CBA released their 1H20 result today, with a statuary NPAT of $6,161 million, up 34%, but this included a one off gain from the sale of CFSGAM, so its not really meaningful.

On a cash basis, the cost base remains under pressure from compliance, wage inflation and IT investment, plus rising insurance claims and provisions for drought and bushfire. But volume grew, and consumer arrears are lower. Overall one of the better managed banks in Australia.

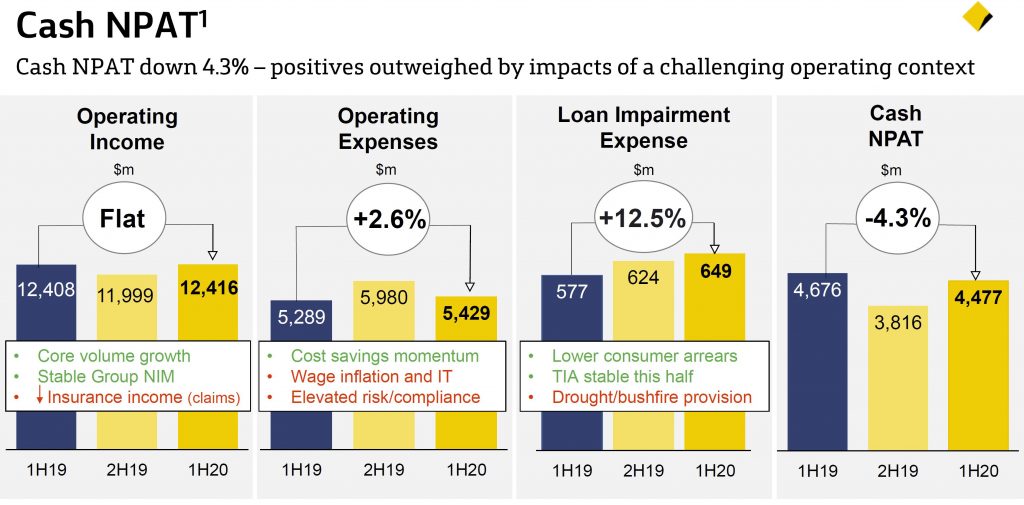

Thus this cash result on a continuing basis is more relevant. It was down 4.3% on pcp to $4,477m, thanks to stronger revenue growth than anticipated – especially from trading income, despite higher provisions and expenses.

