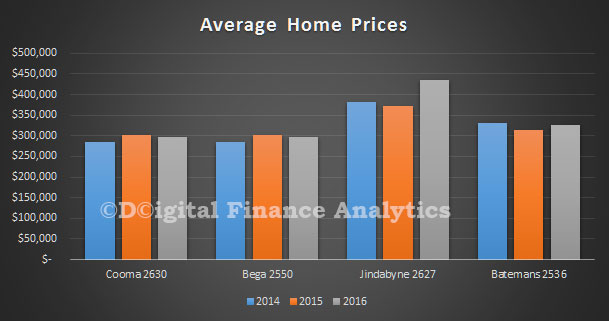

We did some specific research for a slot on ABC Radio in South Eastern Regional NSW, covering the regions around Cooma, Bega, Jindabyne, and Batemans Bay. Using data from our surveys we were able to pull out some insights into the property markets in these locations. Given the fixation elsewhere on capital city prices, it is worth remembering that the property market actually consists of a series of micro-markets, with very different characteristics and outcomes. Our research shows this nicely.

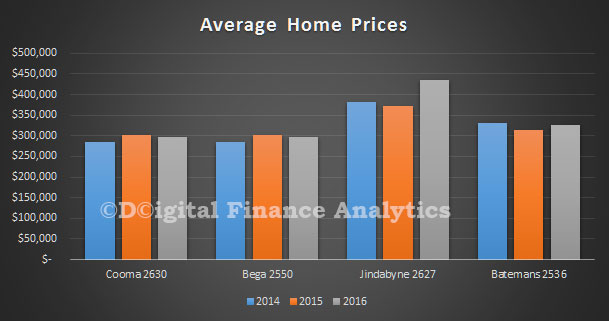

So, looking at the four markets, lets start with average home price trends.

At Cooma, the Capital of the Snowy Mountains, prices are on average around $240,000, though they have slipped a bit in the past year, with a fall of around 10%.

At Cooma, the Capital of the Snowy Mountains, prices are on average around $240,000, though they have slipped a bit in the past year, with a fall of around 10%.

Bega, in the rural heartland of the Sapphire Coast, has an average price of around $300,000 with a small fall in the last year of around 3%.

Jindabyne which overlooks Lake Jindabyne near the Snowy Mountains has an average price of $430,000, and has seen a strong rise this year after a small fall last.

Finally, Batemans Bay, in an area surrounded by understated natural beauty, attracting everyone from watercolour artists and rock fishermen, keen surfers and fishing enthusiasts to families on holiday, has an average price of $330,000 up about 3% this year. Units here rose around 1.3% to around $230,000.

The types of families vary across the region. For example, Jindabyne has many younger families, including those with growing kids, whereas Batemans Bay has an older population including many edging towards, or in retirement. Households in Bega and Cooma tend to be in the middle, with an average age of 51.

