The Australian economy grew 0.2 per cent in seasonally adjusted chain volume terms in the December quarter 2018, according to figures released by the Australian Bureau of Statistics (ABS) today. But the heavy lifting was done by Government, leading to a 2.3% annual result. In seasonally adjusted terms we had two quarter falls in GDP per capita, so we are technically in recession on a per capital basis.

Actually the December data provided no major surprises as both the headline GDP and behaviour of consumers were broadly as anticipated. This is also true on housing, investment and public demand.

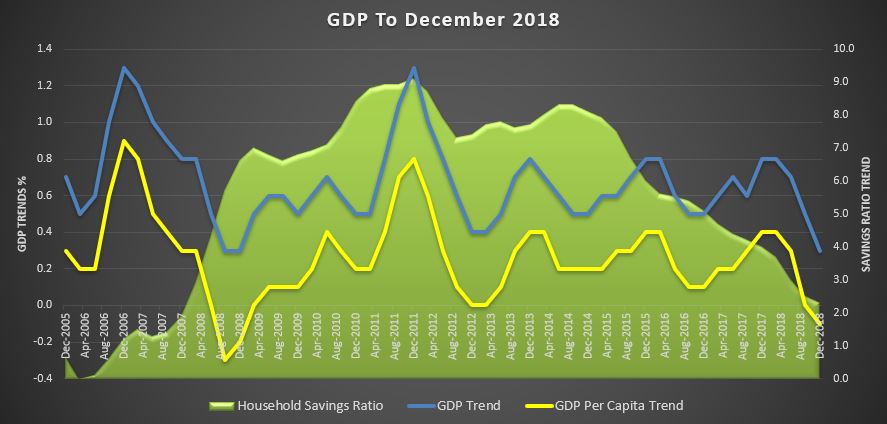

The trend data shows a fall in GDP, GDP per capital and in the savings ratio. Expect significant fiscal stimulus in the budget, and more after the election. This is an economy running of just a few cylinders.

New home building activity fell by 3.6 per cent during the final quarter of 2018 while home renovation activity declined by 3.1 per cent. Despite the softening at the end of 2018, activity was still higher than in the same quarter a year earlier.

Here is the ABS summary:

AUSTRALIAN ECONOMY GREW BY 0.2%

Australia’s gross domestic product (GDP) grew by 0.2% in the December quarter 2018, following a 0.3% rise in the September quarter. The Australian economy grew 2.3% through the year.

GROSS DOMESTIC PRODUCT, Volume measures: Seasonally adjusted

CONTINUED STRENGTH IN GOVERNMENT EXPENDITURE

Government final consumption expenditure rose 1.8% in the December quarter 2018 and remains strong through the year at 5.6%. National non-defence (4.2%) was the main contributor to growth in the quarter, due to increases in social benefits to households from continued government spending on disability, health and aged care services. State and local government expenditure increased 1.1% driven by rises in non-employee expenses.

GOVERNMENT FINAL CONSUMPTION EXPENDITURE, Volume measures: Seasonally adjusted

SUSTAINED GROWTH IN INVESTMENT BY GENERAL GOVERNMENT

General government gross fixed capital formation increased 2.7% this quarter. The rise was driven by state and local general government (6.3%), with continued strength due to public infrastructure investment. This was offset by national general government, which fell 5.7% following defence purchases in the September quarter. Through the year general government gross fixed capital formation has risen 9.0%, again reflecting the high number of public infrastructure projects occurring across the country.

GENERAL GOVERNMENT GROSS FIXED CAPITAL FORMATION, Volume measures: Seasonally adjusted

BUILD UP IN INVENTORIES

Inventories held by business increased $685m in the December quarter 2018.

CHANGE IN INVENTORIES – Selected industries, Volume measures: Seasonally adjusted

GROWTH IN HOUSEHOLD CONSUMPTION SLOWS

Household final consumption expenditure increased 0.4% in the December quarter 2018, with through the year growth moderating to 2.0%. The growth in household consumption was driven by spending on health, clothing and footwear, and hotels, cafes and restaurants. There were falls in household spending for electricity, gas and other fuel, purchases of vehicles and furnishings and household equipment.

HOUSEHOLD FINAL CONSUMPTION EXPENDITURE, Volume measures: Seasonally adjusted

BROAD BASED GROWTH IN COMPENSATION OF EMPLOYEES

Compensation of Employee (COE) increased 0.9% in December quarter 2018 due to strength from both the private and public sector. Through the year COE increased 4.3% and with growth above its five year December average of 3.4% growth.

COMPENSATION OF EMPLOYEES, Current prices: Seasonally adjusted

HOUSEHOLD SAVING RATIO INCREASED MARGINALLY

The household saving ratio rose to 2.5% in the December quarter 2018. This slight pick up was due to modest growth in household disposable income alongside lower growth in household spending. The growth in gross disposable income was due to continued growth in compensation of employees as well as an increase in insurance claims received by households.

HOUSEHOLD SAVING RATIO, Current prices: Seasonally adjusted

Chief Economist for the ABS, Bruce Hockman, said: “Growth in the economy was subdued, reflecting soft household spending and a decline in dwelling investment. The approvals for dwelling construction indicate that the decline in dwelling investment will continue.”

Household spending grew by 0.4 per cent, reflecting a continuation of modest spending in recent quarters. Investment in dwellings fell 3.4 per cent.

Falls in private investment dampened growth in the quarter. This was consistent with the decline in construction industry value added, falling 1.9 per cent. Services industries supporting construction activity detracted from growth with professional scientific and technical services industry value added declining for the first time in three years. Mining investment fell in the quarter as significant projects transitioned from the construction to the production phase. This is reflected in oil and gas production, which grew 7.7 per cent.

Public demand sustained growth in the quarter. Public investment remained at high levels with State and Local government growth of 6.3 per cent reflecting continued work on a number of large infrastructure projects. Government final consumption expenditure grew 1.8 per cent, with ongoing expenditure in health, aged care and disability services. This investment translates to ongoing strength from the healthcare industry, which remains the largest contributor to economic growth.

Mr Hockman said “As the economy transitions out of the mining boom, investment has remained strong with major public works driving growth around Australia.”