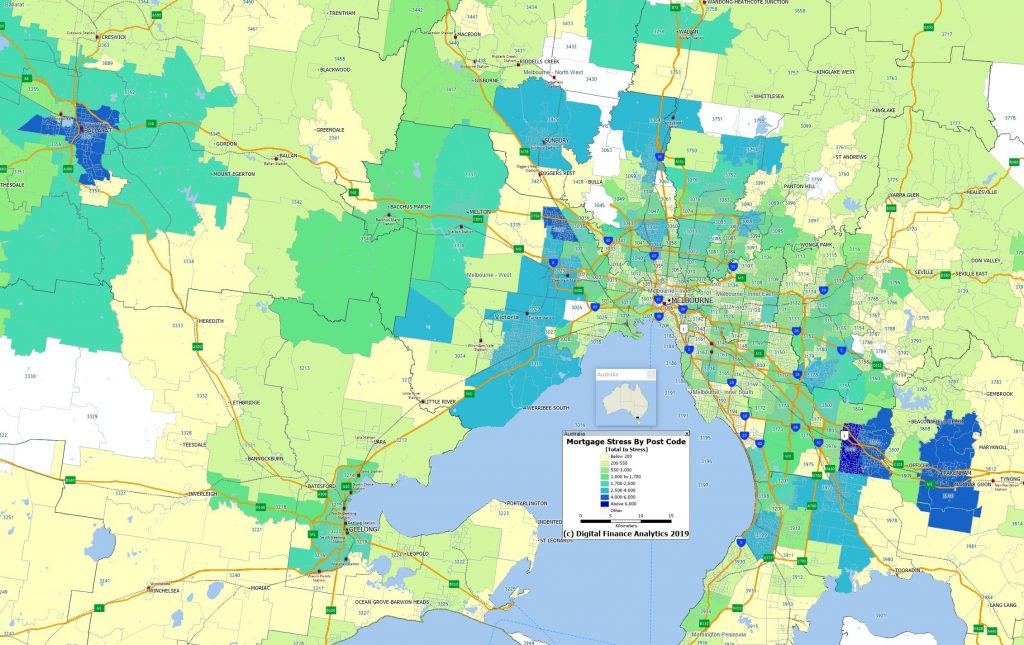

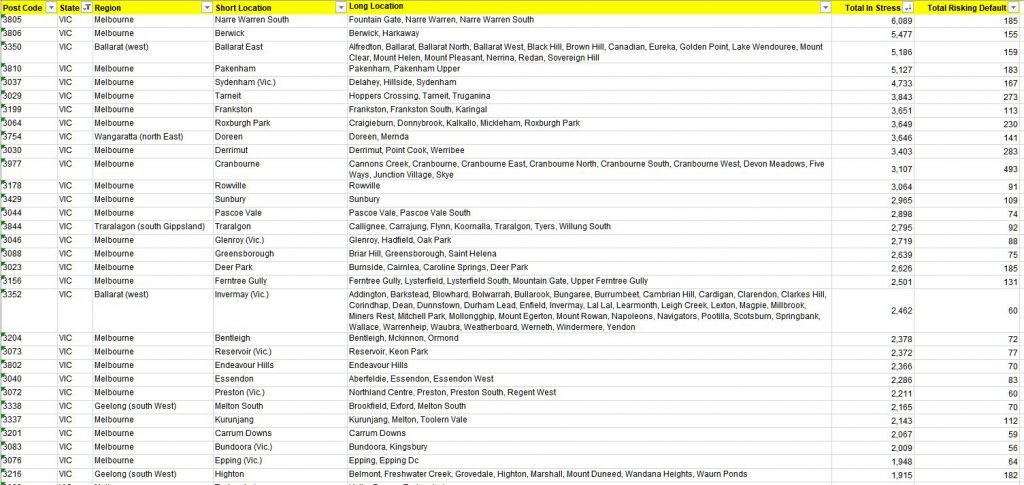

Top count of stressed postcodes in VIC. Click on the images to see full screen.

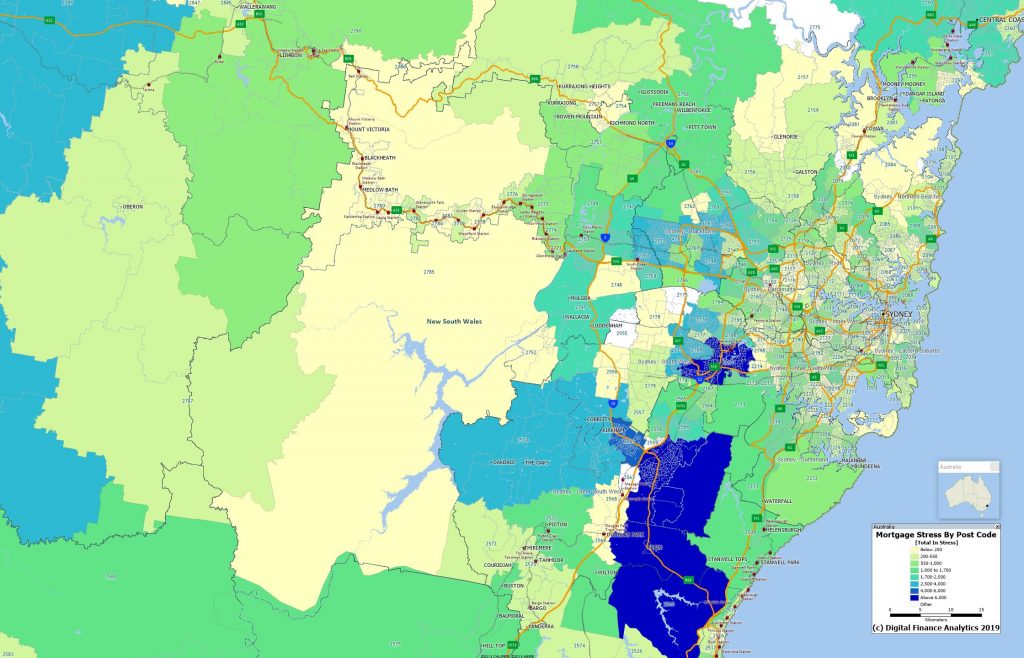

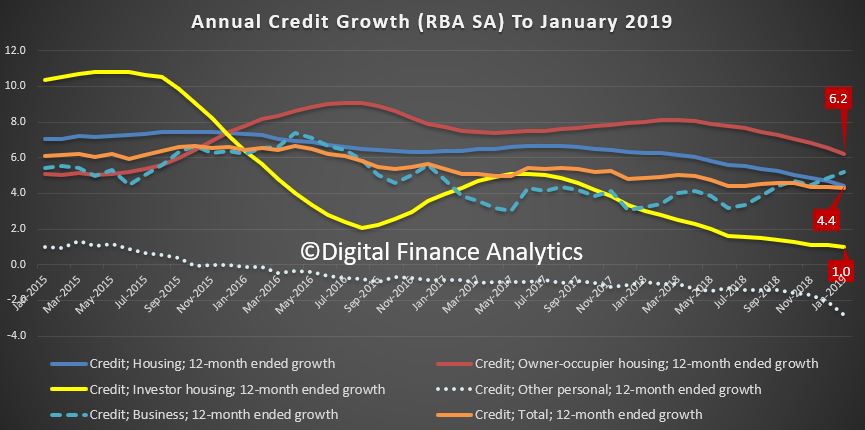

The top stressed post codes (by count) in NSW. Click on the image to view full screen.

