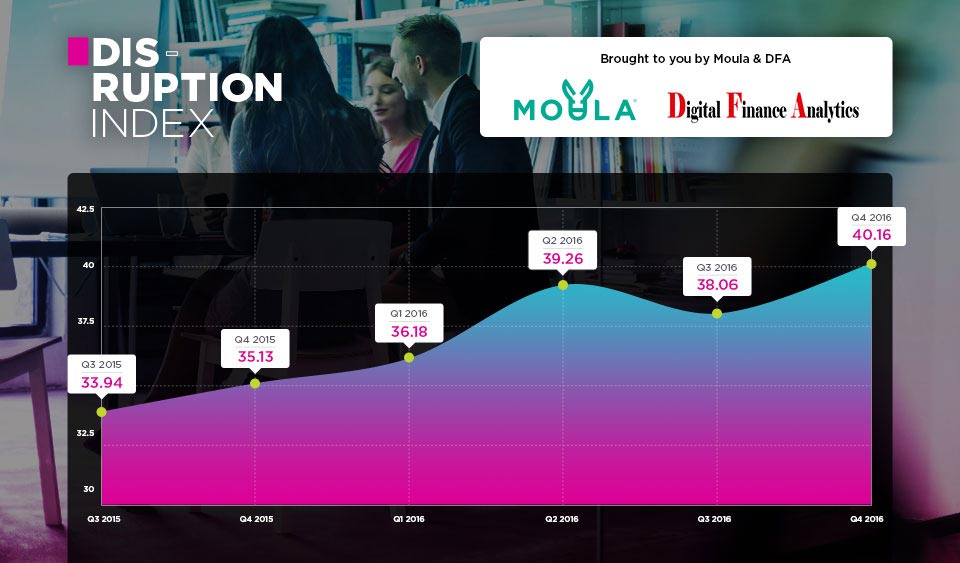

The latest edition of the Financial Services Disruption index is released today. It measured 40.16, up 5.52% from last quarter.

The Disruption Index tracks change in the small business lending sector, and more generally, across financial services. The Financial Services Disruption Index, which has been jointly developed by Moula, the lender to the small business sector; and research and consulting firm Digital Finance Analytics (DFA).

The Disruption Index tracks change in the small business lending sector, and more generally, across financial services. The Financial Services Disruption Index, which has been jointly developed by Moula, the lender to the small business sector; and research and consulting firm Digital Finance Analytics (DFA).

Combing data from both organisations, we are able to track the waves of disruption, initially in the small business lending sector, and more widely across financial services later.

Highlights this time include:

- Non-bank SME lenders are becoming more mainstream, with 14.1% of the surveyed population now familiar with the options available from this segment of lenders. Compare this 4.2% at the same time last year, we see a significant 230%+ increase. However, in number terms, we are talking about roughly 300,000 businesses now aware (up from less than 100,000), so there is sizeable upside for those willing to shake the market up and be relevant for the ‘engine room’ of the Australian economy.

- The gulf between SME loan assessment expectations and banks’ loan assessment execution is growing, with continued downward pressure on expected turnaround times. The latest survey indicates 5.4 days expected assessment turnaround… requiring significant bank process replumbing to meet those types of targets.

- Businesses data provisioning is now commonplace and the early fears around security of login credentials and ‘what will they do with my data’ appear to be receding.

- Ease of process (loan applications completed in a few clicks) and speed of assessment appear to be the catalysts here. In the last quarter, 80%+ of all businesses starting a loan application moved on to provision some form of electronic data.

- Moula continues to execute loans in, on average, 29 hours. Loans to more complex business structures, such as trusts, impact on the average loan processing speed due to additional compliance-related processes. Loans to more simple structures such as sole traders and companies are typically executed within 12 hours of the initial application.

- Business confidence rose in borrowing SME’s especially in eastern states of NSW, VIC and ACT. Less strong in SA, TAS and QLD. There has been a strong fall in WA thanks to the end of the mining boom, and second order impacts across other industry sectors there.