We continue our analysis of the latest household survey results, with a deep dive into the motivations and barriers of first time buyers, whom both industry and government hope will pick up the slack as property investors flee.

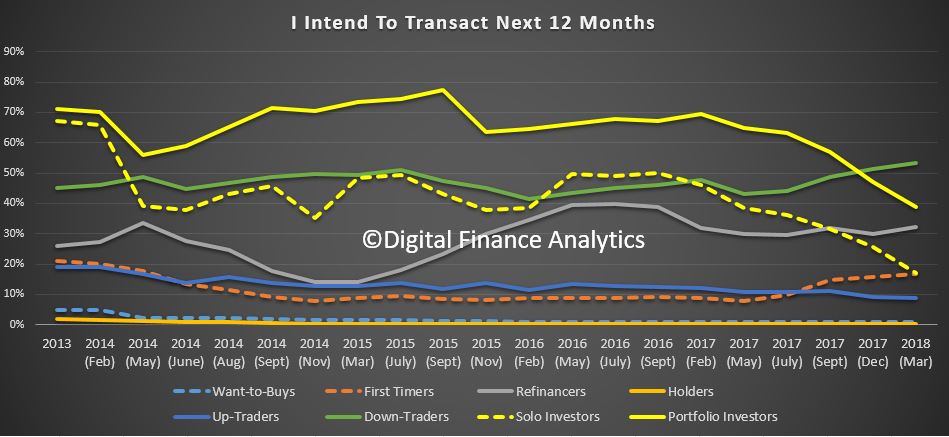

We showed there was an increase in the number of first time buyers seeking property and saving to buy, and their intention to transact is a little higher. That said, the number of first time buyers is lower, at around 150,000 than the number of investors they are replacing at 650,000, so net demand will fall at a time when more new builds are coming on stream, something like 150,000 over the next 1-2 years.

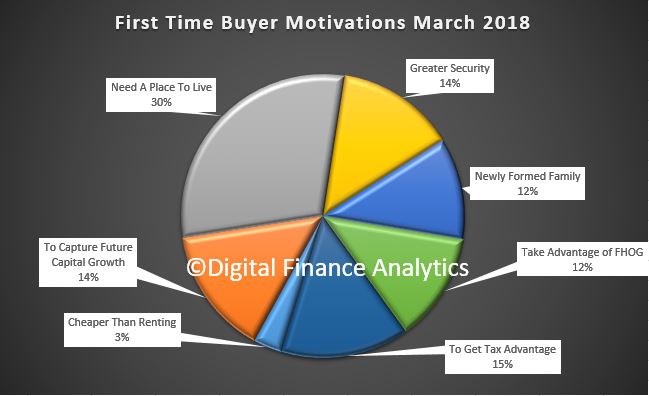

Lets look at first time buyer relative priorities and motivations. Around 30% say the reason to buy relates to finding a place to live, while 15% said it was to gain a tax advantage, 14% to gain future capital growth, and 12% to access the first home owners grants, which some states are offering. 14% said it was to gain greater security (as opposed to short term renting) and 12% said it was because of a newly formed family. Only 3% said it would be cheaper than renting. More are getting help from the Bank of Mum and Dad, as we discussed recently.

Lets look at first time buyer relative priorities and motivations. Around 30% say the reason to buy relates to finding a place to live, while 15% said it was to gain a tax advantage, 14% to gain future capital growth, and 12% to access the first home owners grants, which some states are offering. 14% said it was to gain greater security (as opposed to short term renting) and 12% said it was because of a newly formed family. Only 3% said it would be cheaper than renting. More are getting help from the Bank of Mum and Dad, as we discussed recently.

