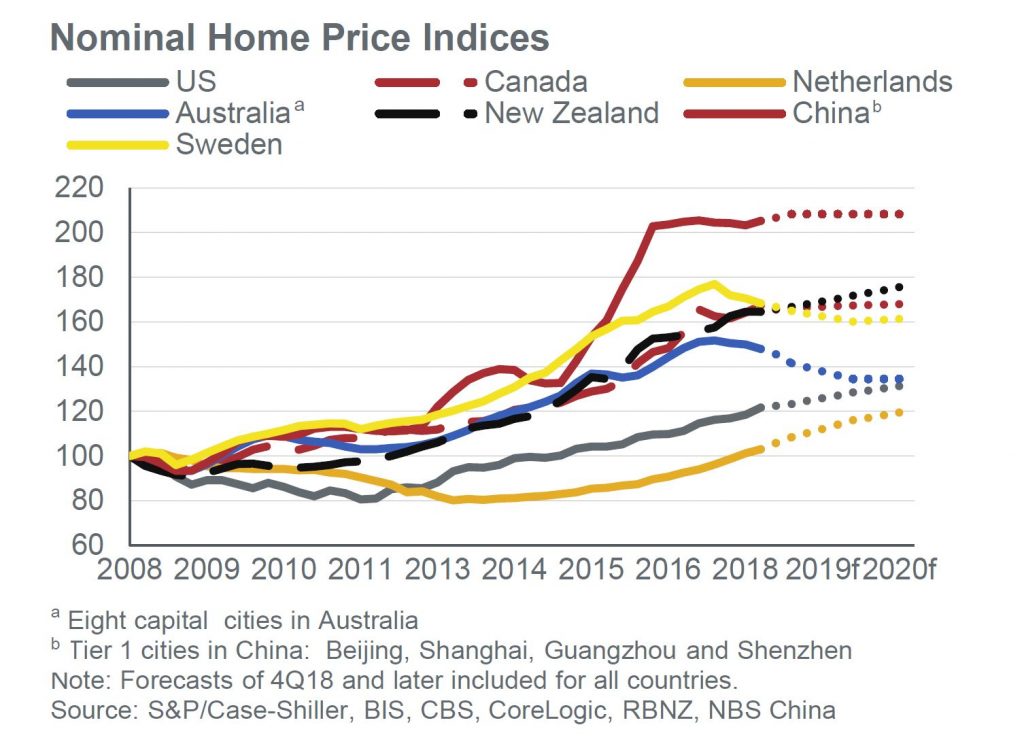

Fitch published their Global Home Housing And Mortgage Outlook for 2019. The story appears to one of falling values in some major centres and more uncertainty economically and politically. For Australia, they expect a national peak-to-trough home price drop of 12% in Australia with Sydney and Melbourne posting larger declines in 2019.

They say overheated home prices in several major cities have been a key theme in recent years. But prices fell or stalled in 2018 in Melbourne, Stockholm, Sydney, Toronto and Vancouver due to government actions to reduce foreign purchases, macro-prudential measures and/or stretched affordability. Fitch Ratings forecasts home prices to fall in Australia and Sweden in 2019 before stabilising in 2020, modest corrections in China and South Korea, and stalled growth in Canada. We have also seen regulators actively managing markets through the tightening and loosening of lending rules.

