We look at the latest data from the US Treasury. $23 trillion of debt and counting. What could possibly go wrong?

And does Australia have “Fiscal Space”?

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

We look at the latest data from the US Treasury. $23 trillion of debt and counting. What could possibly go wrong?

And does Australia have “Fiscal Space”?

The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

Contents:

0:25 Introduction

1:15 US Economy

2:20 Fed Cuts

06:40 China/trade

9:10 US Markets

12:10 China GDP

14:00 Australian Section

14:00 ANZ/Credit/Remediation

15:50 Building Approvals

17:07 Auction Results

17:30 Property Prices

20:00 Rental Yields

20:40 Hot Spots

24:40 Wealth Inequality

26:40 First Time Buyer Incentives

27:15 Australian Markets

Former Liberal Party leader John Hewson has questioned the management of superannuation funds and called out Australia’s sovereign wealth fund for ignoring climate risks. Via InvestorDaily.

Speaking on a panel at the Crescent Think Tank in Sydney on Thursday (24 October), Mr Hewson noted that most of the $2.9 trillion of superannuation money is invested in stock markets, primarily in the US and Australia.

“You are heavily exposed when those markets are as overvalued as they are. By any measure the US stock market is way overvalued. There is going to be a correction. It’s just a matter of when and how far. Super funds are taking a risk by staying in those markets,” the former Liberal Party leader said.

“Some have rebalanced portfolios and put a bit more into cash, but you don’t earn anything on cash. Fixed-interest gives you a very low return.”

Mr Hewson noted the low interest rate environment globally, highlighting that around 25 per cent of sovereign bonds have negative rates.

“These are uncharted waters for those in the financial sector. Everyone is chasing yield but the only place you get a return is a stock market. The big question is how sustainable is that return? You can see how volatile equities markets are just based on a tweet from Trump. This is a very volatile and dangerous world for superannuation funds to be so exposed,” he said.

Mr Hewson was one of the key figures behind The Climate Institute’s Asset Owners Disclosure Project (AODP), which has since been taken over by ShareAction. Over the years the AODP index and report has repeatedly called out Australia’s sovereign wealth fund, the Future Fund, for lagging behind its international peers on climate change.

Last week Future Fund CEO David Neal stated that Australia’s sovereign wealth fund does not invest for social concerns and will continue to invest in fossil fuels.

“Our job is very clear. Our job is to generate a financial return for the nation,” Mr Neal told a committee in Canberra last week.

Commenting on the Future Fund’s stance, Mr Hewson said: “This is a fund that was buying British American Tobacco flat out when both sides of government were running anti-smoking campaigns.”

“They are not interested in climate risk. The fund is not transparent enough to satisfy a lot of people. They are taking big risks,” he said.

We discuss the latest in “safe haven” Gold.

The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

Contents:

0:24 Introduction

0:58 US Markets

3:10 The Feds “Non-QE” QE

5:40 Brexit and UK Markets

6:50 Metro Bank

8:06 ECB

10:20 Australian Segment

10:30 Economic Data

12:30 Cash Transaction Ban

14:20 Property Sales and Prices

16:45 Foreign Buyers

18:45 WA First Time Buyer Incentives

19:40 Bank Profitability

20:30 Interest Only Lending

21:25 Local QE Is Coming

25:30 Local Market Summary

I caught up with world renowned economist Harry Dent, ahead of his latest visit to Australia next month, and we discussed the debt and housing bubbles and how this may play out.

As a valued-add, you can secure up to 2 complimentary tickets to Harry’s Australian events.

Melbourne: November 17th-18th

Sydney: November 19th-20th

Brisbane: November 21st-22nd

Perth: November 24th-25th

That’s right. By clicking on the special link below you won’t have to pay anything.

Simply click here to secure your complimentary tickets

I have to warn you though. I’ve only been given a total of 50 complimentary tickets to give away and once they’re gone, they’re gone.

[Note: I get no benefit from publicizing these events]

We discuss the additional questions we were not able to cover during our live stream last week – see below for original show (commences at 00:30).

We ran our live event last night. This is the edited edition in which we discussed out latest scenarios.

The original version, with live chat replay is also available. Formal show starts at 34 mins in.

The latest edition of our weekly finance and property news digest with a distinctively Australian flavour to 12th October 2019.

Contents

0:30 Introduction

1:20 US China Trade

3:10 US Markets

5:20 Fed Market Operations

10:10 Canada

10:50 Brexit and UK Markets

13:20 EU

14:00 China

15:05 Australian Section

15:10 Aussie Banks Under Pressure

18:40 Economic data and trends

21:25 Consumer and Business Sentiment

23:00 Property prices

26:20 Building Defects

31:15 Aussie QE

32:10 Aussie Markets

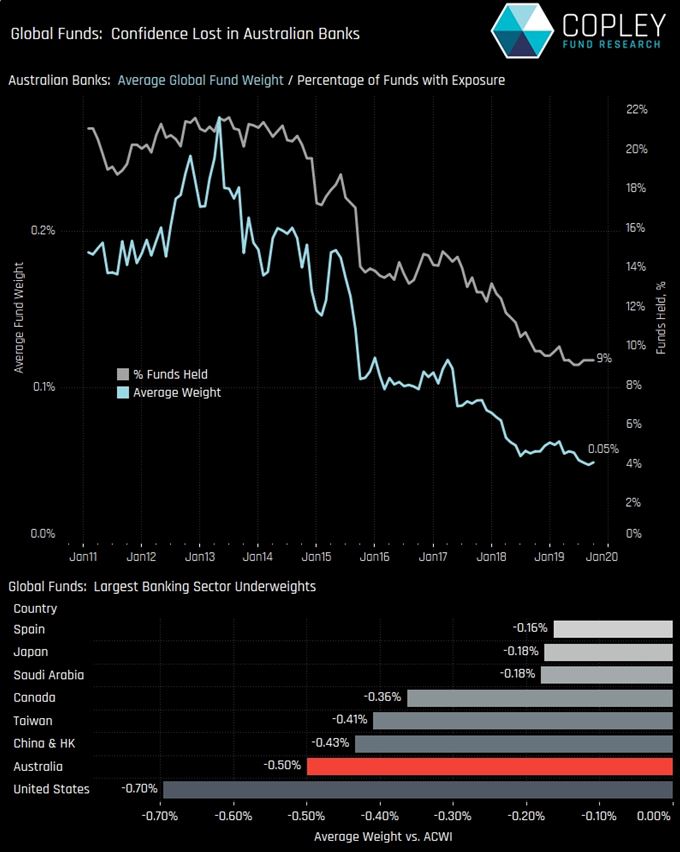

Australian banks are having their toughest time attracting investors, according to new analysis from Copley Fund Research, which monitors flows in funds with $1.2 trillion under management.

An exodus by fund managers has left 91% of the 430 funds in Copley’s global analysis with zero exposure to the sector. That’s the lowest take-up on record. On average, allocations to the industry are equivalent to just 0.05% of global funds.

“Regulatory concerns, faltering housing markets and a low interest rate environment have prompted global investors to all but throw in the towel on their Australian bank investments,” said Steven Holden, CEO of Copley Fund Research. “Opportunities elsewhere in the Asia-Pacific region are proving more attractive, such as Singapore and India.”

Copley Fund Research provides data and analysis on global fund positioning, fund flows and fund performance.

This report is based on the latest published filings as of 31 August 2019 from three fund categories:

Global: $800bn total AUM, 432 funds

Global EM: $350bn total AUM, 193 funds

Asia Ex-Japan: $65bn total AUM, 104 funds