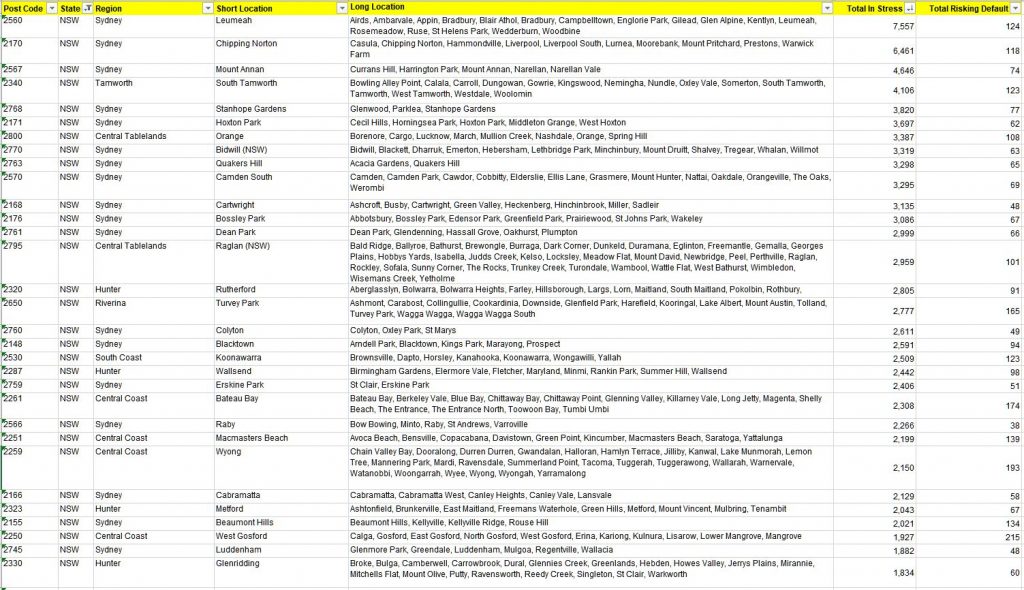

Here are the most stressed postcodes across Queensland.

As requested!

Click on the image to view full screen. Other states to follow in due course.

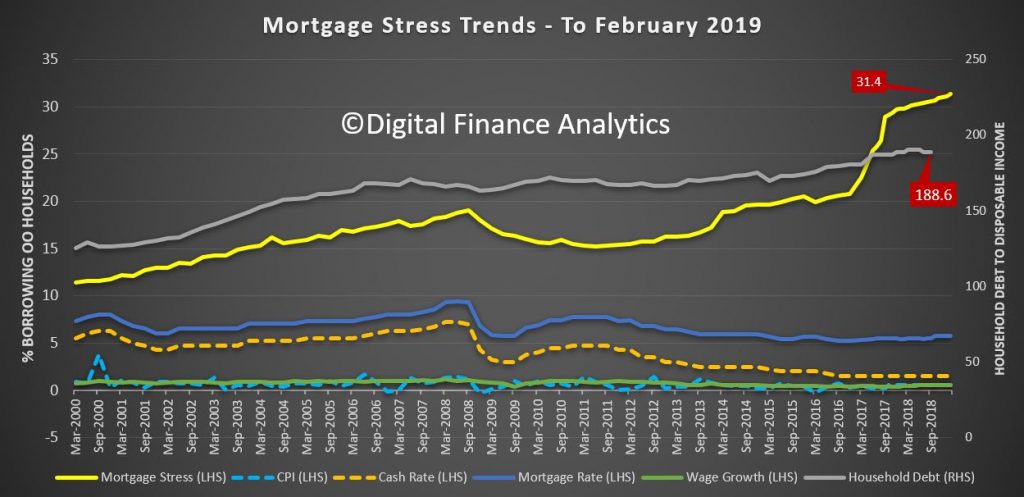

Digital Finance Analytics (DFA) has released the February 2019 mortgage stress and default analysis update. Unfortunately, the pressure on households continues to rise as weak ongoing wages growth is not offsetting costs of living, and mortgage repayments and total debt still grows. In addition, the number of households in severe stress continues to rise, suggesting a lift in potential defaults later.

The latest RBA data on household debt to income to September fell a little to 188.6[1], but still remains highly elevated. The housing debt ratio continues to climb to a new record of 139.6, according to the RBA. This shows that household debt to income is still increasing.

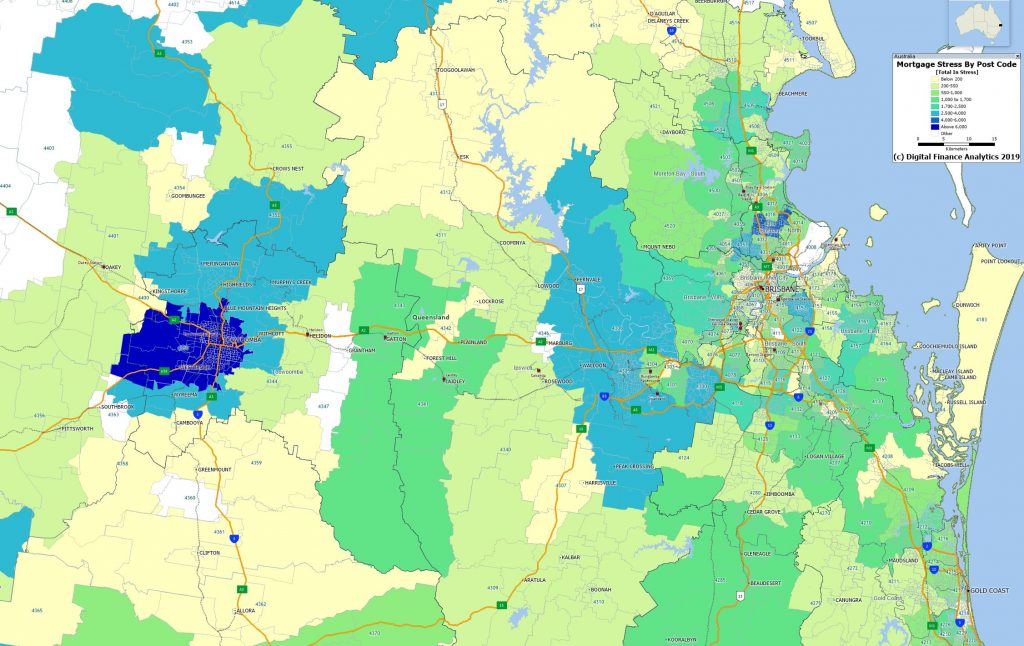

This is confirmed by the latest financial aggregates recently released by the RBA, to end January 2019, with owner occupied lending still growing significantly faster than inflation at 6.2%.

This high debt level helps to explain the fact that mortgage stress continues to rise.

Across Australia, more than 1,036,214 households are estimated to be now in mortgage stress (last month 1,026,106), another new record. This equates to more than 31% of owner occupied borrowing households. In addition, more than 28,903 of these are in severe stress (last month 25,750). We estimate that more than 66,000 households risk 30-day default in the next 12 months, up 3,000 from last month. We continue to see the impact of flat wages growth, rising living costs and higher real mortgage rates. Bank losses are likely to rise a little ahead.