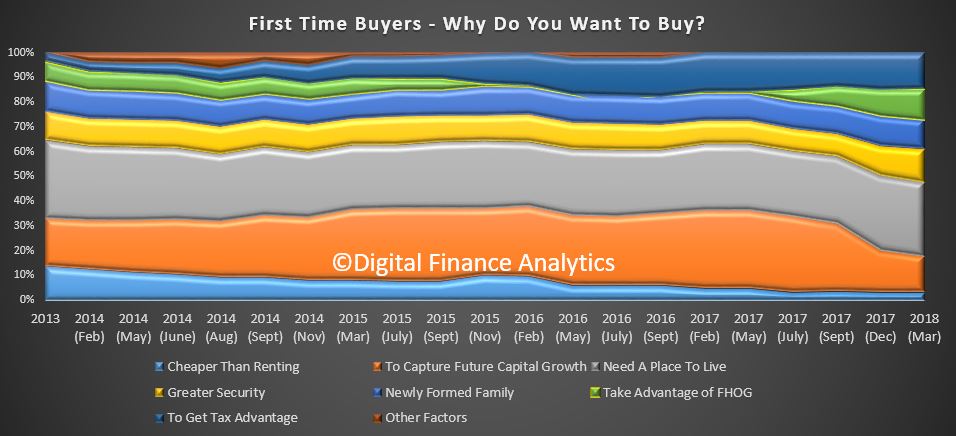

We can also look at trends over time, and the proportion who think capital growth will occur has fallen by half in the past year, while the number seeking to take advantage of the first home owner grants has started to rise (mainly thanks to new state-based initiatives). The other factors have remained pretty static, through more are seeking tax advantages and greater financial security.

We can also look at trends over time, and the proportion who think capital growth will occur has fallen by half in the past year, while the number seeking to take advantage of the first home owner grants has started to rise (mainly thanks to new state-based initiatives). The other factors have remained pretty static, through more are seeking tax advantages and greater financial security.

