We continue our series featuring the results of our November Mortgage stress update. Today we look at Greater Adelaide and South Australia. In SA we estimate there are 80,530 households in mortgage stress, which equates to 28.3% of borrowing households in the state. We estimate that 3,900 risk 30-day default in the next 12 months.

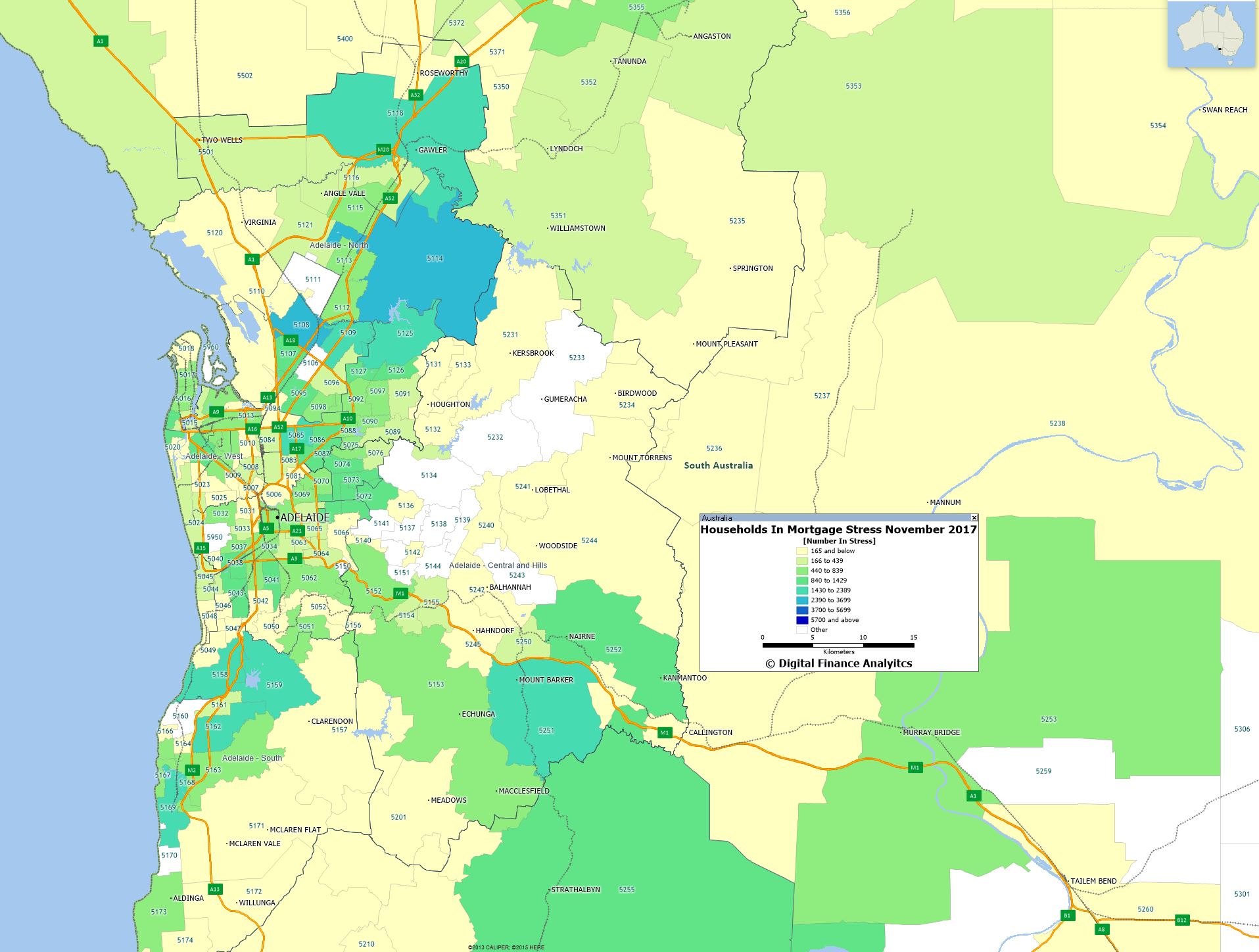

Here is the mortgage stress map for Adelaide and the surrounding area.

The post code with the highest number of households in stress is 5108, Paralowie and Salisbury with 2,821; a suburb of Adelaide, North & North East Suburbs about 19 kms from the CBD. There are around 10,500 households in the area, and the average age is 34 years. The ABS Census says children aged 0 – 14 years made up 20.8% of the population and people aged 65 years and over made up 12.3% of the population.

The post code with the highest number of households in stress is 5108, Paralowie and Salisbury with 2,821; a suburb of Adelaide, North & North East Suburbs about 19 kms from the CBD. There are around 10,500 households in the area, and the average age is 34 years. The ABS Census says children aged 0 – 14 years made up 20.8% of the population and people aged 65 years and over made up 12.3% of the population.

80% of households here live in separate houses. Around 40% have property with a mortgage. The average mortgage repayment is $1,300 a month. The average monthly household income is around $4,440 giving an average loan to income ratio of 29.1%. The SA income average is higher at $5,250. In 2010, the average home price was around $210,000 compared with 285,000 today, reflecting average annual growth of around $12,000, well below the national average.

5108 is ranked 90 on our national default ranking.

Next time we look at Perth and WA

Next time we look at Perth and WA