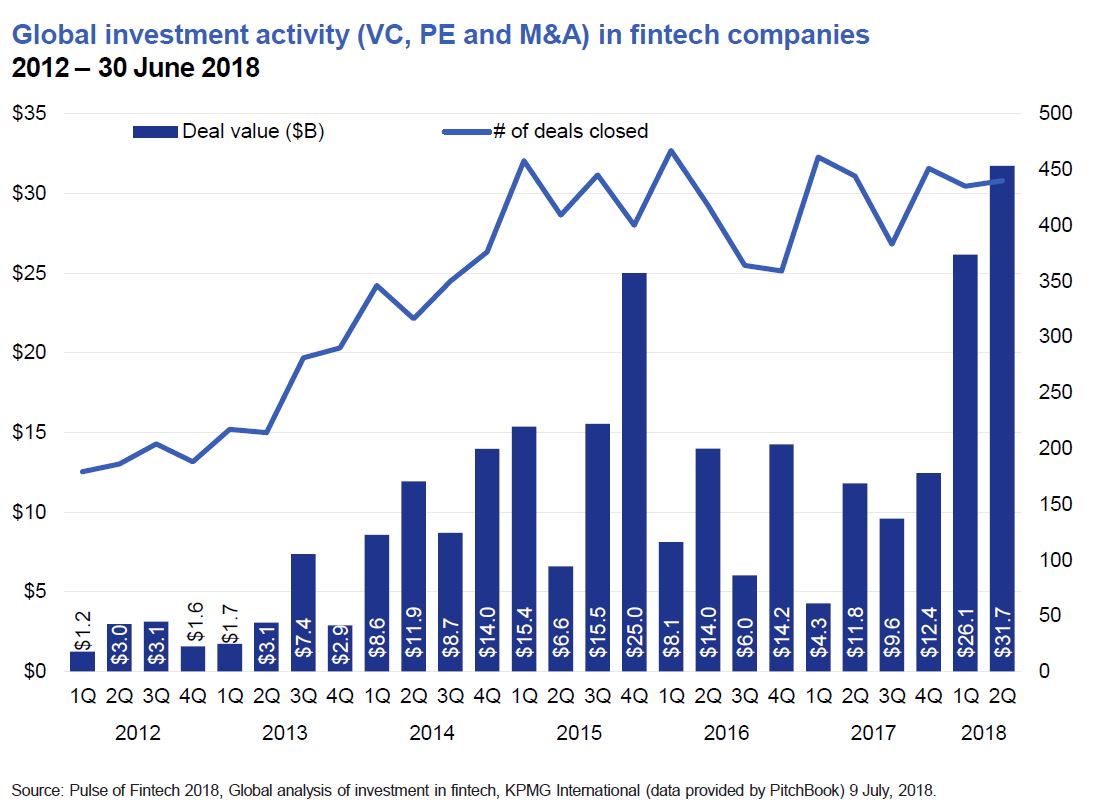

According to the KPMG’s The Pulse of Fintech 2018, 2018 started with a bang for the fintech market, with overall investment across venture capital (VC), private equity (PE) and mergers and acquisitions (M&A) deals at mid-year already well above 2017’s total investment results. The sharp increase in activity was driven in part by two massive deals: the record-setting $14 billion raise by Ant Financial during Q2’18 and Vantiv’s acquisition of WorldPay in Q1’18 for $12.9 billion.