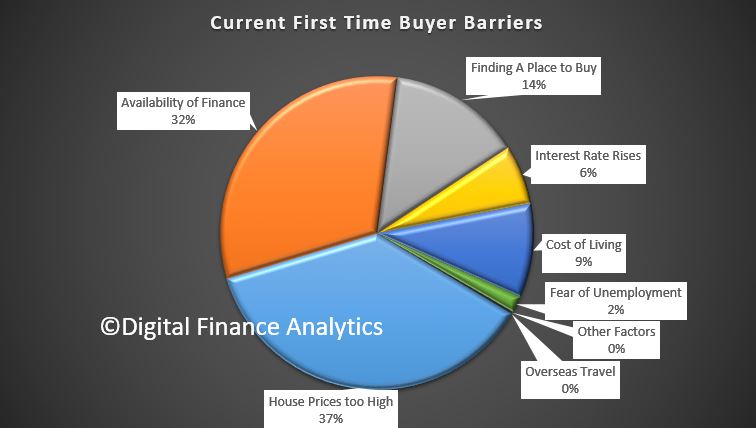

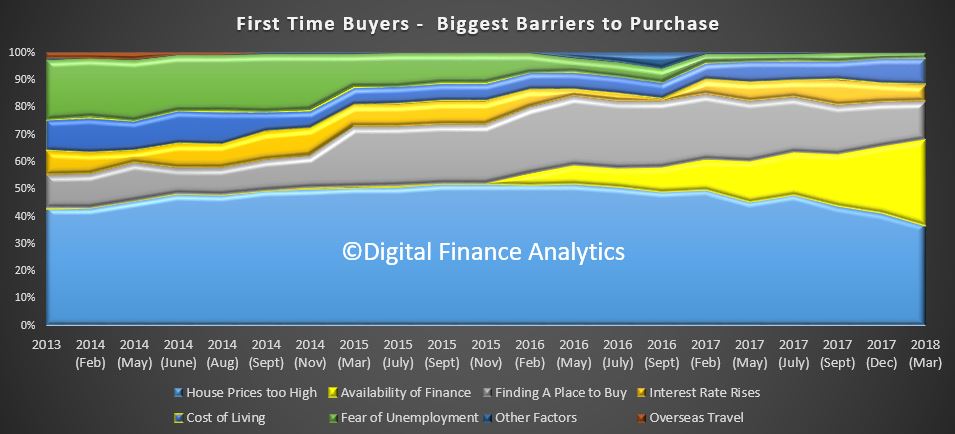

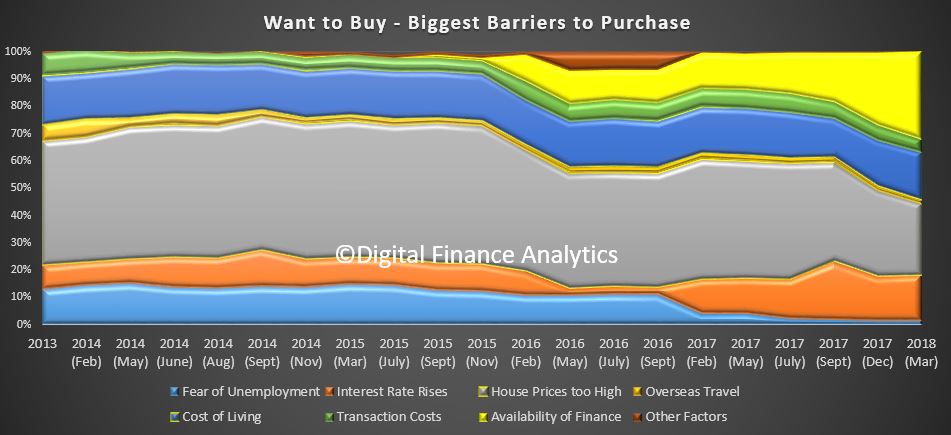

Turning to the barriers to purchase, the first and most significant stumbling block is that home prices are still too high (37%). Next is the availability of finance at 32%, followed by finding a place to buy at 14%, risks relating to interest rate rises 6% and costs of living 9%. Fear of unemployment is a low 2%, and other factors, including overseas travel hardly registered.

Turning to the barriers to purchase, the first and most significant stumbling block is that home prices are still too high (37%). Next is the availability of finance at 32%, followed by finding a place to buy at 14%, risks relating to interest rate rises 6% and costs of living 9%. Fear of unemployment is a low 2%, and other factors, including overseas travel hardly registered.

Turning to the trend data we see the most significant factor is the growing proportion who are unable to get funding to purchase. Back in 2015, this hardly registered, whereas now one third of prospective purchasers cannot get funding. This is a reflection of the ever tighter lending standards currently in play, despite low attractor interest rates.

Turning to the trend data we see the most significant factor is the growing proportion who are unable to get funding to purchase. Back in 2015, this hardly registered, whereas now one third of prospective purchasers cannot get funding. This is a reflection of the ever tighter lending standards currently in play, despite low attractor interest rates.

