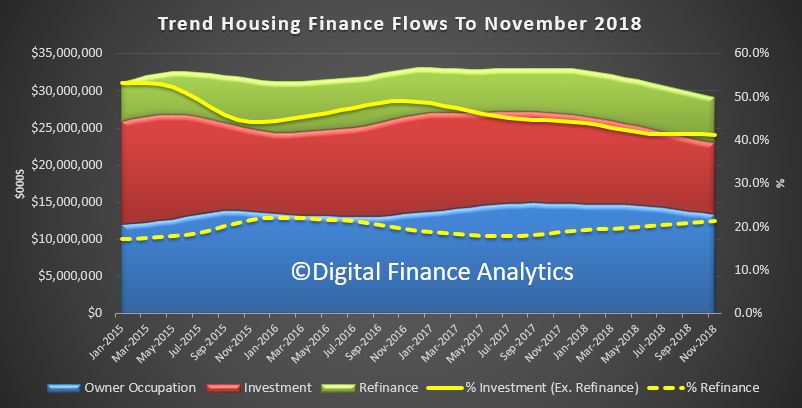

The ABS released their housing finance data to end November 2018. The trend estimate for the total value of dwelling finance commitments excluding alterations and additions fell 1.1%, or $338 million to $29.2 billion dollars. Owner occupied housing, excluding refinance fell 1.2% or $167 million to $13.4 billion and investment housing commitments fell 1.5%, or $145 million to $9.5 billion dollars. Refinanced loans were down 0.4% or $26 million to $6.2 billion. In trend terms, the number of commitments for owner occupied housing finance fell 0.2% in November 2018.

In trend terms, the number of commitments for the construction of dwellings fell 0.9%, the number of commitments for the purchase of new dwellings fell 0.6% and the number of commitments for the purchase of established dwellings fell 0.1%.

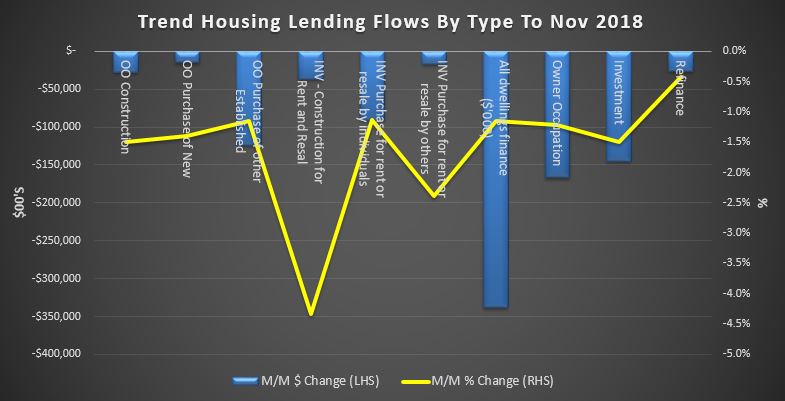

Looking in more detail at the movements, Owner Occupied construction fell 1.5%, down $28 million to $1.8 billion, the purchase of new owner occupied property fell 1.4% or $14.9 million, to $1 billion dollars. The owner occupied purchase of existing dwellings fell 1.2% or $123 million to $10.6 billion dollars. Investment construction fell 4.3% or $36 million to $0.8 billion dollars, investment purchases by individuals fell 1.1% or $90 million to $7.9 billion dollars and investment by other entities including self managed super funds fell 2.4% or $17 million to $0.71 billion dollars.

