In an article, released by the US FED via the first issue of Consumer & Community Context, they explore the impact that rising student loan debt levels may have on home ownership rates among young adults in the US. They suggest that higher debt overall helps to explain lower home ownership.

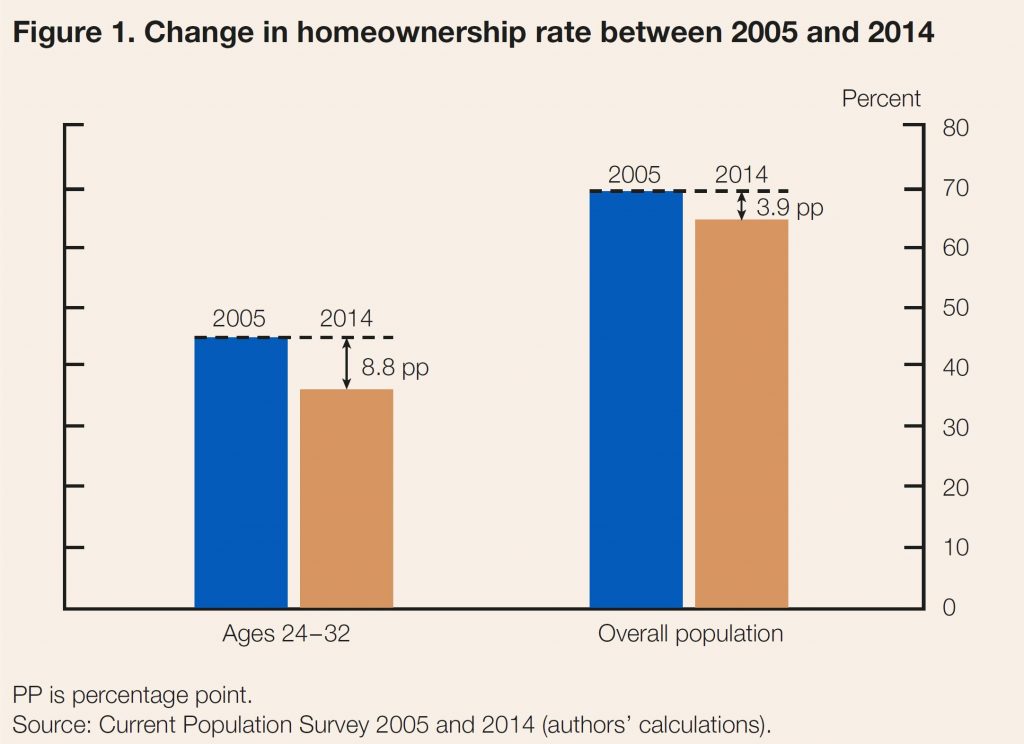

The home ownership rate in the United States fell approximately 4 percentage points in the wake of the financial crisis, from a peak of 69 percent in 2005 to 65 percent in 2014. The decline in home ownership was even more pronounced among young adults. Whereas 45 percent of household heads ages 24 to 32 in 2005 owned their own home, just 36 percent did in 2014—a marked 9 percentage point drop

While many factors have influenced the downward slide in the rate of home ownership, some believe that the historic levels of student loan debt have been particular impediments. Indeed, outstanding student loan balances have more than doubled in real terms (to about $1.5 trillion) in the last decade, with average real student loan debt per capita for individuals ages 24 to 32 rising from about $5,000 in 2005 to $10,000 in 2014.3 In surveys, young adults commonly report that their student loan debts are preventing them from buying a home.

They estimate that roughly 20 percent of the decline in home ownership among young adults can be attributed to their increased student loan debts since 2005. Our estimates suggest that increases in student loan debt are an important factor in explaining their lowered home ownership rates, but not the central cause of the decline.

Estimating the Effect of Student Loan Debt on Home ownership

The relationship between student loan debt and home ownership is complex. On the one hand, student loan payments may reduce an individual’s ability to save for a down payment or qualify for a mortgage. On the other hand, investments in higher education also, on average, result in higher earnings and lower rates of unemployment. As a result, it is not immediately clear whether, on balance, the impact of student loan debt on home ownership would be positive or negative.

Since we are interested in isolating the negative effect of increased student loan burdens on home ownership from the potential positive effect of additional education, our analysis aims to estimate the effect of debt on home ownership holding all other factors constant. In other words, if we were to compare two individuals who are otherwise identical in all aspects but the amount of accumulated student loan debt, how would we expect their home ownership outcomes to differ?

To estimate the effect of the increased student loan debt on home ownership, we tracked student loan and mortgage borrowing for individuals who were between 24 and 32 years old in 2005. Using these data, we constructed a model to estimate the impact of increased student loan borrowing on the likelihood of students becoming homeowners during this period of their lives. We found that a $1,000 increase in student loan debt (accumulated during the prime college-going years and measured in 2014 dollars) causes a 1 to 2 percentage point drop in the home ownership rate for student loan borrowers during their late 20s and early 30s. Our estimates suggest that student loan debt can be a meaningful barrier preventing young adults from owning a home. Next, we apply these estimates to another interesting question: How much of the 9 percentage point drop in the home ownership rate of 24 to 32 year olds between 2005 and 2014 can be attributed to rising student loan debt?

