We have completed the latest round of our 52,000 household surveys, and today we discuss the results relating to property buying intentions by extracting the data from our Core Market Model. It was this data six months back which enabled us to predict the currently observed slowdown in sales, auction clearances and home prices.

So what is in store for the next few months? Well, in short its more of the same, only more so, with more households reporting difficulties in obtaining finance, fewer expecting to transact in the next year and to see home prices rise.

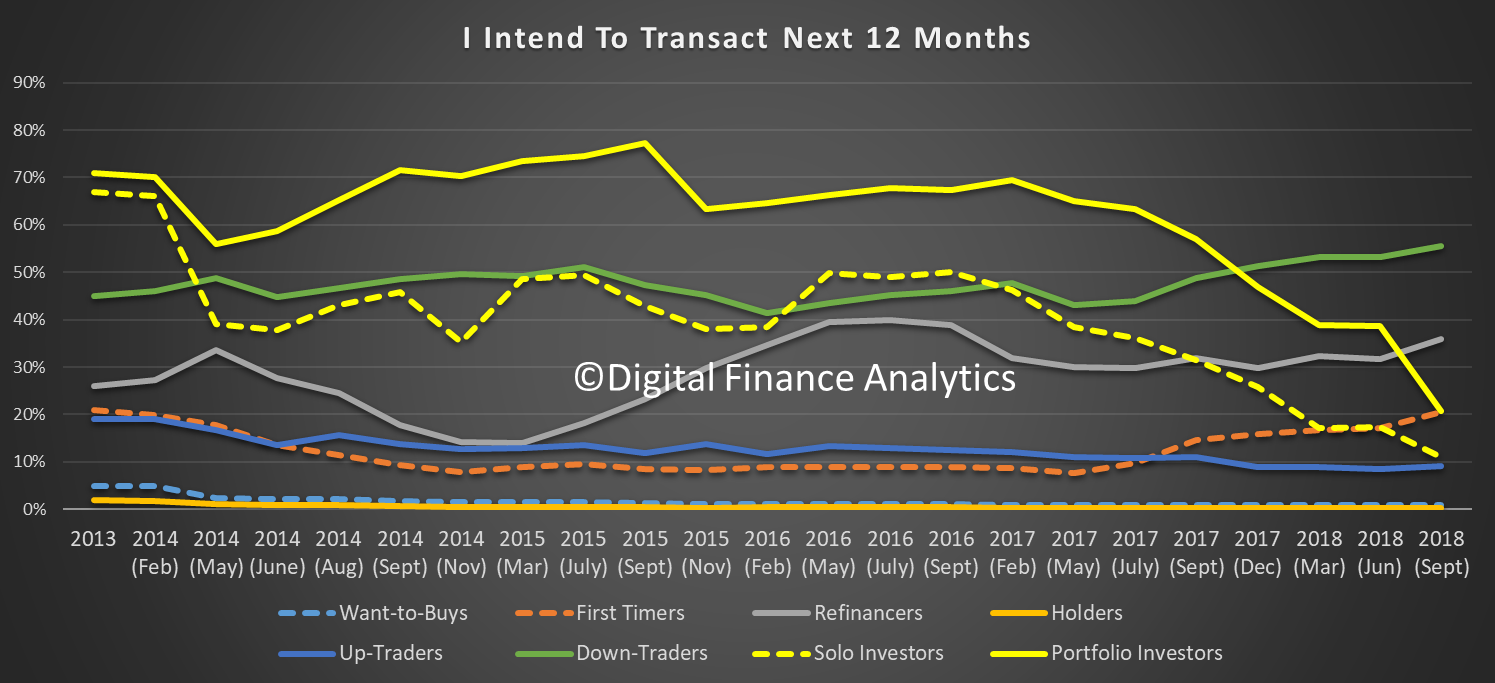

So we start with transaction intentions. The first startling observation is the fall in the number of property investors, including those who hold portfolios of investment properties intending to transact. 20% of portfolio investors are expecting to transact, and the bulk of these intend to sell a property, compared with a year ago when 50% said they would transact, and most were looking to add to their portfolios. Most solo property investors are now on the side lines, with around 10% expecting to transact, and most of these on the sell side. Demand for investment property will continue to fall, as rental yields and capital appreciation fall.