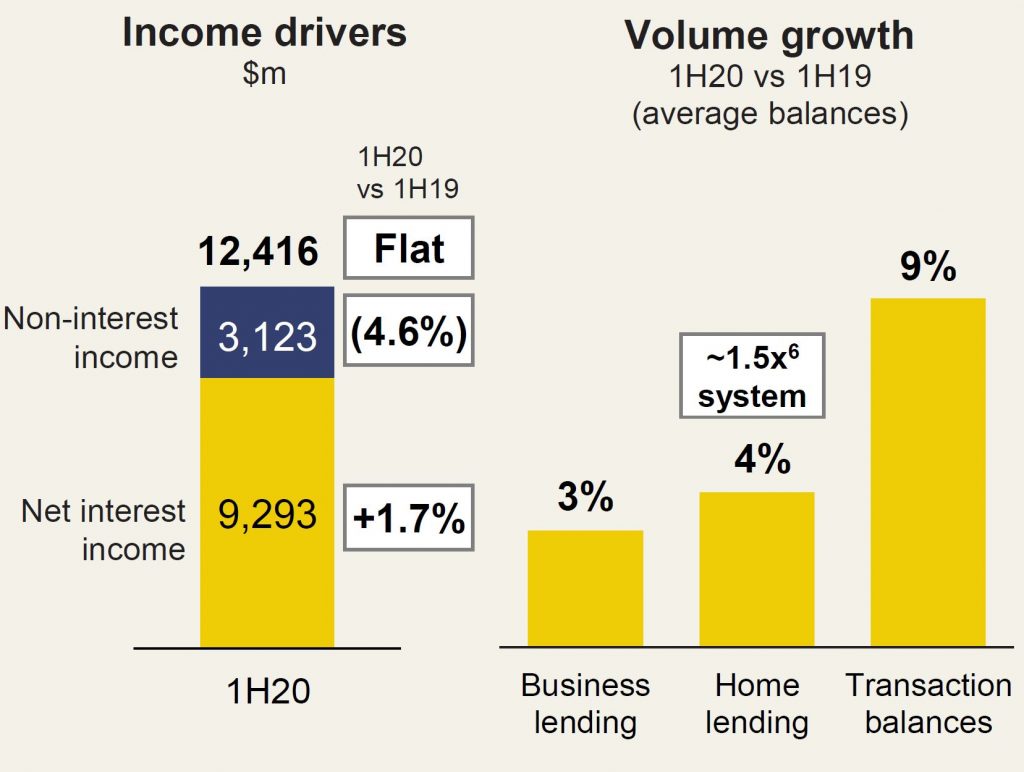

Operating income was flat at $12,416 million while net interest income was up 1.7% thanks to growth of book.

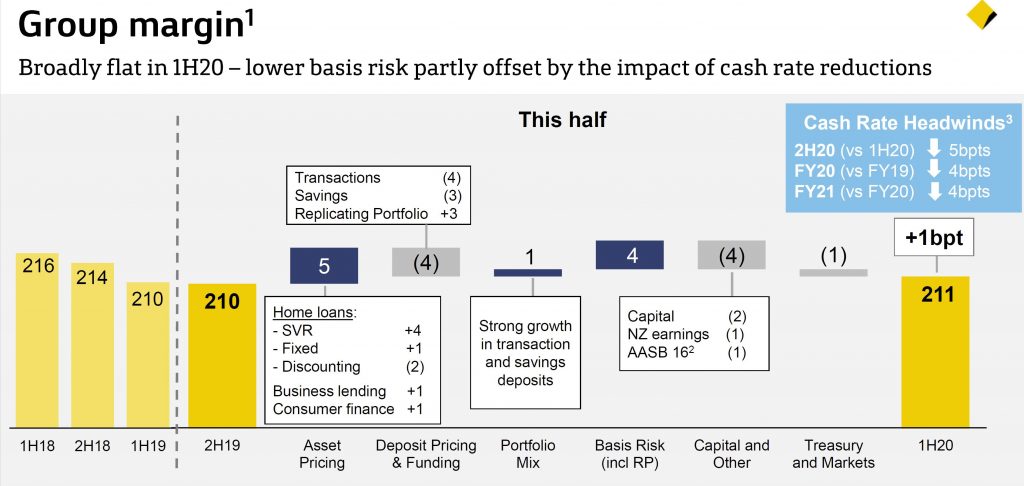

The Group net interest rate margin was 2.11%, up 1 basis point from 2H19. They indicated that the lower cash rate will continue to impact NIM – by around 5 basis points in 2H20, and 4 basis points across the FY 20 and FY 21.

Non-interest income was down 4.6%, mainly thanks to the impact of bushfire related claims ($83m) on insurance income, changes to wealth management fees and hedging losses.