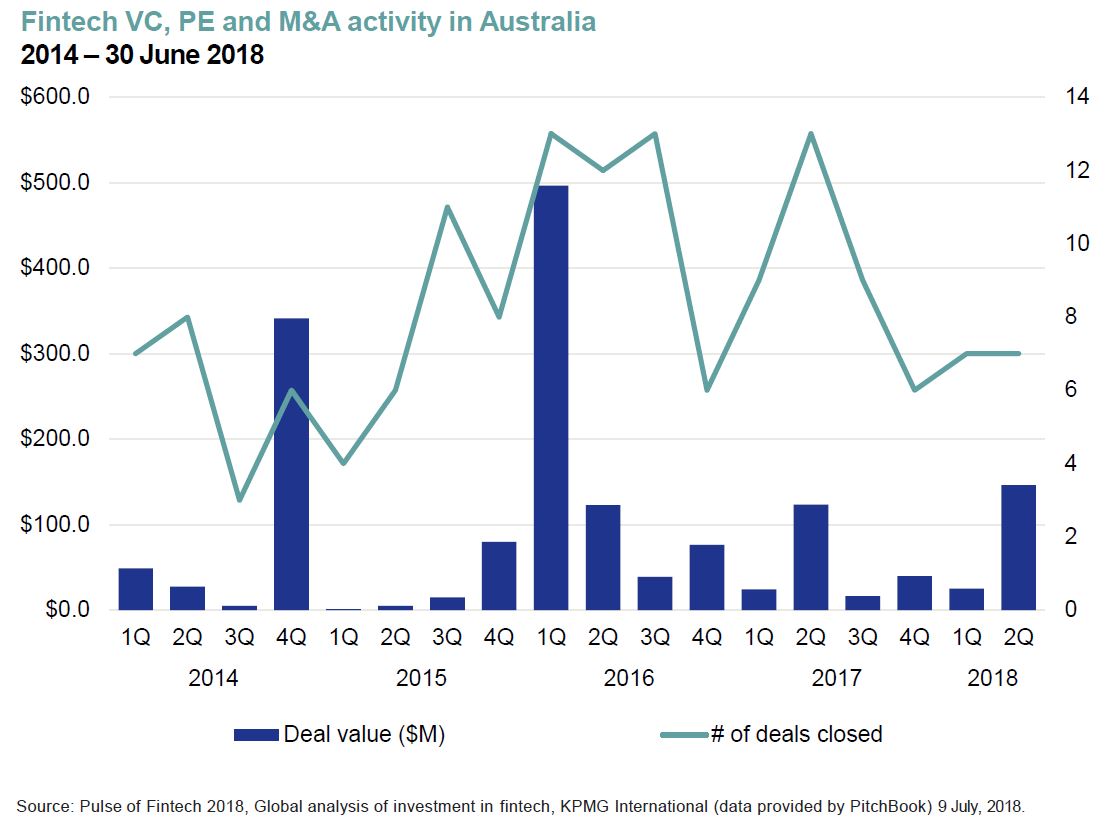

Across the Asia Pacific, momentum also accelerated, although Australia was at the back of the pack with just 7 deals in each of the first two quarters of 2018.

Notwithstanding the two outlier deals, fintech market activity worldwide gained momentum during the first half of the year as the geographic diversity and reach of fintech investment continued to expand. Brazil, for example, gained some prominence earlier this year as Nubank joined the fintech unicorn club. France, Switzerland, South Korea and Japan also saw significant fintech deals — extending investment well beyond traditional fintech leaders like the US, UK, China and India.

In the more mature fintech areas of payments and lending, dominant market players continued to emerge over the first 6 months of 2018, attracting larger and larger deal sizes. Meanwhile, a broader range of companies focused on newer areas of fintech innovation, such as artificial intelligence (AI) and data analytics, also attracted attention from fintech investors.

Regulatory issues have been a hot button topic for corporate and other fintech investors so far this year, particularly in Europe, as a result of the implementation of Payment Services Directive 2 (PSD2) and General Data Protection Regulation (GDPR). The increasing focus on managing regulatory requirements and compliance contributed to an increase in funding for regtech companies. In just 6 months, VC funding to regtech companies has already exceeded regtech funding raised during all of 2017.

2018 year-to-date funding has already exceeded total annual regtech funding in every year previous except 2016. The US and UK attracted the majority of this funding. At a technology level, regtech investments have been quite varied — from a $25 million raise by UK-based CloudPay — a payments processing platform compliant with specific regulations, to $38 million raised across two funding rounds by US-based Harbor — a blockchain-based compliance platform that tokenizes private securities for trading.