On the other hand, the number of people trading down is rising, with more than 50% of these looking to sell before prices fall further. There is some demand from first time buyers, and up-traders, but the net conclusion is there will be more property coming to market and fewer buyer, so prices are set to fall further, and quite quickly. The spring season appears all but shot.

On the other hand, the number of people trading down is rising, with more than 50% of these looking to sell before prices fall further. There is some demand from first time buyers, and up-traders, but the net conclusion is there will be more property coming to market and fewer buyer, so prices are set to fall further, and quite quickly. The spring season appears all but shot.

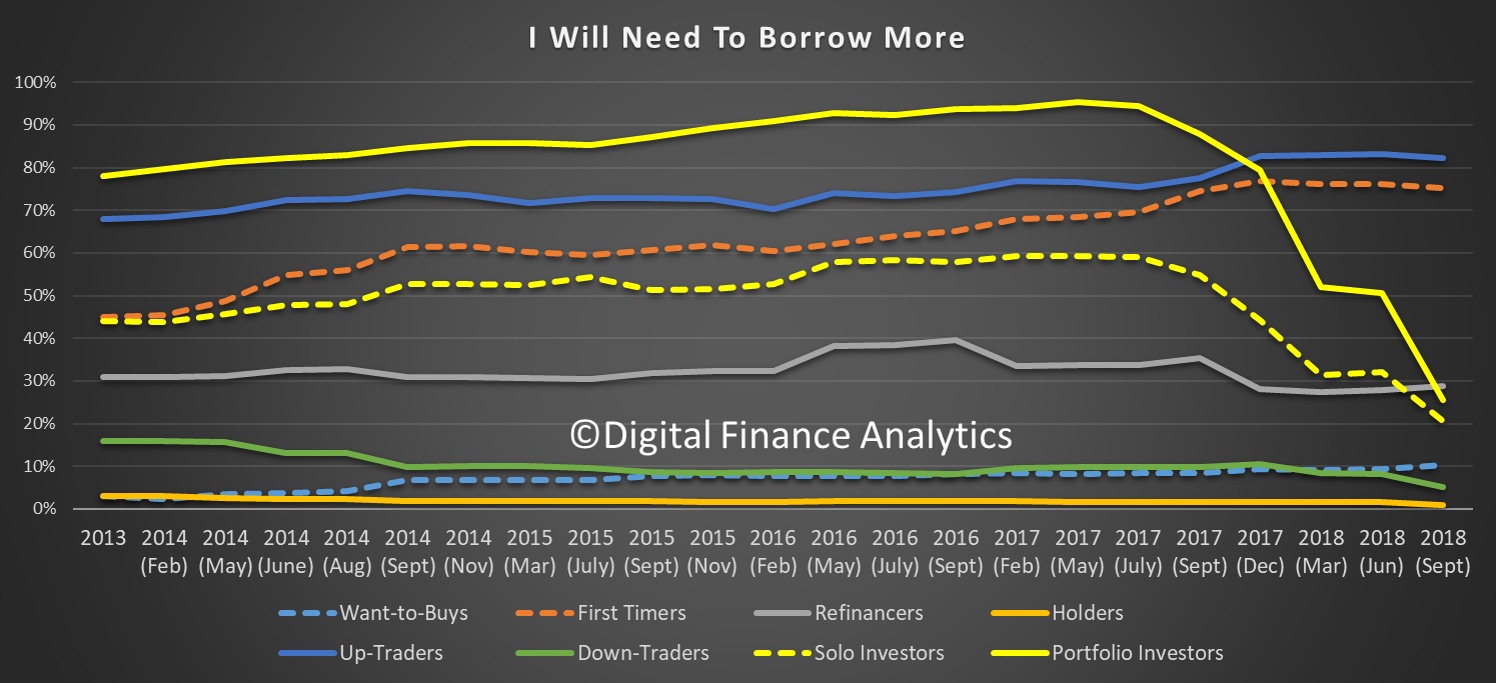

These trends are mirrored in the demand for credit. Property investors are now less likely to borrow, while those trading-up and first time buyers are still in the market (but in terms of volumes this is a smaller group). Refinance households are still in the market for a replacement loan, but these do not add to new demand for credit.