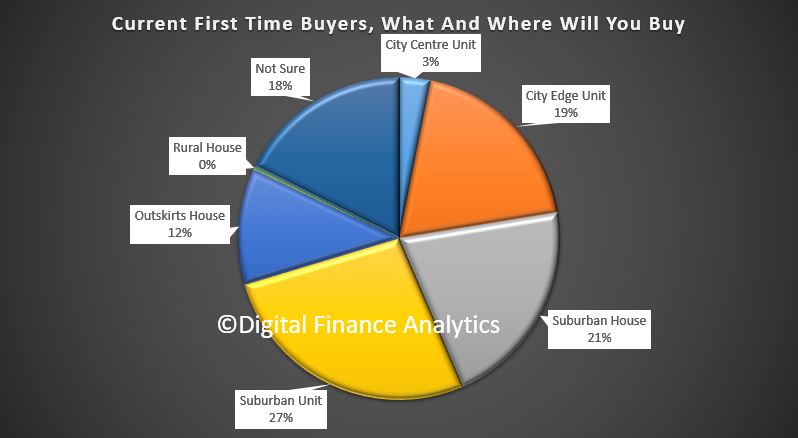

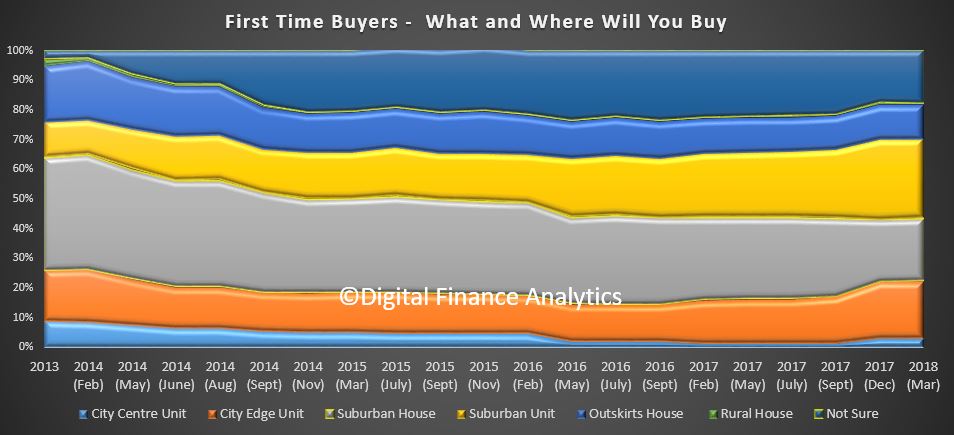

Next we turn to what type of property, and in which locations first time buyers are looking.

Next we turn to what type of property, and in which locations first time buyers are looking.

Around half of all first time buyers are expecting to purchase a unit or apartment, as opposed to a house. This continues the trend of recent years. 27% will be seeking a suburban unit, 19% a city edge unit and 3% a city centre unit. The proportions are higher in the main east coast states, with Sydney, Melbourne and Brisbane all registering growing demand for units, thanks to price and affordability pressure.

The trend data shows a steady rise in unit purchases.

The trend data shows a steady rise in unit purchases.

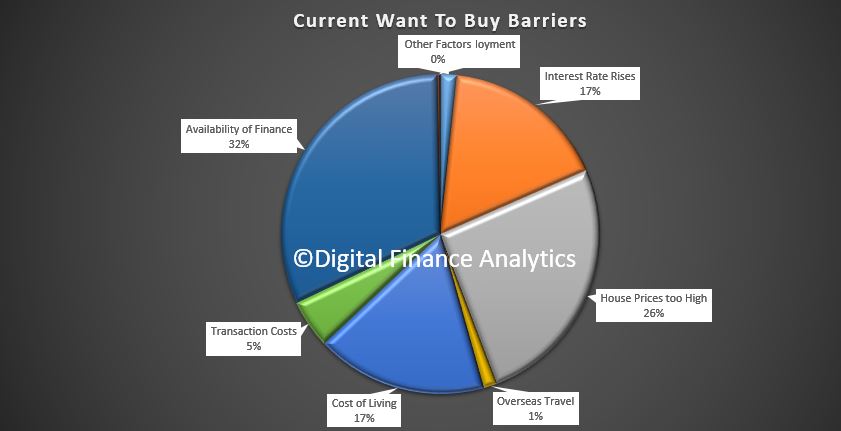

Just to round out our survey results, those wanting to buy find that availability of finance is the most significant barrier (32%), followed by high home prices (26%) and costs of living pressures (17%). Concerns about rising interest rates also came it at 17%.

Just to round out our survey results, those wanting to buy find that availability of finance is the most significant barrier (32%), followed by high home prices (26%) and costs of living pressures (17%). Concerns about rising interest rates also came it at 17%.

You can see in the trends how concerns relating to funding and costs of living are rising.

You can see in the trends how concerns relating to funding and costs of living are rising.

