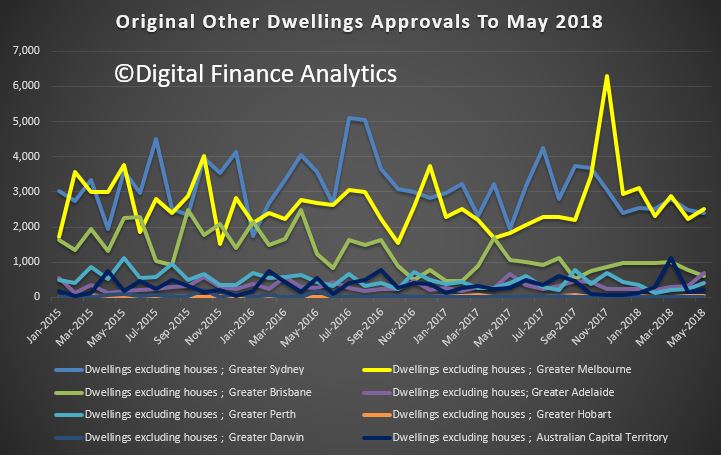

The number of dwellings approved in Australia fell by 1.5 per cent in May 2018 in trend terms, according to data released by the Australian Bureau of Statistics (ABS) today. At is all about a fall in unit approvals, with a notable decline in Melbourne. Expect more falls ahead, a further signs of trouble in the housing sector.

“Dwelling approvals have weakened in May, driven by a 2.6 per cent fall in private dwellings excluding houses,” said Justin Lokhorst, Director of Construction Statistics at the ABS.

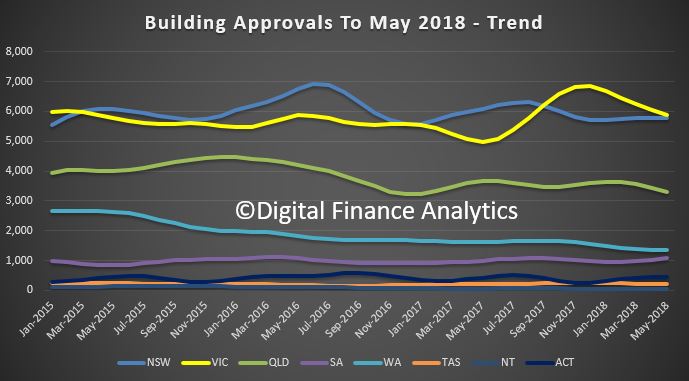

Among the states and territories, dwelling approvals in May fell in Queensland (4.2 per cent), Victoria (2.7 per cent), Tasmania (2.0 per cent) and Western Australia (0.8 per cent) in trend terms.

Dwelling approvals rose in trend terms in South Australia (4.3 per cent), Northern Territory (2.8 per cent) and Australian Capital Territory (1.5 per cent), and were flat in New South Wales.

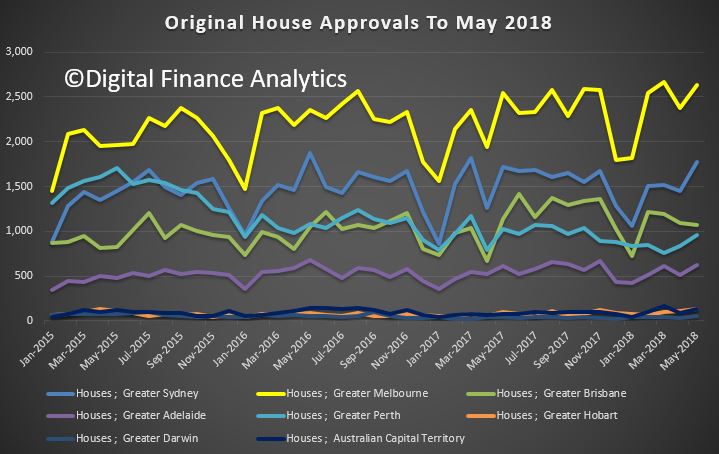

In trend terms, approvals for private sector houses fell 0.5 per cent in May. Private sector house approvals fell in Queensland (1.7 per cent), Western Australia (0.6 per cent), South Australia (0.4 per cent) and New South Wales (0.2 per cent). Private sector house approvals were flat in Victoria.

In seasonally adjusted terms, total dwellings fell by 3.2 per cent in May, driven by a 8.6 per cent decrease in private sector houses. Private sector dwellings excluding houses rose 4.3 per cent in seasonally adjusted terms.

The value of total building approved fell 0.7 per cent in May, in trend terms, and has fallen for seven months. The value of residential building fell 0.8 per cent, while non-residential building fell 0.4 per cent.

The HIA said:

“The market is cooling for a number of reasons including a slowdown in inward migration since July 2017, constraints on investor finance imposed by state and federal governments and falling house prices.

“A slowing in Australia’s population growth since June 2017 coincides with changes to visa requirements announced early last year. Since then Australia has experienced almost a year of slowing population growth.

“Finance has become increasingly difficult to access for home purchasers. Restrictions on lending to investors and rising borrowing costs have seen credit growth squeezed. Falling house prices in metropolitan areas have also contributed to banks tightening their lending conditions which have further constrained the availability of finance.