As a result, we expect demand for credit to wilt further in the months ahead. Of course for the banks to maintain their profit output they need to see real growth in new credit, we do not expect that will eventuate, so credit will continue to ease.

As a result, we expect demand for credit to wilt further in the months ahead. Of course for the banks to maintain their profit output they need to see real growth in new credit, we do not expect that will eventuate, so credit will continue to ease.

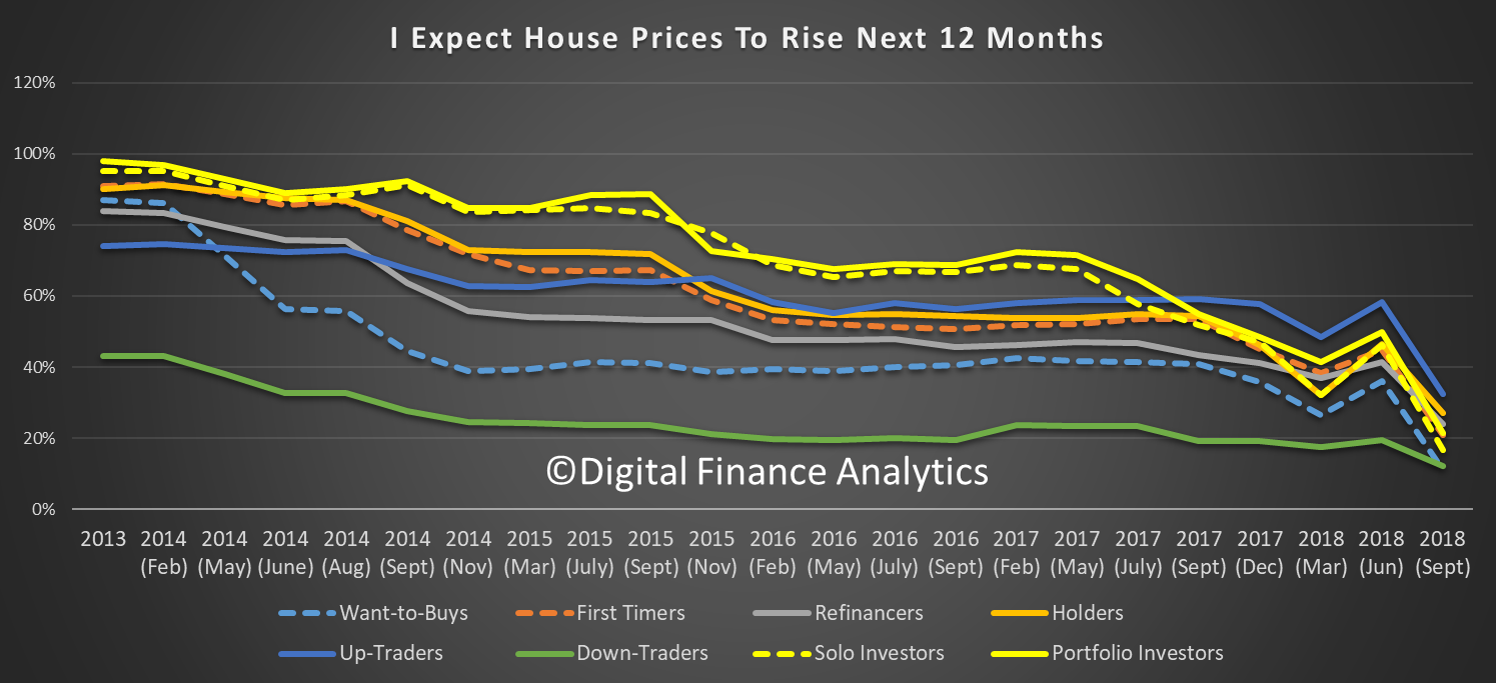

Universally, households are less bullish on home price growth, than a year ago, with a sharp down turn since June 2018. Down traders are the least likely to expect rises at 18%, while 35% of those trading up were bullish on home price values. Property investors are getting less and less positive about future price accumulation.

