This is the edited show broadcast live on 19th May 2020. We discussed our latest finance and property scenarios, the latest news and also walked through our mortgage stress data for selected requested post codes.

There is a path to higher home prices due to lower rates in line with the RBA market model, however it ignores availability of credit. The “Tulip” model weirdly takes little account of the credit drivers.

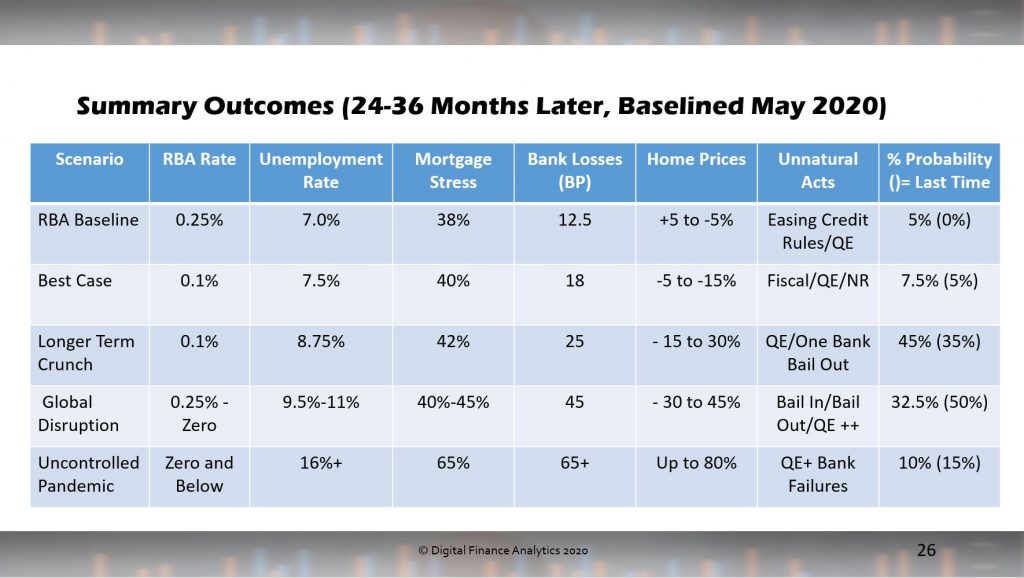

Most likely though unemployment will remain higher, while incomes are squeezed and so we have a stronger weighting on FALLS in property values over the next couple of years. How far they fall, and where, will be determined by how much stimulus is thrown at the economy, the migration settings and bank’s willingness to lend in a weaker employment and income environment.

You can watch the edited show here:

Note in the show we were comparing the ratios to the total household population in each post code.

The unedited original stream, with live chat is also available here: