I was on The Business tonight discussing the results from our surveys, with a focus on property investors and the tide of renters getting into difficulty creating a cascading issue more broadly for the market.

Tag: ABC

Is The Power Of Government Getting Out Of Hand?

We discuss an excellent ABC News article by Laura Tingle, 7.30’s chief political correspondent. Who is calling the shots?

https://www.abc.net.au/news/2019-12-07/scott-morrison-australian-public-sector-sidelined-for-ministers/11775144

ABC Joins The Cash Ban Dots

Hot on the heels of their previous post comes another article from ABC news which makes the link between the $10k cash ban, negative interest rates and the IMF. It’s titled “Banning cash so you pay the bank to hold your money is what the IMF wants“.

This is something which followers will know we have been highlighting for some time.

This theory … has not been plucked out of thin air.

It is based on repeated public papers and statements by the international body in charge of financial stability — the Washington-based International Monetary Fund (IMF).

A recent IMF blog entitled “Cashing In: How to Make Negative Interest Rates Work”, explains its motive in wanting negative interest rates — a situation where instead of receiving money on deposits, depositors must pay regularly to keep their money with the bank.

As the blog notes, during the global financial crisis central banks reduced interest rates.

Ten years later, interest rates remain low in most countries, and “while the global economy has been recovering, future downturns are inevitable”.

“Severe recessions have historically required 3 to 6 percentage points cut in policy rates,” the IMF blog observed.

“If another crisis happens, few countries would have that kind of room for monetary policy to respond.”

The article then goes on to explain that to “get around this problem”, a recent IMF staff study looked at how it could bring in a system that would make deeply negative interest rates “a feasible option”.

The answer, it said, is to phase out cash.

Cudos To The ABC, They Finally Covered The Cash Ban!

The ABC have written a piece on the proposed cash restrictions (even if it was after the closing date for submissions to Treasury relating to the exposure draft). It appears opposition is mounting, given they cite One Nation, CPA Australia, The Institute of Public Affairs and The Australian Chamber of Commerce. However, Chartered Accountants Australia and New Zealand argued the $10,000 cash limit was high, and needed to be lowered.

Australians could face two-year jail sentences and fines of up to $25,200 under proposed laws that limit the use of cash to $10,000 — a move some groups argue would create an Orwellian state by giving authorities greater control over people’s finances.

Key points:

- The proposed law would apply to all payments of more than $10,000 to a business with an ABN, such as buying a car from a car yard

- Private transactions between individuals with no ABN would be exempt from the new rules

- One Nation has indicated it will vote against the bill, as some business groups argue it is an attack on the basic liberty of free exchange

A number of stakeholders have called on the Federal Government to withdraw the proposed laws, which were first announced in the 2018-19 budget as part of measures to fight the so-called black economy.

The Government’s Black Economy Taskforce had argued a $10,000 cash limit for transactions between businesses and individuals would help fight the cash economy by stamping out tax evasion, money laundering and other crimes.

But some groups fear the laws could give the banks, which have faced much scrutiny under the banking royal commission, too much control over people’s money.

The laws would apply to all payments made to businesses with an ABN for goods or services, affecting major purchases like cars, boats, housing and building renovations.

The Government has said the measure would not apply to individual-to-individual transactions, such as private sales where the seller does not have an ABN, or cash payments to financial institutions.

The laws, if passed, would take force on January 1, 2020, and for certain AUSTRAC reporting entities from January 1, 2021.

HEM Westpac Win

The Federal Court has dismissed ASIC’s responsible lending case against Westpac and ordered the regulator to pay the bank’s costs. Via ABC.

I will make a separate post on the implications of this finding, in the light of ASIC stated intent to change the responsible lending laws, and the current hearings underway.

ASIC had alleged that Westpac breached responsible lending laws on up to 262,000 home loan approvals made using an automated process that relied on the Household Expenditure Measure benchmark, rather than using each applicant’s individually assessed living costs.

In September last year, Westpac agreed to pay a $35 million settlement to ASIC and admit that it breached responsible lending laws.

However, in November Justice Nye Perram sensationally rejected the settlement, finding that it was ambiguous and that the parties did not actually agree on what the responsible lending laws required and, therefore, how many loans were in breach and what the penalty should be.

Today, Justice Perram dismissed ASIC’s case against the bank, awarding costs against the regulator and leaving it negotiating with Westpac over the legal bill in reaching the failed settlement.

In the rejected settlement, Westpac had admitted its automated loan approval system used the Household Expenditure Measure (HEM) — a relatively low estimate of basic living expenses — to calculate potential borrowers’ living costs.

The bank used the HEM instead of actually evaluating the customers’ declared living expenses, and admitted this practice breached the National Consumer Credit Protection Act in certain circumstances.