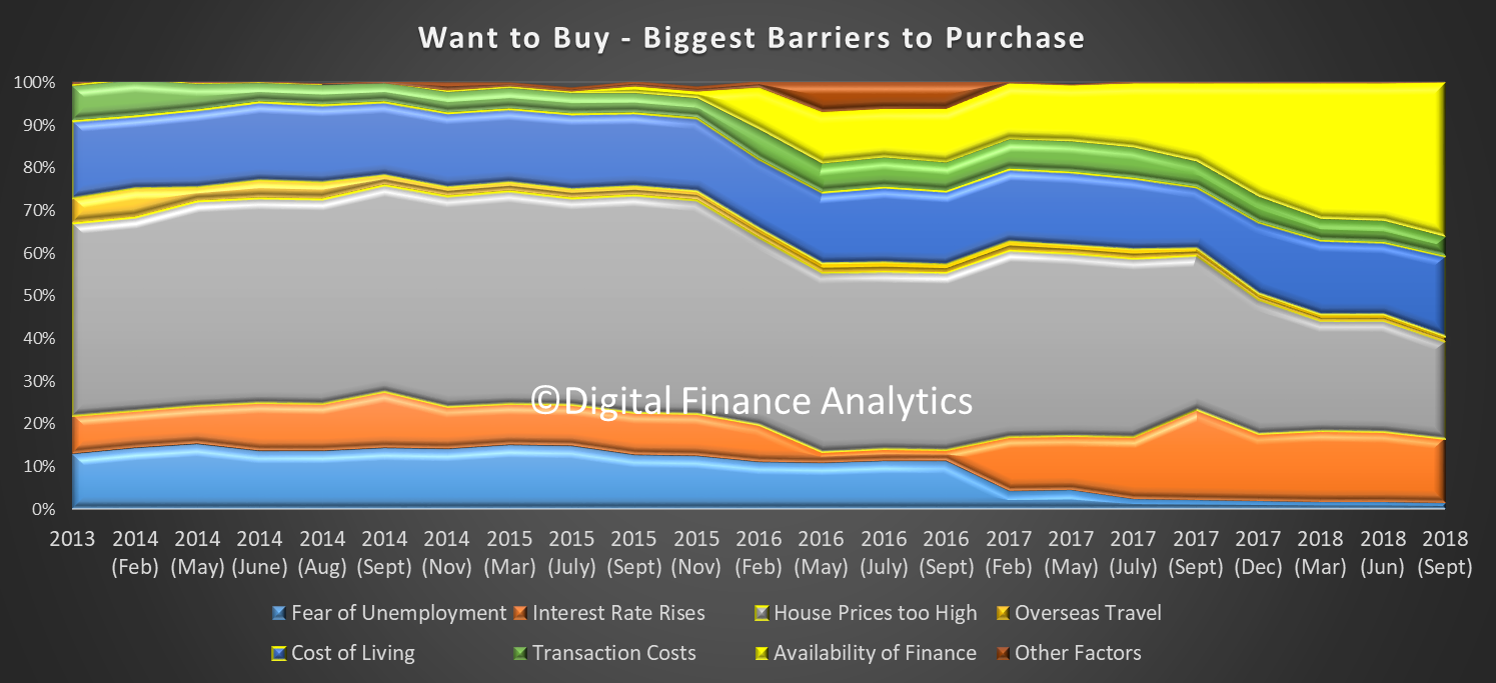

Turning to the specific segments, 36% of those wanting to buy, but who cannot, reported their barrier related to the (non) availability of finance. This is a record, and reflects the tighter underwriting standards now in force.

Turning to the specific segments, 36% of those wanting to buy, but who cannot, reported their barrier related to the (non) availability of finance. This is a record, and reflects the tighter underwriting standards now in force.

