The latest edition of our weekly summary of events in the finance and property industry has been released, a week in which the RBA told us more about household finances, major banks reported lifts in delinquencies and the number of households in mortgage stress continued to rise.

You can watch our video summary.

We start our review of the week by looking at data from the RBA. They held the cash rate again, and in a speech Governor Philip Lowe said the bank is not overly concerned that a “severe correction in property prices” would trigger a banking collapse, as happened in the US in 2008-09. However, he was far more worried that Australians would bring the economy to a grinding halt by curbing their spending. He said Household debt is “high” relative to incomes, making it likely that many Australians would respond to a market correction with a “sharp correction in their spending”, in an attempt to pay down debt. As a result, an otherwise manageable downturn could be turned into something more serious.

He also made the point that allowing young Australians to use their superannuation for a deposit will not assist affordability and downplayed the importance of tax policies. “The best housing policy is really a transport policy,” he said during a question-and-answer session. The latest RBA chart showed household debt rose again.

The Quarterly Monetary statement highlighted the risks from low income growth, although the underlying causes are not that clear, and that the Bank is still relatively optimistic about future growth. However, again the theme of high household debt came to the fore with data showing that one third of households had no mortgage repayment buffer. It’s worth saying this data comes from securitised loans which may be regarded as the cream of the crop, so risks in other portfolios may be higher.

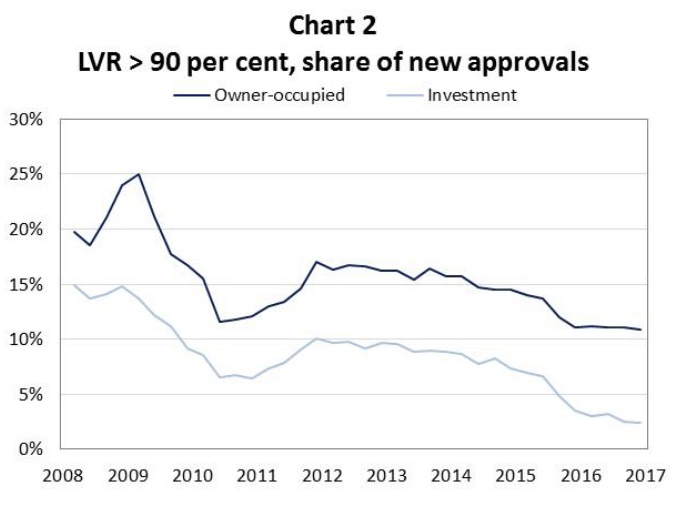

We have several results in the week, with impressive full year numbers from Macquarie; but less impressive results from NAB, ANZ and Genworth, the Lenders Mortgage Insurer. From this we learnt that delinquencies are rising, especially in the mining heavy states of WA and QLD. Genworth in particular reported a rise in claims. Whilst tighter lending rules are lower the LVR bands, heightened risks seem to be baked in. Yellow Brick Road, who also reported, highlighted the impact of recent regulatory tightening on the mortgage sector.

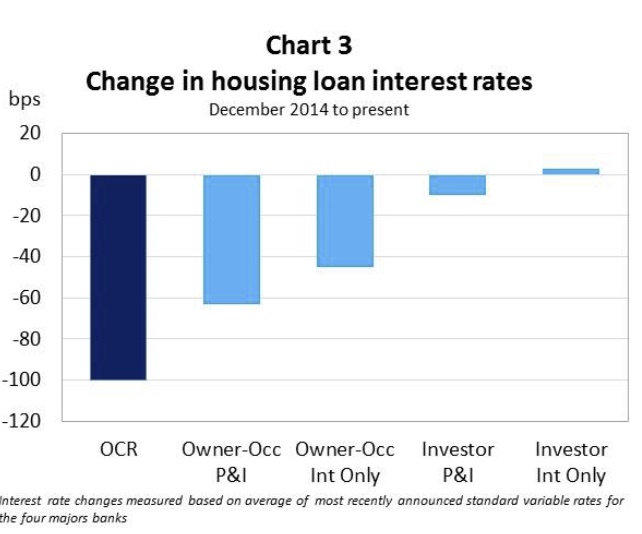

We also saw how the retail banks net interest margins are under pressure, this despite recent mortgage rate rises, and hikes to the small business sector, which is the soft underbelly of the portfolio when banks seek to recover NIM. NIM is being hit by the higher capital requirements which are being imposed on the banks. This suggests that more out of cycle rate rises are likely, despite the fact that funding costs appear to have stabilised.

