The ABS released their data series for August covering the entire lending spectrum (the housing details were released previously).

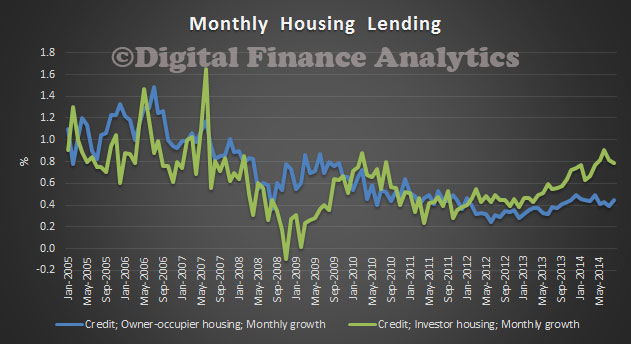

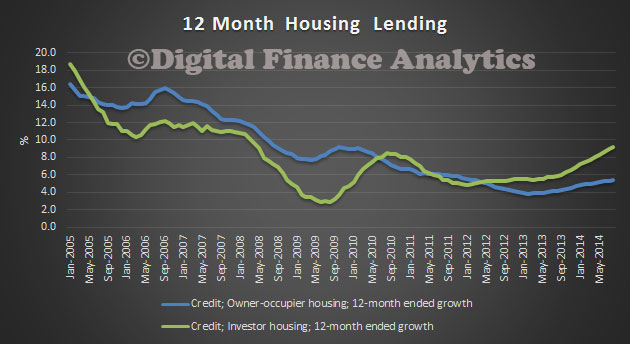

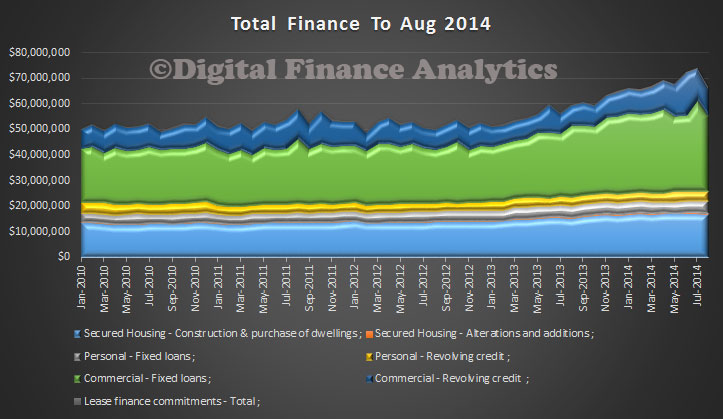

The total value of owner occupied housing commitments excluding alterations and additions fell 0.1% in trend terms, and the seasonally adjusted series fell 2.0%.

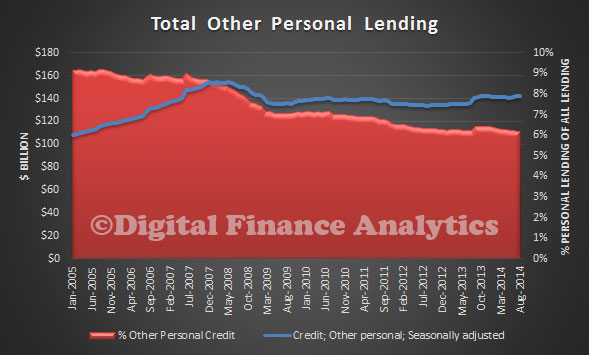

The trend series for the value of total personal finance commitments rose 1.0%. Fixed lending commitments rose 1.0% and revolving credit commitments rose 0.9%. The seasonally adjusted series for the value of total personal finance commitments rose 5.2%. Revolving credit commitments rose 5.9% and fixed lending commitments rose 4.7% .

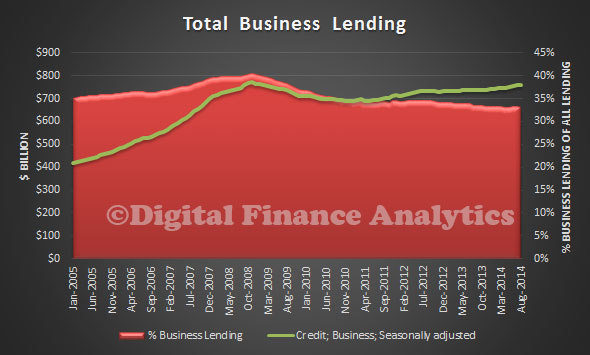

The trend series for the value of total commercial finance commitments rose 0.2%. Revolving credit commitments rose 0.4% and fixed lending commitments rose 0.1%. The seasonally adjusted series for the value of total commercial finance commitments fell 16.3% in August 2014, after a rise of 3.4% in July 2014. Fixed lending commitments fell 18.6%, after a rise of 21.0% in the previous month. Revolving credit commitments fell 9.6%, following a fall of 26.8% in the previous month.