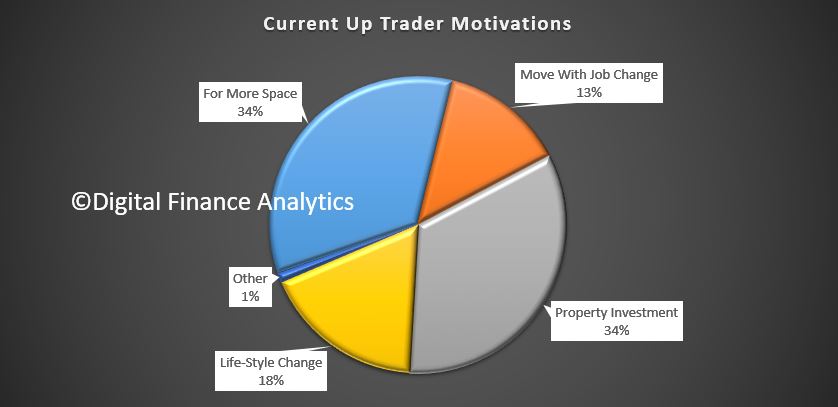

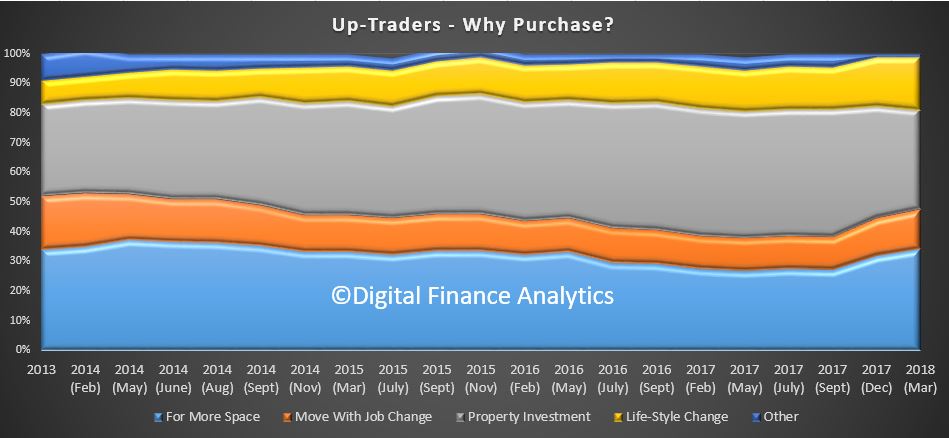

Turning to those seeking to trade up, we see a pivot from property investment (34%) and consequential capital growth to finding more space to live (34%). Life style changes at 18% and job changes also figure (13%).

Turning to those seeking to trade up, we see a pivot from property investment (34%) and consequential capital growth to finding more space to live (34%). Life style changes at 18% and job changes also figure (13%).

The trends are clear, it is now more about space, and less about property investment. There are a smaller number of households in this category now, at around 600,000, so they will not be able to blot up all the available property, including those previously taken by investors.

The trends are clear, it is now more about space, and less about property investment. There are a smaller number of households in this category now, at around 600,000, so they will not be able to blot up all the available property, including those previously taken by investors.