According to the HIA, new home sales fell slightly in March down 1.1% mainly due to fall in new houses; but there were significant state variations, with NSW the only state to record an increase in detached house sales, posting a 10.4 per cent rebound after a soft result in February. Detached house sales fell by 4.6 per cent in Victoria, by 5.4 per cent in Queensland and fell in South Australia and Western Australia by 1.7 per cent and 1.2 per cent respectively.

We released the latest mortgage stress report, which showed of the 3.1 million mortgaged households, an estimated 767,000 are now experiencing mortgage stress. This is a 1.5% rise from the previous month and maintains the trends we have observed in the past 12 months. The rise can be traced to continued static incomes, rising costs of living, and more underemployment; whilst mortgage interest rates have risen thanks to out-of-cycle adjustments by the banks and bigger mortgages thanks to rising home prices.

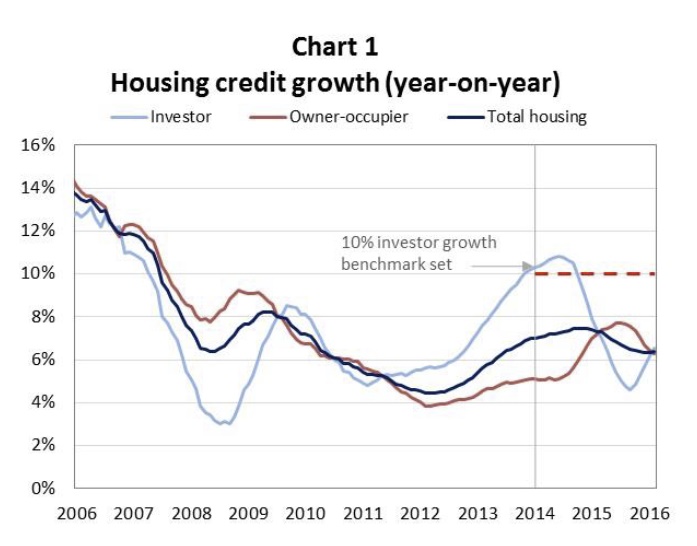

We think the affordability calculations the banks use need to be reviewed, and the regulators need to do more to get to the bottom of the continuing reclassification of loans between owner occupied and investment – more than $51 billion have been switched, which is around 10 per cent of all investor loans.

Next week we will publish our stress by post code data, and the latest household finance confidence index.