However, there was an irreconcilable difference of opinion between ASIC and Westpac over when use of the HEM breached the law.

Out of 261,987 loans approved using the HEM benchmark, 211,937 involved customers declaring expenses that were lower than the HEM — that is, below the typical household’s spending on basic goods and services, and in the bottom 25 per cent of household spending on less essential items.

In these cases, use of the HEM actually reduced the amount of money the customer could borrow compared to what they declared.

In the roughly 50,000 cases where declared living expenses were higher than the HEM, use of the benchmark increased the loan amount the customer could receive.

However, in about 45,000 of these cases, both ASIC and Westpac agreed the use of the customers’ actual expenses rather than the HEM would have had no impact on whether they were deemed suitable for the loan.

That left 5,041 loans approved using the HEM that may not have been if actual declared expenses were used — they would have been referred to manual credit assessment instead.

This meant some of those customers might have been approved for home loans they potentially could not afford to repay without financial hardship.

In rejecting the settlement, Justice Perram said neither party could explain what would have happened after that manual loan assessment process, whether any of these 5,041 loans were actually unsuitable and whether any significant harm had been done to any or all of those customers

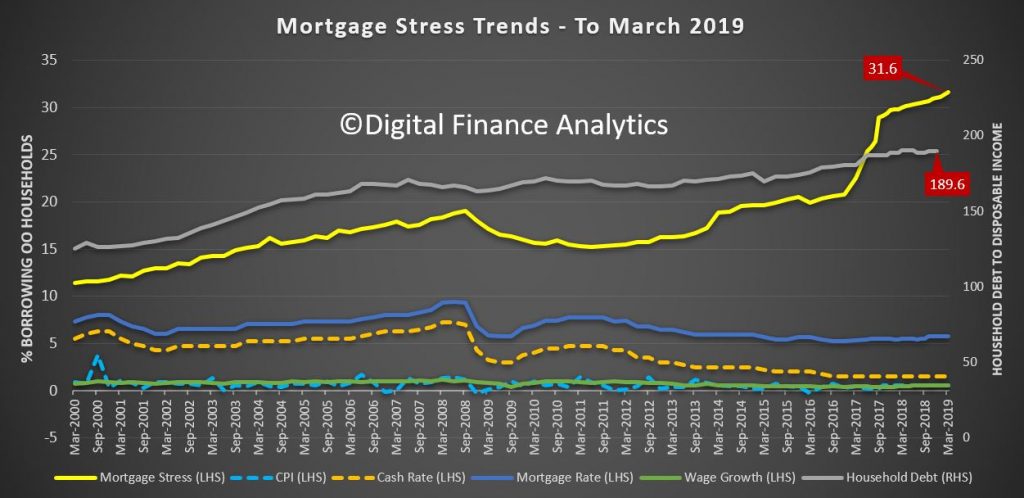

ANZ Raises Concerns About Mortgage Stress

From the ABC.

On Radio Nation PM Programme this evening.

It was just weeks ago that mention of rising mortgage defaults was met with some sniggers and jeers, with many in the industry pointing to what are still actually very low rates of arrears overall.

So you can imagine the surprise when the boss of one of Australia’s big four banks conceded today that he too was worried about home owners keeping up with their repayments.

If that’s not scary enough, according to the ANZ, as many as 5 per cent of homes slumped into negative equity in March, where the value of what they owe the bank is more than what their home is worth, putting even more pressure on borrowers.

It begs the question: is the worst of the house price falls now over, or is there worse to come?

I discuss the latest data.

Discussing The Latest House And Unit Price Moves On News 24

A brief segment today when I discussed the latest price moves, in the light of the Opal tower, off the plan buying and other factors. The question is, how far, and how fast?

ABC News Does The Refinance Problem

ABC The Business Does Home Prices

A segment aired tonight discussing the latest property price data.

Included my observations on the property market and future expectations. See my post for more.

Government Re-spins The Royal Commission Spin

The ABC is reporting that Malcolm Turnbull said in hindsight it would have been better for the Government to have set up a banking royal commission two years ago.

Mr Turnbull and his senior colleagues have spent the past two years arguing against a royal commission into the financial sector, although some of his backbenchers were campaigning vigorously for a royal commission.

Mr Turnbull and his senior colleagues have spent the past two years arguing against a royal commission into the financial sector, although some of his backbenchers were campaigning vigorously for a royal commission.

ABC Insiders did a nice montage yesterday showing the evolution of the spin, from initially vehemently resisting a commission.

The PM finally called a royal commission late last year and shocking revelations have emerged as it has been taking evidence.

This was after an appalling interview with Kelly O’Dwyer who has been the Minister for Revenue and Financial Services, since July 2016.