The news from the New York Federal Reserve indicates that the “one-off” spike in repo rates is more structural than many thought – many pundits blamed the timing of tax payments and the like.

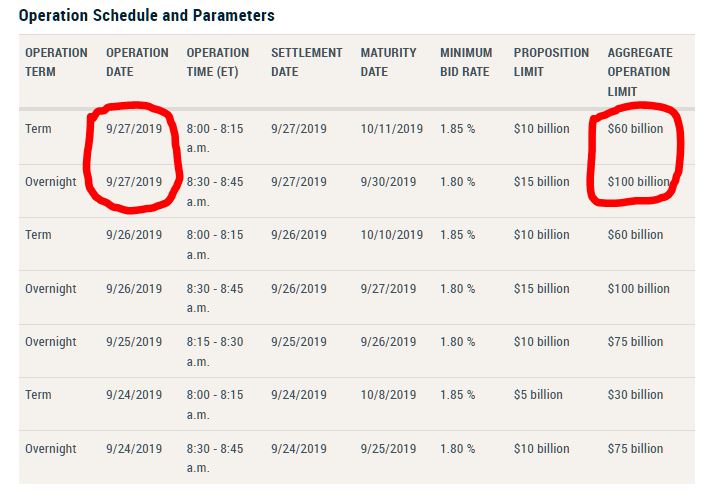

But the latest tranches of both the term and overnight operations are now at $60 billion and $100 billion respectively. All up this is now ~$250 billion in funding, and counting. And the target rate is still on the high side, and the offers over subscribed.

If this continues then the Fed’s balance sheet will be growing again, and fast (remember when they were planning to shrink?).

In essence, more of the US economy will be supported by a larger FED, a larger and market distorting Fed to boot.

But the underlying question, still open, is, are these measures signs of a deeper malaise, signalling banks are not trusting some of their counter-parties? Without constant liquidity support will the markets fall over? And in the light of events over the past week plus, do the remarks from the Fed pass muster? We think not. This is significantly more serious than they admit.