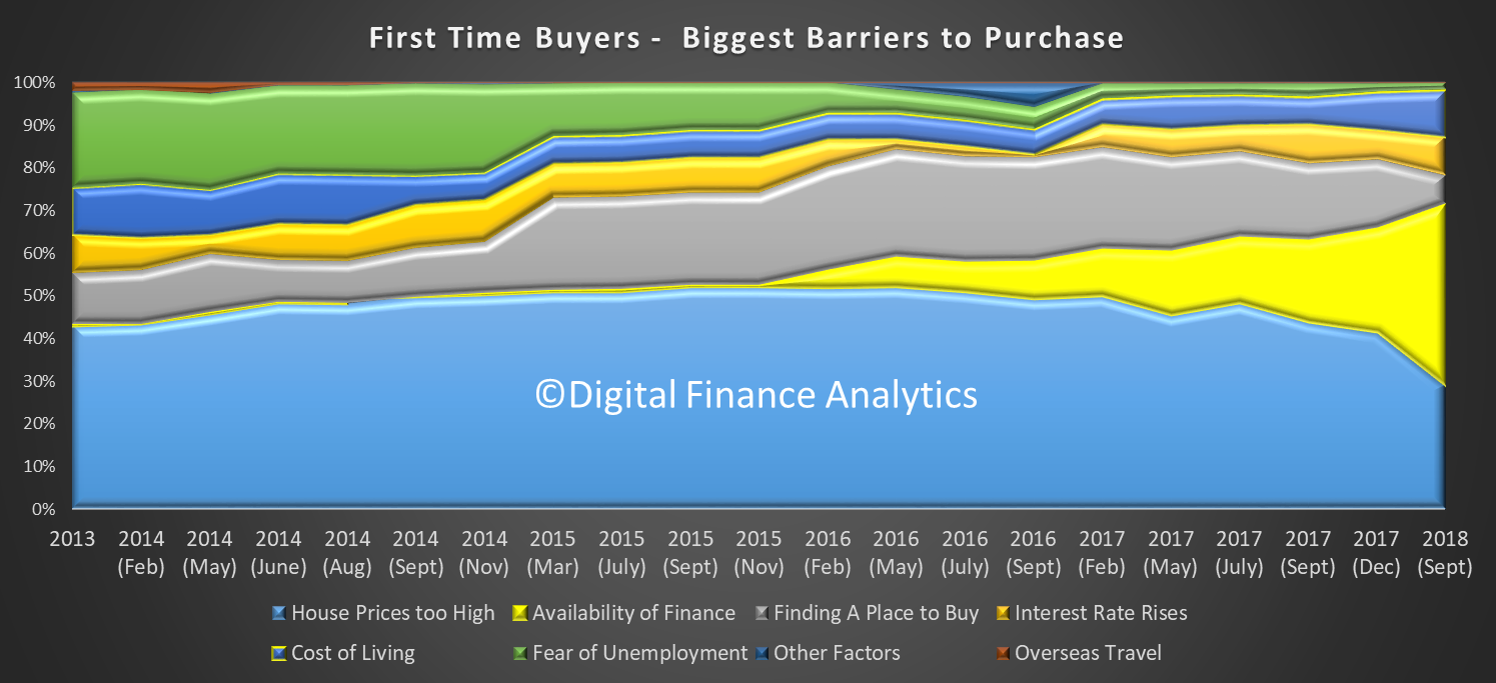

We find the same thematic among first time buyers where 42% report a problem with finance availability, a record.

We find the same thematic among first time buyers where 42% report a problem with finance availability, a record.

