On 12 September, the European Central Bank (ECB) announced that it will introduce a two-tier system for banks’ reserve remuneration, exempting a portion of deposits in excess of the minimum reserve requirement from the negative deposit facility rate and giving that portion a 0% rate instead. The introduction of the tiering system on banks’ excess liquidity placed at the central bank is credit positive, says Moody’s.

This is because it will reduce the cost of holding liquidity at the ECB, providing a partial offset. They expect that the tiering mechanism will be particularly positive for banks with material excess liquidity.

The announcement comes as the ECB’s Governing Council announced that it would maintain its accommodative monetary policy stance given slowing economic conditions in Europe, persistent downside risks of global trade tensions and muted inflationary pressures. As a result, the ECB relaunched its Asset Purchase Programme and lowered the rate on the deposit facility by 10 basis points to negative 0.50% from negative 0.40%.

The tiering system on banks’ excess liquidity will moderate the negative effect of persistent low rates on banks in the euro area.

The two-tier system will exempt from negative interest a maximum volume of six times the banks’ minimum reserve requirement, therefore paid at 0%. The minimum reserve requirement and the non-exempted portion of the excess reserves will be charged 0.5%.

The tiering system will apply to all banks and start at the end of October 2019.

Since the aggregated minimum reserve requirement is currently €132 billion, approximately €786 billion (six times the aggregated minimum requirement) would be exempt from negative rates. The remaining reserves and deposit facility would be subject to the new deposit rate of negative 50 basis points, providing a net annual benefit to the euro area’s banks of about €2 billion relative to the status quo of negative 40 basis points on the full balance of €1.9 trillion liquidity placed at the ECB, equivalent to 0.8% of EU banks’ annual net interest income.

In 2018, Moody’s estimate that banks’ €1.8 trillion of total liquidity placed at the central bank at a rate of negative 0.40% cost around €7 billion. This compares with US banks, whose deposits placed with the US Federal Reserve in 2018, remunerated at a rate of 2.35%, represented a revenue of around €40 billion.

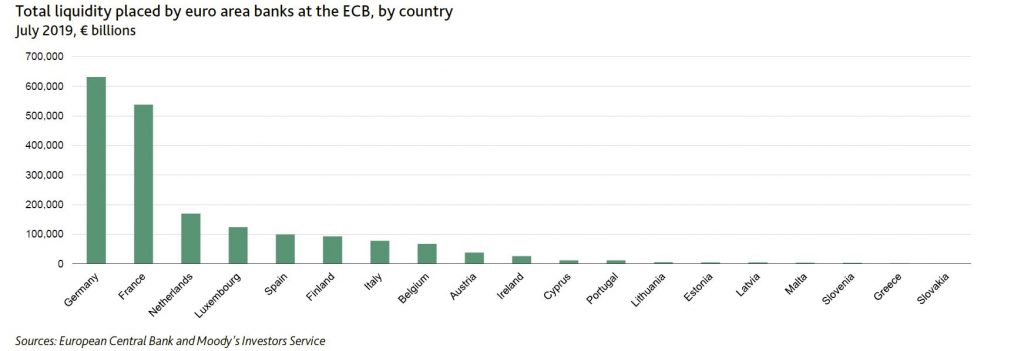

The introduction of a two-tier system for banks’ reserve remuneration will be particularly positive for German and French banks, whose liquidity holdings exceed the most their reserve requirements and account for more than 60% of the total liquidity placed at the ECB. The tiering mechanism that the ECB has introduced is similar to the mechanism implemented by Switzerland’s central bank, which also set exemption thresholds for deposit rates as a multiple of banks’ minimum reserve requirements.

Southern European banks will benefit to a lesser extent because they do not hold large amounts of excess reserves at central banks.

However, they will continue benefiting from the third series of targeted longer-term refinancing operations (TLTRO III). The ECB in June 2019 announced that banks could access two years of funding at 10 basis points above the ECB’s refinancing rate of 0%. On 12 September, the ECB removed the 10-basis-point surcharge and announced that TLTRO funding would extend to maturities of three years instead of two, conditions that will be particularly favourable for banking systems with large outstanding repayments from previous TLTRO programmes, such as those in Italy and Spain.