Salvatore Babones, Australia’s Globalization Expert from the University of Sydney discusses the emerging 6G mobile network. The opportunities are…?

Category: Disruption Index

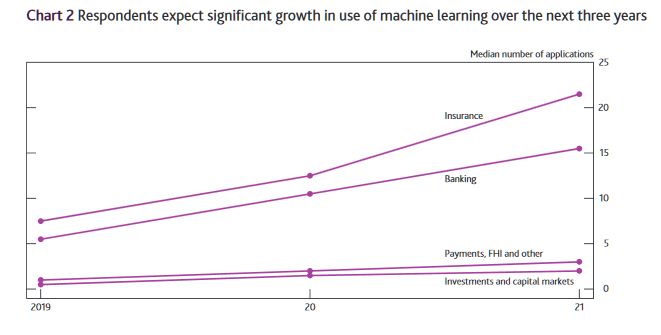

Machine Learning On The Rise In Financial Services

The Bank of England (BoE) and Financial Conduct Authority (FCA) have a keen interest in the way that ML is being deployed by financial institutions.

They conducted a joint survey in 2019 to better understand the current use of ML in UK financial services. The survey was sent to almost 300 firms, including banks, credit brokers, e-money institutions, financial market infrastructure firms, investment managers, insurers, non-bank lenders and principal trading firms, with a total of 106 responses received.

In the financial services industry, the application of machine learning (ML) methods has the potential to improve outcomes for both businesses and consumers. In recent years, improved software and hardware as well as increasing volumes of data have accelerated the pace of ML development. The UK financial sector is beginning to take advantage of this. The promise of ML is to make financial services and markets more efficient, accessible and tailored to consumer needs. At the same time, existing risks may be amplified if governance and controls do not keep pace with technological developments. More broadly, ML also raises profound questions around the use of data, complexity of techniques and the automation of processes, systems and decision-making.

The survey asked about the nature of deployment of ML, the business areas where it is used and the maturity of applications. It also collected information on the technical characteristics of specific ML use cases. Those included how the models were tested and validated, the safeguards built into the software, the types of data and methods used, as well as considerations around benefits, risks, complexity and governance.

Although the survey findings cannot be considered to be statistically representative of the entire UK financial system, they do provide interesting insights.

The key findings of the survey are:

- ML is increasingly being used in UK financial services. Two thirds of respondents report they already use it in some form. The median firm uses live ML applications in two business areas and this is expected to more than double within the next three years.

- In many cases, ML development has passed the initial development phase, and is entering more advanced stages of deployment. One third of ML applications are used for a considerable share of activities in a specific business area. Deployment is most advanced in the banking and insurance sectors.

- From front-office to back-office, ML is now used across a range of business areas. ML is most commonly used in anti-money laundering (AML) and fraud detection as well as in customer-facing applications (eg customer services and marketing). Some firms also use ML in areas such as credit risk management, trade pricing and execution, as well as general insurance pricing and underwriting.

- Regulation is not seen as a barrier but some firms stress the need for additional guidance on how to interpret current regulation. Firms do not think regulation is a barrier to ML deployment. The biggest reported constraints are internal to firms, such as legacy IT systems and data limitations. However, firms stressed that additional guidance around how to interpret current regulation could serve as an enabler for ML deployment.

- Firms thought that ML does not necessarily create new risks, but could be an amplifier of existing ones. Such risks, for instance ML applications not working as intended, may occur if model validation and governance frameworks do not keep pace with technological developments.

- Firms use a variety of safeguards to manage the risks associated with ML. The most common safeguards are alert systems and so-called ‘human-in-the-loop’ mechanisms. These can be useful for flagging if the model does not work as intended (eg. in the case of model drift, which can occur as ML applications are continuously updated and make decisions that are outside their original parameters).

- Firms validate ML applications before and after deployment. The most common validation methods are outcome-focused monitoring and testing against benchmarks. However, many firms note that ML validation frameworks still need to evolve in line with the nature, scale and complexity of ML applications.

- Firms mostly design and develop ML applications in-house. However, they sometimes rely on third-party providers for the underlying platforms and infrastructure, such as cloud computing.

- The majority of users apply their existing model risk management framework to ML applications. But many highlight that these frameworks might have to evolve in line with increasing maturity and sophistication of ML techniques. This was also highlighted in the BoE’s response to the Future of Finance report. In order to foster further conversation around ML innovation, the BoE and the FCA have announced plans to establish a public-private group to explore some of the questions and technical areas covered in this report.

