In recent years, central banks in several systemically important countries have adopted unconventional monetary policy measures (UMPMs)—ranging from large scale purchases of public and private debt securities to direct lending to banks—designed to inter alia, repair the monetary transmission mechanism by ensuring depth and liquidity in financial markets and provide monetary accommodation at the zero lower bound of policy interest rates. One distinguishing feature of UMPMs, which has also been referred to as quantitative easing (QE), is that the central bank actively uses its balance sheet to influence market prices and conditions beyond the use of a short-term or “policy” interest rate. As a result of these policies, the balance sheets of the central banks implementing the UMPM programs expanded significantly over the period 2008–14. This has led to large injections of money into the economy through increased reserves (which, by a “money multiplier,” increased broad money), as well as introduction of negative interest rates for some policy instruments in some advanced countries. With money and securities being imperfect substitutes, these programs resulted in portfolio rebalancing of assets of the United States, the United Kingdom, Euro area, and Japan—the Systemic Four (S4)— banks and corporations, which in turn increased asset prices. Investors responded by acquiring more risky assets outside the S4 that became relatively more attractive compared with S4 government bonds and securities: capital outflows from the S4 rebounded leading to increased inflows and issuance of new securities in emerging market economies (EMEs).

The overall effect of the S4 UMPMs on the rest of the world (RoW) liquidity and monetary conditions is not yet clear, as positive trade and capital spillovers may likely be accompanied by increased macro-financial vulnerabilities. While empirical studies find evidence of significant spillovers of monetary easing in the S4 on the RoW through trade and finance channels, research on the impact of the S4 UMPMs on the RoW banks’ balance sheets, liquidity, and money supply is still in an embryonic stage. Indeed, the substitution of cross-border banking flows with portfolio flows of non-banks does raise new concerns about financial vulnerabilities. The growing role of non-financial corporations (NFCs) as de facto “financial intermediaries” may reduce the effectiveness of macroprudential policies and limit the ability of policy makers to respond to future shocks.

Seen from a broader perspective, such UMPM programs might also lead to a loosening of fiscal discipline and shifts in the allocation of resources. In this context, the overall effect of the S4 UMPMs on the RoW is likely to be dependent on both the specific policy frameworks of affected countries and each UMPM program. Likewise, the affect of S4 UMPMs reversals on the RoW, i.e., monetary policy normalization, could also be varied. Against this background, this paper attempts to break new ground in empirically investigating UMPM spillovers on global liquidity and monetary conditions and financial sector balance sheets in other countries. In particular, we focus our analysis on spillovers from S4 monetary policy easing (conventional and QE/UMPMs) on the RoW’s monetary aggregates, banks’ balance sheets (NFC deposits), and NFC securities issuances. We also assess potential threats stemming from UMPMs unwinding to the RoW. To the best of our knowledge, this topic remains largely unexplored, which is a major gap in understanding of UMPM spillovers/leakages.