The Rise in Student Loan Debt and Decline in Home ownership since 2005

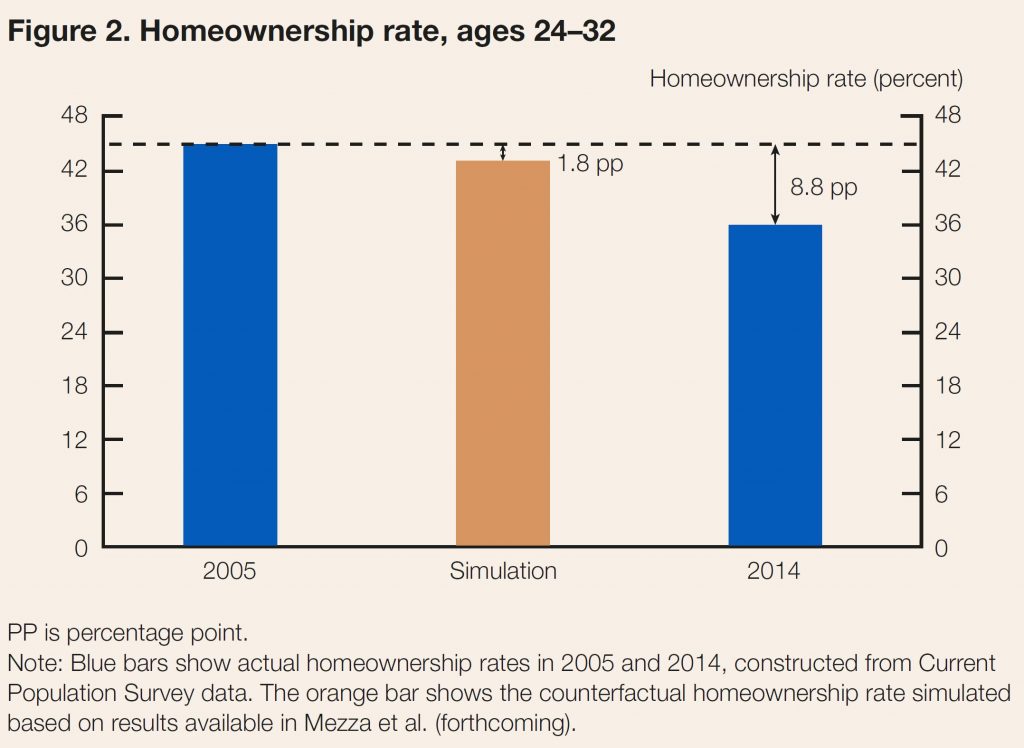

Answering this question requires two steps. First, we calculate an expected probability of home ownership in 2005 for each individual in our sample using the estimated model from our previous research. Second, we produce a simulated scenario for the probability of home ownership by increasing each individual’s debt to match the student loan debt distribution of this age group in 2014. The difference between the probabilities calculated in these two steps determines the effect of the increased debt on the home ownership rate of the young, holding demographic, educational, and economic characteristics fixed.

This exercise captures two key dimensions of the shifts in the distribution of student loan debt between 2005 and 2014, in addition to the overall increase in the average amounts borrowed. First, the fraction of young individuals who have borrowed to fund post secondary education with debt has increased by roughly 10 percentage points over this period, from 30 to 40 percent. Second, the amounts borrowed at the upper end of the distribution increased more rapidly than in the middle.

According to our calculations, the increase in student loan debt between 2005 and 2014 reduced the home ownership rate among young adults by 2 percentage points. The home ownership rate for this group fell 9 percentage points over this period (figure 2), implying that a little over 20 percent of the overall decline in home ownership among the young can be attributed to the rise in student loan debt. This represents over 400,000 young individuals who would have owned a home in 2014 had it not been for the rise in debt.

An important caveat to keep in mind when interpreting our estimates is the difference in mortgage market conditions before and after the financial crisis. The model used to develop these estimates was built using data for student loan borrowers who were between 24 and 32 years old in 2005, so a large fraction had made their home-buying decisions before 2008, when credit was relatively easier to obtain. Following the crisis, loan underwriting may have become more sensitive to student loan debt, increasing its importance in explaining declining home ownership rates.

Student Loan Debt May Have Even Broader Implications

for Consumers

There are multiple channels by which student loans can affect the ability of consumers to buy homes. One we would like to highlight here is the effect of student loan debt on credit scores. In our forthcoming paper, we show that higher student loan debt early in life leads to a lower credit score later in life, all else equal. We also find that, all else equal, increased student loan debt causes borrowers to be more likely to default on their student loan debt, which has a major adverse effect on their credit scores, thereby impacting their ability to qualify for a mortgage.

This finding has implications well beyond home ownership, as credit scores impact consumers’ access to and cost of nearly all kinds of credit, including auto loans and credit cards. While investing in post secondary education continues to yield, on average, positive and substantial returns, burdensome student loan debt levels may be lessening these benefits. As policymakers evaluate ways to aid student borrowers, they may wish to consider policies that reduce the cost of tuition, such as greater state government investment in public institutions, and ease the burden of student loan payments, such as more expansive use of income-driven repayment.