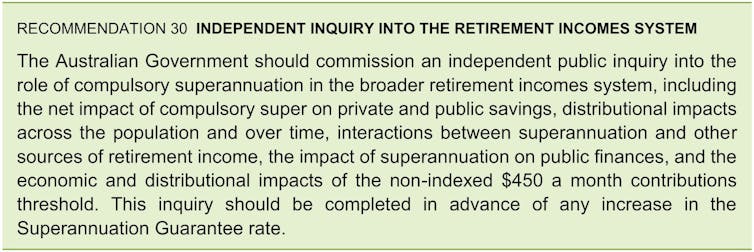

The Federal government has today announced that it will be commissioning an independent review of the retirement income system, via InvestorDaily.

This review was recommended by the Productivity Commission in their report Superannuation: Assessing Efficiency and Competitiveness and comes 27 years after the establishment of compulsory superannuation.

The review will look at the three pillars of the existing retirement income system, being the Age Pension, compulsory superannuation and voluntary savings.

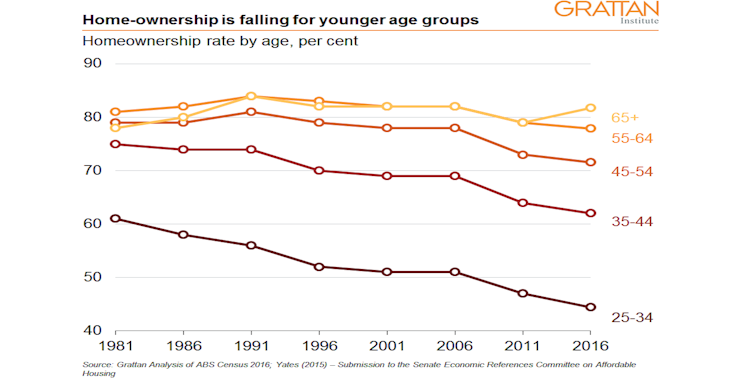

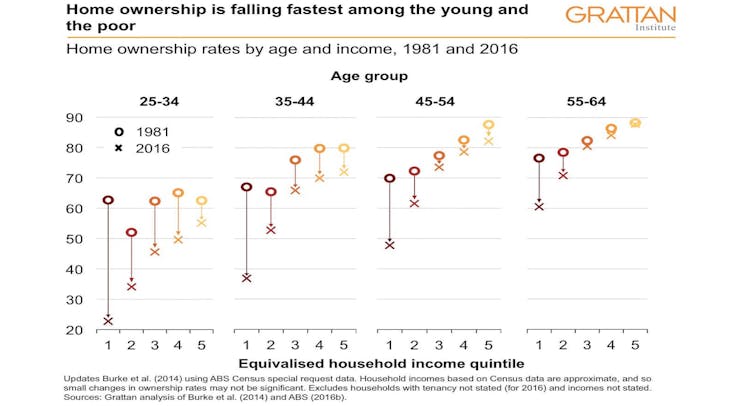

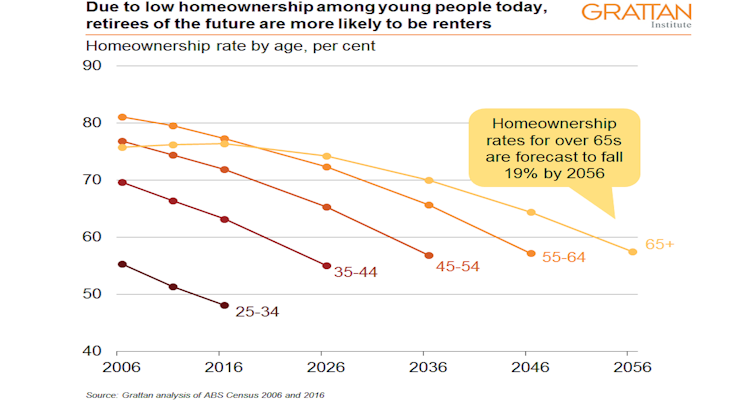

In doing so, the review will cover the current state of the system and how it will perform in the future as Australians live longer and the population ages.

Through its work, the review will establish a fact base of the current retirement income system that will improve understanding of its operation and the outcomes it is delivering for Australians.

The review will be conducted by an independent three person panel.

Mr Michael Callaghan AM PSM, a former Executive Director of the International Monetary Fund and a former senior Treasury official will chair the review, together with fellow panellists Ms Carolyn Kay, who has more than 30 years’ experience in the finance sector across roles both in Australia and overseas, including as a member of the Future Fund Board of Guardians, and Dr Deborah Ralston, who is a Professorial Fellow in Banking and Finance at Monash University, a member of the RBA’s Payments System Board and most recently chair of the Alliance for a Fairer Retirement.

A consultation paper will be released in November 2019 and the final report provided to Government by June 2020.

The Review will establish a fact base of the current retirement income system that will improve understanding of its operation and the outcomes it is delivering for Australians. It aims to identify how the retirement income system supports Australians in retirement, the role of each pillar in supporting Australians through retirement, distributional impacts across the population and over time and the impact of current policy settings on public finances.

FSC CEO Sally Loane said the FSC will work closely with the review to ensure continuing improvements to Australia’s retirement income system, particularly through the superannuation system.

“Superannuation consumers receive significant benefits from competition and choice, and this will be an important focus of the FSC’s approach to the Review,” Ms Loane said.

“However, this review should not delay important reforms that the Government has already committed to that will significantly improve consumer outcomes in superannuation.

“These include the introduction of a ‘default once’ framework to prevent unintended multiple accounts, as recommended by both Commissioner Kenneth Hayne and the recent Productivity Commission review of superannuation, and legislating an obligation for trustees to consider the retirement needs of their members.”

The FSC will also suggest to the review that the government should retain its policy of increasing the Superannuation Guarantee to 12 per cent. The FSC also suggests that superannuation laws should be simplified and red tape in the sector should be removed including barriers to rationalising legacy products.

“The FSC looks forward to advocating strongly for these positions during the Review process over the coming year,” Ms Loane said.

AMP welcomed the review and said a strong retirement system is essential to supporting the wellbeing of Australians now and into the future.

“This is a once-in-a-generation opportunity to improve our current retirement system to make sure it adequately serves everyone’s needs. Now is the time to have the debate on this issue,” an AMP spokesperson said.