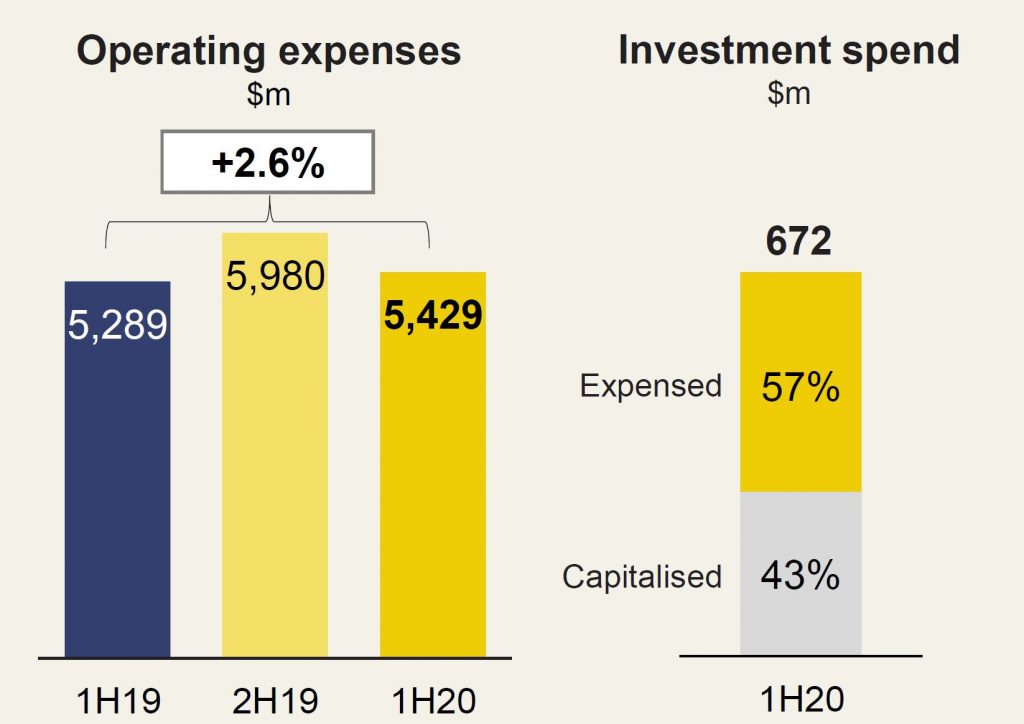

Operating expenses were up 2.6% to %5,429m with $630m was refunded to customers to 31 Dec 2019 following the Royal Commission misconduct and other required remediation. A further $596m is outstanding.