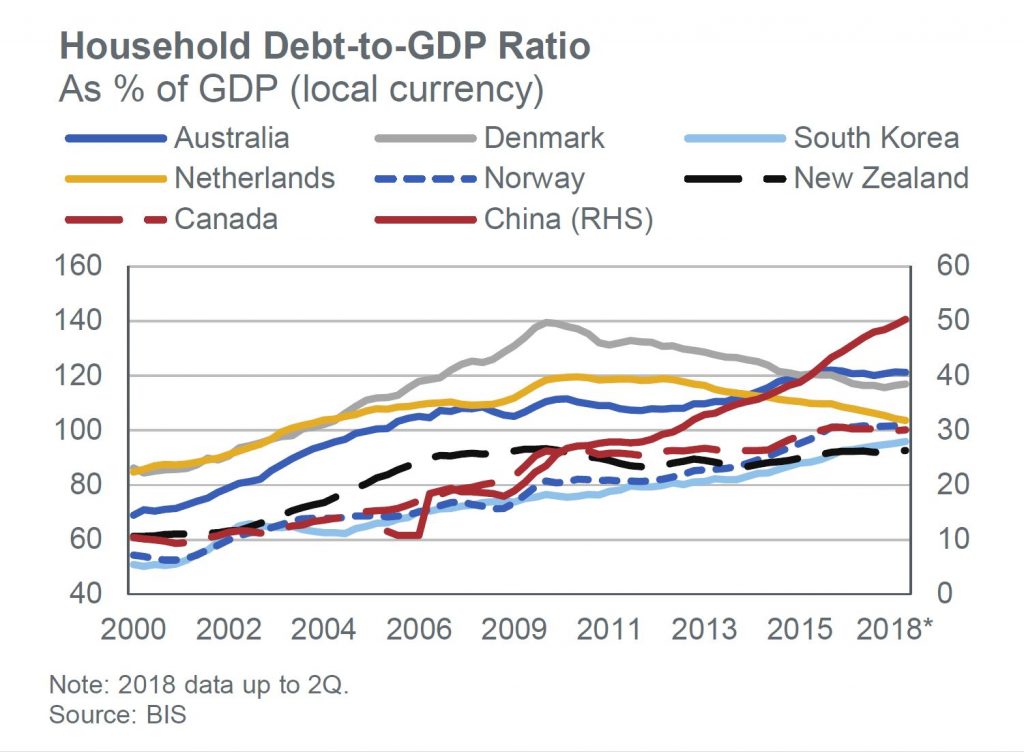

High Household Debt Amplifies Risks

Fitch says household debt-to-GDP ratios are at or over 100% in Australia, Canada, Denmark, the Netherlands and Norway, and over 85% in New Zealand, South Korea, Sweden and the UK. High household debt makes the wider economies more vulnerable to shocks in the financial sector and borrowers more exposed to downturns. Household debt growth has stalled in Denmark and the Netherlands due to affordability constraints and regulatory intervention. The household debt-to-GDP ratios in Australia,

Canada and Norway have stabilised after sharp growth while they have continued to grow in China and South Korea, albeit at a slower pace.

Political Uncertainty Affects Housing

Fitch highlights several cases of political risks in the report, including Brexit, a political appointment to oversee Fannie Mae and Freddie Mac, and new governments in Latin America. Their impact varies: our no-deal Brexit scenario analysis suggests price drops in the UK and much slower price growth in Ireland while uncertainty is already contributing to price falls in London; less government participation in the US mortgage market could

increase mortgage pricing and lead some lenders to reduce product offerings; in Brazil, there is uncertainty regarding the new government’s ability to enact market-friendly policies that would support home price growth.

Cracks Appear in Economic Growth Outlook

Fitch notes in its Global Economic Outlook that cracks are starting to appear in the global growth picture, with China and the eurozone slowing, further rate increases expected in the US, stubbornly low core inflation in the eurozone and Japan, and the dollar’s strength putting pressure on emerging markets.

These factors contribute to Fitch’s view that economic growth is slowing, albeit to a moderate degree and in many cases from a position of strength. However, our macroeconomic outlooks to 2020 for the 24 countries in this report are still mainly stable or improving, which supports our mostly stable housing and mortgage market evaluations.

