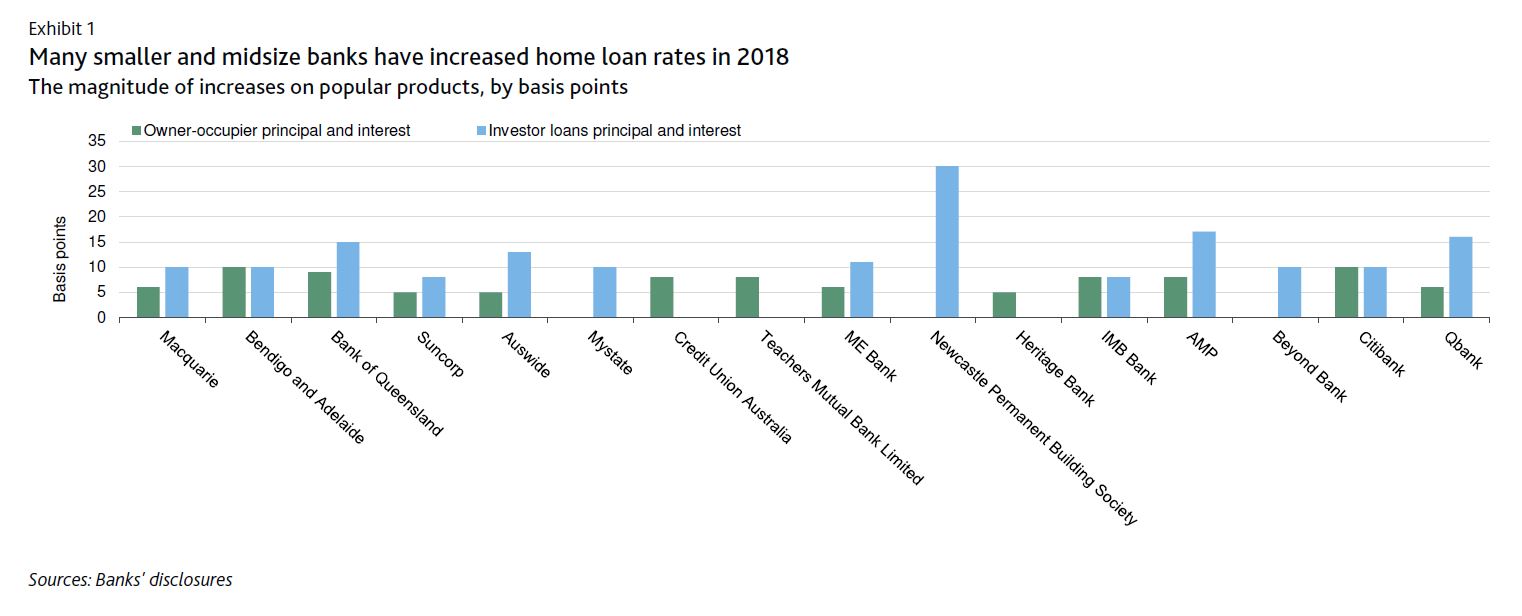

According to Moody’s , Australian regional banks Bendigo and Adelaide Bank and Teachers Mutual Bank Limited increased their home loan rates.

This follows a number of other small and midsize banks that have recently raised their home loan rates, taking the total to 16. The increase in rates is credit positive for these banks because it will help preserve their net interest margins amid higher wholesale funding costs and slower loan growth.

In contrast, Australia’s four-largest banks – Australia and New Zealand Banking Group Corporation, Commonwealth Bank of Australia, National Australia Bank Limited and Westpac Banking Corporation – have yet to raise their lending rates amid intense political scrutiny and against the backdrop of a probe by Australia’s Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. Given that the four major banks have traditionally been the first-movers on headline home loan rates, we see smaller lenders’ willingness and ability

to increase rates as credit-positive evidence that they retain pricing power independent of the current challenges confronting the major banks.To date, the rate increases have been concentrated in variable-rate home loan products, which are more popular in Australia than fixed-rate loans, at about 10 basis points for owner-occupier principal and interest loans, and higher for riskier products such as investor and interest-only loans.

Higher home loan rates will offset higher wholesale funding costs, with short-term funding costs being particularly affected.