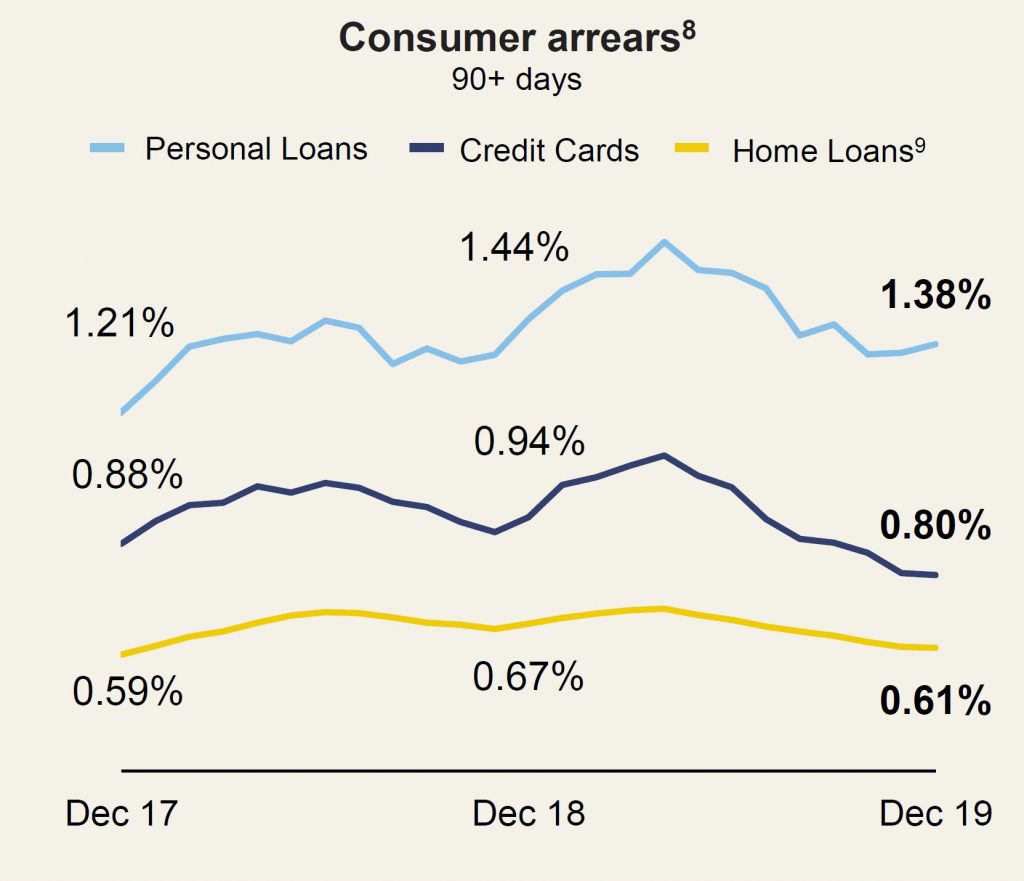

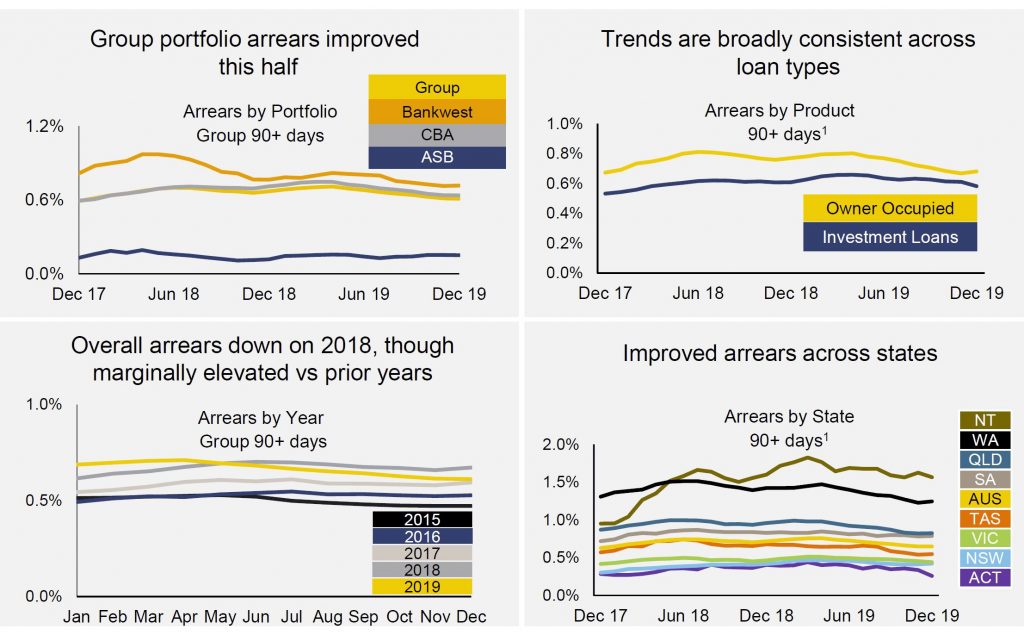

Loan impairment expenses were 17 basis point of average gross loans and acceptances. This was up 2 basis points, but includes 3 basis points for drought and bushfire provisions. They note a fall in consumer arrears thanks to the improved property market, but said pockets of stress remain in the discretionary retail, agricultural and construction sectors. Provisions lifted from 1.28% to 1.34% to $5,026 million.

Mortgage arrears are down a little, though are marginally elevated vs prior years.

Exposure to apartment development has reduced b y 63% since December 2016. Sydney represent 60% of the development exposure.