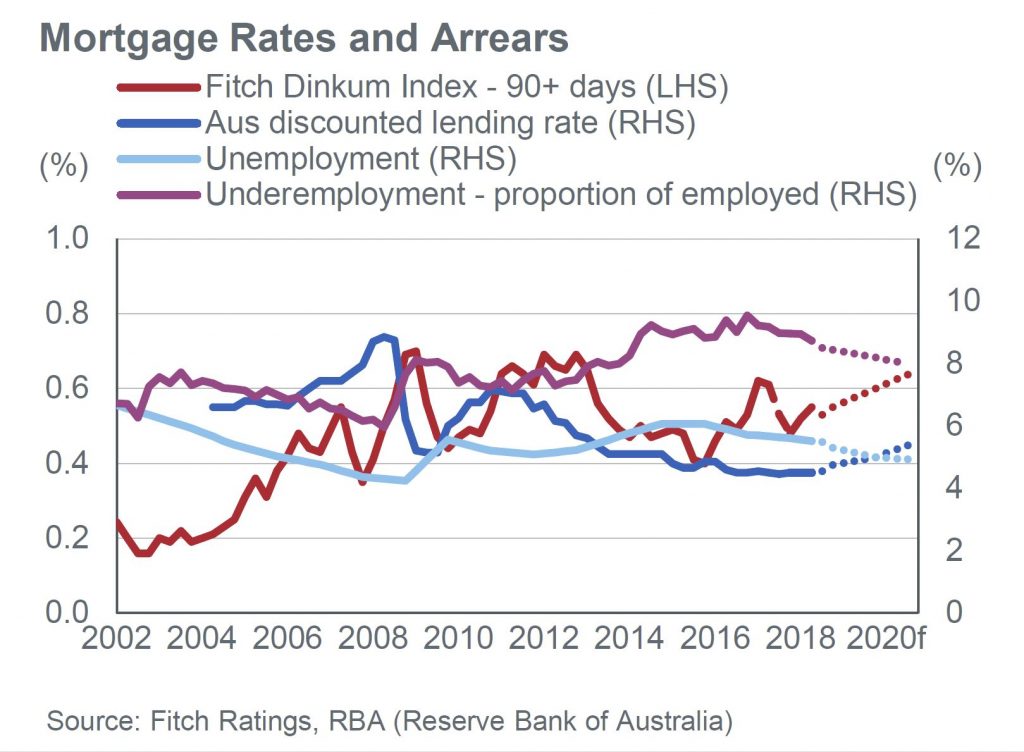

Arrears Concerns Beyond 2020

Fitch does not forecast material increases in arrears in 2019 and 2020 for any country in the report. We expect the impact from weaker growth and generally slow mortgage rate rises to be relatively benign. But there is downside pressure in the medium term from rising rates, fading fiscal stimulus in the US and weaker growth in China, in the context of still high global debt. A faster-than-expected tightening in global financial conditions could worsen mortgage performance.

Mixed Impact from Rising Rates

The speed of mortgage rate rises will vary with North America expected to post the fastest increases and Japan and the eurozone the slowest. The impact will depend on whether mortgages have long-term fixed rates and the macroeconomic backdrop. Highly leveraged markets with large numbers of variable-rate loans, such as Australia, Norway, Sweden and the

UK, could see marked deterioration in loan performance should rates rise quickly. Markets with long-term fixed-rate loans, such as Belgium, France, Latin America, the Netherlands and the US, may see lenders gradually increase their appetite for higher-risk borrower and loan characteristics as their profitability suffers and competition intensifies.

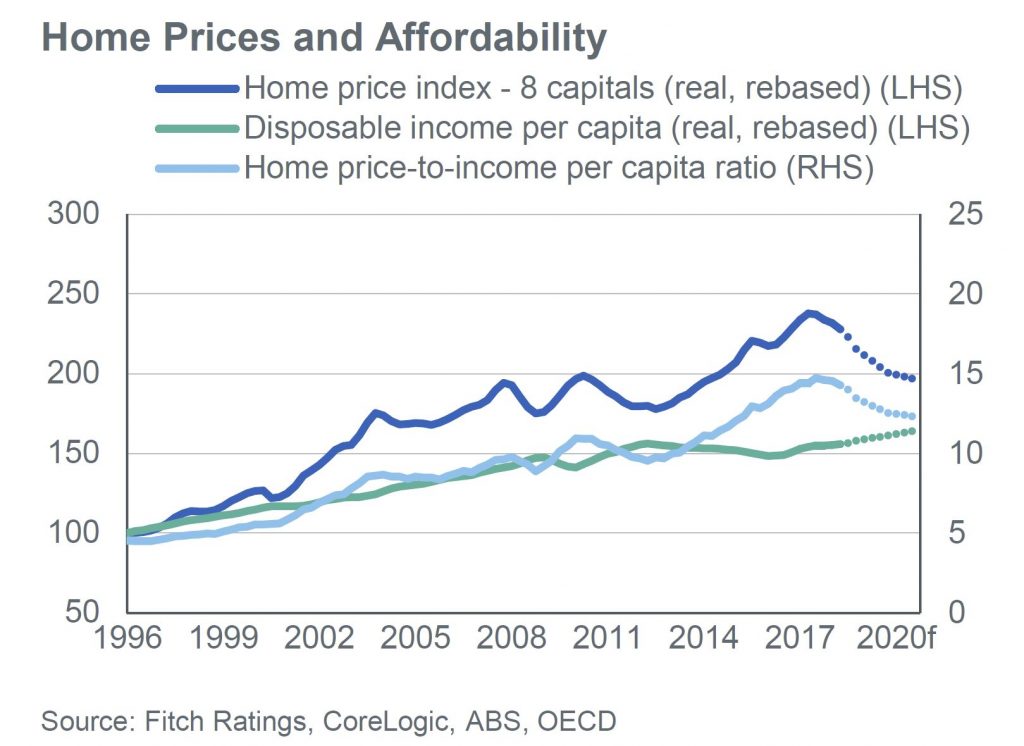

Price Declines Set to Continue In Australia

Fitch forecasts a national home price decline of an additional 5% in 2019 before above-trend GDP growth and strong net migration should stabilise prices in 2020. The peak-to-trough decline of 6.7% as of December 2018 has been driven by lower investor demand reflecting macro-prudential limits on interest-only and investment lending, and tighter enforcement

of lending standards.

