We continue our series featuring the results of our November Mortgage stress update. Today we look at Greater Perth and Western Australia. In WA we estimate there are 124,000 households in mortgage stress, which equates to 30.2% of borrowing households in the state, up 2,500 from last month. We estimate that 9,800 households risk 30-day default in the next 12 months.

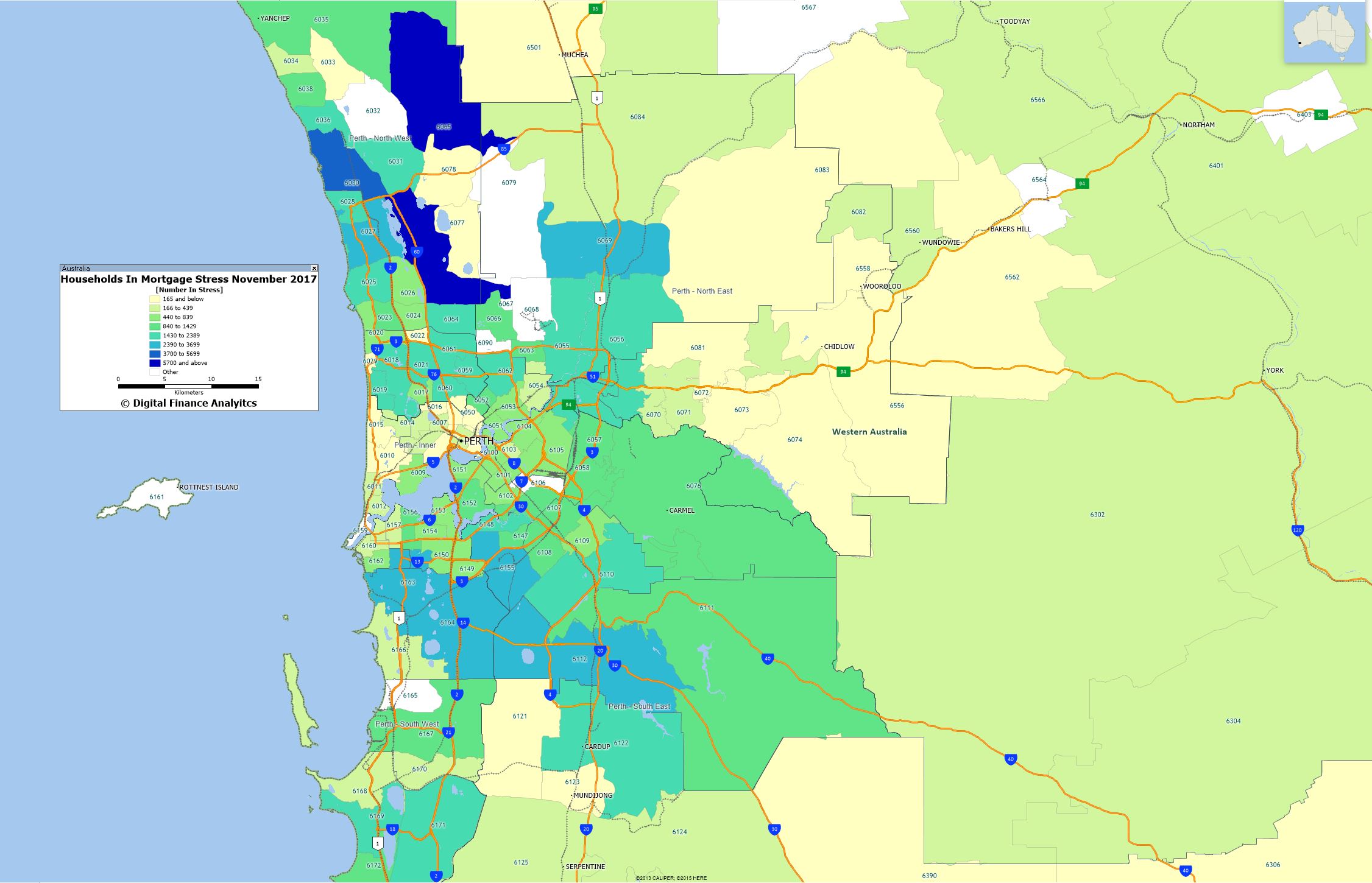

Here is the mortgage stress map for Perth and the surrounding area.

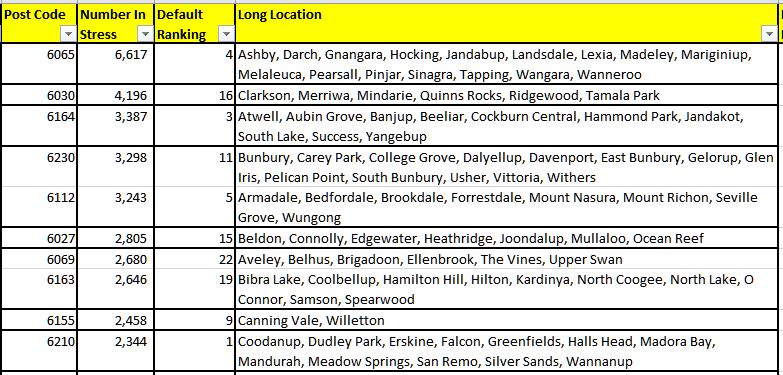

The most stressed WA post code (and second highest nationally) is 6065. This is the area around Wanneroo, including Tapping, Hocking and Landsdale and is located about 25 kilometres north of Perth. It is an area of high population growth and residential construction mainly on smallish lots. There are more than 6,617 households in mortgage stress in the region. The average home price is $635,000 compared with $529,000 in 2010, and down from a peak of $813,000 in 2014. There are about 17,000 households in the district, with an average age of 33. The average income is $8,300 a month, and 58% have a mortgage with average repayments of $2,170, well above the WA and national averages.

6065 is ranked 4th nationally in terms of prospective mortgage defaults. 6210, including Mandurah and Meadow Springs in the 10th most stressed post code in WA, based on the number of households, but ranks first nationally in terms of potential risk of default.