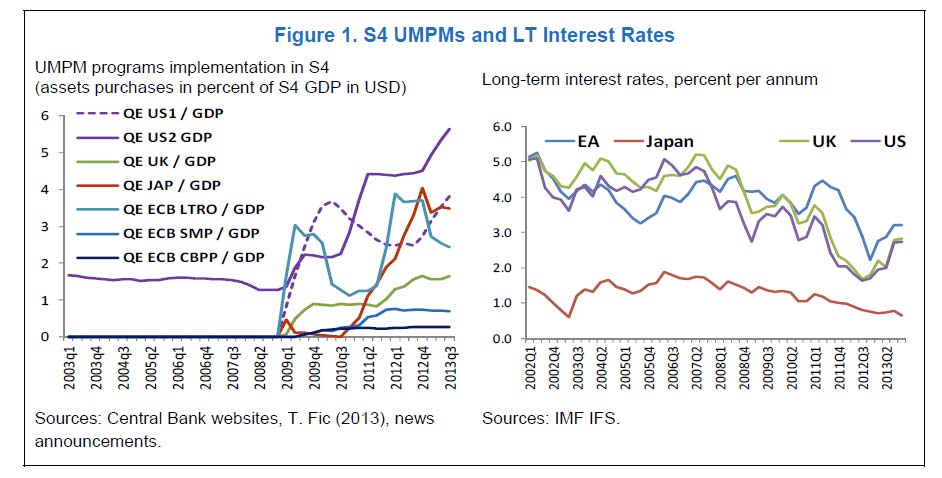

The paper focuses on specific QE programs and UMPMs implemented by the S4: (i) the large-scale assets purchase (LSAP) by the U.S. Fed, split by type of securities into purchases of U.S. treasuries, mortgage backed securities (MBS), and securities of government sponsored enterprises (GSE); (ii) the QE strategy implemented by the Bank of England (BoE); (iii) the assets purchase program of the Bank of Japan (BoJ); and (iv) the ECB’s government bond purchases (phases one and two), the ECB’s three-year long-term refinancing operation (LTRO), and the ECB’s securities market program (SMP).

We find positive and statistically significant relationships between UMPM implementation and global liquidity and monetary conditions in terms of global NFC deposit growth (including China), banks’ cross-border flows, and issuance of securities (particularly in foreign currency). We also find significant differences in the impact of the UMPMs implemented by individual S4 on broad money, NFC deposits, and securities issuance in EMEs. The BoJ’s asset purchases programs appear to have a positive impact on global liquidity and other countries’ monetary conditions, while they appear to have a negative association with issuance of securities. In contrast, the effects of the QE program implemented by the BoE have strong negative association with global liquidity, measured by broad money and NFC deposits and positive impact on issuance of NFC securities. Results for QE implemented by the U.S. Fed and ECB UMPMs are mixed.

The paper develops a new quarterly dataset covering the period Q1:2002–Q2:2014, leveraging monetary data reported by IMF member countries through the IMF’s standardized report forms (SRFs), which have the advantage of providing a consistent set of definitions based on the IMF’s Monetary and Financial Statistics Manual, and can be replicated over time and across countries using officially reported data. Core and non-core liabilities of banks are computed using detailed SRF data reported to the IMF on a confidential basis. Leveraging the IMF’s SRFs is our major advantage, relying on broad money as monetary aggregate, which is comparable across SRF reporting countries. In contrast, other studies have typically relied on countries’ self-reported monetary aggregates under more traditional classifications (e.g., M0, M2, etc.) subject to different national definitions, which make cross-country comparisons less meaningful.

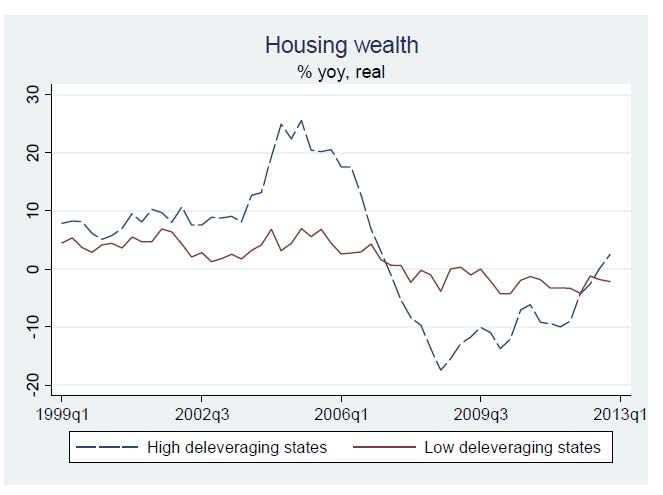

The UMPMs implemented by the S4 and analyzed in this paper are negatively correlated with the nominal long term (LT) interest rates (Figure 1), confirming existing results of the empirical studies that show that UMPMs had significant impact on respective long-term government bond yields (LT interest rates).