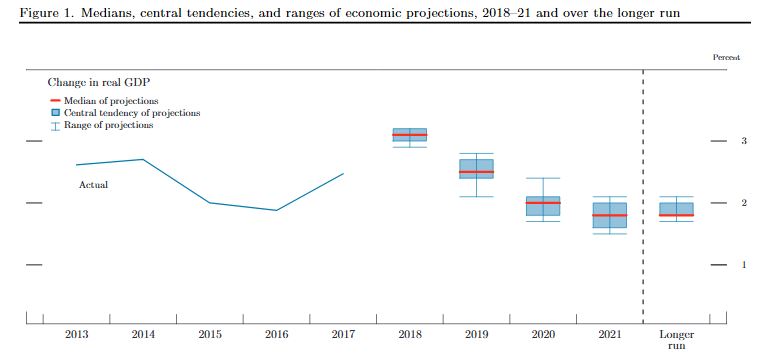

Fed Hikes As Expected – More To Come…

The Fed moved as expected, and continues to highlight more upward movements in the months ahead – in fact their language is arguably more bullish now. The target range for the federal funds rate is now 2 to 2-1/4 percent.

In their projection release, they see GDP sliding from 2019….

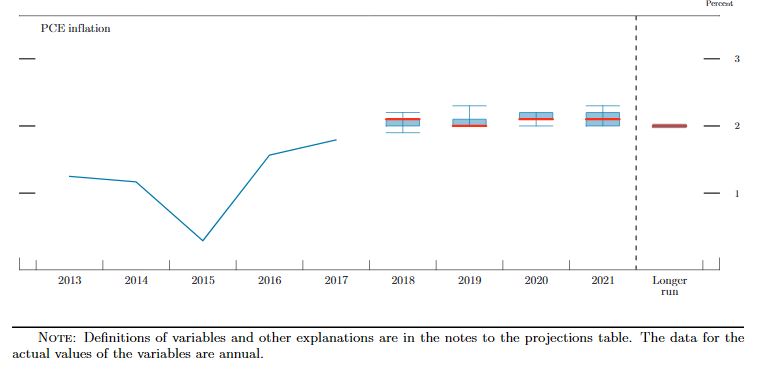

… while inflation is expected to rise:

… while inflation is expected to rise:

Information received since the Federal Open Market Committee met in August indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has stayed low. Household spending and business fixed investment have grown strongly. On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent. Indicators of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective over the medium term. Risks to the economic outlook appear roughly balanced.

In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 2 to 2-1/4 percent.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Voting for the FOMC monetary policy action were: Jerome H. Powell, Chairman; John C. Williams, Vice Chairman; Thomas I. Barkin; Raphael W. Bostic; Lael Brainard; Richard H. Clarida; Esther L. George; Loretta J. Mester; and Randal K. Quarles.

Think carefully before buying Bitcoin – and don’t buy the ‘safe haven’ claims

The sharp rise and subsequent fall in Bitcoin’s value places it among the greatest market bubbles in history. It has outpaced the 17th-century tulip mania, the South Sea bubble of 1720, and the more recent Japanese asset price and dot-com bubbles.

The rapid price rise garnered attention from an increasing number of academics and investment advisers. Some have suggested that Bitcoin improves portfolio performance and can even be used as a potential “safe haven” asset in place of gold.

Our work finds that much of this research is flawed and overlooks some important attributes that any investor should consider before allocating funds to such a speculative investment.

This is particularly relevant if investing in Bitcoin is rationalised as a prospective safe haven in times of market turmoil.

Hard to value

The first attribute investors consider is how to value Bitcoin. Typically, assets are valued based on the cash flows they produce. Bitcoin lacks this property.

This leads to ongoing debate as to the true value of Bitcoin and other cryptocurrencies. Some, such as the Winklevoss twins and other Bitcoin entrepreneurs, believe the price will soar far higher. Others, including Nobel prize winner Eugene Fama and esteemed investor Warren Buffett, believe the real value is closer to zero. Another Nobel winner, Robert Shiller, suggests the correct answer is “ambiguous”.

There is even wide variation in price across the various Bitcoin exchanges. This is common in fragmented markets and makes it difficult for an investor to find the best market price at any point in time – a process called price discovery.