Our analysis uses the DFA core market model which combines information from our 52,000 household surveys, public data from the RBA, ABS and APRA; and private data from lenders and aggregators. The data is current to the end of February 2019. We analyse household cash flow based on real incomes, outgoings and mortgage repayments, rather than using an arbitrary 30% of income.

Households are defined as “stressed” when net income (or cash flow) does not cover ongoing costs. They may or may not have access to other available assets, and some have paid ahead, but households in mild stress have little leeway in their cash flows, whereas those in severe stress are unable to meet repayments from current income. In both cases, households manage this deficit by cutting back on spending, putting more on credit cards and seeking to refinance, restructure or sell their home. Those in severe stress are more likely to be seeking hardship assistance and are often forced to sell.

Despite the oft repeated view that household finances are fine, the continued accumulation of larger mortgages compared to income whilst costs are rising and incomes static explains the issues we are now seeing.

Housing credit growth is running significantly faster than incomes and inflation, and continued rises in living costs – notably child care, school fees and electricity prices are causing significant pain, this despite some relief at the bowser. Many continue to dip into savings to support their finances. We are seeing a rise in households seeking help with their finances, including access to debt counsellors and other advice channels. WA is seeing very strong growth in cries for help, but pain in NSW is also on the rise.

Indeed, the fact that significant numbers of households have had their potential borrowing power crimped by lending standards belatedly being tightened, and are therefore mortgage prisoners, is significant. “More than 40% of those seeking to refinance are now having difficulty. This is strongly aligned to those who are registering as stressed. These are households urgently trying to reduce their monthly outgoings”.

The next question to consider is which households are being impacted. In fact, negative equity is touching “lots of different segments” of the market for different reasons, but collectively it is an “early warning sign” for what is to come.

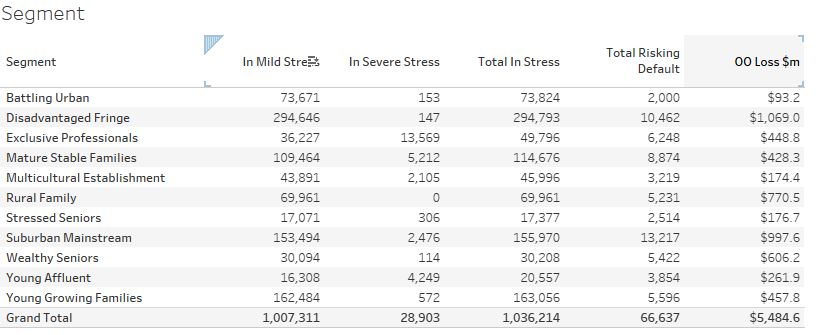

Probability of default extends our mortgage stress analysis by overlaying economic indicators such as employment, future wage growth and cpi changes. Our Core Market Model also examines the potential of portfolio risk of loss in basis point and value terms. Losses are likely to be higher among more affluent households, contrary to the popular belief that affluent households are well protected. This is shown in the segment analysis below:

Stress by the numbers.

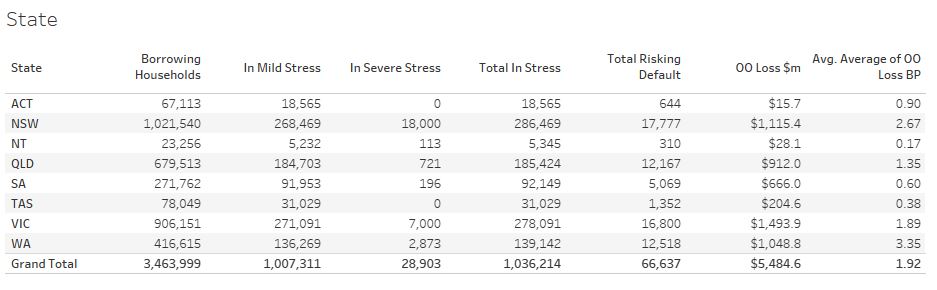

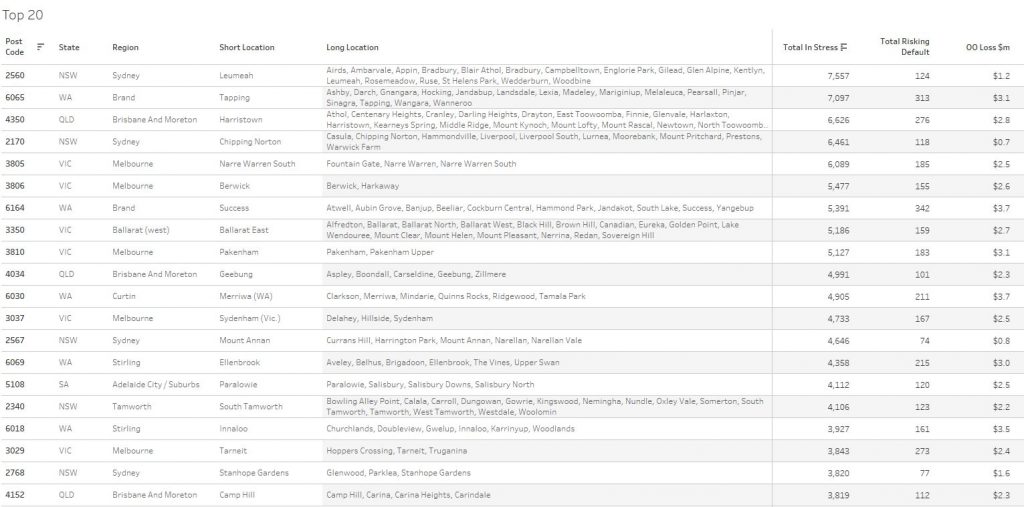

Regional analysis shows that NSW has 286,469 households in stress (282,165 last month), VIC 278,091 (278,860 last month), QLD 185,424 (185,493 last month) and WA has 139,142 (139,621 last month). The probability of default over the next 12 months rose, with around 12,500 in WA, around 12,100 in QLD, 16,800 in VIC and 17,700 in NSW.

The largest financial losses relating to bank write-offs reside in NSW ($1.1 billion) from Owner Occupied borrowers) and VIC ($1.49 billion) from Owner Occupied Borrowers, though losses are likely to be highest in WA at 3.3 basis points, which equates to $1,048 million from Owner Occupied borrowers.

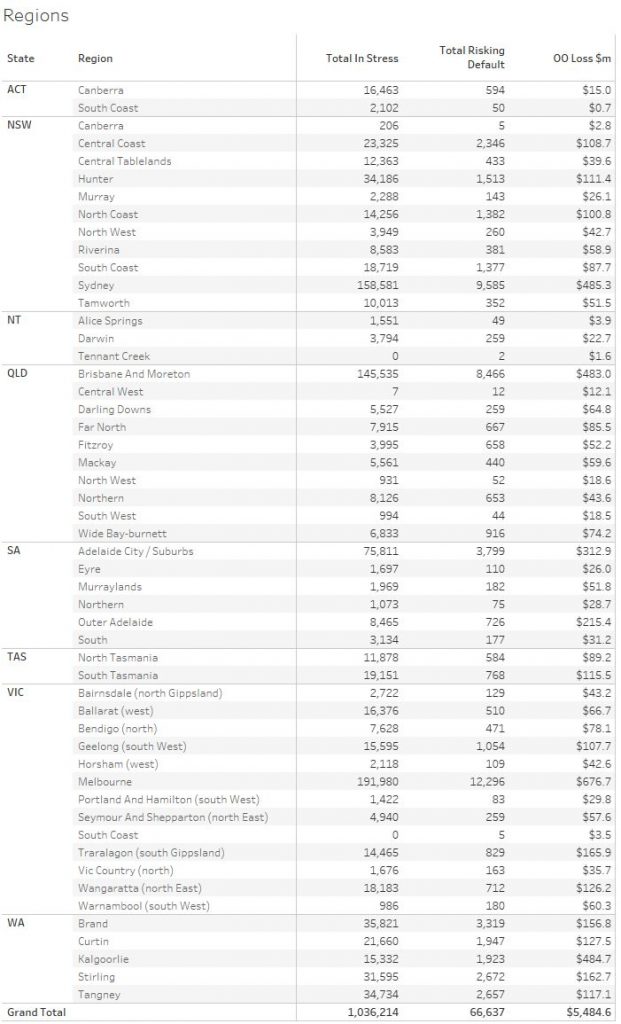

A fuller regional breakdown is set out below.