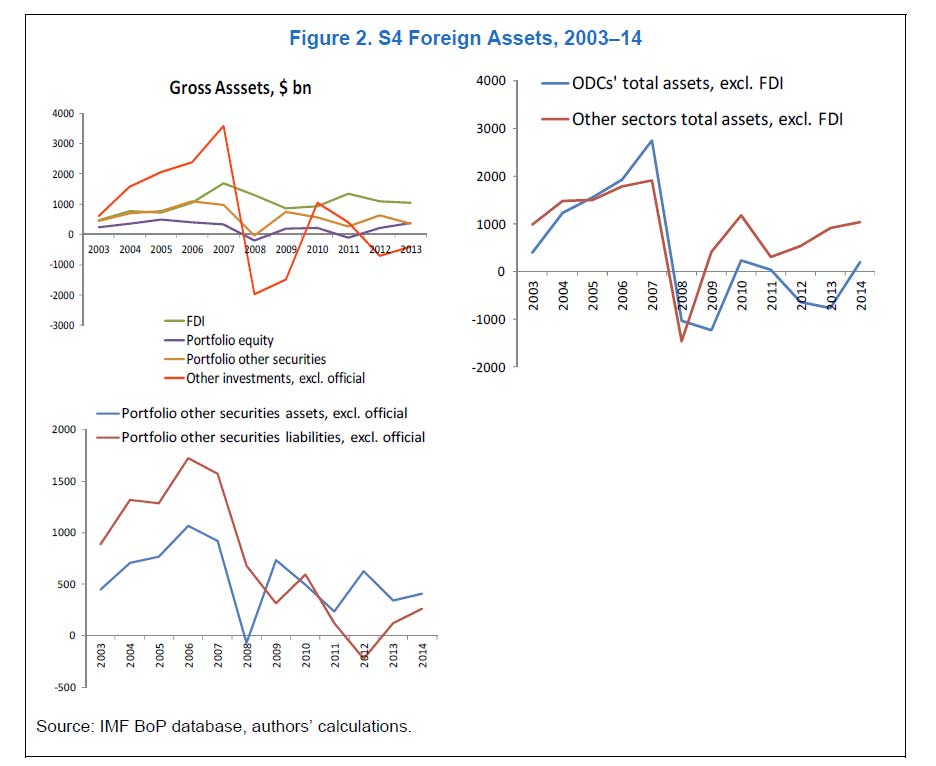

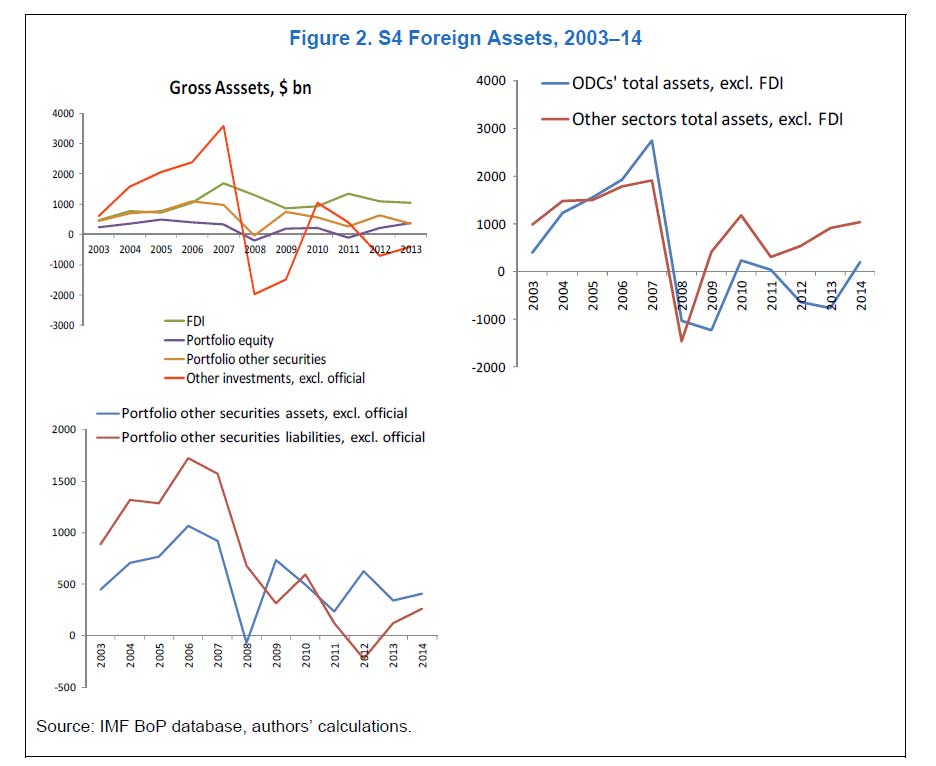

This suggests that S4 UMPMs contributed to the compression of long-term interest rates in S4, which prompted a materialization of rebounded private capital outflows from these countries (Figure 2).

This suggests that S4 UMPMs contributed to the compression of long-term interest rates in S4, which prompted a materialization of rebounded private capital outflows from these countries (Figure 2). Through a detailed descriptive and econometric analysis the results of this paper suggest that the impact on global liquidity, monetary conditions, and bank balance sheets from individual S4 UMPMs differ depending on the nature of each program, initial macro-economic conditions, and countries’ policy response. The U.S. QE programs might dominate in impact due to its size and the relevance of the U.S. dollar as a global transaction currency.

Through a detailed descriptive and econometric analysis the results of this paper suggest that the impact on global liquidity, monetary conditions, and bank balance sheets from individual S4 UMPMs differ depending on the nature of each program, initial macro-economic conditions, and countries’ policy response. The U.S. QE programs might dominate in impact due to its size and the relevance of the U.S. dollar as a global transaction currency.

In addition, while we find a positive impact of S4 UMPMs on global liquidity and money growth, the differential nature of these programs can potentially have countervailing effects on each other and on global liquidity. For example, the U.S. Fed was concentrating on the asset side of the balance sheet to support the financial intermediary function, while the BoJ was targeting the liability side to provide a buffer against funding liquidity by increasing private banks’ excess reserves. The difference in policies explained in part by the differences in financial systems (market-based system in the United States versus bank-based system in Japan). Targeted assets purchases programs may have a potential positive impact on asset markets as they may prevent excessive swings in asset prices.

