The risk of an imminent U.S. recession remains low despite the recent flattening of the U.S. yield curve, Fitch Ratings says.

“The underlying recession signals traditionally embodied by a yield curve inversion, namely high policy interest rates relative to long-term expectations of policy rates, and falling bank profitability and credit availability, are absent. Yield-curve flattening does nevertheless emphasize that the U.S. economic cycle is in a late stage of expansion.

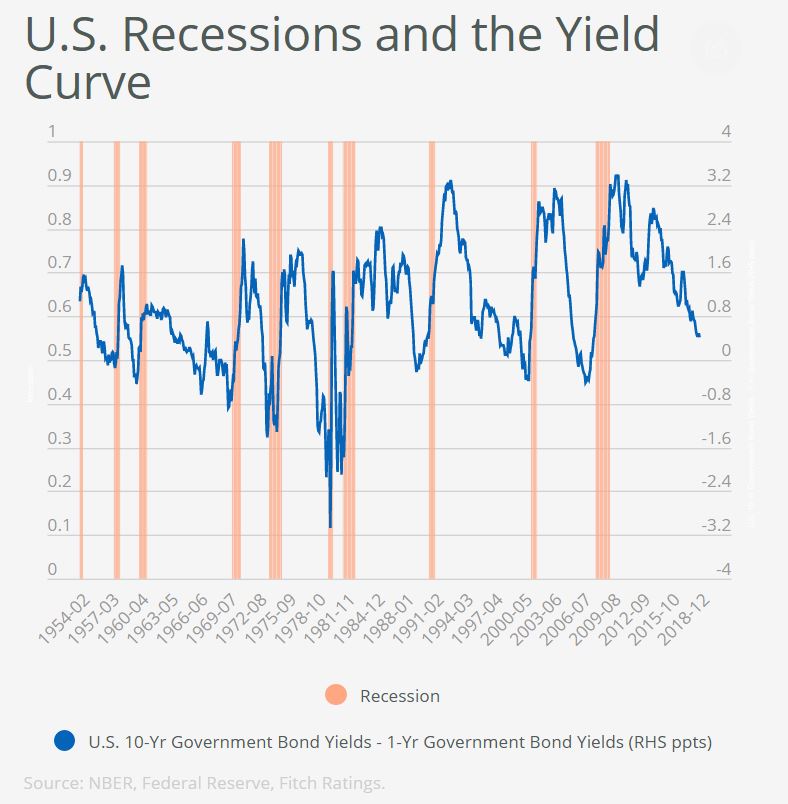

The yield curve has been a good lead indicator of U.S. recessions. Each of the past nine recessions were preceded by a yield curve inversion when 10-year yields fell below one-year yields. The recent narrowing of the 10-year minus one-year spread to its lowest level since summer 2007 has prompted a debate about potential economic implications.

The yield curve has not yet inverted except at some shorter tenors. Our Global Economic Outlook forecasts suggest that to be unlikely. We forecast the U.S. 10-year yield to end this year at 3.1% from 2.85% today and predict a year-end Fed Funds rate of 2.5%. We also see both the Fed Funds rate and 10-year yields rising broadly in tandem through 2019. Even if the yield curve inverts, there are reasons to discount this as a ‘red flag.’

