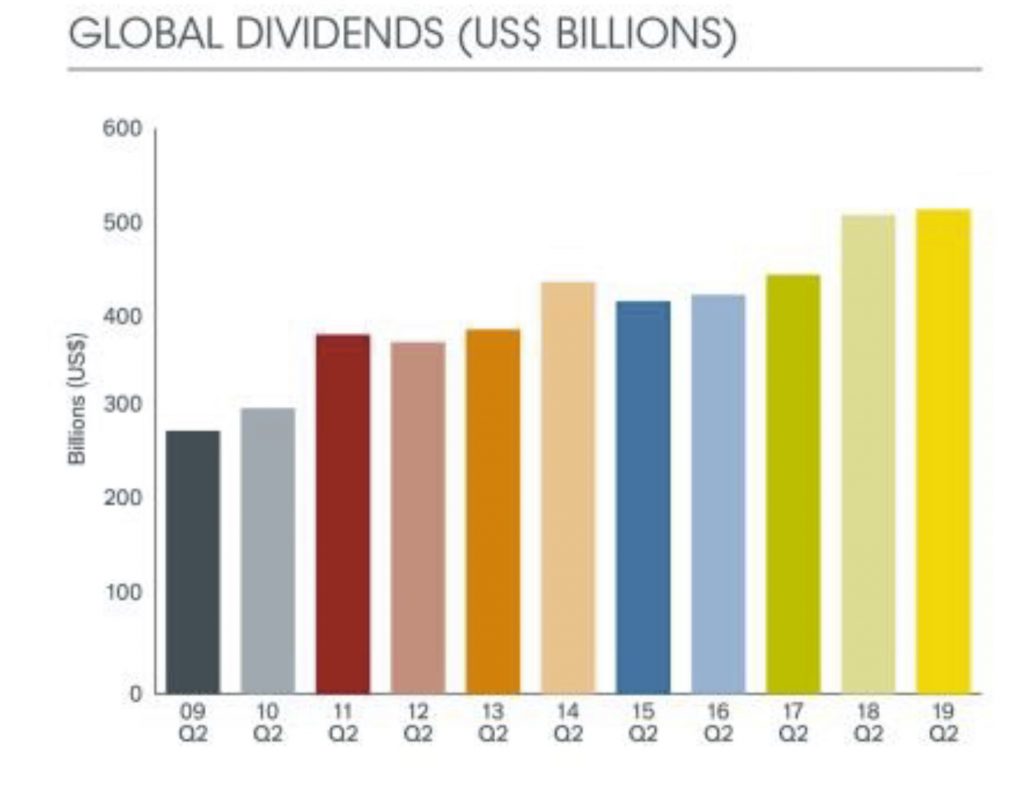

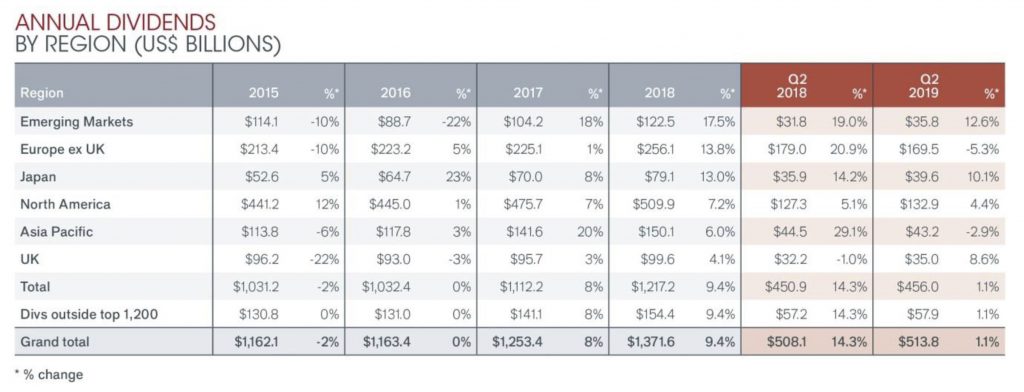

The deceleration in the world economy has begun to make an impact on dividends, according to the latest Janus Henderson Global Dividend Index. The total paid to shareholders broke a new record of $513.8bn in the second quarter, but the rate of increase was the slowest for more than two years. In headline terms, payouts were 1.1% higher, held back by the strength of the US dollar.

Underlying growth of 4.6% was the slowest in two years but was only slightly below the long-run average. This slowdown was in line with Janus Henderson’s forecast, which had already factored in a lower rate of growth this year.

With slower growth come fewer records. Japan, Canada, France and Indonesia were the only countries to set records in the second quarter. Emerging markets saw the fastest growth, propelled higher by Russia and Colombia, while Japan registered the best performance among the developed regions. The rest of Asia Pacific, and Europe ex UK underperformed the global average, while the US came in a touch weaker than Janus Henderson anticipated. Dividends from financials and energy stocks saw the fastest increases, but technology and consumer basics lagged.

Asia Pacific ex Japan lagged slightly behind the rest of the world in the second quarter, with the total $43.2bn distributed 2.2% higher on an underlying basis.