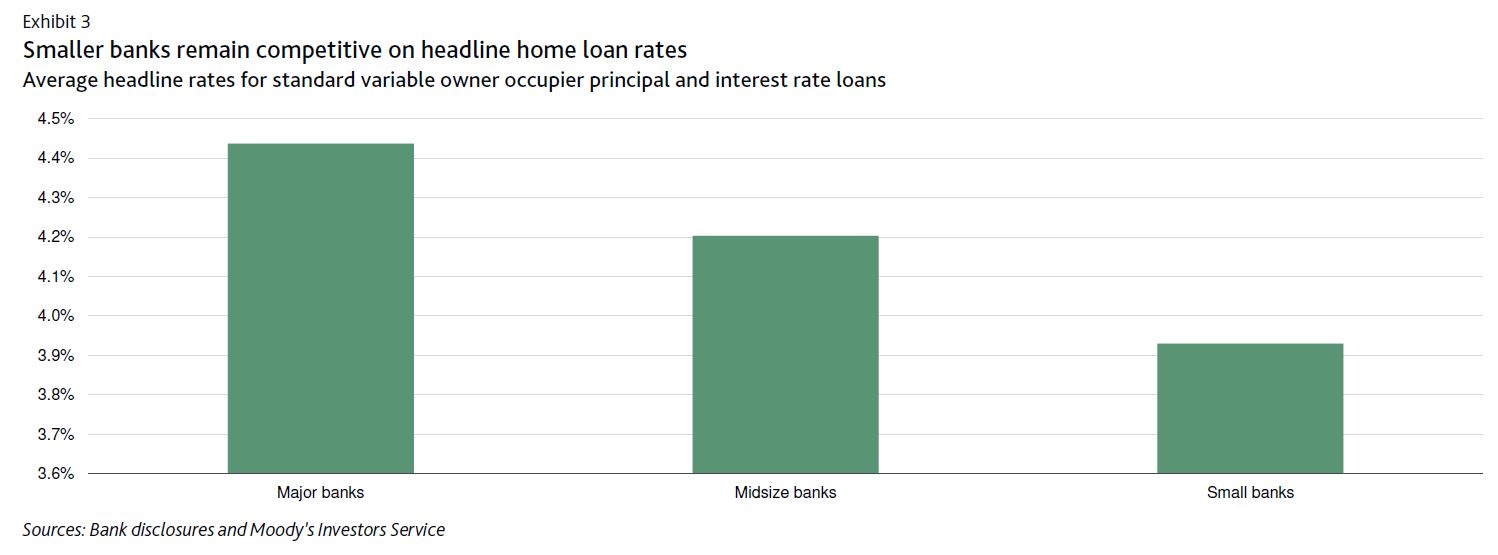

Long-term debt issuance costs have increased proportionally less and, importantly, remain low by historical comparison. As such, the effect on banks’ weighted-average cost of long-term debt has thus far been muted. Positively, blended average deposit costs are marginally lower because banks have been paying lower rates on short-term deposits. The net effect varies by bank, according to various factors including their loan mix and funding profile. For instance, midsize listed banks have a moderately lower proportion of home loans and more short-term wholesale funding than smaller, predominantly mutual banks, which tend to have a higher concentration in home loans and are principally retail deposit-funded. As a consequence, the smaller banks may gain a little more profitability benefits from the latest round of rate increases. Following the rate increases, smaller banks still offer more favourable headline home loan rates than the major banks. However, the majors continue to offer significant discounts to attract the highest-quality borrowers at a time when system loan growth has slowed.

Despite the very high level of household leverage in Australia, we do not expect the current round of home loan rate moves to cause a sharp increase in loan delinquencies or credit costs. That is because labour market conditions, which are a strong indicator of mortgage performance, are likely to remain favourable, underpinned by solid economic growth forecasts. Additionally, the increases in home loan rates are small compared with the buffer built into home loan serviceability assessments. Australian lenders commonly assess borrowers’ repayment ability based on an interest rate floor of 7.25%, which is well above the average home loan rate of around 5.25% posted by Australian banks over the past three years. Moreover, collateral quality will remain strong, despite ongoing house price corrections in Sydney and Melbourne. The average loan-to value ratio for Australian bank home loan portfolios remains around 50%.