We ran our September 2019 live event last night with strong participation from our audience. During the show we discussed our updated scenarios (based on a starting point of August 2018) and answered a range of questions on property and finance.

The edited edition of the show is available to view in replay. This excludes the pre-show and live chat, but does include some behind the scene glimpses.

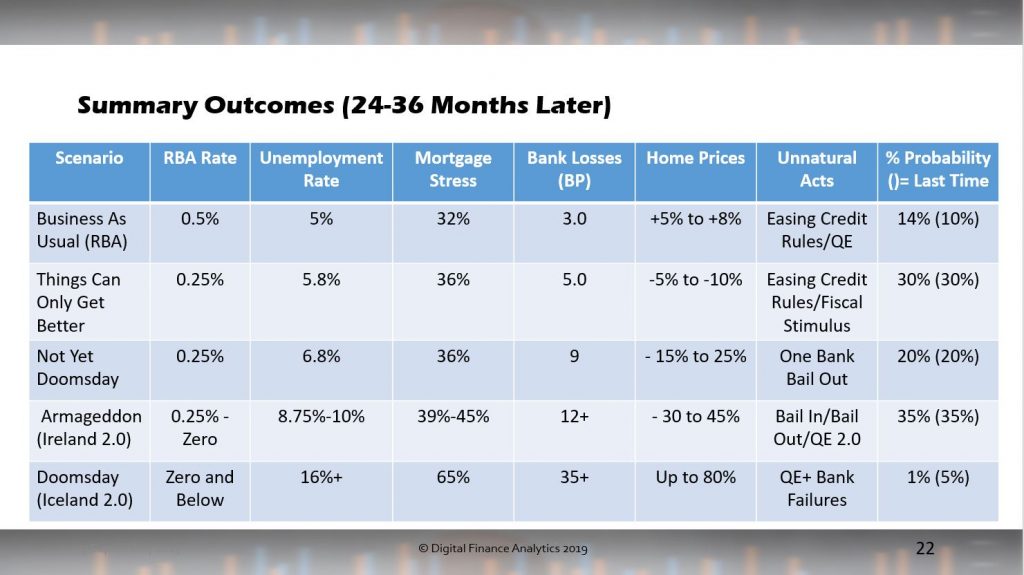

Our scenarios present a range of alternative outcomes, looking 2-3 years out. “Business As Usual” is based on the RBA’s view, with some tweaks – as we do not believe unemployment will fall to their target of 4.5%! Here there is a path to higher home prices, though with falls later as the current “recovery” reverses.

“Things Can Only Get Better” – is our view of the fading local economy without significant international economic disruption, with unemployment rising, as retail and construction slows, countered by additional Government intervention within their “surplus” limits. Here home prices fall once again.

“Not Yet Doomsday” is our scenario where international economic conditions deteriorate (China, US, Brexit Etc…) as global growth slows. This has a significant impact on the local economy and the spillover effects drive the Australian economy into recession. As liquidity pressures emerge one bank will need assistance.

“Armageddon” is where we get a GFC 2.0 type event, with global liquidity under pressure, and banks needing to be rescued by either bailing in or bailing out. The spillover impacts will be significant (as once again tax payers or households end up picking up the tab. More QE will follow.

Finally “Doomsday” would be the case where Central Banks and Governments allow banks to fail, with all the knock-on consequences.

As well as estimating the impact on unemployment and home prices we also weight the probability of each outcome. This is updated each month as new information arrives via our Core Market Model.

The original live stream recording is also available, with the show commencing at 30 mins in to allow for the live chat replay.