High price volatility

Bitcoin prices also have a high level of variation (volatility) when compared to other possible investments including bonds, stocks and gold. Even tech stocks such as Twitter, which are considered relatively volatile, are found to have less price variation. This adds to the difficulty investors face when trying to value Bitcoin and any portfolios that contain it.

This is of particular concern given the large daily losses that Bitcoin has experienced in its relatively short life. The largest one-day decline experienced by the popular S&P500 index since 2011 is 4.2%. Bitcoin has had nearly 200 days that were worse (and over 60 days worse than the biggest decline in the gold price of 10.2%).

Put another way, Bitcoin has had 200 days worse than the worst day on the stock market. This hardly seems like an enticing investment for most.

Low liquidity

Investors should also consider the ease with which they are able to buy and sell any assets in which they invest. One method used to measure this liquidity attribute is the bid-ask spread – the difference in the price at which one is able to buy and sell the asset.

More liquid assets have a narrow bid-ask spread. Bitcoin’s bid-ask spread varies from one exchange to another, but in general it is much larger than for other assets.

While bid-ask spreads provide one measure of implicit trading costs, investors also consider the explicit transaction fees they are charged when trading. Transaction fees for trading traditional investments are typically well known and have trended down over time.

While Bitcoin fees have recently declined, they have proven to be highly variable, ranging from over $30 to under $1. The time taken to process a transaction can also be greater than 78 minutes. This is much longer than for stocks or bonds and creates another layer of uncertainty for investors.

Only for the most risk-loving

Bitcoin is harder to value, more volatile, less liquid, and costlier to transact than other assets in normal market conditions. Potential investors should be wary and carefully consider whether such highly speculative assets are appropriate additions to any portfolio.

Given safe havens are typically in demand during financial crisis, when markets are more volatile and less liquid, it is highly unlikely that Bitcoin is even worth considering as a safe-haven asset.

Author: Lee Smales Associate Professor, Finance, University of Western Australia

Fintech Spotlight – What’s On the Cards?

I caught up with the Co-Founder and CEO, David Boyd of Credit Card Compare, on their announcement of expansion into Singapore.

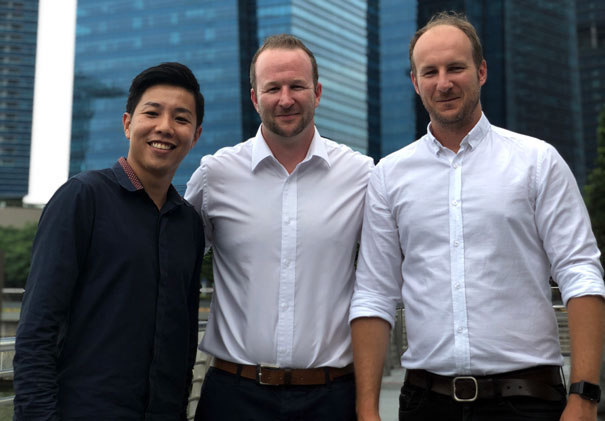

Kwok (A Co-Founder of Finty), David & Andrew Boyd.

Kwok (A Co-Founder of Finty), David & Andrew Boyd.

Credit Card Compare does what it says on the tin, by providing a website for prospective credit card customers to select and compare the features and benefits of a wide range of Australian credit cards. In fact, the business, which started in a domestic setting a decade ago has thrived, and now has around 150,000 people seeking advice each month via the site.

When customers get a card approved from the bank, they receive a referral fee but do not handle the application or credit assessment processes, so Credit Card Compare is essentially a lead generating platform for lenders. The trick of course is to get current data passed back from the banks and David said that given the legacy systems in some organisations, this can be a challenge. They have some additional enhancements in the works, which we will see down the track. As yet they do not provide advice on which card is best, but simply make it possible for consumers to compare cards on a range of standard parameters and prioritise the features which they believe are most important.

The announcement of Credit Card Compare’s acquisition of Singapore based start-up, Finty.com highlights their desire to reach out and expand into selected Asian markets. Singapore has a unique credit card market, in that as well as card applicants being enticed with cash back, rewards and points, Finty enriches the rewards they receive, and as a result has a significant footprint in the market, despite relatively modest numbers of applications. In that market, customer rewards for taking a card are paid once approved, and most card holders possess a battery of separate cards for different purposes, for example, travel, expenses, and shopping. The average Singaporean would somewhere between six to eight cards, a much higher number than in Australia where most people only have one or two cards.