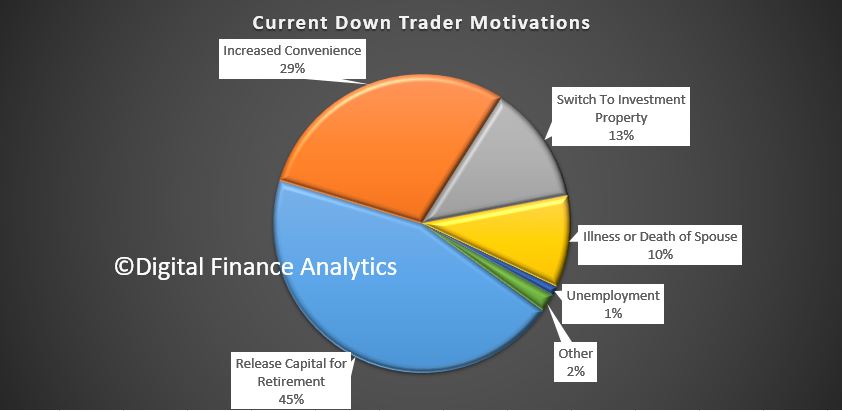

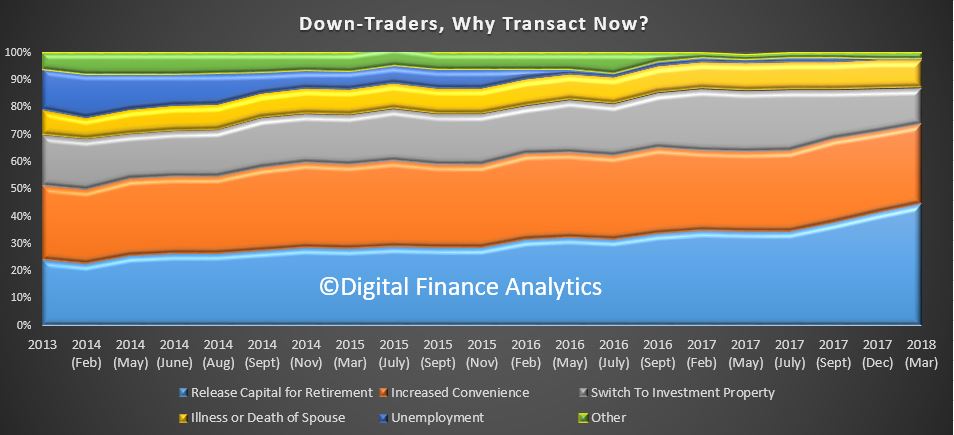

Down traders are being driven more strongly by the urge to release capital (45%), whilst the intention to switch to an investment property is now lower (13%). Indeed there is an air panic, for fear of larger price fall later. One reason why more property is coming onto the market. Increased convenience (29%) and illness or death of spouse also figure. There are more than 1.2 million households in this group, so their need to sell will help to increase the supply of properties for sale, and so drive prices lower, especially at the upper end of the market.

Down traders are being driven more strongly by the urge to release capital (45%), whilst the intention to switch to an investment property is now lower (13%). Indeed there is an air panic, for fear of larger price fall later. One reason why more property is coming onto the market. Increased convenience (29%) and illness or death of spouse also figure. There are more than 1.2 million households in this group, so their need to sell will help to increase the supply of properties for sale, and so drive prices lower, especially at the upper end of the market.

The trends are pretty clear, with a greater concern to release capital a less of a focus on investment property purchase.

The trends are pretty clear, with a greater concern to release capital a less of a focus on investment property purchase.

Put all the data together, and we conclude that despite strong migration, net demand for property will ease in the months ahead, with a consequential fall in values in many areas.

Put all the data together, and we conclude that despite strong migration, net demand for property will ease in the months ahead, with a consequential fall in values in many areas.

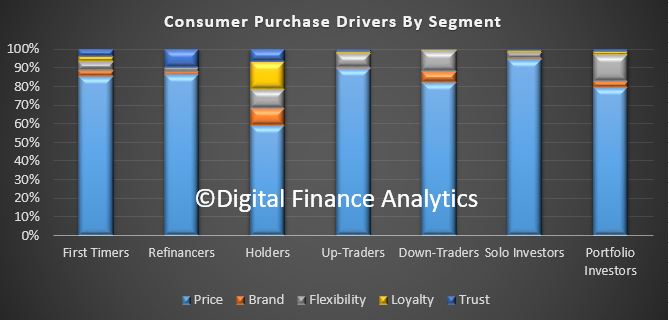

And finally, we also examined the purchase drivers across our household segments, and as you may have guessed, for many, price will be the critical determinate of purchase, whereas elements such as brand recognition, trust and flexibility were rated much lower. No surprise then that lenders are still offering amazing attractor rates to capture new business, despite pricing up their back books to maintain margin. As the Productively Commission highlighted, loyalty is not being rewarded by the industry. We happen to think this may change as the markets evolve and demand for credit slows.

We will incorporating these findings into our latest Core Market Model and the next edition of the Property Imperative report, due out in about a month.

We will incorporating these findings into our latest Core Market Model and the next edition of the Property Imperative report, due out in about a month.