And here is a list of the highest count of stressed households by post code across the country.

Handling Mortgage Stress

Households who are in financial difficulty should not ignore the signs. Though many do. And trying to refinance to solve the problem often ends up just postponing the inevitable.

We think there are some simple steps households can take:

Step one is to draw up a budget, so you can see where the money is coming and going. From our research, only half of households have any budget. This means you can then make decisions about what is most important, and what can be foregone. Select and prioritise.

Step two is to talk with your lender, as they have a legal obligation to assist is case of hardship. Yet many households avoid having that conversation, hoping the problem will cure itself. I have to say, in the current low-income growth, high cost environment, that is unlikely. And remember rates are likely to rise at some point.

Step three. Work out what would happen if mortgage rates rose by say half or one percent. Pass that across your budget and examine the impact. Then you will really know where you stand. Then plan accordingly.

[1] RBA E2 Household Finances – Selected Ratios September 2018

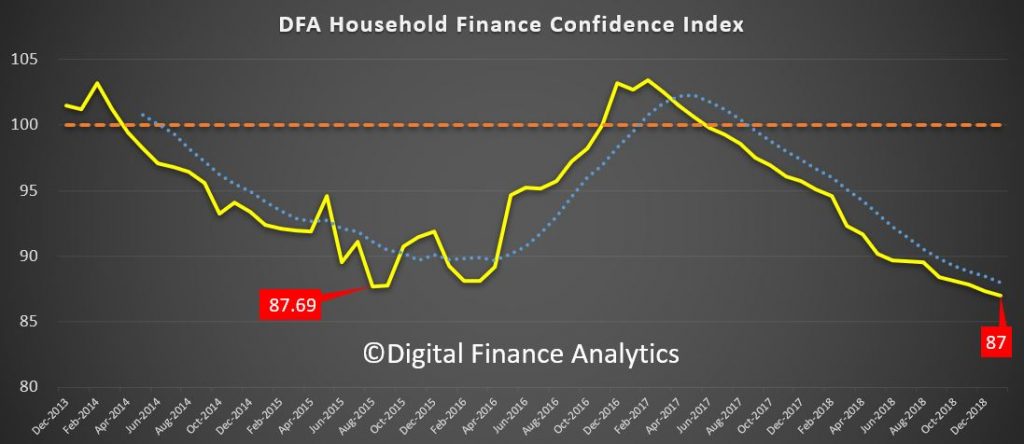

This is starting to look serious as the latest DFA household financial confidence index results for January 2019 reveals a further decline in levels of confidence.

The index fell to 87 in January, down from 87.3 in December, the lowest its been since the survey commenced, well below the neutral setting of 100.

By way of background, these results are derived from our household surveys, averaged across Australia. We have 52,000 households in our sample at any one time. We include detailed questions covering various aspects of a household’s financial footprint. The index measures how households are feeling about their financial health. To calculate the index we ask questions which cover a number of different dimensions. We start by asking households how confident they are feeling about their job security, whether their real income has risen or fallen in the past year, their view on their costs of living over the same period, whether they have increased their loans and other outstanding debts including credit cards and whether they are saving more than last year. Finally we ask about their overall change in net worth over the past 12 months – by net worth we mean net assets less outstanding debts.

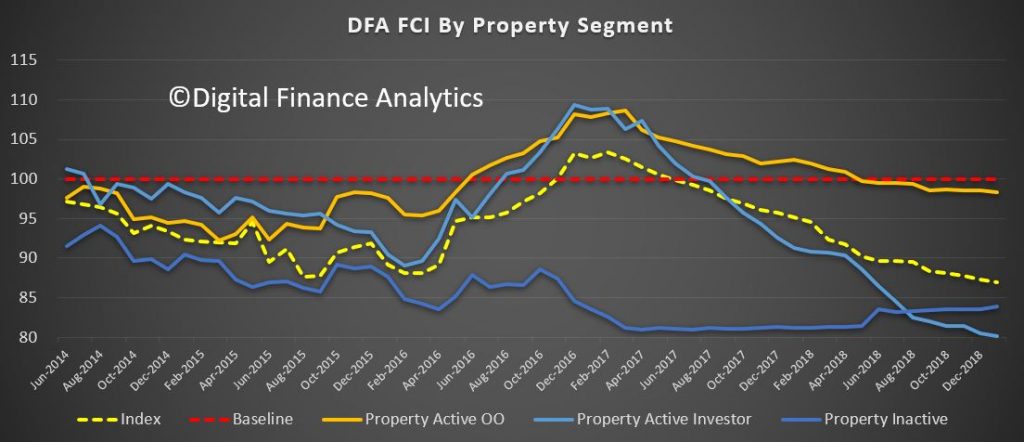

Looking at the results by property segments, we see a fall in confidence among property investors, as home prices and rental yields continue to fall, and reflecting concerns about potential changes to negative gearing and capital gains ahead. That said, purchase interest has risen a little. We will discuss this later.

Owner occupied borrowers are also feeling the heat, reflecting some mortgage price pain, as well as the basic affordability issues. Those renting however are a little more positive relatively speaking, thanks to rents being lower now and a greater choice of property for rent being available, especially in Sydney. Overall investors are the least confident now, a considerable switch from a year or so ago!

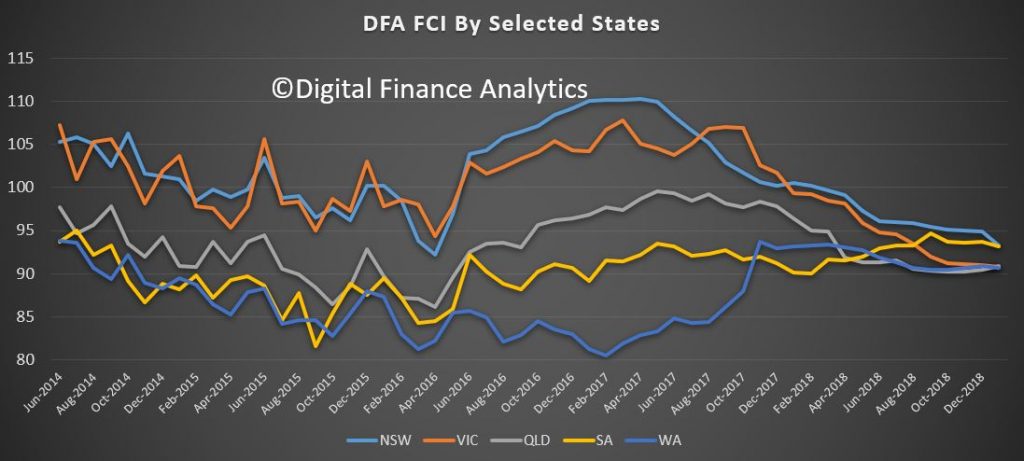

Cutting the data by states, we see that the bunching continues as property price falls in Sydney and Melbourne erode confidence there, relative to the other states. The most significant fall was in NSW, as home prices fall – and the fall out from Opal Tower had an impact more broadly on new purchases, and off the plan commitments.