David sees significant growth potential across Asia, and also potentially some leverage from Finty.com back into the Australian business, seeing a win-win between the two businesses, with niche expertise from Singapore paired with executional capability in Australia.

Given the release of the ASIC report into Credit Cards, where they underscore the fact that many households have the wrong cards for their purchase and repayment behaviour, it seems to me that Credit Card Compare is well placed to bring greater sophistication into the local Australian market, whilst growing across the region. A nice trick to pull off if they can do it.

Global Growth Robust, But US Inflation Risks Rising

Near-term global growth prospects remain robust despite rising trade tensions and political risks, but US inflation risks are rising, says Fitch Ratings in its new Global Economic Outlook (GEO).

Accelerating private investment, tightening labour markets, pro-cyclical US fiscal easing and accommodative monetary policy are all supporting above-trend growth in advanced economies. In emerging markets (EMs), China’s growth rate is holding up better than expected so far this year in the face of slowing credit growth; Russia and Brazil continue to recover, albeit slowly; and the rise in commodity prices is supporting incomes in EM commodity producers.

“Global trade tensions have risen significantly this year, but at this stage the scale of tariffs imposed remains too small to materially affect the global growth outlook. A major escalation that entailed blanket across-the-board geographical tariffs on all trade flows between several major countries would be much more damaging,” says Brian Coulton, Fitch’s Chief Economist.

Populist political forces continue to create policy risk and increase the threat of rising tensions within the eurozone that could adversely affect the outlook for investment, a key driver of growth last year. At this stage, we have made only a modest downward revision to our eurozone investment forecast for this year (to 3.3% from 3.9% in March), but a further escalation in uncertainty represents an important downside risk.

A much sharper-than-anticipated pick-up in US inflation remains a key risk to the global outlook. The decline in US unemployment – to 3.8% in May – is becoming more important to watch, and we forecast the rate to hit a 66-year low of 3.4% in 2019. A wide array of indicators of US labour market tightness suggest it is now only a matter of time before sharper upward pressures on US wage growth start to be seen.

“An inflation shock in the US could bring forward adjustments in US and global bond yields and sharply increase volatility, harming risk appetite. In particular, it could lead to a rapid decompression of the term premium, which remains negative for US 10-year bond yields. In combination with a likely aggressive Fed response, this would be disruptive for global growth,” adds Coulton.

Global growth forecasts remain unchanged since our March GEO, at 3.3% for 2018 and 3.2% for 2019. Nevertheless, 2018 growth forecasts have been revised down for 10 of the 20 economies that make up the GEO, with the eurozone seeing a 0.2pp downward revision, the UK a 0.1pp downward revision and Japan a 0.3pp downward revision. Brazil and South Africa have seen sizeable markdowns, and our Russia and Indonesia forecasts have also been lowered. These have been offset by 0.1pp upward revisions to the US and China and a stronger outlook for Poland and India in 2018.

For 2019, there have been fewer forecast changes, with the notable exception of Turkey, where recent currency turmoil and interest rate hikes are set to take a heavy toll on domestic demand. The US 2019 growth forecast has been raised by 0.1pp, and China’s 2019 outlook has been upgraded by 0.2pp following better-than-expected recent momentum.

Fitch still forecasts a total of four Fed rate hikes in 2018, followed by three more next year. Recent pronouncements from ECB officials suggest that the Asset Purchase Programme (APP) will be phased out in 2018, but also appear to imply that purchases will be scaled down between September and the end of the year rather than stopping abruptly after September. This is significant for the likely timing of the first ECB rate hike in 2019. ECB forward guidance has stated that rate hikes will not take place until “well after” the end of asset purchases, which the bank has clarified to mean quarters rather than years. A December 2018 end-date for the APP would imply rate hikes in 3Q19 or 4Q19. On this basis, we have revised our forecast of ECB rate hikes to just one increase in 2019, from two hikes before.

Global monetary policy normalisation and upward pressures on the US dollar have likely been contributing to the rise in financial market volatility witnessed so far this year. Both these global trends look set to stay.

Member Personalisation the ‘New Paradigm’

Super funds must embrace digital, personalised advice if they want to retain their high-balance members, says industry veteran and SuperEd founder Jeremy Duffield.