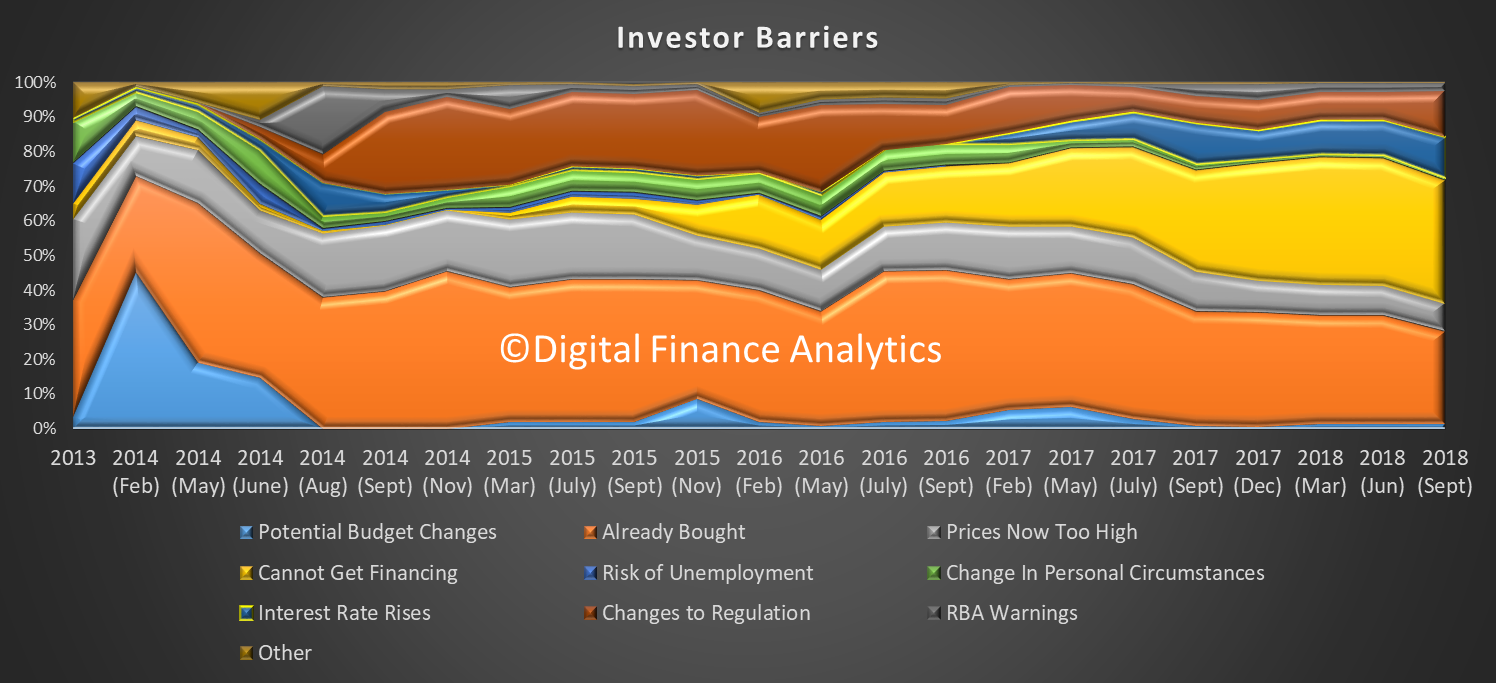

Investors have a similar problem with 36% saying they have issues with finance, and more are now concerned about potential changes in regulation (including Labor’s changes to negative gearing).

Investors have a similar problem with 36% saying they have issues with finance, and more are now concerned about potential changes in regulation (including Labor’s changes to negative gearing).

In fact, Investors are ever more reliant on the tax breaks, as capital growth eases. 40% are banking on the tax benefits, while 15% expect future capital appreciation.

In fact, Investors are ever more reliant on the tax breaks, as capital growth eases. 40% are banking on the tax benefits, while 15% expect future capital appreciation.

When we look at the motivations of those seeking to trade down, 48% are looking to capital release, and now few are interested in acquiring an investment property. Increased convenience remains a significant driver.