Regtech investment is still relatively immature, with approximately half of total funding raised by seed and early stage companies. In the most mature markets, there have also been a small number of mid-stage investments this year, including Series C raises by CloudPay and Tipalti.

Over the next 12 to 24 months, we expect to see investment in regtech to grow rapidly — particularly in areas like AI, Know your Customer (KYC) and Know your Data (KYD).

Blockchain continued to draw a significant amount of attention from investors in Q1 and Q2’18, although investments typically focused on more experienced companies and consortia looking to obtain additional rounds of funding rather than on new market entrants.

Investor interest in blockchain was not limited to one jurisdiction. Good sized funding rounds were seen during the first half of the year, including $100 million+ rounds to R3 and Circle Internet Finance in the US and $77 million to Ledger in France. The US was particularly active on the blockchain front, with total investment in the first half of the year already exceeding the total seen in 2017.

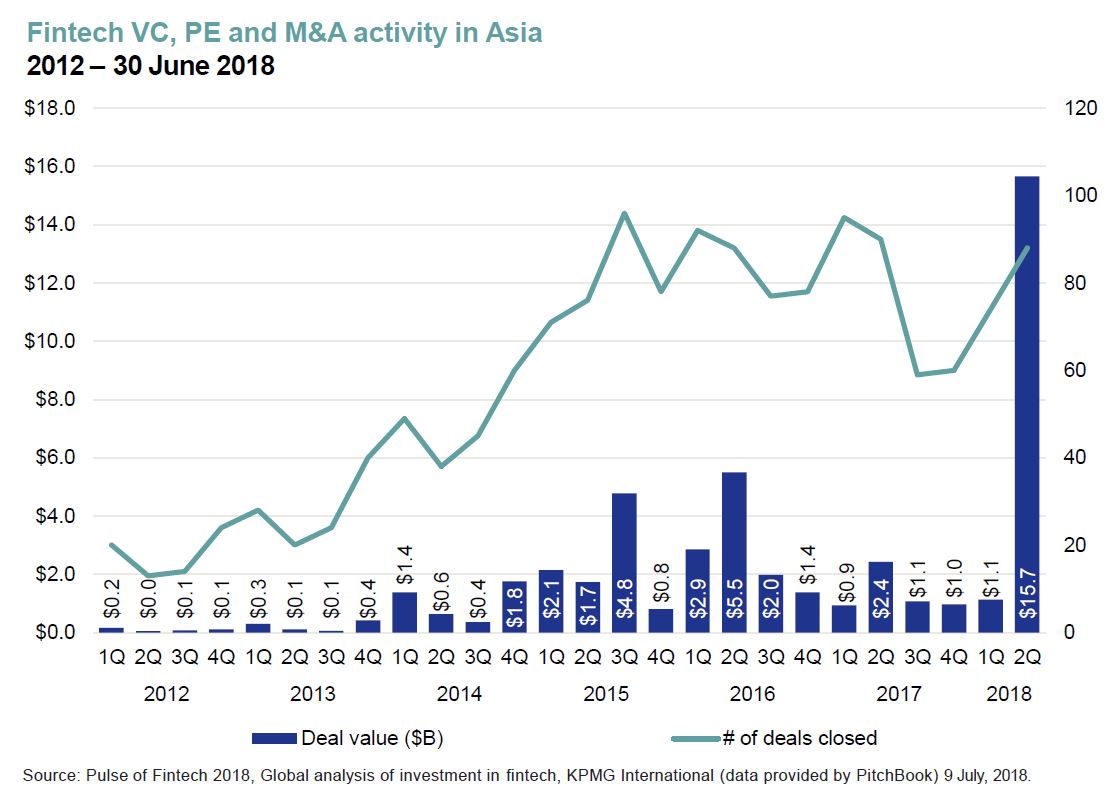

Asia Pacific.