Jeremy Duffield had a 30 year career at Vanguard between 1980 and 2010, and established the US indexing giant’s Australian presence in 1996.

Mr Duffield left Vanguard in late 2010 to co-found digital advice, education and member engagement fintech start-up SuperEd with former Westpac executive Hugh Morrow.

SuperEd received a $5 million funding boost in January 2018 from investors including former Macquarie director Mark Johnson and Shadforth founder Kevin Bailey.

The company offers digital member engagement services to super funds, including retirement income forecasts, member relationship management, education, and intra-fund advice.

“Personalisation is going to be a huge trend, because it’s what people expect in everyday life now,” Mr Duffield told InvestorDaily.

He differentiated SuperEd from other ‘robo-advice’ businesses that are mostly calculator-based and “leave it up to the consumer” to interpret the results of the calculator.

“That’s always been unrealistic – the numbers don’t speak for themselves, members need more than that and they need the story. We’re trying to work with super funds to tell the story,” Mr Duffield said.

SuperEd is the engine behind former Challenger executive Paul Rogan’s start-up Retirement Essentials, which helps retiring Australians apply for the government age pension.

SuperEd’s other clients include a corporate super advice group, group insurer AIA and “one of the large Victorian super funds”, said Mr Duffield.

Commenting on the industry’s transition to digital advice, Mr Duffield it is “disappointingly slow” – but it is happening.

“They’re hiring digital chiefs, they’re building up their web capabilities, they’re investing in CRM – there are signs.

“But it does feel like starting Vanguard Australia all over again – I’m out there in front trying to get people to change the way they do things,” he said.

Having helped drive down the cost of investment during his time at Vanguard, Mr Duffield is looking to do the same for the advice process.

“I think there’s more value to be added through advice than there is product,” he said.

Mr Duffield said he is “fully confident” that the trend towards digital advice will develop over time.

“We might be early, but we’re definitely in the right place. These changes that we’re betting on just have to happen,” he said.

Fintech Disruption Index Moves Higher

The latest edition of the Disruption Index has just been released, and it is 41.57, up from 38.29 last quarter. This is good news for Fintechs in that the SME community is adopting digital faster than ever.

The Financial Services Disruption Index, which has been jointly developed by Moula, the lender to the small business sector; and research and consulting firm Digital Finance Analytics (DFA).

The Financial Services Disruption Index, which has been jointly developed by Moula, the lender to the small business sector; and research and consulting firm Digital Finance Analytics (DFA).

Combing data from both organisations, we are able to track the waves of disruption, initially in the small business lending sector, and more widely across financial services later.

The index tracks a number of dimensions. From the DFA Small business surveys (52,000 each year), we measure SME service expectations for unsecured lending, their awareness of non-traditional funding options, their use of smart devices, their willingness to share electronic data in return for credit, and overall business confidence of those who are borrowing relative to those who are not.

Moula data includes SME conversion data, the type of data SME’s share, the average loan amount approved, application credit enquiries, and speed of application processing.

Here are some of the highlights:

Business Confidence

SME Business Confidence of those borrowing is on the up, reflecting stronger demand for credit, with the indicator jumping a healthy 15.8%, however, the amount of “red tape” which firms have to navigate is a considerable barrier to growth.

Knowledge of Non-bank Financial Providers

Awareness of new funding options continues to rise if slowly, creating a significant marketing opportunity for the new players, and a potentially larger slice of the pie.

Business Data

Greater willingness to share data and use of cloud-based services continue to rise. One-third of businesses have data held within the cloud, including accounting, customer management, invoicing, human resource, and tax management. We see variations across the segments in their use of these services. Of the businesses applying for funding, almost 90% now provide some form of electronic data via online loan application and are clearly comfortable in doing so (suggesting security concerns are less of a deterrent than the incentive of the speed of application and execution).

Average Loan Size

Average loan size continues to move upwards to register above $40k for the first time, indicating that better businesses are embracing alternative finance arrangements. More than likely, these businesses have traditional banking relationships, but either choose (or are forced to) look elsewhere for liquidity.

Australia Rises In Global Alt-Lending Ranks

Australia is now the Asia Pacific region’s second-largest alternative finance market, largely due to a favorable regulatory climate, according to new KPMG analysis.

The Australian market is quickly becoming a hotbed of alternative lending, and new analysis from KPMG suggests it has risen up in the ranks.