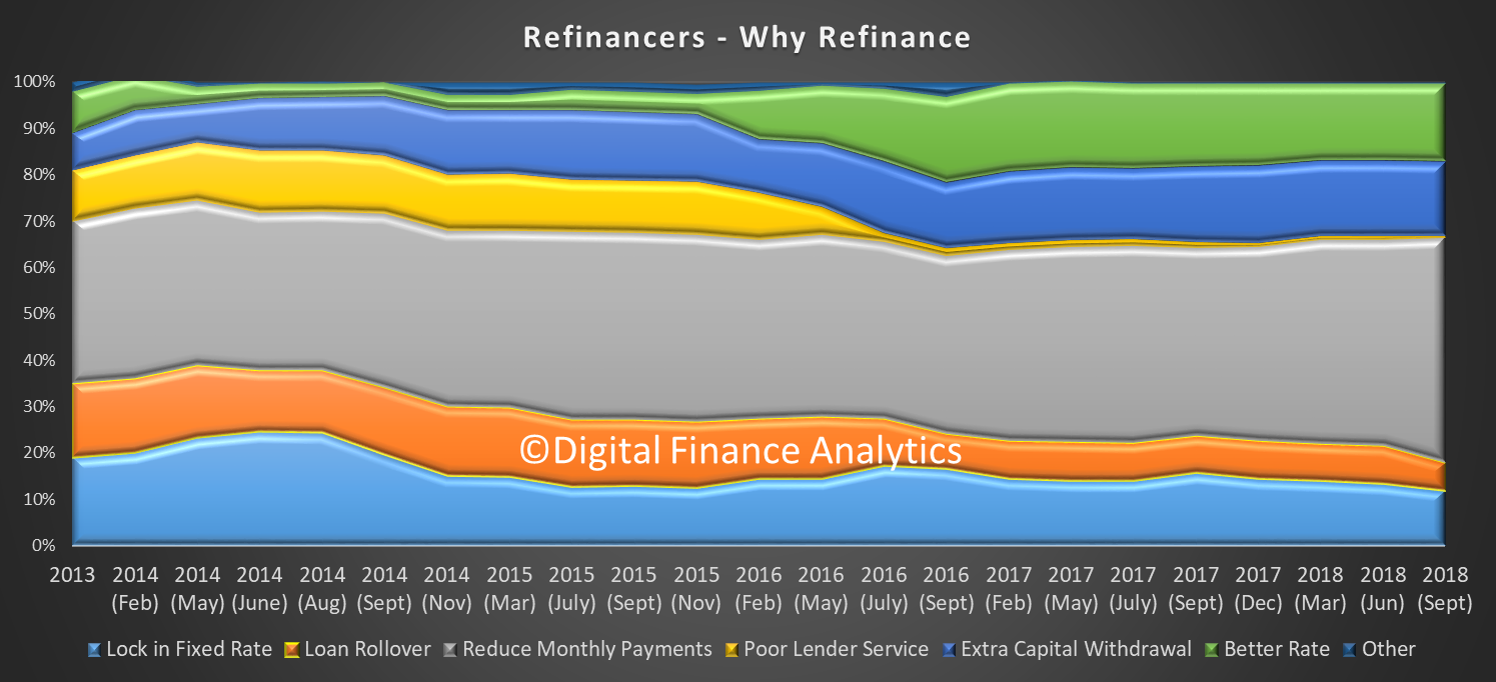

Households seeking to refinance are mainly being driven by a quest to reduce monthly repayments (49%) and there is a high correlation with those experiencing mortgage stress, as we reported yesterday. Lender service, or the lack of it, does not seem to count for much.