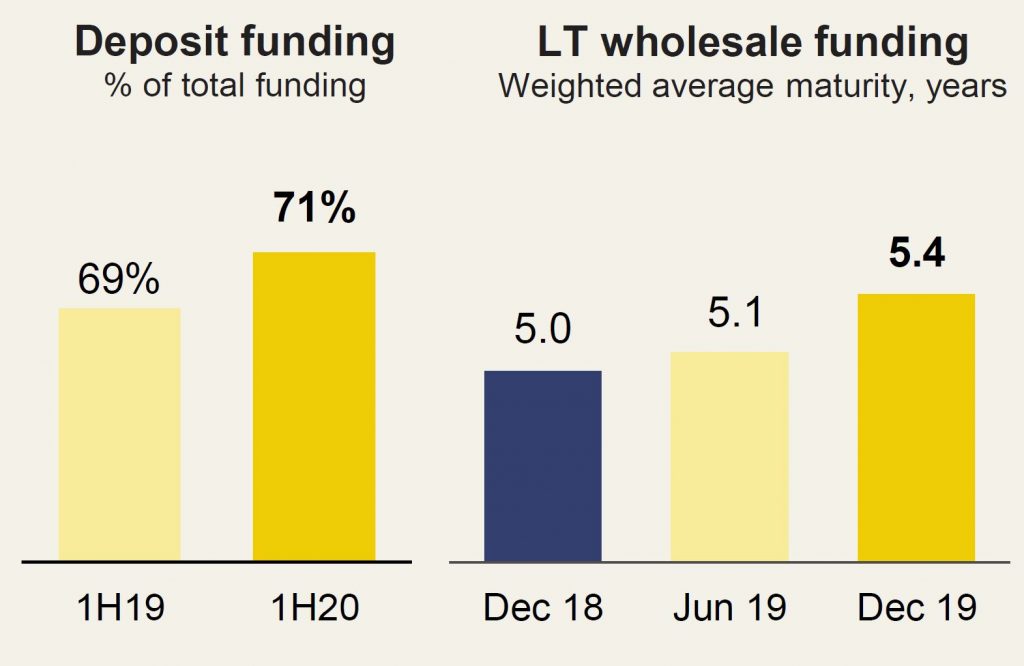

The percentage of book funded by deposits rose to 71% from 69% in 1H19. Overall average wholesale funding is 5.4 years. The Net Stable Funding ratio improved 1% to 113% and the Liquidity Coverage Ratio increased by 3% to 134%.