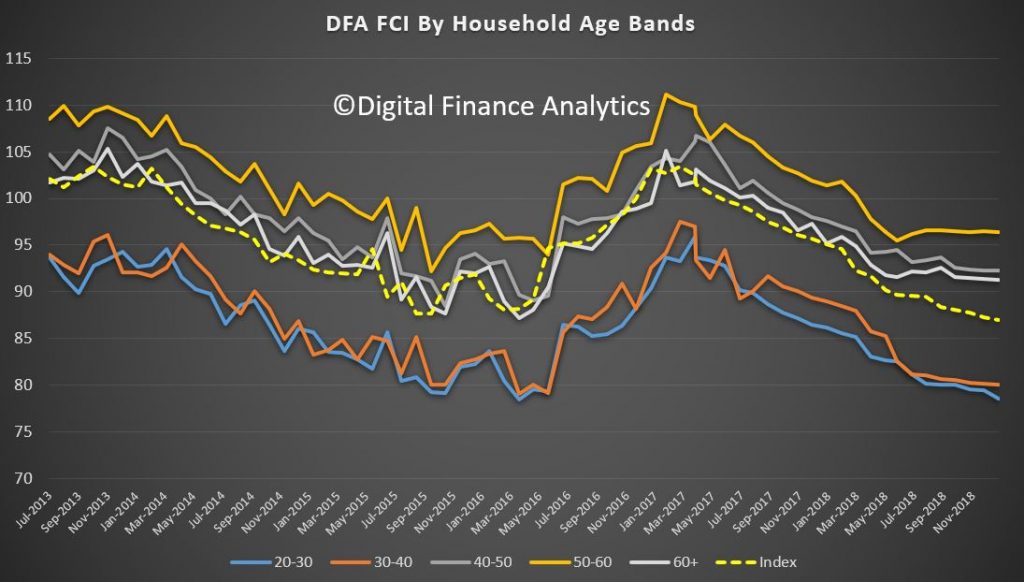

Across the age ranges we continue to see weakness, with younger households more exposed, although those older households with share market investments saw a rebound in January, which boosted their confidence a little.

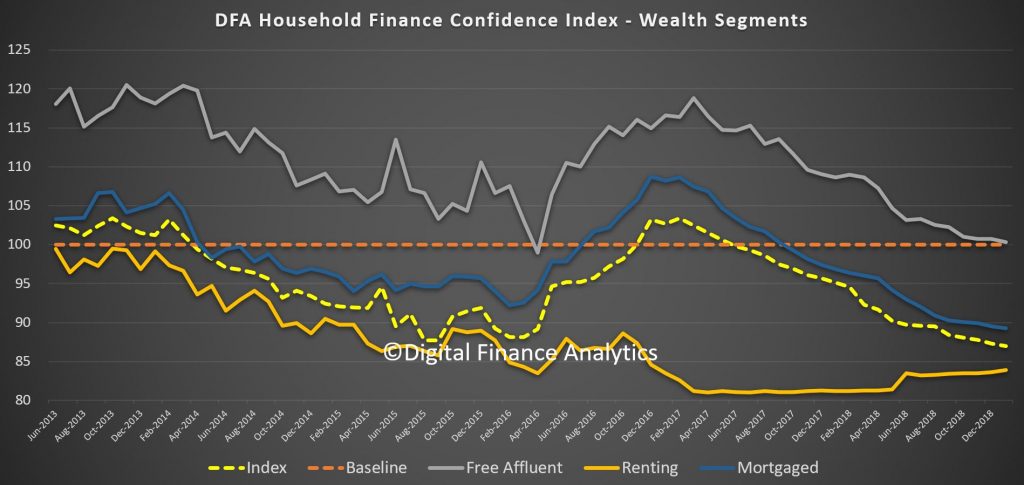

Turning to our wealth segments, we continue to see property owners without a mortgage the most confidence, though falling close to the long term neutral benchmark, while those with mortgages (either investor or owner occupied) continue to decline. Renters remain the least confident. This could become an important indicator in the run up to the next election, in that even those heartland voters supporting the incumbent Government are less positive than usual.

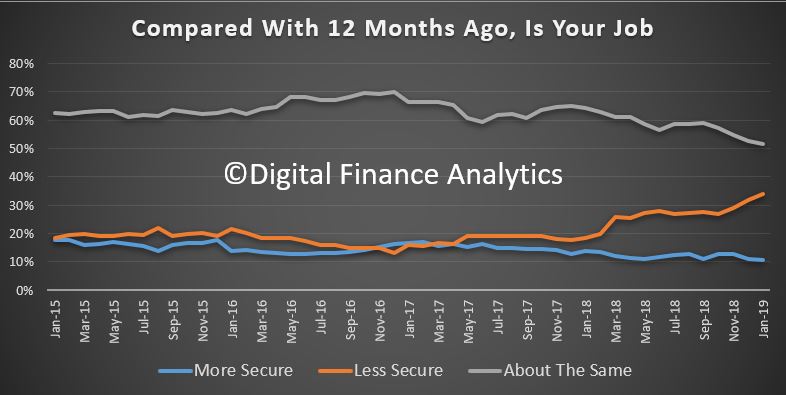

We can then examine the moving parts within the index. We start with job confidence. Those feeling more secure about their job prospects fell 2.19% to 10.57%, while those feeling less confident rose 4.84% to 33.85%. 51.68% saw no change, but that fell by 3.30%. There was a noticeable rise of concerns in the construction sector as building approval momentum falls.

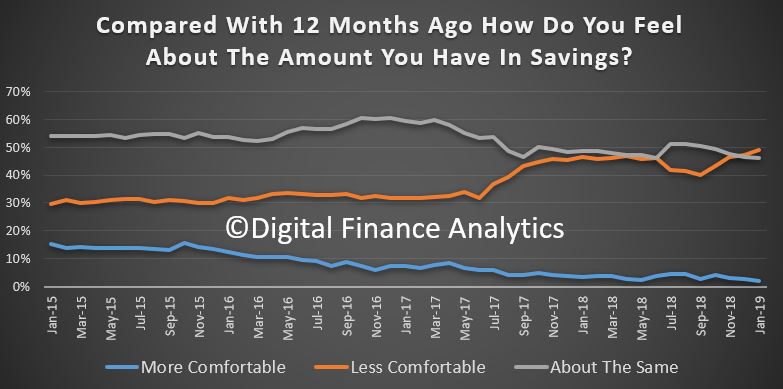

Savings rates continue to fall for many, and others are raiding what savings they have to maintain their lifestyles – something which of course cannot continue indefinably – one reason why the savings ratio continues to fall. June 1.98% of households were more comfortable than a year ago, down 1.28%, while 48.96% were less comfortable, a rise of 2.52%. 46.24% were about the same, down 1.56%.