The S4 UMPM policies had a statistically significant impact on the EMEs’ banks money supply and funding liquidity though their impact on bank balance sheets, NFCs deposits, and NFC securities issuance. The portfolio rebalancing channel of QE/UMPM policies has led to the redistribution and increased issuance of EMEs’ debt and has increased the non-core liabilities in EME banking sectors.

The results also suggest that non-core liabilities of EME banks exhibit higher volatility than those of developed countries, making EMEs banking systems more vulnerable to the S4 monetary policy reversals and unwinding of the programs. At the same time, macroprudential regulation in EMEs may become less effective due to the increased significance of the non-banking sector as de facto “financial intermediary.”

Furthermore, UMPM programs have been accompanied by economic costs, since they seem to have led to the reallocation of resources on banks’ balance sheets and possibly contributed to loosening fiscal discipline in EMEs. Therefore, close monitoring of macro-financial vulnerabilities in EMEs and undertaking debt sustainability analysis on a frequent basis may be prudent to head-off policy mistakes and to maintain financial stability. Finally, as monetary policy begins to normalize in the S4, RoW liquidity and monetary conditions might get tighter. As the “taper tantrum” episode of 2013 showed, simply signaling a change in future monetary policy can create a wave of extreme volatility in the markets, influencing RoW exchange rates, flows and asset prices. This suggests the need for better communication among central banks and with the financial markets in addition to strengthening of the global financial safety net.

A full assessment of the effects of the UMPMs can be made only after a complete return to a normalized monetary policy. Nonetheless, at this point, our analysis can help shed light on the potential impact of the UMPMs on global monetary and liquidity conditions.

Note that IMF Working Papers describe research in progress by the author(s) and are published to elicit comments and to encourage debate. The views expressed in IMF Working Papers are those of the author(s) and do not necessarily represent the views of the IMF, its Executive Board, or IMF management.