According to a new report from KPMG’s Cambridge Centre for Alternative Finance and the Australian Centre for Financial Studies, Australia could now be the Asia Pacific region’s second-largest alternative lending market, close behind China. News reports in the International Business Times on Friday (Sept. 22) said that a survey of 600 online alternative finance firms across the Asia Pacific found that Australia’s market grew 53 percent in the last year alone.

A key driver of that growth is favorable government policies, researchers said, with regulators around the world exploring how to ensure borrower protections without stifling innovation. About two-thirds of survey respondents said Australia’s regulatory climate is appropriate for the alternative lending industry.

While alternative finance remains a small portion of the overall lending market, the report also found that the Asia Pacific region is experiencing significant overall growth in this space.

China, though, is the clear winner, with its AltFin market accounting for 99.2 percent of the total Asia Pacific market, reports said.

The Australian government may be looking to facilitate growth of the alternative finance space, but research released in June suggested the industry has another hurdle to overcome: awareness.

Data from Moula and the research and consulting firm Digital Finance Analytics, outlined in their Disruption Index report, found there is room for the industry to gain traction by increasing visibility among small business borrowers.

“There is still a certain air of skepticism about non-traditional forms of lending,” said DFA Principal Martin North in an interview with Australian Broker at the time. “So, SMEs who need to borrow tend to still go to the normal suspects. They’ll look to the banks or put it on their credit cards.”

He added that this means the alternative finance industry has to work harder to boost awareness and promote education.

“I think the FinTech sector has a terrific opportunity to lend to the SME sector, but they haven’t yet cracked the right level of brand awareness,” North continued. “Perhaps they need to think about how they use online tools, particularly advertising, to re-energize the message that’s out there.”

Bitcoin faces another test as users battle over how its trading platform should be used

The price of Bitcoin remains on a rollercoaster as investors and developers continue to battle over its future.

The cryptocurrency crept above $US3,000 a little more than a week ago, before crashing to almost $US2,000. Since the start of this week it’s been on a steady climb back towards $US3,000. This chart shows the recent fluctuations:

But a report in the Wall Street Journal (WSJ) suggests that tensions still remain in Bitcoin community. While its price climbs, the eventual path that Bitcoin follows is still subject to a significant degree of uncertainty.

The rift centres around what Bitcoin is for and how it should be used. In one camp, users want Bitcoin to remain as a finite commodity similar to gold.

Opponents want the speed and size of Bitcoin transactions to be rapidly sped up. In effect, they want Bitcoin to function to a similar fashion to a highly liquid currency like the US dollar.

The cryptocurrency was established with a limited supply of 21 million Bitcoins, of which around 14 million have been mined. That shortage of supply could go some way to explaining the dramatic increase in prices this year.

The blockchain network that Bitcoin trades on provides a historical record of all Bitcoin transactions. All users can see the blockchain activity, but the system provides a high degree of protection for people’s individual identity.

The Wall Street Journal provided a brief summary of how the activity on the blockchain currently works. Bitcoin transactions are packaged into blocks by companies that specialise in processing the trades.

However, the size of those transactions is currently capped. That means a processing speed of approximately just seven transactions per second, compared to a large network like Visa which can process hundreds of thousands in the same time frame.

With Bitcoin’s popularity exploding, the reduced capacity has led to delays and higher transaction fees.

Not surprisingly, some market participants want to increase the volume of transactions. But they’re facing resistance from those who want to maintain the status quo.

That resistance stems partly from a desire to protect their investment, but they also want to maintain the original Bitcoin platform without the intrusion of big business.

Previous attempts at compromise have failed, and the possibility of a split in the currency is back on the table.

The dispute has led a growing number of users to sell out of Bitcoin and purchase Ethereum instead. Prices for Ethereum (the world’s second biggest cryptocurrency) have also skyrocketed this year.

Ethereum, which experienced a flash crash overnight, was worth $US190 at the end of May and now trades at around $US300, after starting the year at a price of $US8.15.

According to the WSJ, all parties are open to boosting transaction capacity for Bitcoin but there are strong disagreements about how to actually go about it.

Businesses would prefer to raise the transaction limit for all Bitcoins, whereas their opponents (led by developers) want to set up a secondary network with faster processing speeds.

The net effect is that the outlook for Bitcoin remains increasingly cloudy as the market continues to develop and mature.