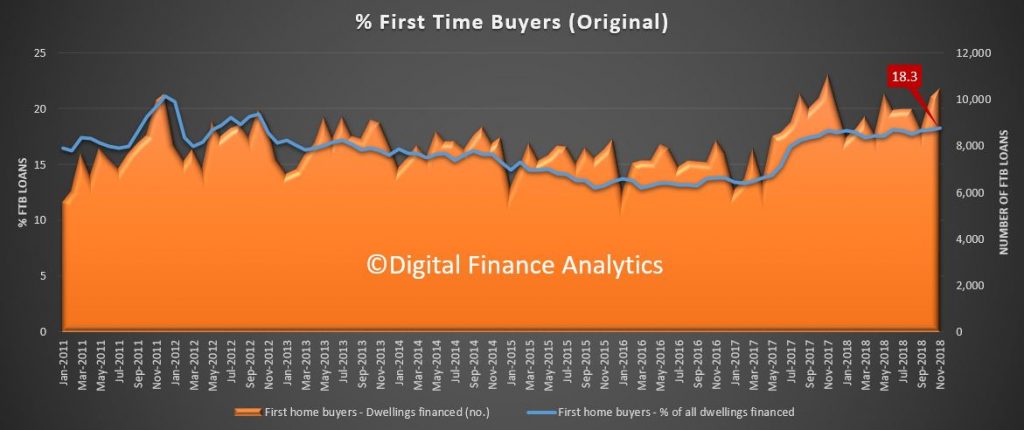

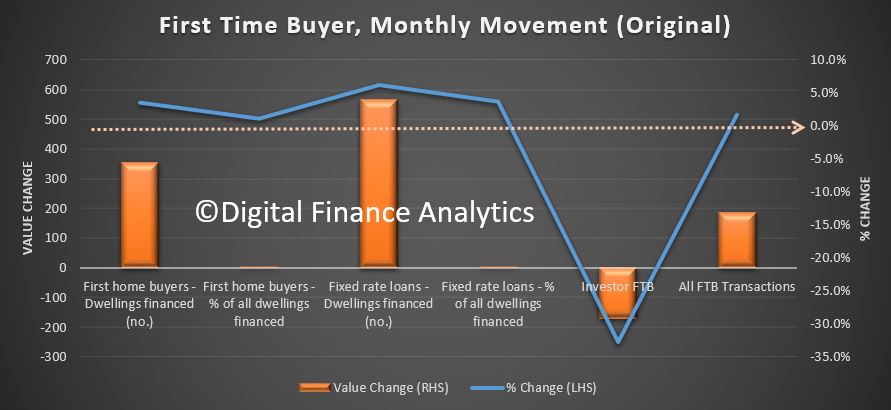

In original terms, the number of first home buyer commitments as a percentage of total owner occupied housing finance commitments rose to 18.3% in November 2018 from 18.1% in October 2018. In November 10,493 first time buyers purchased, 356 more than in the previous month.

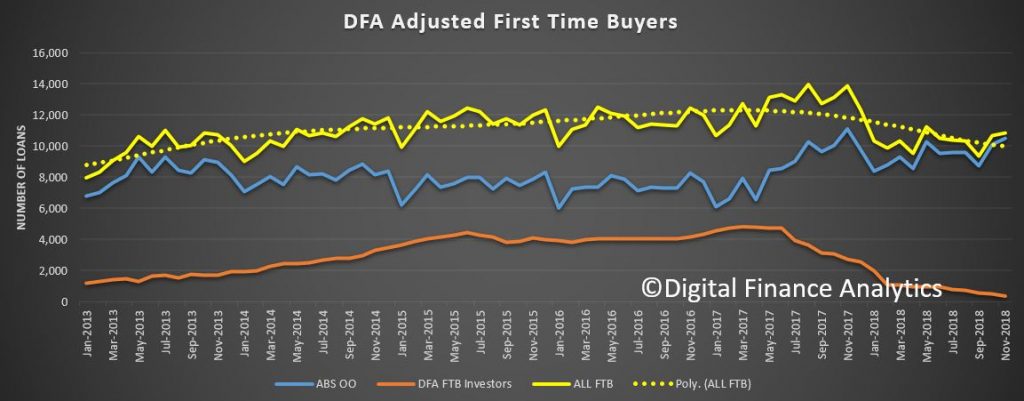

The number of first time investors continues to fall, as measured by our surveys, with just 350 transaction written in the month, compared with 2,760 a year ago.