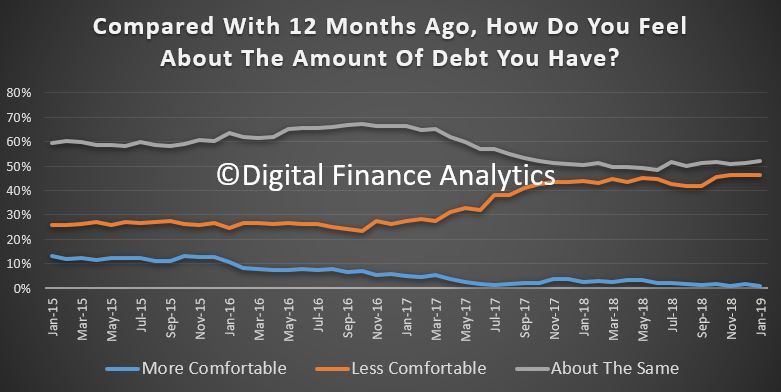

Turning to debt, 1.11% of households are more comfortable than a year ago, and 52% are about the same. 46% are less comfortable than a year back, thanks to rising rates, switches to interest and principal from interest only loans and problems in servicing the repayments. We also continue to see growth in quasi credit such as Afterpay, as well as other forms of short term credit. Household debt of course continues to rise faster than incomes or inflation.

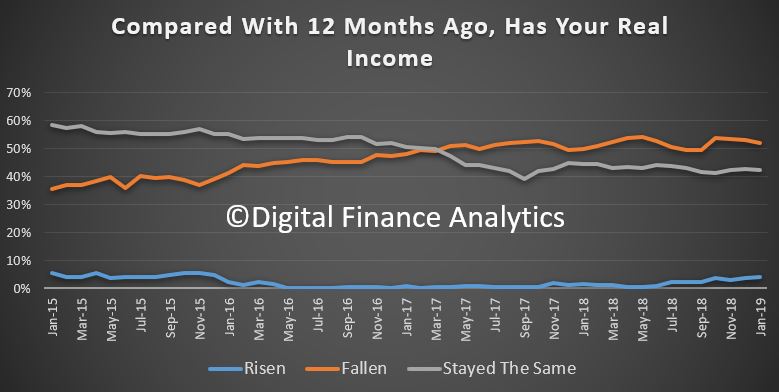

Income growth remains a real concern for many households (in real terms many have seen falls in recent years). 3.88% of households reported their real incomes had grown in the past year, 51.99% said incomes had fallen in real terms, and 42.5% said there had been no change. We continue to observe pressure on the income side of household balance sheets, despite the RBA’s expectation that wages will rise eventually. One bright spot was dividend payments which were higher, but this failed to offset the total picture.

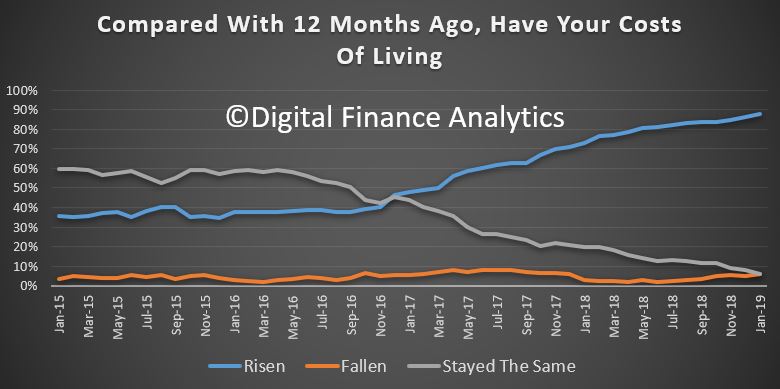

One of the killer categories is the costs of living. Once again we think the CPI figures just do not reflect the lived experience of many households. 87.75% said their costs had risen over the past year, up 3.2%. This includes the old favorites, electricity, child care, health care, and household staples, despite a fall in costs of fuel at the bowser.

And finally, household net worth continues to take a dive thanks for falling home prices – this despite recent positive share price moves. Overall 32.18% of households sand their net worth had improved, down 1.82% from last month, 37.28% said their net worth had fallen, up 4.05% and 27.42% said there had been no change, down 2.52%.

One other interesting point which came out from the analysis is that potential property investors are more active now, thanks to the falls in asking prices, and importantly, the burning fuse with regards to ending negative gearing should Labor win the next election. Thus we have seen a rise in investors considering transacting. Some lenders are offering “special” fixed rate offers, in the light of APRA’s hands off approach, and of course Hayne did not do anything on responsible lending. The tighter underwriting standards are still in play of course – for now – but I would not bee surprise to see a kick up in new investor lending in the weeks ahead, despite the lower levels of financial confidence.

In summary then, interesting times as household finances are squeezed, yet the fixation on property for many Australians remains strong. There is still a belief that falls will be limited, and they will bounce back. We are not so sure!

We will update the index next month.

Welcome to the Property Imperative weekly to the ninth of February 2019 – our digest of the latest finance and property news with a distinctively Australian flavour.

This was a mega week in which the Royal Commission reported, mortgage brokers were crushed, the RBA cut growth expectations, and we saw more confirmation of the pressures on households. And NAB lost both its Chairman and CEO. So let’s get started.

Read the transcript or watch the video.

The final report from the Royal Commission was disappointing, in that whilst 20 plus companies will be referred for potential criminal proceedings, and NAB was called out for not getting it, and the 76 recommendations may be worthy, – we discussed the recommendations in more detail in our post “A Banking Royal Commission Special Report” , the report failed to address two critical issues. Hayne has left lending practices where they are (yes, the banks have tighter standards now, at least temporarily, but he left the household expenditure measure benchmark question hanging) and failed to address the question of conflict between providing advice and selling financial services products, which was at the heart of the hearings. Too often advice let to customers buying products which maximised the income of advisors and firms, when they were not necessarily in the best interests of said customer. See our post “Why The Royal Commission Report Is A Fail”.

Paul Keeting, the architect of financial deregulation in the 1980’s was quoted as saying in the Australian “The royal commissioner should have recommended — this conflict between product and advice — be prohibited. This he monumentally failed to do. He should have acted upon the examination and the evidence of these serious conflicts of interest.”

Finance sector stocks when higher before the report was released, and some are suggesting insiders made $20 billion or so as a result. A leak was denied by The Government of course, but we are not so sure. There were massive stock movements at 11:00 am on Monday, when remember the report was made public AFTER the market had closed at four PM.

Mortgage brokers got a shock, because their business models are potentially crushed. The Commission proposes that trail commissions – payments in subsequent years to brokers by banks for loans they introduced – should be banned – as quote “they are payments for no value”. And in due course brokers need to move to a fixed fee arrangement, paid for by the borrower, which would make the arrangement more transparent, but may restrict competition, and swing momentum back to the big banks, who would be set to benefit. I discussed this with mortgage broker and financial adviser Chris Bates – see “What Does The Hayne Report Mean To Mortgage Brokers And Financial Advisers?”. They will also be given a requirement to act in the best interest of their clients, something which is assumed by many customers of brokers today, but which is not currently the case.

So, in summary, Hayne will be remembered more for the exposes in the hearings, where the bad conduct and criminal behaviour of the finance sector were revealed, rather than firm recommendations to make substantive changes. It mostly falls back to the institutions and regulators to heal themselves. I am less confident, so expect bad practice to continue. NAB lost their chairman and CEO, they were both called out as not getting the problem in the bank – and it is possible that other heads will roll as criminal proceedings commence, but I suspect most will remain unpunished.