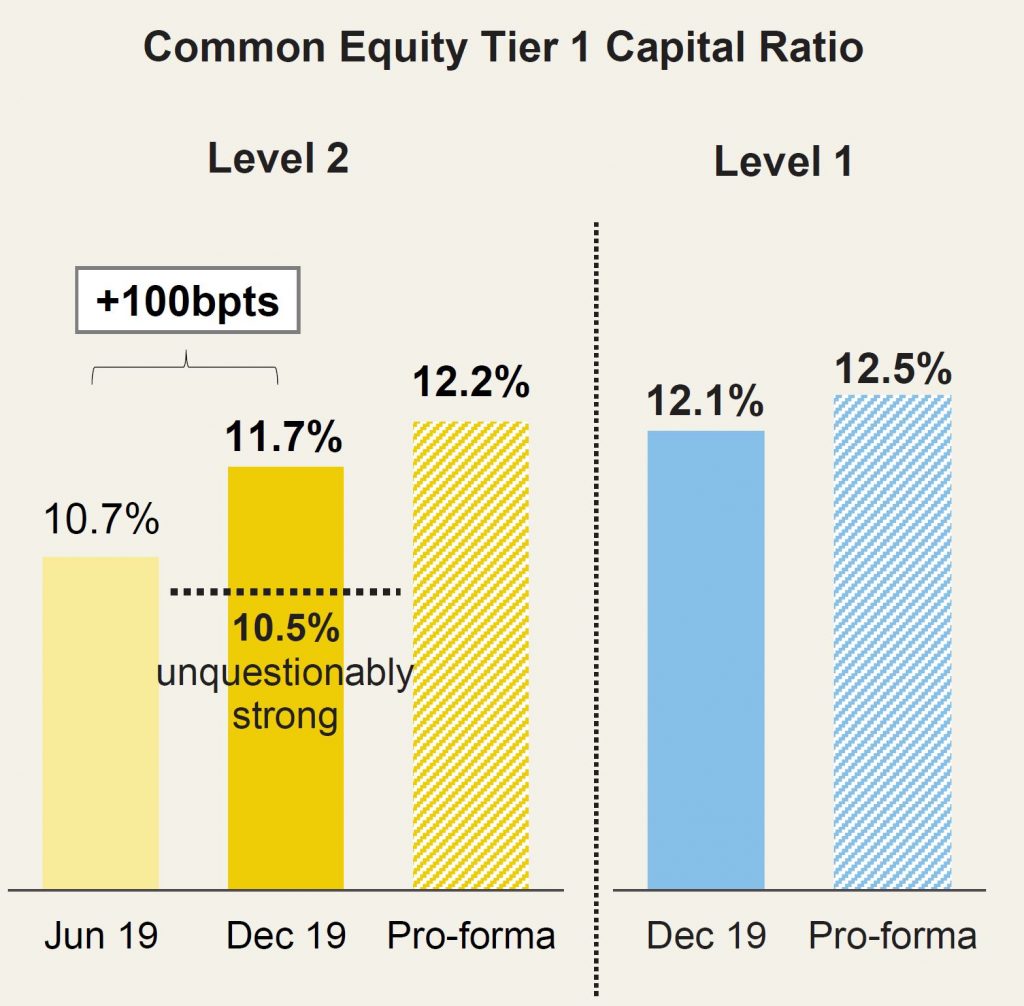

The Lever 2 CET1 ratio rose by 100 basis points to 11.7% and is above the APRA threshold. This was helped by recent asset sales. Further divestment proceeds will assist ahead.

A $500m on-market purchase will support the Dividend Reinvestment Plan. No discount will be applied to shareholders.

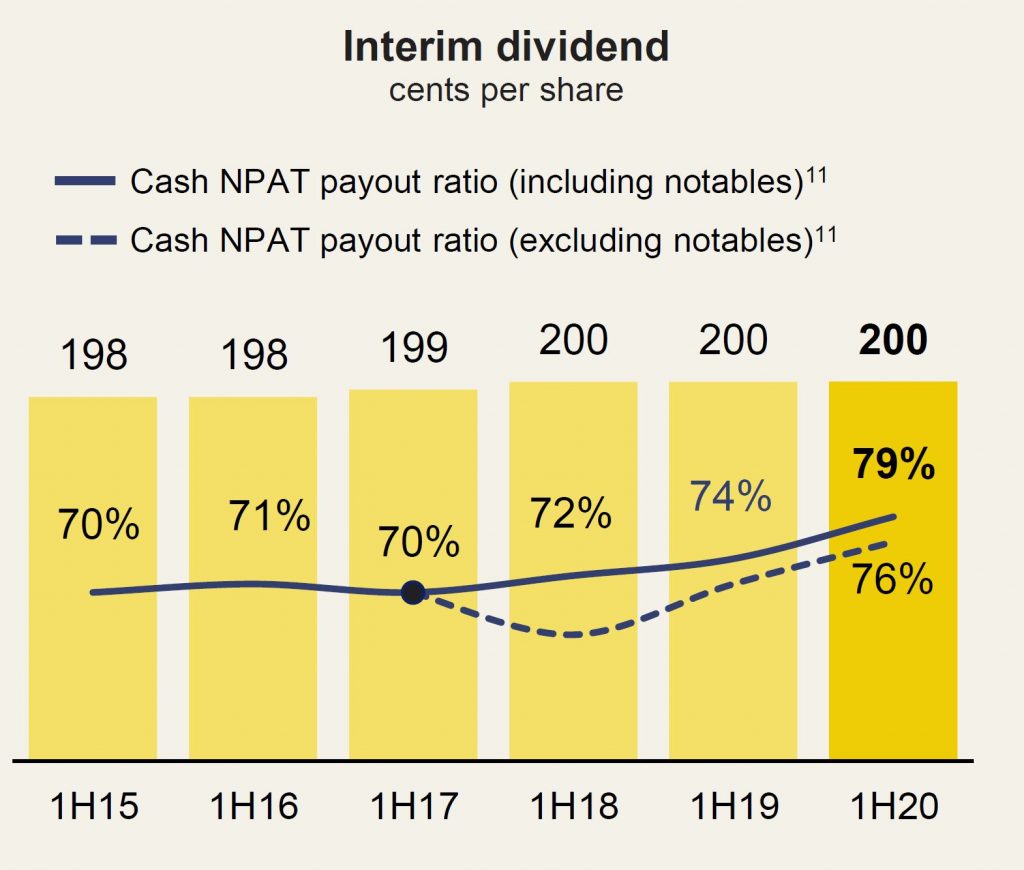

The bank declared a dividend of $2.00 per share, fully franked – unchanged from 1H19 interim.