In a seasonally quiet Australia, dividends only rose 5.7% on an underlying basis, continuing the five-year trend of stagnant dividend growth. The rise was down to just one company, QBE Insurance, whose rebounding profits enabled a big increase in its dividend, which is now almost back to levels last seen two years ago. Westpac held its dividend flat for the eighth consecutive quarter.

For seasonal reasons, Hong Kong dominates Q2. Underlying growth was just 2.5% and a quarter of Hong Kong companies in our index cut their dividends, including China Mobile. This is a larger proportion than in all the other large markets, reflecting a slowing Chinese economy.

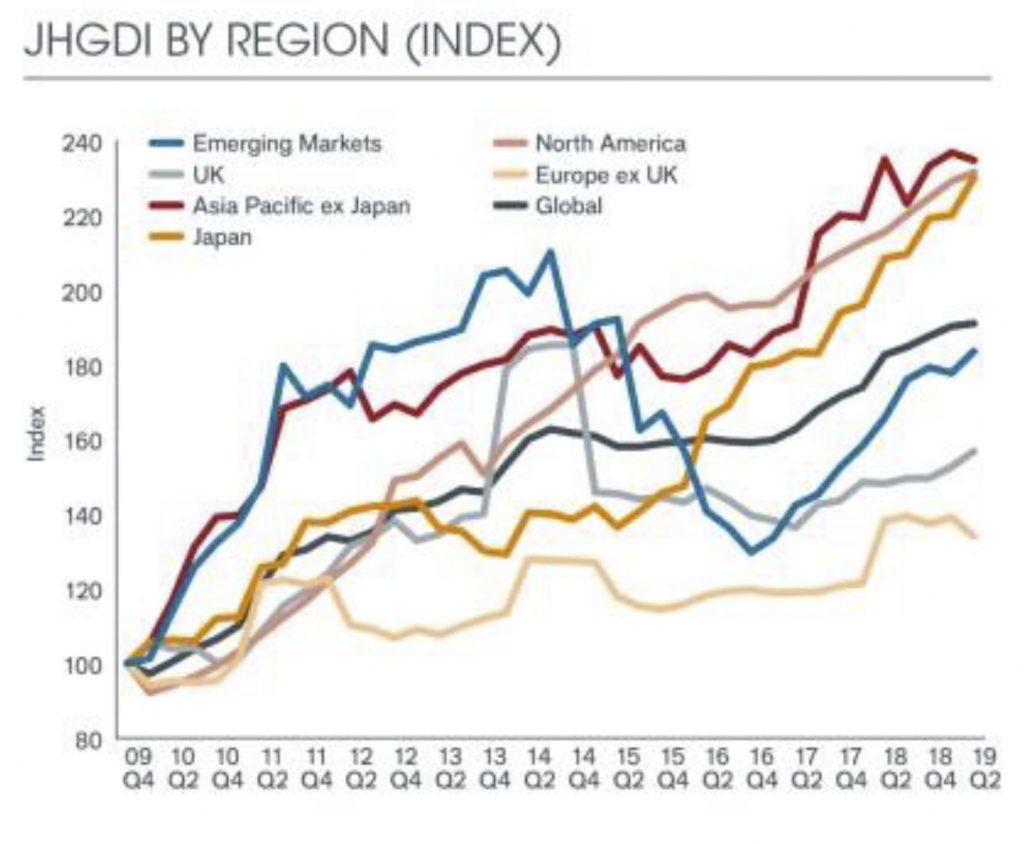

Record dividends in Japan, up 6.8% on an underlying basis, reflected rising profitability and expanding payout ratios. Almost three quarters of companies raised their dividends. Japanese dividend growth has been outperforming the rest of the world for four years, reversing a long period of relative stagnation. Japanese dividends have now caught up with Asia Pacific and North America, the two fastest growing regions in the world, with all three having seen payouts rise close to 130% since the end of 2009.

Investors receive seven tenths of their annual European dividend income in Q2. Growth in Europe has lagged behind the rest of the world over the last few years, and the second quarter of 2019 was no exception. Payouts fell 5.3% year-on-year on a headline basis, thanks in large part to a weak euro, and took our index for Europe to 134.0, its lowest level in over a year. In underlying terms, European dividends were just 2.6% higher. A small number of big dividend cuts held back the total, but the proportion of companies raising payouts is also in decline. Spain, the Netherlands, Switzerland and France were ahead of the European average, but Germany and Belgium lagged behind.

US dividends rose at their slowest pace in two years, up 5.3% on an underlying basis to $121.7bn. The pace of dividend growth in the US slowed across a range of sectors with most seeing single-digit increases. More than four fifths of companies raised their payouts, however, keeping the US near the top of the international rankings. The banking sector continued to show strong dividend growth, but auto manufacturers all held their payouts flat, reflecting growing global structural challenges for the sector.

In the UK, underlying growth was 5.3%, similar to the global average, though very large specials boosted the headline total. The largest contribution to underlying growth came from the banking sector. The Q2 figures were in line with Janus Henderson’s expectations, and therefore there is no change in the 2019 forecast for $1.43 trillion in dividends, equivalent to 4.2% growth on a headline basis, and 5.5% in underlying terms