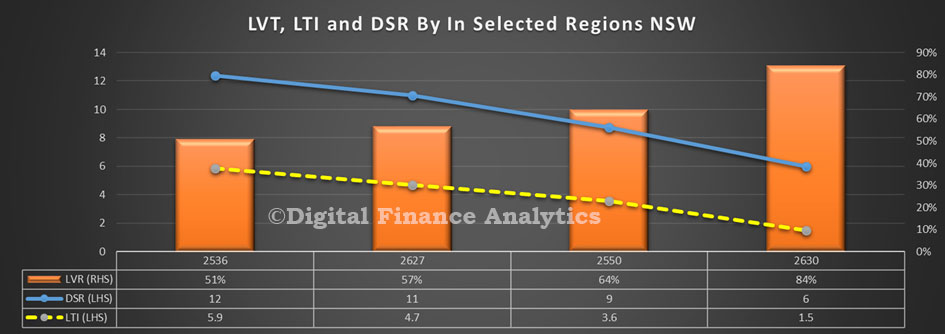

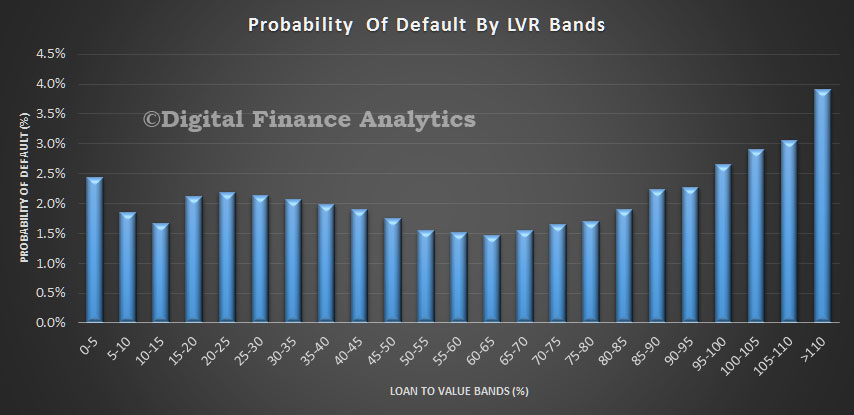

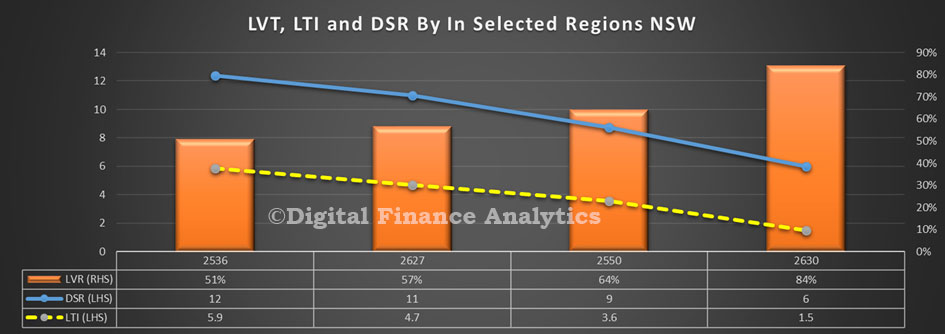

So now we look at the mortgage metrics for these areas. The loan to value ratio is highest in Cooma at 84%, reflecting some price falls, and larger mortgages. But the loan to income and debt servicing ratios are quite healthy, so there is little mortgage stress at current interest rates. It rates were to rise, that could change. Many of the properties here have been held for several years, so some capital value has been locked in, but capital growth remains limited.

Compare this with Batemans Bay. Here the LVR is significantly lower, at around 51%, but the DSR and LTI are higher. This reflects the more limited incomes many older households now have, despite the fact they still have an outstanding mortgage. There is more sensitivity to rising rates. There have been more recent property transfers, and loan refinances. We also see growth in the number of apartments in the region.

Households in Jindabyne have a higher debt service ratio, reflecting the larger mortgages required to purchase here compared with incomes. Again there is sensitivity to rising rates. The loan to income ratio is 4.7 on average.

Households in Jindabyne have a higher debt service ratio, reflecting the larger mortgages required to purchase here compared with incomes. Again there is sensitivity to rising rates. The loan to income ratio is 4.7 on average.

We also found that demand along the coast is being supported by those from the cities buying a second property for holiday, or investment purposes, including the scenario where they grab equity from an existing Sydney property to fund the purchase. This illustrates the spillover effects of high Sydney prices.

So overall, property momentum in these regions does not mirror the growth rates in Greater Sydney, though there are some spillover effects. Property on the coast is in greater demand, including from investors, and many prospective local buyers are being priced out of the market. Some mortgage holders have quite a high debt burden, in terms of meeting repayments, and would be sensitive to rising rates.

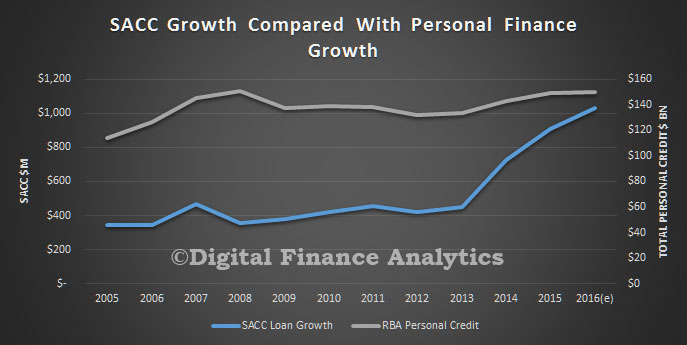

Now Professor Gill North has published an important academic paper – see this link – “Small Amount Credit Contract Reforms in Australia: Household Survey Evidence and Analysis” which takes the analysis of the survey data much further. Here is the abstract.

Now Professor Gill North has published an important academic paper – see this link – “Small Amount Credit Contract Reforms in Australia: Household Survey Evidence and Analysis” which takes the analysis of the survey data much further. Here is the abstract.