The RBA had a big week, with Governor Lowe speaking at the National Press Club on Wednesday, and then releasing the Statement on Monetary Policy on Friday. Lowe’s view is that economic growth will slow a bit compared with previous forecasts – 3% this year and 2.75% beyond. He believes income growth will start to lift as the unemployment rate slides further. He thinks this will be enough to keep the economy ticking over. Despite this, there is now, he says equal weight to both a fall in the cash rate or a rise. And in the SMOP, there was recognition that falling home prices may have a dampening effect on consumption and growth as the “wealth effect” dissipates. Many suggest, this downside risk is still underplayed. Plus, the new headline inflation number for June 2019 came it at a low 1.25% in the statement, which is a significant reduction.

Damien Boey at Credit Suisse said “We cannot help but feel that the RBA is missing something in all of this, hence its rather shallow downgrades to consumption growth forecasts, and its optimistic forecast for only a 10% reduction in residential investment this year. … If the Bank does not understand or admit to the nature of banking and credit problems, it will always think that the economy is healthier than it is. It will always have too high a view of the potency of rate cuts, and therefore delay them until the last minute”.

Westpac’s Bill Evans said of the RBA’s move, “This move to a balanced rate outlook is significant because it clearly establishes that the Bank is prepared to contemplate rate cuts – a position that has really only emerged since the housing markets have reversed. It is also consistent with changes announced by other central banks notably the US Federal Reserve.” Of course, bond rates remain higher in the US than here, which is unusual, and signals higher bank funding costs ahead. This was something which CBA signalled in their results out this week. So, I am expecting more out of cycle mortgage rate hikes ahead.

My own view has been for some time that cash rate cuts won’t have much impact, but thanks to the budget trends, there is capacity for quite big tax cuts to try and stimulate consumption. I expect the upcoming budget to start that trend, and there will be more fiscal loosening later in the year as the economy weakens.

The latest news on home prices is more of the same. Down, down, prices are down. CoreLogic’s 5-city dwelling price index slide another 0.24%. The quarterly declines are rising to 3.57% and values have fallen by 8.5% since their most recent peak, with Sydney down 12.5%, Melbourne down 9.0% and Perth down 16.7%. Remember these are averages, and in some areas, prices are down more than 20%; with more to come. And the auction results remain in the doldrums, on low volumes and clearance rates the national auction clearance rate dropped 5.0% to 42.8%. In Sydney auction clearance rate fell by 4.2% to 49.5% though in Melbourne it rose a tad to 44.3%, both well below the trends from a year ago.

And by the way CBA senior economist, Gareth Aird showed the correlation between home prices and jobs growth, which goes counter to the RBA’s view that jobs momentum will support prices. Another reason why we think prices will go on sliding.

All of this is in stark contrast to the ME Bank Household Comfort report out this week. The most shocking chart was the high proportion of households who still think prices will rise. Only 13% of homeowners and 11% of investors expect the value of their properties to fall this year, versus 38% of homeowners and 52% of investors that believe property prices will rise either a “little” or a “lot”. Clearly more should be watching our shows. But then price growth expectations, are wired in – many have never seen falls – and the real estate sector, still are saying things are on the turn, and she’ll be right. Sorry, to disappoint, but there are more falls to come. And by the way that same report said it was the renting sector who are felling more bullish as rents slide.

The ANU, as reported in the Australian, said that the average household has seen no gains in their after-tax income since the end of 2010, which was when the economy was emerging from the global financial crisis. According to ANU’s Centre for Social Research and Methods, the fall in the past three years was greater than during the last recession in 1991-92. In fact, living standards peaked in 2011. There was no improvement for the next four years, but incomes started falling behind rising living costs from late 2015 onwards. Many will not be surprised, and it helps to explain why we think household consumption will continue to fall.

NABs surveys this week also highlighted concerns among households. They said that anxiety increased most over the cost of living, and despite a healthy labour market, concerns over job security also climbed to its highest level since mid-2016.

“In terms of household finances, retirement remains the big worry, followed by providing for the family’s future, raising $2,000 for an emergency, and medical and healthcare costs”.

“Against this background, almost four in 10 Australians said they had experienced some form of financial hardship last quarter, the highest in two years.” And importantly spending plans are being curtailed, which will flow on to lower growth of course.

And our own mortgage stress data for January underscored the pressure on households. The long grind in WA continues, with more households under financial pressure, but we are seeing further deterioration in other states too. The number of households in severe stress continues to rise. The latest RBA data on household debt to income to September fell a little to 188.6, but remains highly elevated. The housing debt ratio continues to climb to a new record of 139.6, according to the RBA. This shows that household debt to income is still increasing. This high debt level helps to explain the fact that mortgage stress continues to rise. Across Australia, more than 1,026,106 households are estimated to be now in mortgage stress (last month 1,023,906), another new record. This equates to more than 31% of owner-occupied borrowing households. In addition, more than 25,750 of these are in severe stress (last month 22,000). We estimate that more than 63,000 households risk 30-day default in the next 12 months, up 1,000 from last month. We continue to see the impact of flat wages growth, rising living costs and higher real mortgage rates. Bank losses are likely to rise a little ahead. See our Video “Mortgage Stress Exists – Believe It!”

Despite the popular view that household finances are fine, in fact the continued accumulation of larger mortgages compared to income whilst costs are rising, and incomes static explains the issues we are now seeing. Housing credit growth is running significantly faster than incomes and inflation and continued rises in living costs – notably child care, school fees and electricity prices are causing significant pain, this despite some relief at the bowser. Many continue to dip into savings to support their finances. We are seeing a rise in households seeking help with their finances, including access to debt counsellors and other advice channels. WA is seeing very strong growth in cries for help!

Indeed, the ABC reported that the National Debt Helpline said calls had skyrocketed in Western Australia amid epidemic of financial stress. And we note that the Treasurer just announced a review of financial counselling: “ It will consider gaps and overlaps in current services and the adequacy of appropriate delivery models for future funding”. Last week John Adams and I highlighted the possible link between mortgage stress and family violence, as suggested by the police.

And finally in our local round up, Business Confidence is also tanking according to Roy Morgan Research who released their Survey for January. They say that confidence has dropped to its lowest level since August 2015 and it was the worst January result ever. “The decline in Business Confidence to begin 2019 comes amidst a slew of poor economic news with significant declines in house prices in Sydney and Melbourne over the last 12 months now joined by lower than expected retail trade figures for December”. This is consistent with the NAB results we reported last week.

So, to the markets. Locally, the ASX 100 had a good run, as the Hayne effect dissipated. The index slid a little on Friday though thanks to the RBA’s downgrades, slipping 0.3% to end at 5,006.4, territory not seen since October, and up 3.56% on a year ago. The local volatility index was down 0.29% to 12.90, and 30.48% lower than a year back, reflecting a “risk on” peak back then.

Since the FED turned turtle on its interest rate policy, the markets confidence is roaring back. Not surprisingly, the ASX Financials Index was up this week, as banks were back in favour, despite a small fall on Friday, to end at 5,911.90, still 5.71% lower than a year ago. Individual banks moved round a bit with ANZ up 0.11% on Friday to end at 26.89, down 2.79% from a year back. CBA also rose, up 0.93% on their results, which revealed strong capital but weaker margins and profit below expectation and ended at 74.75, which is 2.58% lower than a year back. NAB fell following the resignation of the CEO and Chairman, to end at 24.75. In fact, this is not the first time NAB has lost leadership after a crisis. Their shares are down 12.27% lower than a year ago, suggesting that relative to peers they have a lot to do to regain market confidence. Their quarter disclosure which came out on Friday, would have not lifted expectations, as again margin is under pressure, and capital fell. It will be interesting to see if the proposed divestments of NABs and CBA wealth businesses continue given Haynes weak recommendations. Strategy may yet be reversed. Westpac fell 0.33% on Friday to end at 26.79, and down 10.84% from a year back. They still have their wealth businesses.