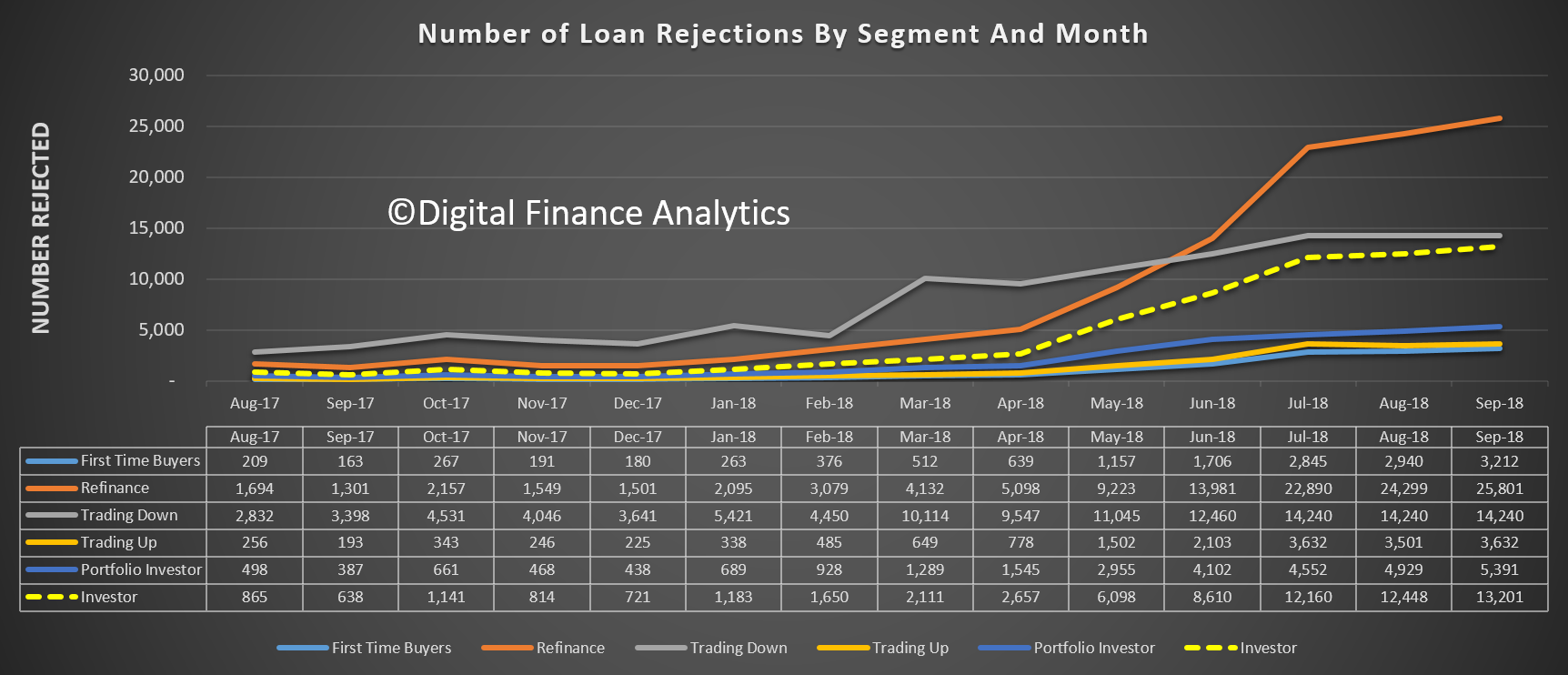

And finally, to ice the cake, as it were, the number of loan rejections continues to rise, especially among refinance and investor cohorts.

And finally, to ice the cake, as it were, the number of loan rejections continues to rise, especially among refinance and investor cohorts.

Add this new data to the other factors:

Add this new data to the other factors:

- Tighter Lending Standards – focus on income AND expenses, not HEM

- Mortgage Borrowing Power dropped up to 40%

- Foreign Buyers dropped 35%, and significant hike in extra fees and taxes

- SMSF borrowing restricted

- Interest Only Borrowing Restricted ($120 billion for reset each year)

- Investors less likely to transact, as capital growth reverses

- Tighter returns on rentals (half under water in cash flow terms)

- Higher interbank funding costs

- Rising mortgage costs and rates (NAB holds)

- Risk from Class Actions and Royal Commission

- Etc…

and there is plenty to suggest further home price falls are in the offing. We will add this new set of data into our scenarios, and we will update our findings in a future post.

But our conclusion is “you ain’t seen nothing yet” to quote an old Bachman Turner Overdrive song from 1974!

You Ain’t Seen Nothing Yet… but don’t worry: It’s only temporary…

https://www.afr.com/real-estate/the-housing-downturn-is-only-temporary-say-real-estate-agents-20181007-h16bez

“Real estate agents in weaker suburbs in Sydney are telling potential buyers at auctions the housing downturn is “only temporary”, urging them to buy while the market is subdued.”

… 30% of funding source in USD, With 10Y US treasury yields > 3.2%, putting pressure on AUD, banks will have no choice but pass on borrowing costs.

Someone said something about “catching a falling knife?”

Interesting, better tell everyone not to apply for help from the banks, as per Responsible Lending Guidelines – if you cannot make a payment today, we take your home.

So think very carefully before making a “Hardship request” just ask the Salvation Army’s finance team.