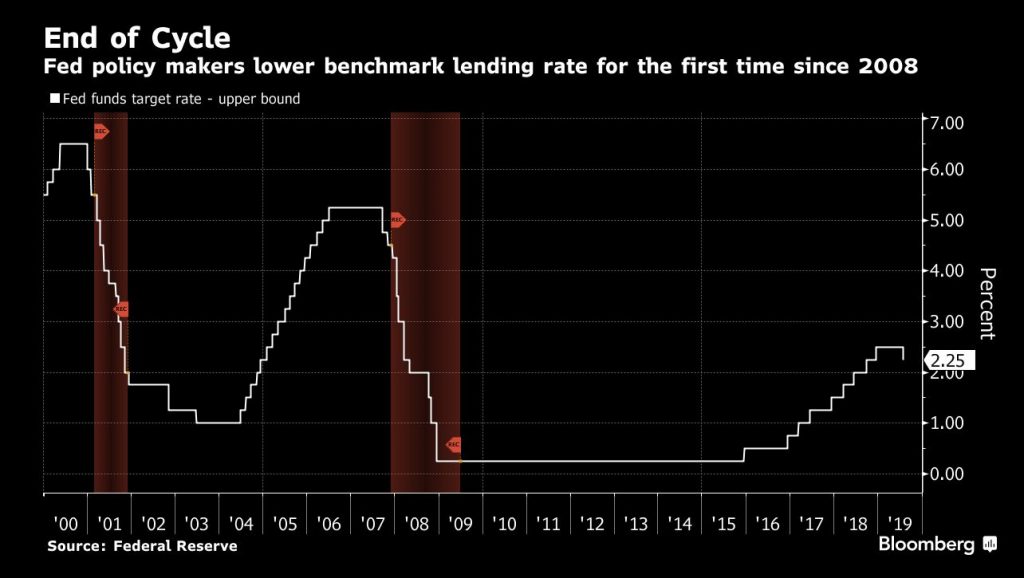

The Fed cut interest rates on Wednesday for the first time since the financial crisis, as had been expected, citing slowing business investment and below target inflation.

In fact, U.S. President Donald Trump had been calling for a rollback, making unprecedented attacks on the central bank and Chair Jerome Powell, which raises questions about its independence.

In reaction, following the first cut in a decade, the Dow and S&P 500 suffered their biggest daily percentage drops in two months. But Fed Chair Jerome Powell dampened expectations for further cuts going forward, calling it a “mid-term policy adjustment.” So, the Fed appears to be in no rush to continue with easing, unless new data supports the need to move. Two officials dissented to this cut, which therefore may not be the part of an easing cycle.

This disappointed the market as it means asset prices may not get so stretched. At the close in NYSE, the Dow Jones Industrial Average lost 1.23%, while the S&P 500 index lost 1.09%, and the NASDAQ Composite index lost 1.19%.

The CBOE Volatility Index, , was up 15.64% to 16.12 a new 1-month high.

Meantime, the U.S. Treasury Department announced plans to maintain record debt sales as Congress and Trump continue a spending frenzy that’s widening the deficit even as economic growth remains solid.

Information received since the Federal Open Market Committee met in June indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although growth of household spending has picked up from earlier in the year, growth of business fixed investment has been soft. On a 12-month basis, overall inflation and inflation for items other than food and energy are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower the target range for the federal funds rate to 2 to 2-1/4 percent. This action supports the Committee’s view that sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective are the most likely outcomes, but uncertainties about this outlook remain. As the Committee contemplates the future path of the target range for the federal funds rate, it will continue to monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion, with a strong labor market and inflation near its symmetric 2 percent objective.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

The Committee will conclude the reduction of its aggregate securities holdings in the System Open Market Account in August, two months earlier than previously indicated.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; James Bullard; Richard H. Clarida; Charles L. Evans; and Randal K. Quarles. Voting against the action were Esther L. George and Eric S. Rosengren, who preferred at this meeting to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent.

Mr. North,

– The comment below is not related to this post. I hope the information provided in the video

https://www.youtube.com/watch?v=4Hu2GoBSVA0

is new for you.

– In this video Robbie Berwick and Philip Soos discuss – among many other financial topics – how banks are “playing games” with the Loan-to-Value Ratio. With applying some tricks the banks are able to to push a LVR ratio of a loan from 90% down to 33%. Mr. Soos explains it much better in the video than I can do in this limited amount of space. Watch the video from (around) the 41 minute mark onwards. In that remaining part of that video Mr. Soos explains how this LVR game is being played by the australian banks and how it benefits those same banks. The banks now have to hold a (much) smaller % of capital against that one loan.

– Mr. Joe Wilkes also discussed the low LVR ratio (in New Zealand) in a previous video with DFA and had some thoughts on why this was happening. Perhaps the info in the video also provides Mr. Joe Wilkes a better explanation on why those LVR in New Zealand are so low.

Thanks – yes we discussed this in a recent post (with Steve Keen).

– The FED (like the BoC, BoE, RBA, RBNZ, etc.) lowered rates because the 3 month T-bill rate has been falling since early 2019. When that rate falls more then the FED will cut even more.

– Even Alan Greenspan admitted in 2007 that the FED follows the market rates. He was asked why the FED left rates so low between say 2001 and 2004. Greenspan’s answer was something along the lines of “It was the market who did it”.