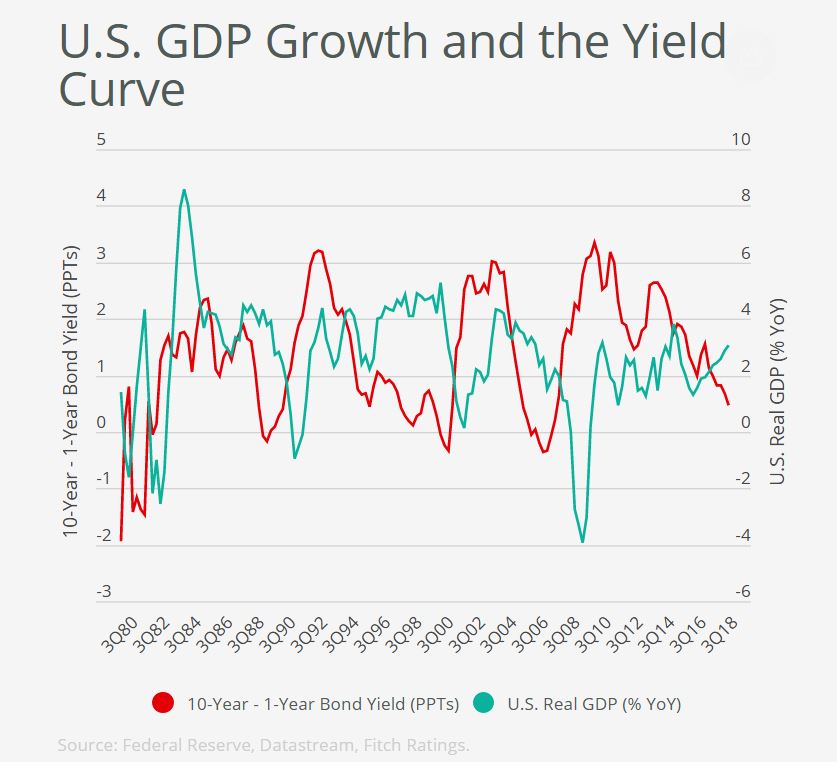

The historical time lags between inversion and recessions have been highly variable, from six months to up to two years. The correlation between the yield curve and GDP growth has been far from perfect. While each recession has been preceded by an inversion, not every inversion has been followed by a recession. The relationship through the mid-1990s was very poor. Since early 2010 there has been a steady flattening while U.S. growth has remained broadly stable.

The flattening since 2010 was associated with massive central bank bond buying under Quantitative Easing (QE) programs reducing long-term yields. While the Fed has started to gradually unwind its Treasury holdings, they remain huge and continue to suppress long-term yields. Ongoing QE purchases by the European Central Bank and Bank of Japan have also likely reduced U.S. bond yields, albeit indirectly.

These distortions to bond pricing reduce the value of the curve as an independent, market-based signal of the monetary policy stance. We do not believe that U.S. monetary policy is tight in an absolute sense, which would be the typical interpretation from a flat or inverted curve, reflecting current policy interest rates that are below levels expected in the long run. The Fed Funds rate is still quite close to zero in real terms despite inflation being close to target and unemployment below sustainable levels.

Bank profits are also traditionally thought to help explain the predictive power of the yield curve. Curve-flattening is generally perceived as compressing net-interest margins (NIM) and reducing banks’ willingness to lend. However, U.S. banks NIMs have risen steadily over the past three years, partly helped by changing balance sheet structures, and little evidence shows any deceleration in private credit or decline in banks’ willingness to lend. An inversion would limit the capacity for banks to further increase net-interest income but there is little evidence of this having happened so far.

Solid consumer income, private investment momentum and an aggressively expansionary fiscal stance should all support strong U.S. GDP growth in the next 12 months. Nevertheless, the flattening yield curve is consistent with the U.S. economy being at a late stage in the cycle, with an unusually long expansion to date and growth currently well above Fitch’s estimate of U.S. supply-side growth potential of 1.9% Fitch expects U.S. growth to tail off quite sharply in 2020 to 2.0% (from 2.9% in 2018) as macro policy support is removed and supply side constraints start to bind”.

– Nonsense.

– The yield curve is a risk appetite gauge, NOT a recession indicator.

– Steve Keen’s work has shown that the US entered a recession in the 1st quarter of 2005. (think: change in debt). This was confirmed by two other independent analysts called John Williams (Shadowstats.com) and Charles Biderman (Trim Tabs). The one looks at the ORIGINAL calculation of US GDP (John Williams) and the other looks at online data provided by the US Treasury (Charles Biderman) whereas the NBER look at the (Political Correct) calculation of US GDP. The NBER thought the US recession started in november 2007.

– The US yield curve inverted in late 2005/early 2006, more than 3 to 4 quarters after the recession began. And the yield curve started to steepen (again) in the 2nd quarter of 2007. That’s more than 2 years after the recession began (think: Steve Keen).

– And the official proclamation of the beginning of the recession (NBER, november 2007) came MORE than 2 years AFTER the recession began (think: Steve Keen).

You better go back to school. If you check the facts buddy, you will see a recession has followed on 99% of ALL yield curve inversions. History proves this.

– Steve Keen uses a special metric/formula: income + change in debt = aggregate demand (AD). And that AD (in the US) started to shrink (=recession) in the 1st quarter of 2005 and it continued to shrink until say the last quarter of 2009. But the US recession in 2005 & 2006 was (very) shallow in comparison to what happened after 2006 & 2007.

– The yield curve doesn’t have to invert before a recession. Like it didn’t right now (I look at the US 30 year yield divided by the 5 year yield). That yield (30y/5y) curve seem to have turned to steepening.

– The yield curve will steepen because investors become (more) aware that “something is wrong”. And that “something” can be/is a recession.

– Steve Keen saw that the australian recession began in november 2007. Because then that Aggregate Demand (see the formula above) started to shrink in Australia.