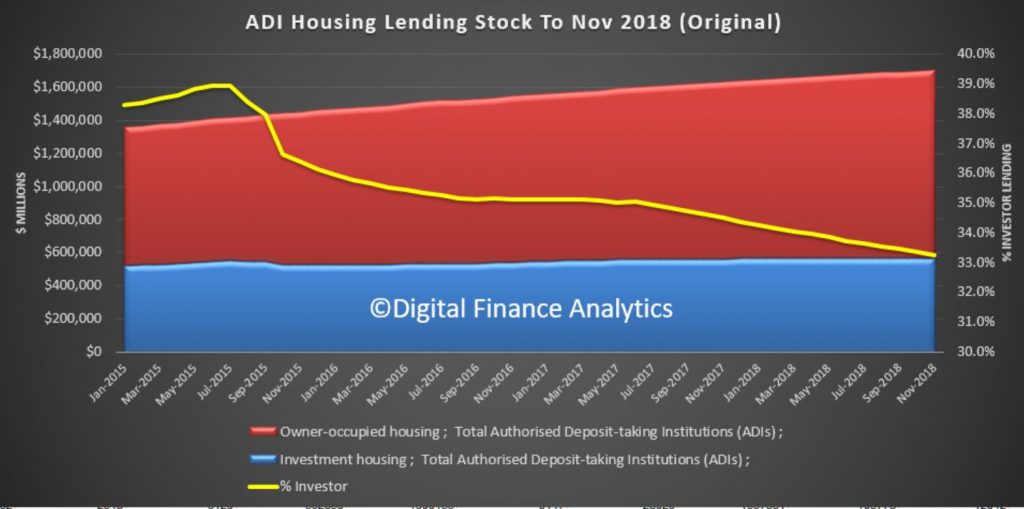

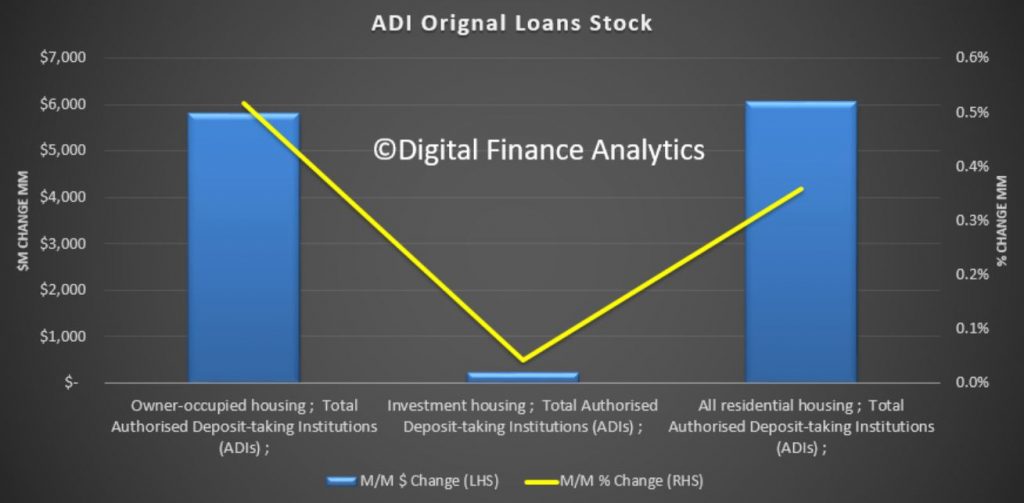

The month on month data shows the relative changes across the categories. Turning to the original stock data, we see total loans growing by 0.5% in the month with investor lending down to 33.26% of all loans. Total ADI loans stood at $1.17 trillion dollars, withe owner occupied loans at $1.1 trillion dollars and investment lending at $0.56 trillion dollars.

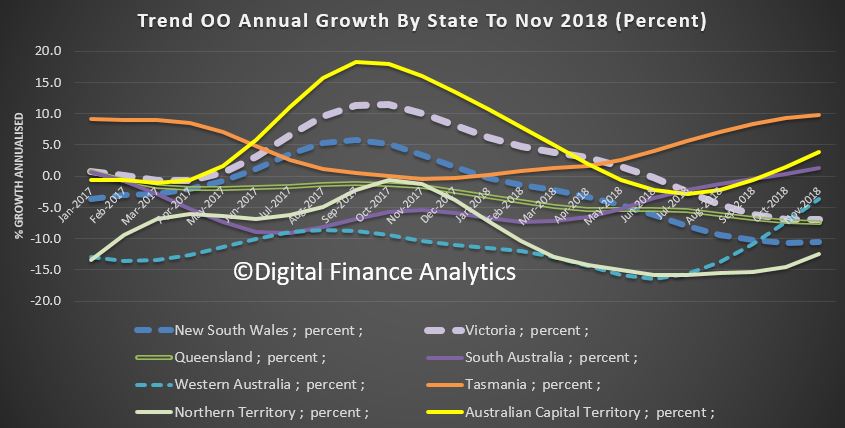

One final cut of the data is to look across the states – here we look at total owner occupied lending. We see a significant fall in NSW and VIC plus QLD, offset only a little by rises in TAS, ACT and SA. This in a nutshell explains why total credit is falling. Frankly the major markets of Sydney and Melbourne set to tone for the entire economy! We do not expect these falls to reverse anytime soon, and as credit drives home prices, the falls will continue. Recent APRA easing will have only small impact.

Finally, note that the ABS says November 2018 is the final issue of the Housing Finance, Australia (5609.0) and Lending Finance, Australia (5671.0) publications. Both publications will be combined into a single, simpler publication called Lending to Households and Businesses, Australia (5601.0).