We ran our regular live Q&A event last night, and had the biggest audience ever (thanks to all those who took part).

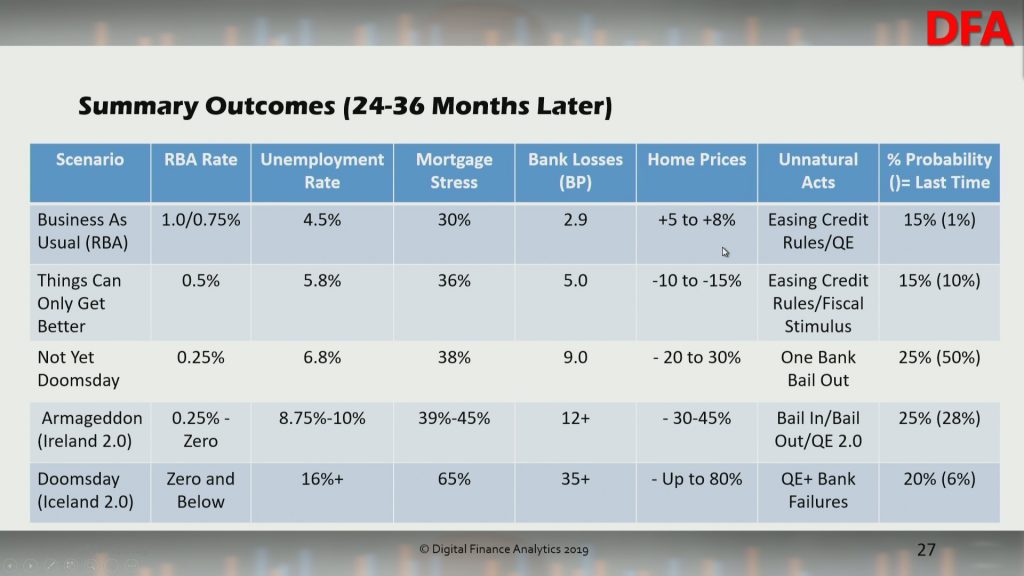

During the show we discussed the latest data from the RBA, ABS and Moody’s, and our updated scenarios. In the current “risk-on” environment, and with the RBA’s pivot to lower rates, QE and lifting the money supply incorporated into our modelling, plus the heightened international risk profiles; there are some big changes to our scenarios.

Given the RBA (and the FED) have flipped to more QE, the future could play out a number of ways over the next 2-3 years. Indeed, if the RBA does get unemployment down to 4.5%, it is possible home prices will be higher by then.

We are expecting a small bounce, but then further falls in home prices as the broader economy weakens, and the risks from an international crisis rise further. But remember average rises or falls mask significant variations. We discuss specific examples on the show where prices have already dropped more than 30%.

You can watch the edited version of the show and our rationale for the scenario revision.

Alternatively, the original stream, including the live chat replay is available.

And we also included a view behind the scenes during the session.