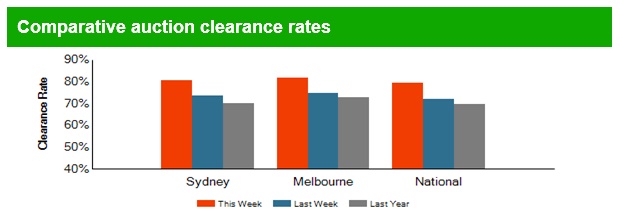

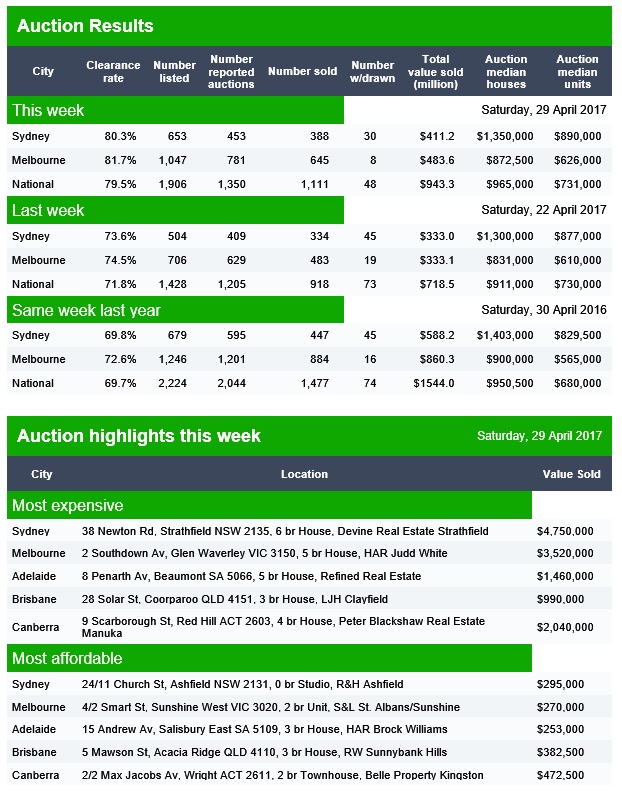

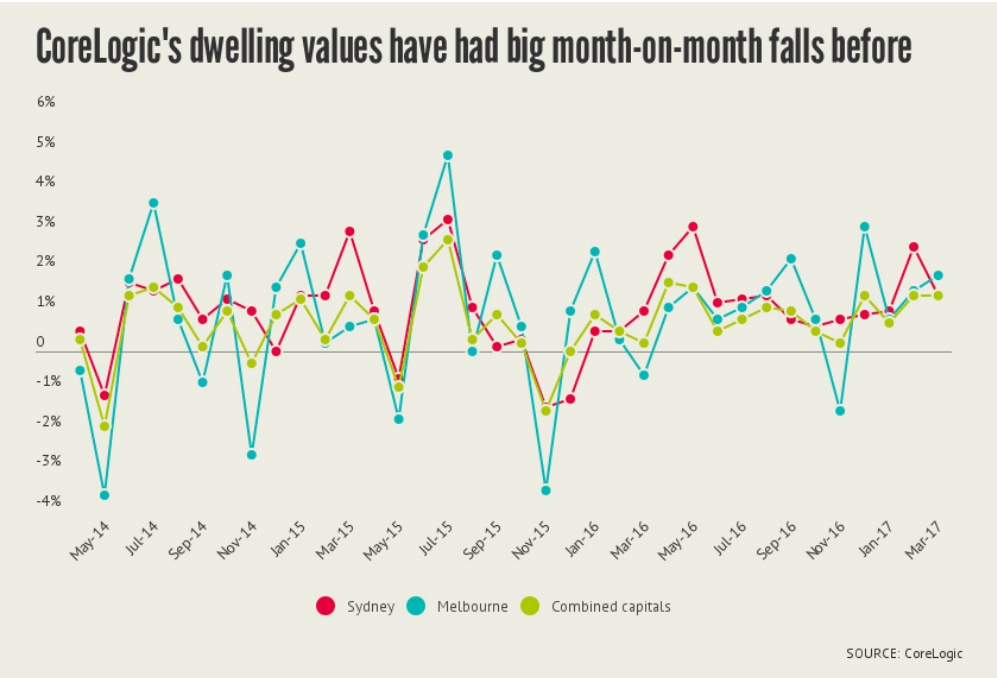

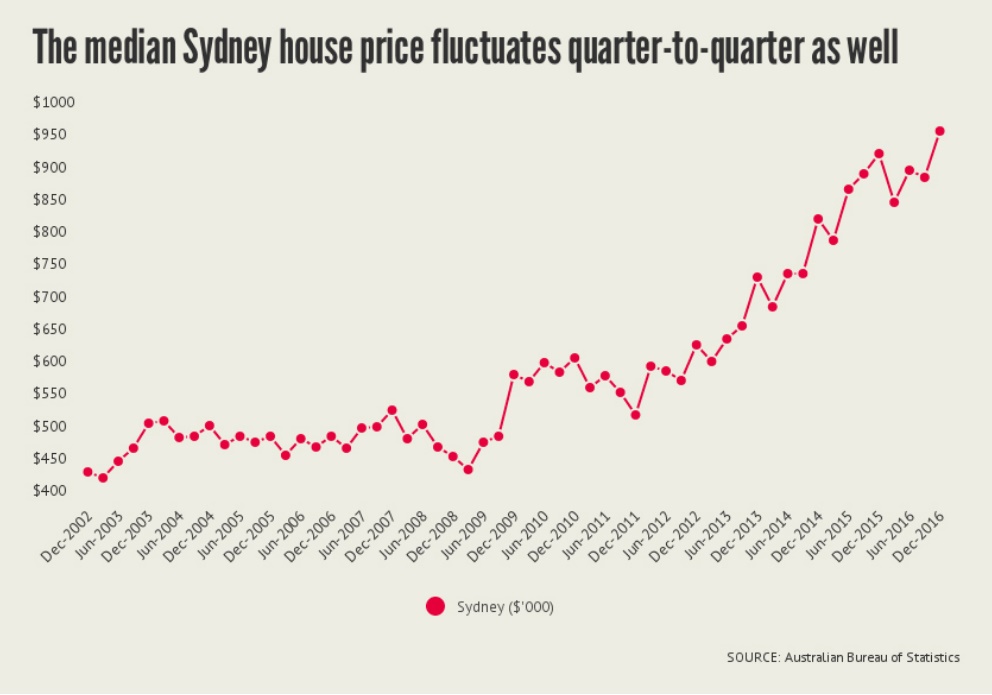

The speculation around whether Sydney home prices are wobbling continues, with the latest CoreLogic numbers flagging a potential fall. But one swallow does not make a summer, and we will need to see more data. Remember there are technical issues behind the CoreLogic index. Auction clearance rates were relatively good, but on lower volumes. We will see what today’s results deliver.

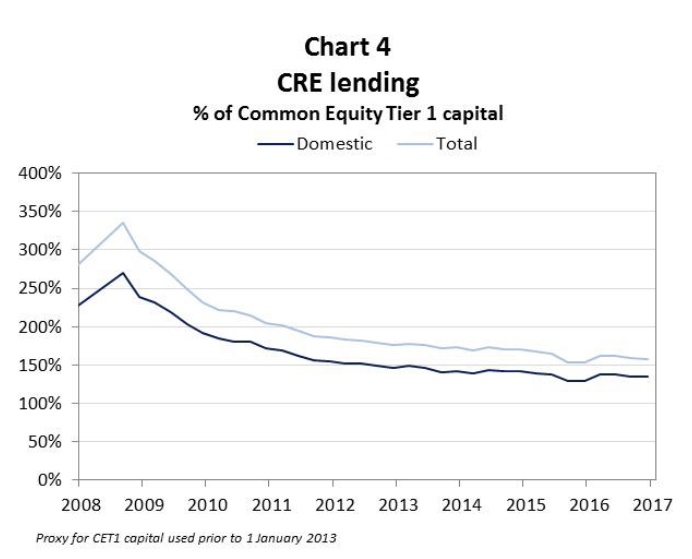

Finally, we expect more discussion on the future shape of capital requirements for the banks, with the Reserve Bank of New Zealand announcing it is undertaking a comprehensive review of the capital adequacy framework applying to locally incorporated registered banks over 2017/18. The aim of the review is to identify the most appropriate framework for setting capital requirements for New Zealand banks, taking into account how the current framework has operated and international developments in bank capital requirements.

In the UK, the Bank of England released details of their approach to setting MREL (a minimum requirement for own funds and eligible liabilities) for UK banks, building societies and the large investment firms. These rules represent one of the last pillars of post-crisis reforms designed to make banks safer and more resilient, and to avoid taxpayer bailouts in future.

Banks are now required to hold several times more loss-absorbing resources than they did before the crisis, while annual stress tests check firms’ resilience to severe but plausible shocks. Banks are now also structured in a way that supports resolution and The Bank of England has the legal powers necessary to manage the failure of a bank, and significant progress has been made to ensure there is coordination between national authorities should a large international bank fail.

We are expecting APRA to release a discussion paper on capital rule tweaks to ensure our banks are unquestionably strong later in the year. This all signals potential higher interest rates for consumers and small business down the track, as more capital is costly.