Among the regionals, Bank of Queensland rose 0.09% to 10.66, but is still 10.56% down from a year ago. Suncorp fell 0.22% to 13.61, up 3.73% from last year, and Bendigo and Adelaide Bank fell 1.59% to 11.15, up 0.36%. They may be more impacted by the proposals to charge customers for mortgage advice. AMP was down 1.21% on Friday, having had a small bounce from the Royal Commission report, because it will allow them to continue to run their advice and product businesses in tandem. AMP ended at 2.44 and remains 51.49% lower than a year ago. Macquarie fell 1.23% to 121.57, but is up 19.5% from a year back, benefitting from its international businesses.

Lenders Mortgage Insurer Genworth was up 1.62% on the latest results, which showed a strong capital position, even if mortgage delinquencies were a little higher, especially in NSW. They ended at 2.51 and is 10.58% lower than 12 months ago. Given lower mortgage volumes, their growth appears limited and if household pressures continue, we must expect more defaults ahead. Mortgage Choice, the aggregator, was hit by the Hayne recommendations on mortgage brokers this week, but rose on Friday, up 2.44% to 84 cents, down 62.61% from a year ago. Given they have advice businesses in their portfolio, I suspect they might do quite well from the changes, if they can morph their business effectively.

The Aussie ended the week at 70.91, up 0.04%, having been above 72 earlier in the week after the Hayne report came out. But the RBA’s neutral stance on future interest rates – signalling more trouble in the economy, dragged it back. We still expect further falls ahead. It is still 9.89% lower than a year ago.

The Aussie Gold Cross rate rose 0.49% to end at 1,853.59, up 9.97% on a year ago, while the Aussie Bitcoin Cross rose 4.88% to 4,672.3, down 53.42% on a year back.

Overseas, at the close, the Dow Jones Industrial Average declined 0.25%, to 25,106.33 and is 1.11% up from a year back. The S&P 500 index gained 0.07%, to 2,707.88 and is up 0.91% from a year ago, It has risen more than 15 percent from 20-month lows in December, spurred by a dovish Federal Reserve and largely positive fourth-quarter earnings, as well as hopes for an eventual U.S.-China trade deal, despite lingering scepticism over the United States and China reaching a trade deal before the March 1 deadline. Of the S&P 500 companies that have reported quarterly results, 71.5 percent have beaten profit estimates but analysts now expect current-quarter profit to dip 0.1 percent from the year before, not grow the 5.3 percent estimated at the start of the year. The S&P 100 was down a little to end at 1.190.16, up 0.28% over the year. The CBOE Volatility Index, which measures the implied volatility of S&P 500 options, was down 3.97% to 15.72 and is down 40.97% form 12 months ago. The S&P Financials index was down 0.94% on Friday to 427.88 and remains 8.02% down from a year back. Bellwether Goldman Sachs fell 0.73% on Friday to 191.67 and is 24.89% lower than last year.

The NASDAQ Composite index climbed 0.14% to 7,298.20 on Friday and is up 3.35% from last year at this time. Apple was up 0.12% to 170.41 and is 7.15% higher than last year. Google’s Alphabet fell 0.32% to 1.102.38 and is 4.78% than a year back. Amazon fell 1.62% to 1,588.22 but is 13.95% higher than 12 months ago and Facebook is up 0.57% to 167.33, down 7.66% from a year back. Intel fell 0.79% to 48.84 and is up 8.52% from last year.

Investors remain jittery about trade tensions between the U.S and China, which have been the catalyst for the global trade war that rocked equity markets. Although the sides met for talks last week in Washington, there have been no signs of progress. On Thursday, U.S. stock markets fell after President Trump said that he had no plans to meet with Chinese President Xi before March 2, when further U.S. tariffs are scheduled to be imposed.

The Feds pussy cat approach to future rate rises has seen the 10-year bond rate come back, and on Friday it was at 2.63, down 0.76%. The 3-month rate was at 2.42, up 0.41%. The US Dollar index was up 0.13% to 96.64, up 7.04% from last year, while the British Pound USD slid a little to 1.2945 and is 6.71% lower than 12 months back.

The UK Footsie was down 0.32% to 7.071.18 as the Brexit discussions continue, and the deadline looms. Its down 2.55% from a year back. The Footsie Financials Index was down 0.84% to 646.19, down 3.85% from last year. The Euro USD was at 1.1331, down 7.53% from 12 months back. The European Commission has projected moderate growth in the EU in 2019, but economic uncertainty has dampened confidence. The forecast lowered its growth forecast for the eurozone to 1.9% in 2018, down from 2.1% in the November forecast. The report highlighted Brexit and the slowdown in China as key sources of uncertainty for European economies, adding that the projections were subject to downside risks.

Deutsche bank was down 2.56% on Friday, to 7.223 and is 40.09% down from this time last year. The Chinese Yuan US Dollar ended at 0.1483 and is 7.02% lower than last year. Crude Oil Futures rose a little, up 0.11% to 52.70 but remains 15.08% lower than last year at this time.

Gold futures were higher, up 0.32% to 1,318.35, down 2.48% from a year ago, Silver was up 0.73% to 15.83 and is 3.04% lower than last year, while Copper was down 0.55% to 2.81, down 8.29% from 12 months ago. And finally, the Bitcoin USD ended the week at 3.716.9, up 8.17% but is still 54.69% lower than a year ago. The total capitalization of the derivatives markets at BTC/USD was $156 million US Dollars. Worth bearing in mind how small the market truly is!

So, we see the change in the wind which the Fed triggered earlier in the month flowing on to strong markets, despite the uncertainties around global growth ahead. Locally as the dust settles on the Hayne report, we expect bank stocks to remain volatile – remember there are still more criminal cases in the works – eventually. But meantime the focus will be on the Australia economy, as the leading indicators signal more trouble ahead, and the RBA plays catch up.

In this context, there can be little expectation of a rebound in home prices, nor a resurgence of lending for mortgages, I think the current settings will mean falls continue, and may accelerate. The next thing to watch for are “unnatural acts” fiscally speaking when the budget comes down in April, before a May election. Unless something unexpected resets the timetable.

Meantime, my advice remains be very cautious about property. There is no hurry to buy. Falling prices may offer opportunity later, but buying into a falling market, even at these low interest rates is tricky, and as I have indicated I expect more out of cycle hikes to come. So, caution is the watch word. But the good news/bad news is the risk of a financial apocalypse has abated in favour of another round of debt creation – which postpones what may well be eventually a significant reset. We will update our scenarios soon.

And before I go, a quick reminder that our next live stream event is now scheduled for Tuesday 19th February at 8:00 PM Sydney – here is the link to the reminder. You can ask a question live or send them in beforehand. I look forward to seeing you there.

And by the way, if you value the content we produce, please do consider supporting our efforts. You can make a one off donation via PayPal, or consider joining our Patreon programme. We really appreciate your support to help us continue to make great content.