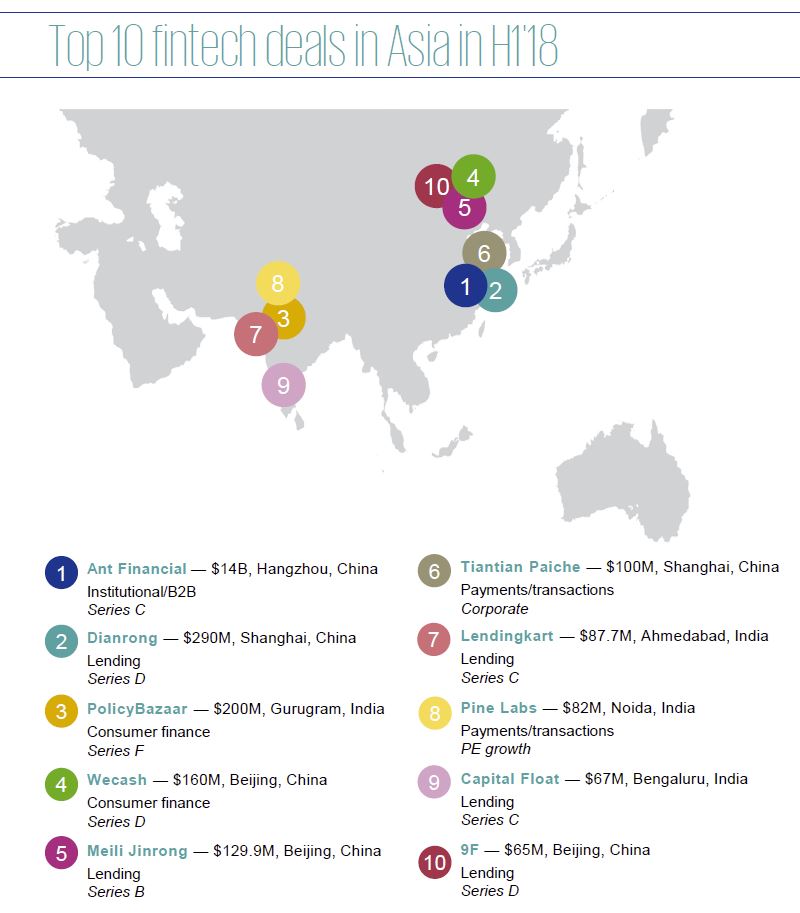

Ant Financial’s record-shattering $14 billion Series C funding round in Q2’18 lifted Asia’s mid-year fintech investment to a massive $16.8 billion compared to $5.4 billion in all of 2017. The single deal accounted for over half of the $23 billion in VC fintech funding seen globally during the 6-month period.

Excluding this massive outlier deal, Asia still saw strong fintech investment, with quarter-over-quarter increases in overall fintech investment in India, Australia and Singapore from Q1’18 to Q2’18. The number of deals in Asia also rose at each deal stage during both Q1 and Q2’18.

Fintech investment in China strengthened in the first half of 2018 compared to the end of 2017. In addition to Ant Financial’s massive deal, China saw four other $100 million+ megarounds—including $290 million to Dianrong, $160 million to WeCash, $130 million to MeiliJinrong, and $100 million to TiantianPaiche. The majority of banks in China have been expanding their focus to digital and developing transformation strategies. This has led to an increase in B2B focused fintechsable to enable banking transformation. Banks have invested in myriad areas, including blockchain, big data and AI.

Australia.

Australia.

Australia appears to be a Fintech backwater, with none of the Asia Pacific top 10 deals being done in the country. That said, in the first half of 2018, Australia’s financial regulator provided its first restricted ADI license to a digital bank, Volt Bank14, although more are expected to be issued in the coming quarters. The purpose of the new license is to support digital banks entering the market and to encourage more competition.