The trend series for the value of total lease finance commitments rose 1.1% in August 2014 and the seasonally adjusted series rose 8.7%, after a fall of 7.3% in July 2014.

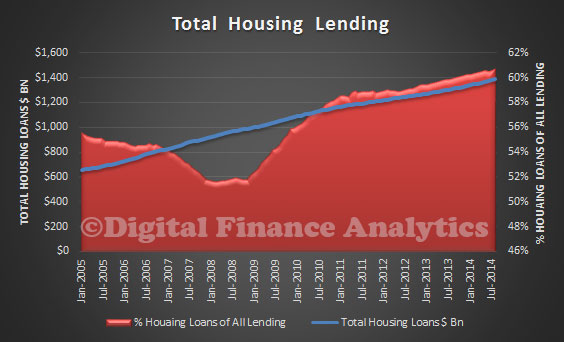

This chart shows the seasonally adjusted flows for all finance categories.

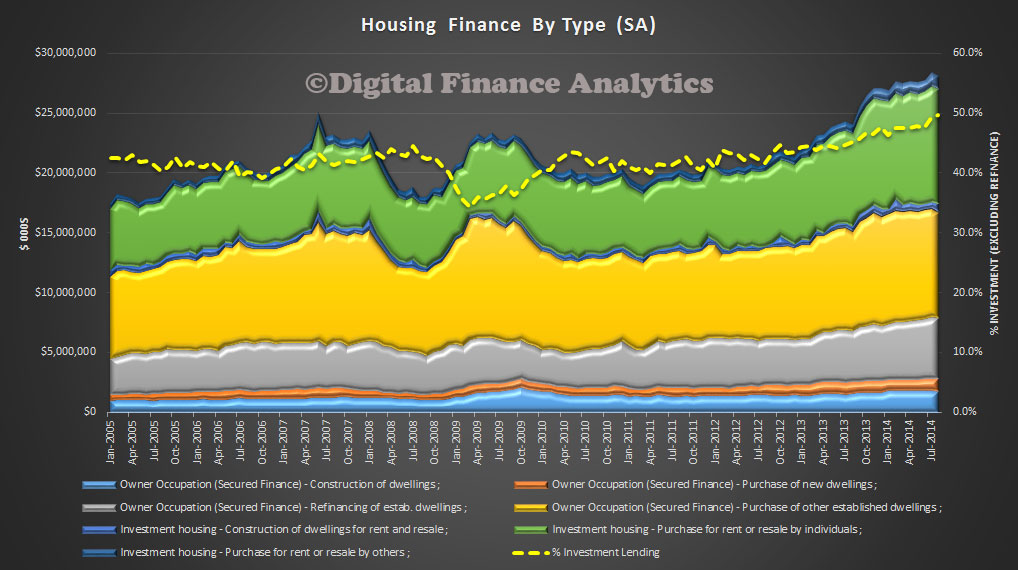

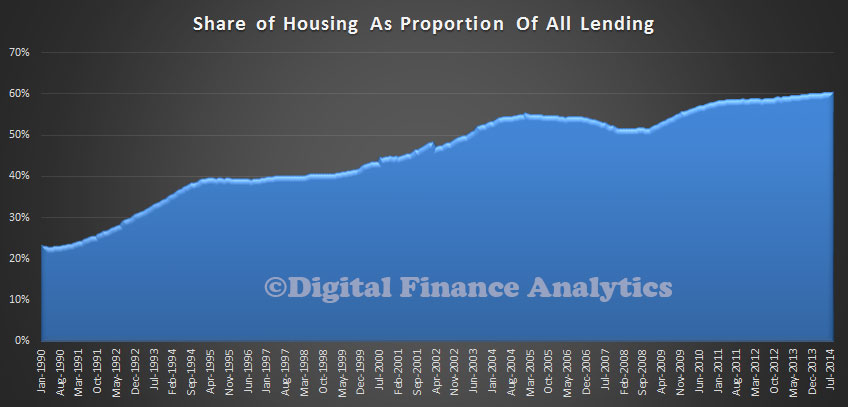

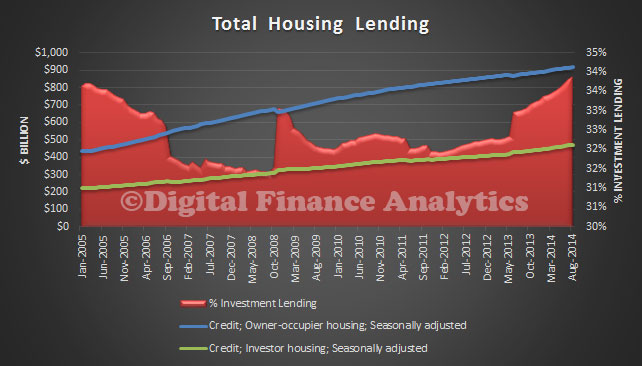

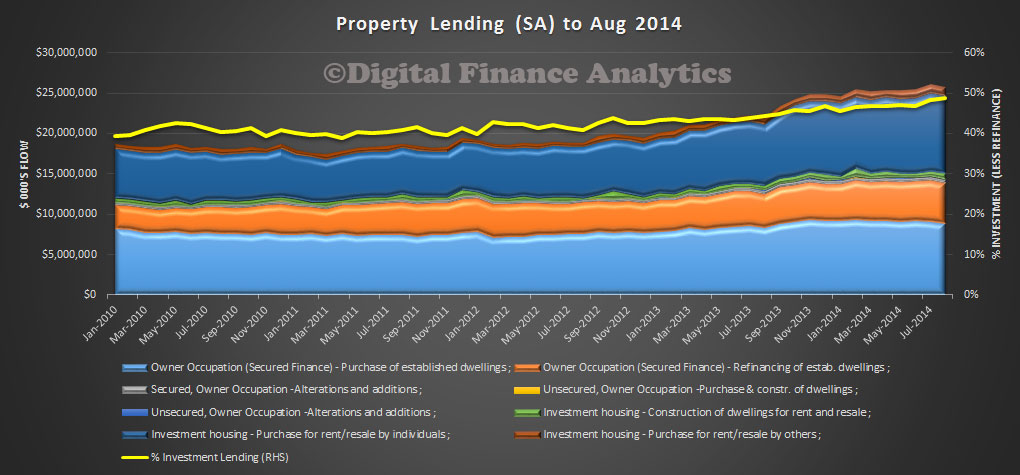

Looking at property, we again see the investment lending sector strong, at close to 50% of all property lending, excluding refinancing.

Looking at property, we again see the investment lending sector strong, at close to 50% of all property lending, excluding refinancing.

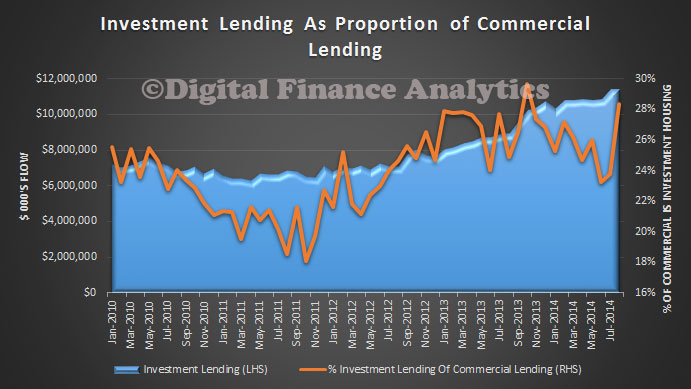

Finally, we look at the share of investment lending as a proportion of all commercial lending. We see it sits above 20%, with a surge recently. The dynamics here are interesting, does if represent a fall in other business lending categories, or a replacement by rising investment property lending?

Finally, we look at the share of investment lending as a proportion of all commercial lending. We see it sits above 20%, with a surge recently. The dynamics here are interesting, does if represent a fall in other business lending categories, or a replacement by rising investment property lending?

The other gap in the data is the number of new properties purchased as investment properties (this is different from investing in building new property). This is an important data point because one of the arguments proffered by some is that negative gearing supports new builds. Our own survey data suggests this is not the case, and most investment lending which is negative geared is going to established property.

The other gap in the data is the number of new properties purchased as investment properties (this is different from investing in building new property). This is an important data point because one of the arguments proffered by some is that negative gearing supports new builds. Our own survey data suggests this is not the case, and most investment lending which is negative geared is going to established property.