They expect price declines to continue at a similar pace in 2019 in Sydney and Melbourne, where larger falls have occurred (peak-to-trough declines of 11.1% and 7.2%, respectively, as of December 2018). The most expensive quartile of properties has experienced the largest declines with falls of 9.5%.

GDP Growth Supports Performance

They forecast loans in arrears over 90 days to increase slightly to 70bp by 2020. Properties in possession will take longer to sell as home prices fall, so loans will remain delinquent for longer. Early-stage mortgage arrears (30 to 90 days in arrears) will be broadly stable in 2019 at 60bp even though lenders have modestly raised mortgage rates for investment and interest only loans despite no policy rate increases. Mortgage performance will be supported by slowing but still solid economic growth, decreasing unemployment and only gradually rising policy and mortgage rates. Risks remain, stemming from the highest household-debt-to-GDP ratio in this

report at 121% as of 2Q 2018.

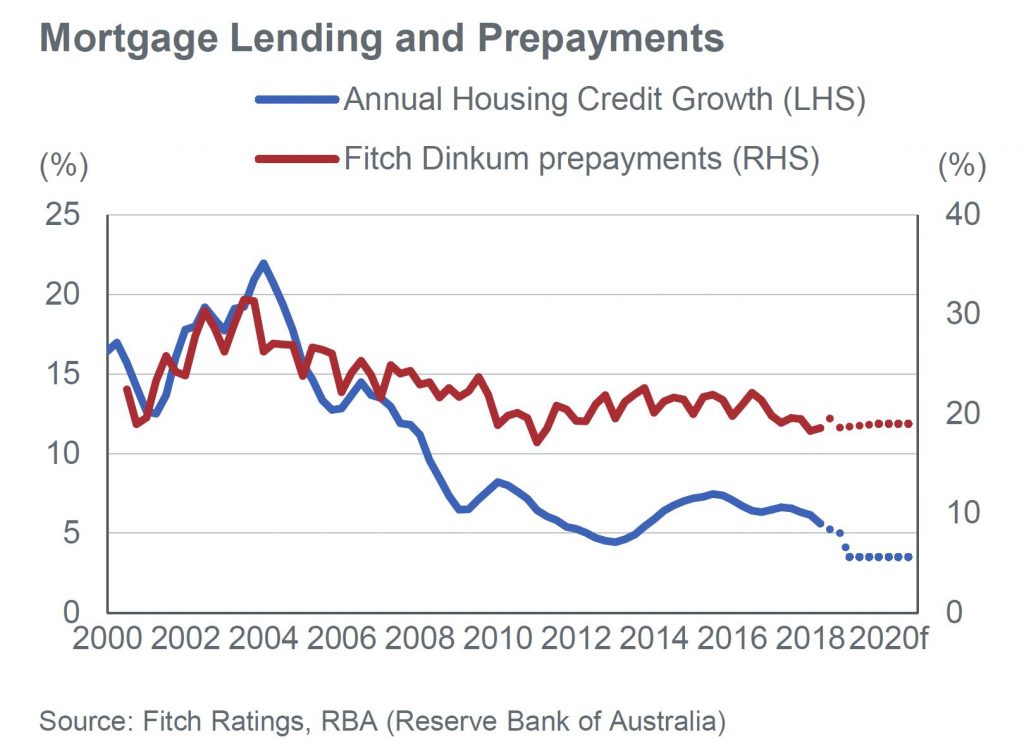

Credit Growth to Remain Low

Housing credit growth is projected to ease further in 2019 to 3.5% from 5.1% yoy growth in October 2018. This is due to tightened macro-prudential limits and a more conservative interpretation of regulatory guidelines for mortgage servicing in light of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. Fitch believes

the commission’s final recommendations, due in February, may further reduce credit availability.

Investment loan origination has been hit by a limit to investment loan growth of 10% (introduced in 2014 and removed in July 2018 for lenders that can prove they have met regulatory requirements for the past six months) and a limit of interest-only origination to 30% of new lending (introduced in 2017 and removed from January 2019 for lenders that have

met regulatory requirements for the past six months) along with foreign investor levies and taxes from state governments.