According to a Moody’s report, just out, the near-term credit implications for Australia and the states are limited given a likely contained economic impact and the availability of ample fiscal buffers.

Taking into account both the direct costs and indirect loss of revenue, Moody’s estimate that the cost of the bushfires will reduce Australia’s

general government’s fiscal balance overall by around 0.1% of GDP per year in the next two fiscal years.

The bushfires are mainly concentrated in rural areas, predominantly in national parkland. As a result, the economic cost has been limited, says Moody’s, who revised their forecast for 2020 GDP growth to 2.1% from 2.3% in 2020.

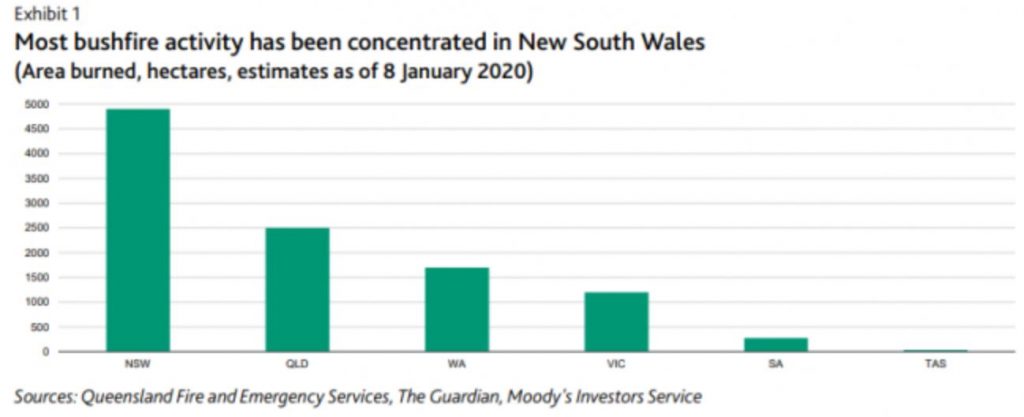

Although fires have burnt across the country, they say the bushfires have been concentrated in NSW, covering an area more than six times larger than that affected by the 2018 Californian fires, for an economy that is seven times smaller than that of California. Predictions by the Australian Bureau of Meteorology indicate that the fires are likely to continue and could even intensify over the coming months.

The Commonwealth government bears some of the direct containment and repair costs – such as for the deployment of military resources for firefighting – as well as the ultimate costs through transfers to the states. The government also incurs some expenditure on relief for affected areas, with AU$2 billion already announced to support affected farmers and businesses. Moreover, Commonwealth tax revenue from affected areas will be hit by temporarily weaker economic activity.

In 2020, reconstruction will boost economic activity, partially offsetting the initial losses from the areas which are being rebuilt.

Over the longer term, if bushfires of this severity were to become more frequent, they would expect tourism and investment, especially in rural areas, to be affected:

…over time, increasingly frequent and severe natural disasters related to climate change are likely to result in rising and recurring costs for Australia’s general and local governments, which will test their capacity – currently strong – to mitigate these costs

– “GDP to take a small hit” ???

– GDP is a joke, it’s higly politicized, it’s only an estimate.

– When one builds a house then that’s counted in the GDP but then the house is counted for a second time when someone lives in it or is being rented out. While e.g. renting out doesn’t produce anything.

– That’s why I regard Steve Keen’s formula “Income + change in debt = aggregate demand” to be much more valuable.