Fitch Ratings says the outlook for global growth has been dented by a series of recent weak data releases, but not dismantled. The broad contours of the agency’s December 2018 Global Economic Outlook (GEO) forecasts for 2019 – with above-trend growth in the US and policy easing preventing growth dipping below 6% in China – still look intact. The eurozone outlook has weakened more significantly but some recovery in growth in 1H19 still looks likely after a very disappointing 4Q18.

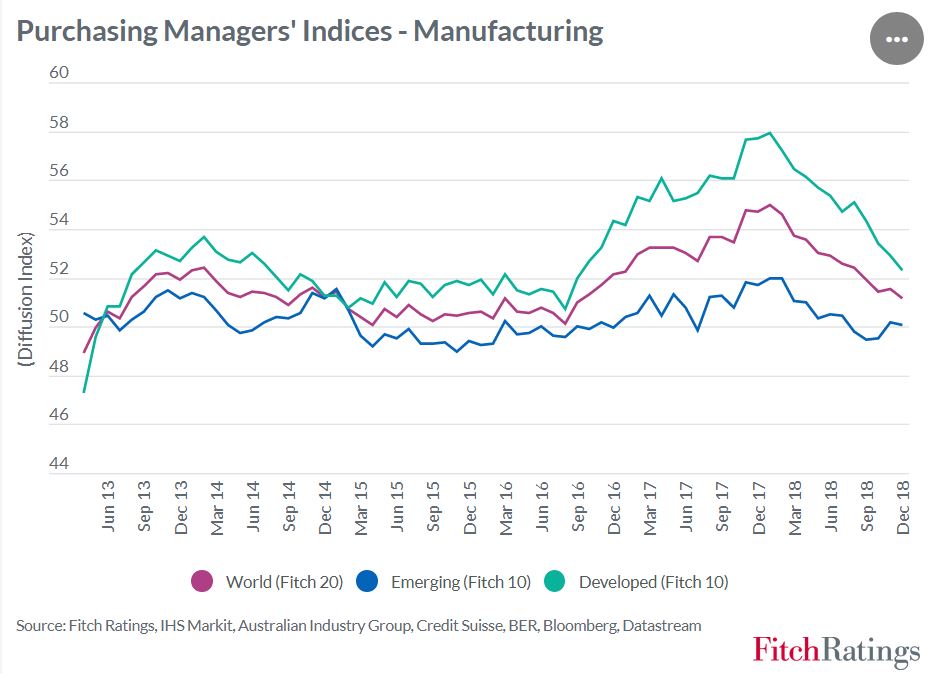

A string of weak data releases since the GEO was released in early December have raised market concerns about the risk of a sharp downturn in global growth in 2019. Most dramatically, business sentiment in the manufacturing sector has seen a widespread deterioration across multiple geographies. Fitch’s economics team’s latest chart of the month shows the (unweighted) average manufacturing Purchasing Managers’ Index (PMI) for the 20 economies covered in the GEO and suggests that the upturn in the global manufacturing cycle seen from 3Q16 petered out in 2H18, consistent with the slowdown also seen in world trade through 2018.

A string of weak data releases since the GEO was released in early December have raised market concerns about the risk of a sharp downturn in global growth in 2019. Most dramatically, business sentiment in the manufacturing sector has seen a widespread deterioration across multiple geographies. Fitch’s economics team’s latest chart of the month shows the (unweighted) average manufacturing Purchasing Managers’ Index (PMI) for the 20 economies covered in the GEO and suggests that the upturn in the global manufacturing cycle seen from 3Q16 petered out in 2H18, consistent with the slowdown also seen in world trade through 2018.

This deterioration in the global manufacturing cycle has its roots mainly in the slowdown in growth in China, which became evident from the middle of last year and followed earlier credit tightening. China’s share of world GDP has continued to grow rapidly in recent years and its domestic economic cycle now has much more pronounced effects on the rest of the world than in the past. The current slowdown in China is substantial – particularly when measured in terms of nominal GDP growth, which peaked at nearly 12% y/y in early 2017 and likely fell below 9% y/y in 4Q18. Moreover, the latest slowdown has been reflected in consumer spending to a greater extent than in the past, including in car sales, which recorded a 4.3% decline last year. China accounts for around a third of global car sales and it seems likely that global auto sales – a key component of world manufacturing – declined last year for the first time since 2009.

However, our 2019 forecast for China’s real GDP growth of 6.1% still looks achievable despite recent weakness in the data. Retail sales, industrial production, profits and trade growth have all fallen further since early December but fixed asset investment growth has recovered in the last three months with infrastructure investment – which led the initial slowdown – returning to positive y/y growth. New housing starts also continue to grow robustly. Moreover the latest credit data showed tentative signs of stabilisation with aggregate financing to the real economy (adjusted to exclude equity and include local government bonds) growing 10.3% in December compared with 10.4% in November. This followed several months of much larger declines in the annual growth rate.

Policy in China has been eased further with the recent cut in banks’ required reserve ratios and the authorities’ commitment to tax cuts and supporting infrastructure spending has become more vocal in recent weeks. Our current baseline forecasts also assume that US tariffs on USD200 billion of Chinese imports will rise to 25% in early 2019, a shock that may be avoided if trade talks make further progress.

Manufacturing indicators in the US have also deteriorated but private sector demand still looks robust and ‘now-cast’ estimates of 4Q18 GDP based on high frequency data are pointing to annualised growth of around 3%, roughly in line with the December GEO. Strong job gains and rising nominal and real wage growth continue to support the consumer and lead indicators of business investment suggest prospects are still for decent growth in 2019, albeit at a slower rate than in 2018. The tightening in financial conditions has been modest and the Fed now looks likely to raise rates in 2019 by less than the three hikes predicted in the December GEO. The Federal government shutdown could take a toll on growth in 1Q19 but for now our working assumption is that fiscal policy continues to provide support to US domestic demand growth in 2019 as a whole.

There is a more material threat to our 2019 eurozone growth forecasts. Eurozone PMI’s have seen the largest falls in recent months and this has been corroborated by weak ‘hard’ industrial production data in the large member states. The December GEO forecast that 4Q18 GDP would rebound to 0.5% is not supported by the incoming data – instead this now points to another quarter of very subdued growth similar to the 0.2% expansion seen in 3Q18.

However, a number of temporary factors – including disruptions to car sales and production related to new emissions standards, weather related complications to domestic trade flows in Germany and social protests in France – have likely played a part in weak eurozone activity in 2H18. This suggests that some recovery in sequential growth should be seen in 1H19. Tightening labour markets and rising wage growth should also remain supportive of consumer spending. Nevertheless the slowdown in world trade and fading credit impulse now look likely to see eurozone growth heading back down towards potential (estimated to be below 1.5%) more quickly than previously expected. The possibility of a no-deal Brexit adds further downside risks. The weaker activity outlook reinforces our expectation that the ECB will likely modify its forward guidance on interest rates soon and possibly consider other accommodative moves related to bank financing.